A Human Approach to Modern Investing

How retail investors can thrive in a world dominated by Quant funds and AI

In the age of algorithms and automated trading, the stock market has transformed into a battlefield where human intuition often seems outmatched by the precision of machines. We have experienced a shift towards emotionless and data-driven funds that make up the majority of volumes on the exchanges. But where does this leave retail investors?

In this article, I will share my strategy for navigating this cold world. Furthermore we will dive deeper into psychological impacts on investing, red flags and managing risk.

1| David vs. Goliath

We’re living in a world that is defined by speed and technology. There is no room for emotions and AI is automating tasks that not far ago required dozens of hours. A similar trend has been seen on WallStreet over the past roughly 17 years. Quant funds and algorithms have changed the entire market and redefined several strategies. In 2012, 60% of all trades on the exchanges were done by Quant funds. These funds exclusively trade based on complex models that were created by among the most brilliant minds on this planet. We’re talking about MIT graduates that won several math competitions and have years/decades of experience in modeling the financial markets. The models get executed by algorithms that are able to act at inhuman speeds and without any emotions. To screw the odds even further into the favor of Quant funds, exchanges are offering discounts to those funds (because of the sheer number of trades). This short video clip by BillionaireBears (LINK) summarizes it well:

The reaction by many market participants has been to praise everyone that you have to be emotionless and cold in investing. This however is highly dangerous because you’re not only damaging your psyche, but you’re also directly competing against the Quants. Machines don’t know fear, greed or euphoria. Trying to compete as a human against machines in an even playing field is a waste of time, therefore we have to embrace the fact that we are humans and that we feel emotions.

2| Embracing Emotions

Knowing yourself is the key to success in investing. While the fundamentals of a business are the foundation of every investment thesis, many people fail because they can’t withstand the pressure they feel when a position is underwater and/or they see that others are making more money than them. My personal system of tackling this problem, is to have a diary. Writing down your thoughts and feelings (in regards to finance) at the evening is great, as you can review the timeline of your emotions over the past weeks. This allows you to understand how market sentiment towards your stocks is right now. Typically, if you feel frustrated it’s time to buy a first tranche of your favorite stocks. In turn, if you feel as if you’re the next Warren Buffet, Stanley Druckenmiller, etc, you should critically evaluate whether a correction is due.

I personally have discovered, that when I need Greek music because Mr.Market is beating me, the point of frustration is near. Everyone reacts differently on different situations, but the key to success is definitely that you have to understand your own behaviors.

3| Red Flags

Finding ideas isn’t difficult, the quality of those ideas obviously varies depending on several factors, but in the age of Twitter, Newsletters & Research Reports, you won’t have problems coming up with ideas. What really makes a difference is how many of your countless ideas actually end up on your watchlist or in your portfolio. Having checklists greatly reduces the amount of stocks that actually end up in the portfolio. I personally have identified a few red flags that make a stock instantly unappealing to me.

I want to note however, that there are always exceptions. Sometimes there are logical reasons for things that seem out of the ordinary. This is also the reason why screens don’t work perfectly. There will always be great stocks that won’t show up on your filter, because one metric isn’t in line with the picture.

