A Journey of Energy and Human Development

Fossil fuels will still dominate the energy space …

The price of a commodity is determined by traders, which balance supply and demand. Both of these variables are hard to predict and normally supply is more important than demand. But since I have written several times already about supply, let’s dive deeper into demand for fossile fuels.

1/ Energy Sources during Human History

Energy is what has been the major force behind human success. The earliest form of energy is still used today. Biomass and wood are burned to create energy. As human civilization progressed, coal replaced biomass to a large extend as the main energy source. Without coal, the Industrial Revolution wouldn’t have taken place and the world would look vastly different.

The 1st oil well was drilled in 1854 in the small village of Bóbrka, Poland. Later, significant oil resources were found in the U.S. and Azerbaijan. Oil when domestically produced has significant advantages over oil sourced from other nations. The transport of energy and in this case oil, requires infrastructure such as pipelines and tankers. This process is inefficient, but necessary. Oil became the new go to resource for energy alongside coal, as big discoveries were made.

Apart from fossile fuels, Nuclear Energy and Renewable Energy are contributing to the energy mix. The later one is often described as the future. I have to disagree and point out, that fossile fuels are still a ~80% of the total energy mix. This, although CAPEX for renewables is higher then CAPEX for oil. Billions have been invested over decades, and not much has changed.But we will get into this later.

1.1/ EROI and it’s impact on energy demand

EROI [Energy Return On Investment] is a frequently used method to measure the efficiency of an energy source. The formula is total energy invested, divided by total netback. EROI is a metric, that is highly dependent on the data the model is provided with. Unfortunately this data is varies widely depending on the source.

As the population grows, energy demand rises. But apart from growth, as a result of a higher population, per capita demand rises over time too. This is the result of the fact, that humans (especially in developing nations) strive for a better quality of life. Over time technological advancement leads to higher demand for capita, and as more people join the middle and upper class, demand for all sorts of energy grows exponentially (see graph below).

With more efficient sources of energy (higher EROI), demand for energy rises. In the graph above we can see, that oil dethroned traditional biomass (wood) as the energy source number 1 around 1910. In the late 1960s oil dethroned coal and gas started to grow massively. Although wood lost it’s spot as the primary source of energy, the amount produced increased anyway. As a matter of fact, traditional biomass produces more energy then wind and solar combined (6% vs. 5%). After coal lost its top spot, it still went on to grow massively over the following decades.

2/ Prosperity & Energy

Human Development, Prosperity, Quality of Life or however you want to call it, is correlated with energy consumption. The article Energy, EROI and quality of life, that was released in 2014 covers this topic in detail.

To measure the quality, quantity and distribution of energy, the authors created the LEI index. 👇

LEI is generated by taking the mean of EROISOC (a measure of the quality of energy delivered), GJ per Capita (the total quantity of energy available per person) and the Gini-index (income distribution acts as a proxy indicator of energy distribution within an economy).

— Energy, EROI and quality of life

The main results of the study have been, that the Human Development Index (HDI) correlates with energy availability. Nations with higher energy availability tend to have higher HDI values, wich shows that quality of life is better.

Furthermore countries with access to more energy have shown, that they have better water quality. The higher the EROISOC , the more people have access to clean water. Without a doubt, energy has a direct impact on quality of life. Sources of energy, that show higher ROEI (Return on Energy Invested), are needed to ensure global prosperity for billions of people.