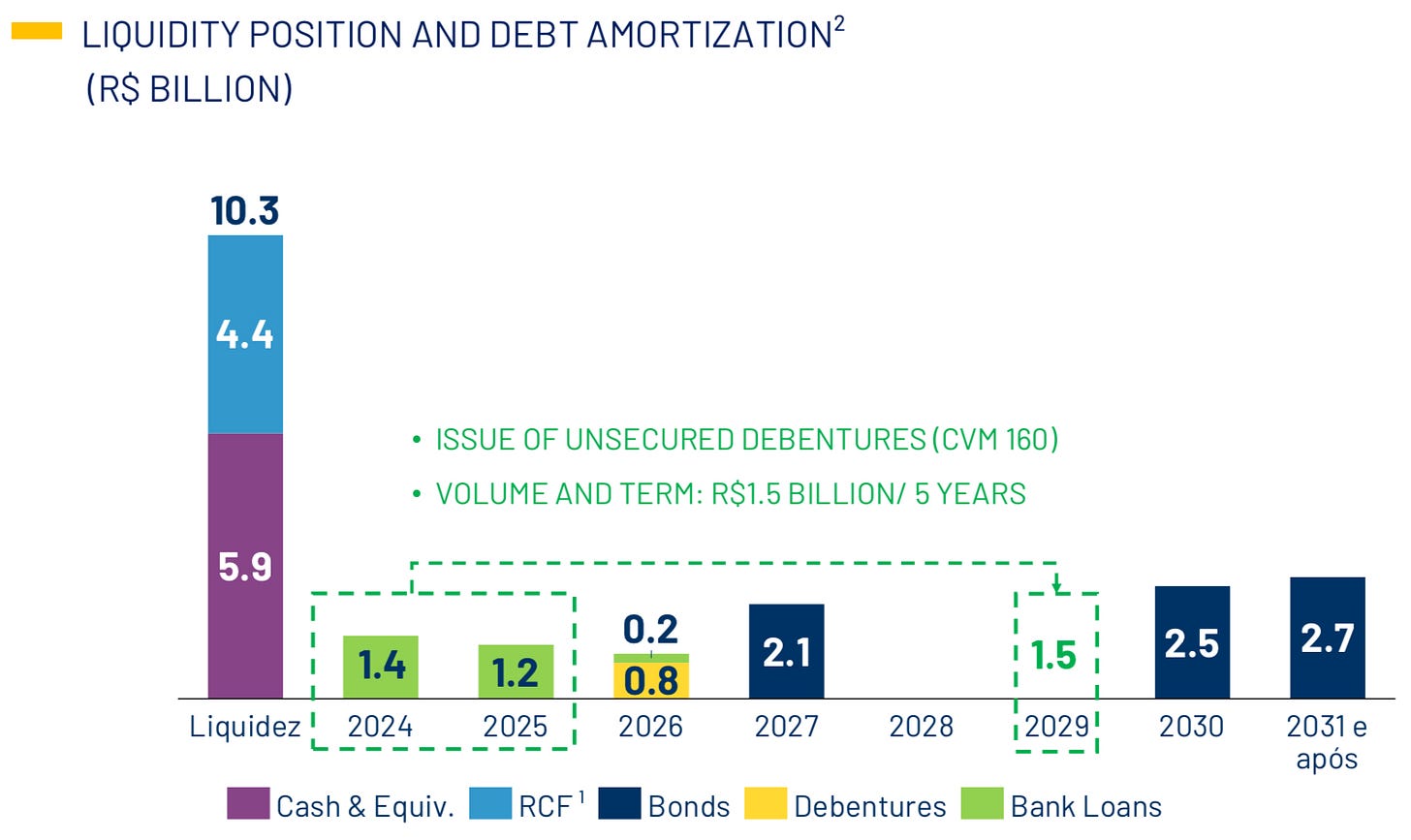

The first red flag is regarding debt & liquidity. If the current ratio (current assets/current liabilities) is below 1, you should take a deep look at the structure of liabilities. Furthermore, liquidity (Revolving Credit Facilities and Cash) should always cover at least 3 years of debt maturities. Anything different means that we have to project the earnings power of the business with a a high degree of certainty. Gerdau for example (steel producer from Brazil that I happen to hold in my portfolio) has liquidity that can absorb debt maturities till at least 2030, even if the company wouldn’t generate FCF over the course of time.

Another red flag that shouldn’t be underestimated is insider trading. While there can be many (logical) reasons for insider selling, abrupt dumping of shares is always a sign that awakens curiosity of investors. Lately there has been a well known company from the U.S. that announced that it would be acquired by another company for a a large premium to the current share price. The stock market didn’t believe that the deal would go through, but management assured investors that everything will go smoothly. At the same time, the CEO dumped a lot of shares. Making statements and acting differently is a red flag that diminishes my trust in the management team and is a clear red flag.

4| Risk management

“Where you want to be is always in control, never wishing, always trading, and always first and foremost protecting your ass”

— Paul Tudor Jones

I personally view risk management as among the most important aspects of investing, as one bad position (if managed badly) can blow up your entire portfolio. On the other hand there is no worse feeling, then buying a position of just 1% of the portfolio that goes on to tripple over a few months.

There is no exact science behind position sizing, but you generally size your position based on the risk the individual position might have. A blue chip company from a western country that grows and trades at low valuation deserves a higher allocation than for example a cyclical small cap from China.

The question is always what your target allocation for each position is. I generally structure the buying process via 2 tranches. After I bought the first tranche, I wait and when I see a confirmation by the markets,that the stock is moving towards my target, (always up, since I don’t short!) I add to the position. Most people have a barrier against buying something that they have already bought cheaper, since they think that the attractiveness of the position has gone down. I totally disagree on that, since we’re adding to a position that has now much less risk (since the trend is confirmed).

The following quote was quoted by Warren Buffet and was written by Peter Lynch, who’s as arguably among the greatest fund managers ever (29% p.a. over 13 years).

“Selling your winners and holding your losers is like cutting the flowers and watering the weeds.”

— Peter Lynch

If my position drops after I bought the first tranche, I wait for a consolidation and add to the position. The process of adding to a losing position however, is not as straightforward as with adding to a winning position. Firstly, the reason for the drop has to be identified. If there is no reason, apart from Mr.Market going crazy, you can add (as long as you haven’t found anything better!). It’s important to not blindly average down on losers, without knowing the reasons for the drop. If any of the red flags I mentioned earlier were about to come true, you should seriously reconsider the entire position.

Let’s however assume that it’s just Mr.Market having a mental breakdown. In this case we come back to the 2nd section of this article, in which I talked about knowing yourself and embracing the fact that we feel emotions. When I bought the first tranche of a stock I highly like with a great risk/reward ratio and it drops to a point where my Greek music phase kicks in, then I know that the frustration is big. I wait for a trend reversal and buy my second tranche (assuming that the fundamentals haven’t gotten worse).

5| Wrapping it all together

In summary, the market has changed radically over the past 17 years. Retail investors are left in a world that is over saturated with informations that are useless and only distract them. In addition, Quant funds are now competing in real time against humans on the trading floor. To survive and thrive in such an environment we have to embrace the fact that we’re humans and that we’re, apart from robots, emotional. Knowing yourself to a degree that allows you to inverse your own emotions is a difficult task, but it’s possible. In order to achieve this, I can only recommend having a diary! We can manage risk by avoiding red flags and developing a system of safety>reward.

In the end, it’s all about the journey and we live in times of social media that allow us to connect with dozens of likeminded people all around the globe. I hope that you were able to get value out of this article, and if you have anything to share/add, don’t hesitate and comment down below.

Yours sincerely,

MODERN INVESTING

Well done thank you

Can you please define your "greek music phase"?