3/ Emerging Markets

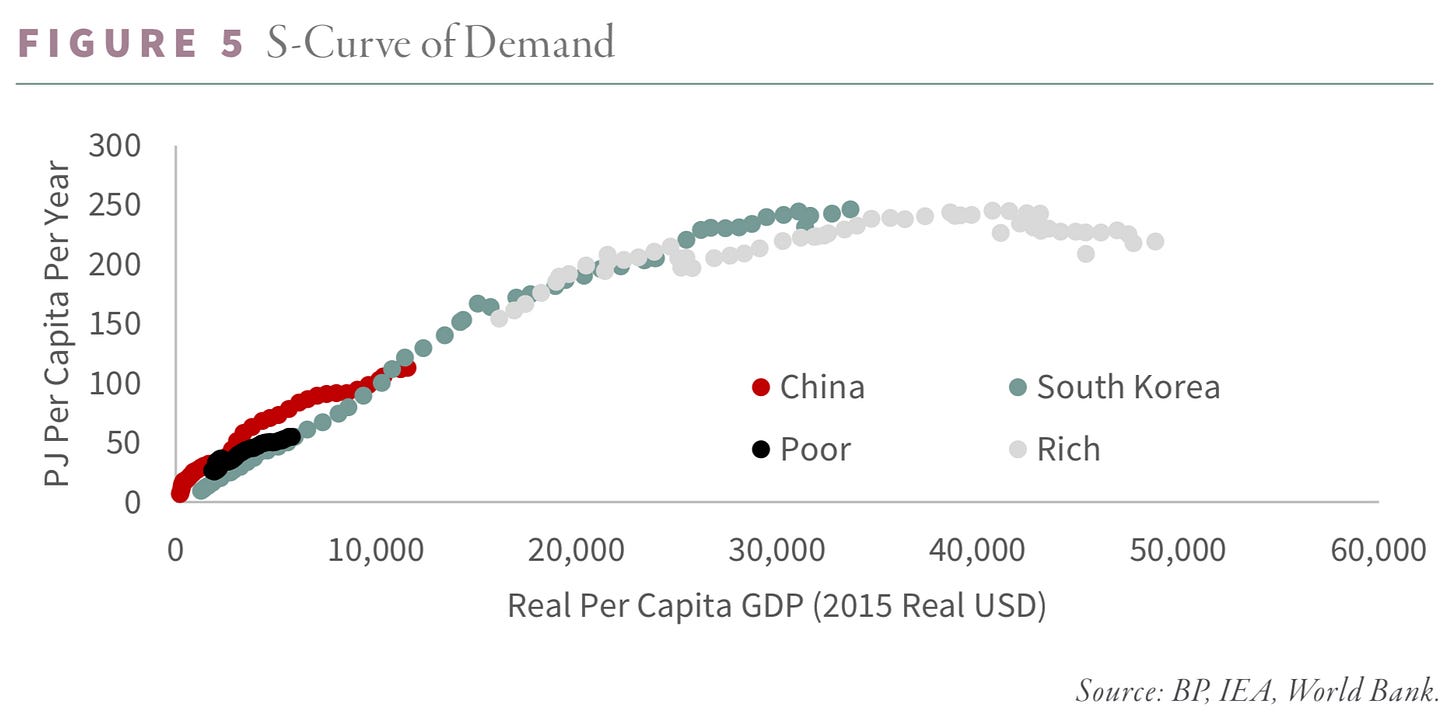

Emerging Markets play an increasingly significant role in energy demand. With India, Indonesia, Pakistan, Bangladesh, etc, we have billions of people that will consume more and more energy, as there economic output increases. We can see a clear correlation between GDP per capita and energy consumption per capita 👇

The results of Emerging markets and higher energy demand per capita will probably lead to much higher demand in Asia and Africa.

For China to exit the middle-income trap and top $20,000 per capita, the S-Curve suggests its energy demand must grow by at least 60%. While an economy’s real per capita GDP is less than $5,000, energy consumption is inconsequential; consumption begins to flatten when it is above $20,000. For most of the twentieth century, people between $5k and $20k per capita GDP remained relatively constant at 500 mm.

Between 2000 and 2010, the population of energy-hungry consumers surged from 600 mm to 2.4 bn, and by 2022, the number had reached 2.6 bn. A third of the world’s population is now in the “sweet spot” of energy demand growth, representing half of all economic growth. Never before have so many people simultaneously been in a period of energy-intensive economic growth. So long as this is true, global energy demand will remain a tailwind.

— Goehring & Rozencwajg Q3 Commentary

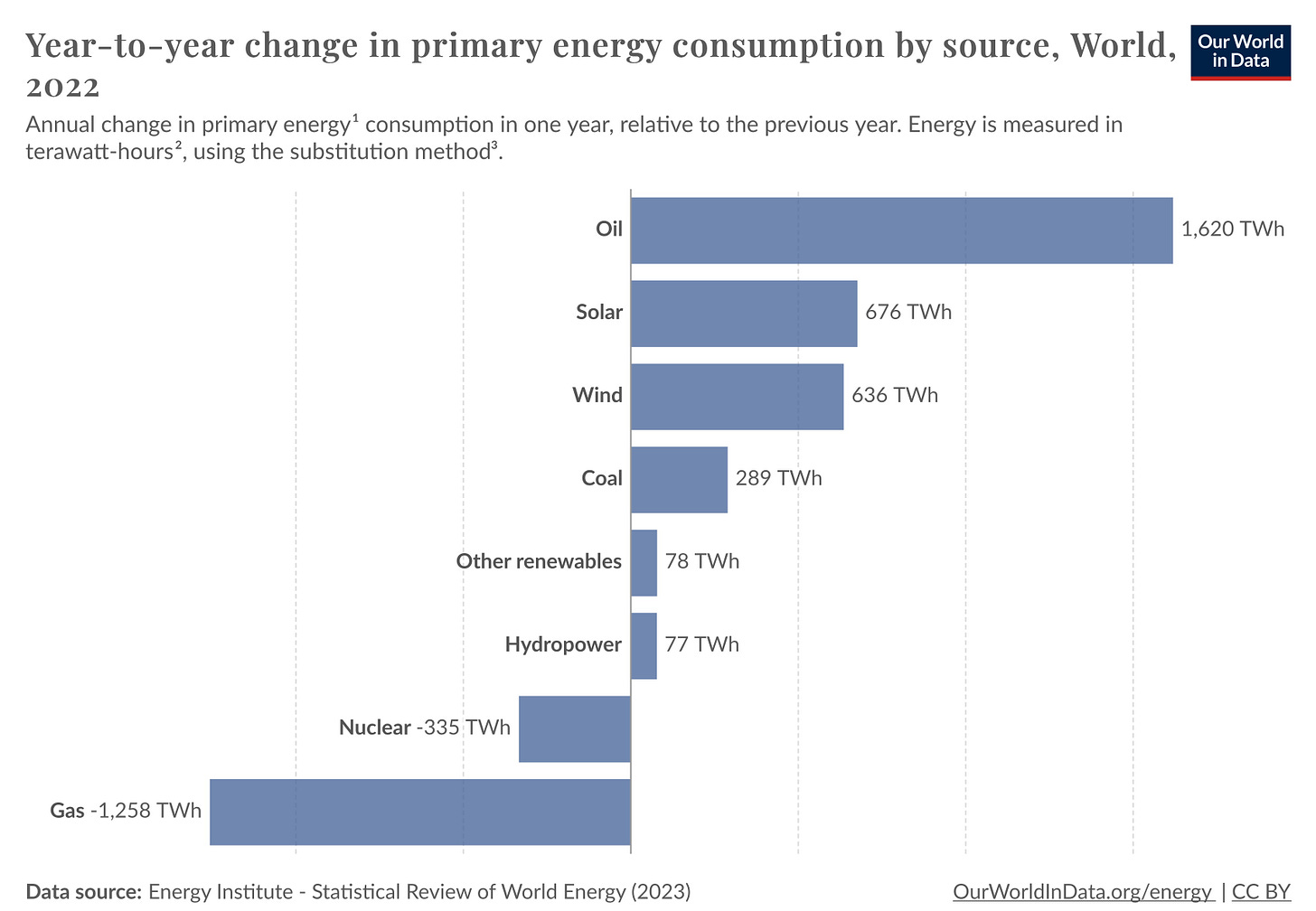

In 2022, the consumption of oil increased as much as that of solar, wind and coal combined (in absolute terms)!

4/ Renewables

Renewables accounted for 5% of global energy production in 2022 and have a EROI that is significantly lower than that of fossil fuels. Once energy storage and backups are added, the picture looks even worse. Renewables are the most expensive form of energy in this case.

The problem is, that in order to ensure global prosperity, humans need a reliable source of energy. This is something that simply isn’t possible with renewables alone. Therefore it’s no surprise, that Art Berman describes Renewable energy as a:

[…] poor substitute for fossil fuels. That’s because renewables are a diffuse form of energy and produce power only about one-third of the time.

— Art Berman Blog

The metals needed to build wind and solar parks are gigantic. The amount of space that is lost is huge and I haven’t even started talking about the inhuman process of rare earth mining. It’s clear that renewables won’t simply erase fossile fuels from the map. It’s not possible ! We need more and more energy each year, and the low efficiency combined with low reliability, isn’t a strength of renewables.

Another point many people seem to forget, is the fact that wind turbines for example have a life expectancy of around 20 years. This means, that till 2050 (most of the Net zero targets are till then) the existing wind turbines will have to be decommissioned and rebuild. While there might be in the future some sort of recycling, there will still be huge amounts of waste. Furthermore, we would have to invest hundreds of billions (again), in an attempt to not lose all the already made “progress”.

The chart below shows potential waste of wind power till 2050. 👇

5/ The bottom line

The bottom line is, that no energy source is perfect. You can choose your poison. I believe in humanities spirit of innovation and think that we will prosper, as a result of innovations in the field of science and energy.

Fossil fuels will remain the main source of energy for decades to come, and as the total demand for energy increases further, oil demand will grow to.

It’s a very complicated situation, but we as people from the 1st world shouldn’t point our fingers to developing nations and lecture them about diverting from fossile fuels. We have used fossile fuels to reach our current standard of living, and have no right of denying other countries to do the same.

For investors this is obviously a highly interesting topic, as oil and gas equities are trading at a significant discount to the rest of the market. While the energy sector represented just 4% of the S&P 500, it accounted for >10% of its earnings.

If we were to move back to the historical average of around 11%, energy stocks would perform very well. On the other hand, many E&Ps are offering high dividend and buyback yields, that would make for an attractive return, even if the stocks wouldn’t appreciate much in value.

I personally remain very long GeoPark, Vår Energi, OKEA, Petrobras, etc.

Yours sincerely,

MODERN INVESTING

Another banger article!