OKEA & Ithaca are among the best bets in the energy market

Update on OKEA ASA and why Ithaca is a great stock …

The word “contrarian” is used over and over again by the investment community. But when the time comes to act against the masses, move against the trend and buy hated assets, everyone is in panic. The time to be greedy is when other are fearful and its even better, when the companies we invest in are build with the core focus of creating shareholder value, in markets that are left for dead by WallStreet.

Among the companies that are going against the trend in an effort to generate abnormal returns, OKEA and Ithaca stand out to me. I have shared my thesis on OKEA several times already and will provide an update on the stock following the earnings report a few weeks ago. In addition, I will share my thoughts on Ithaca Energy, which is going to become a new position in my portfolio.

1| OKEA

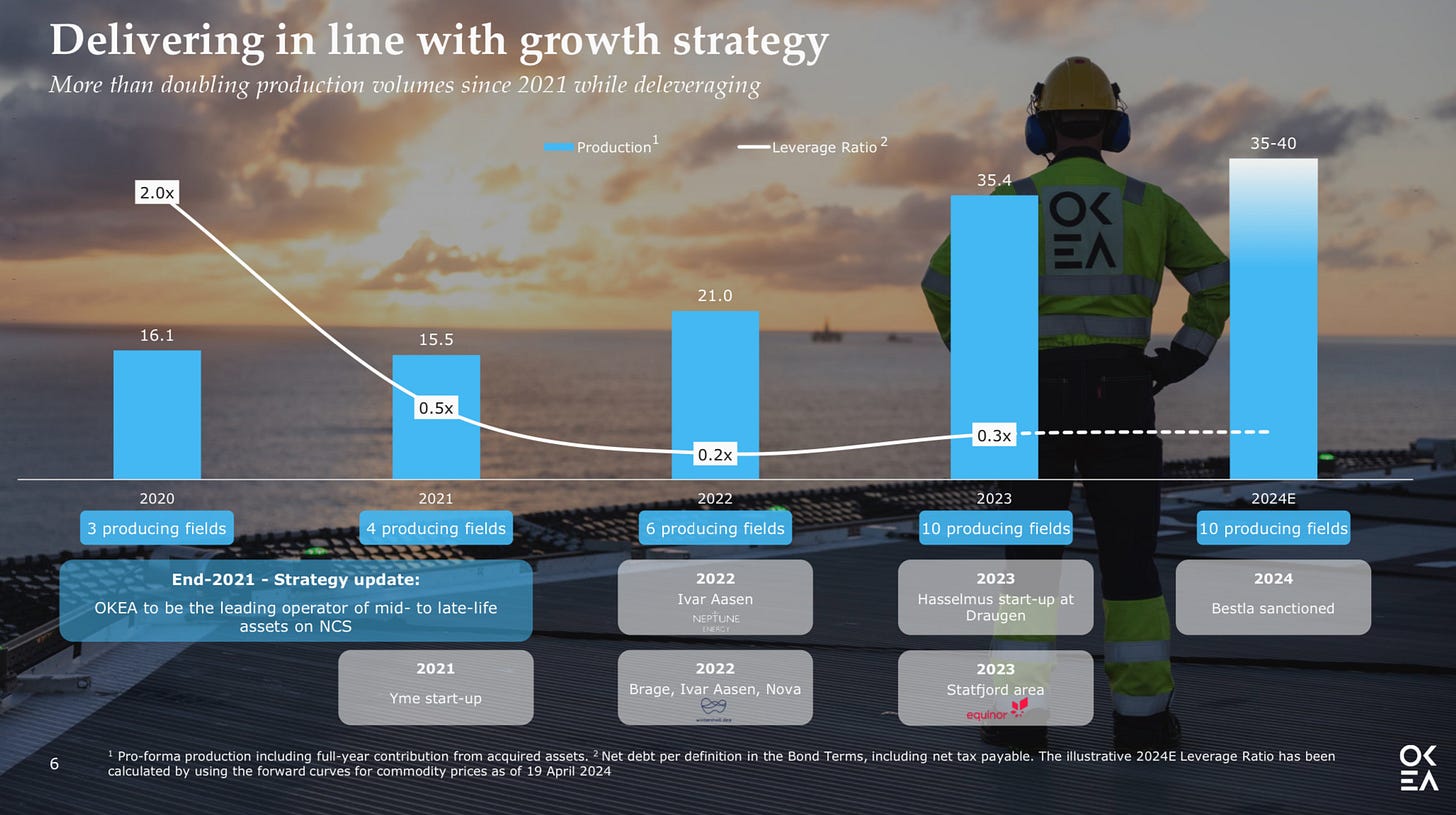

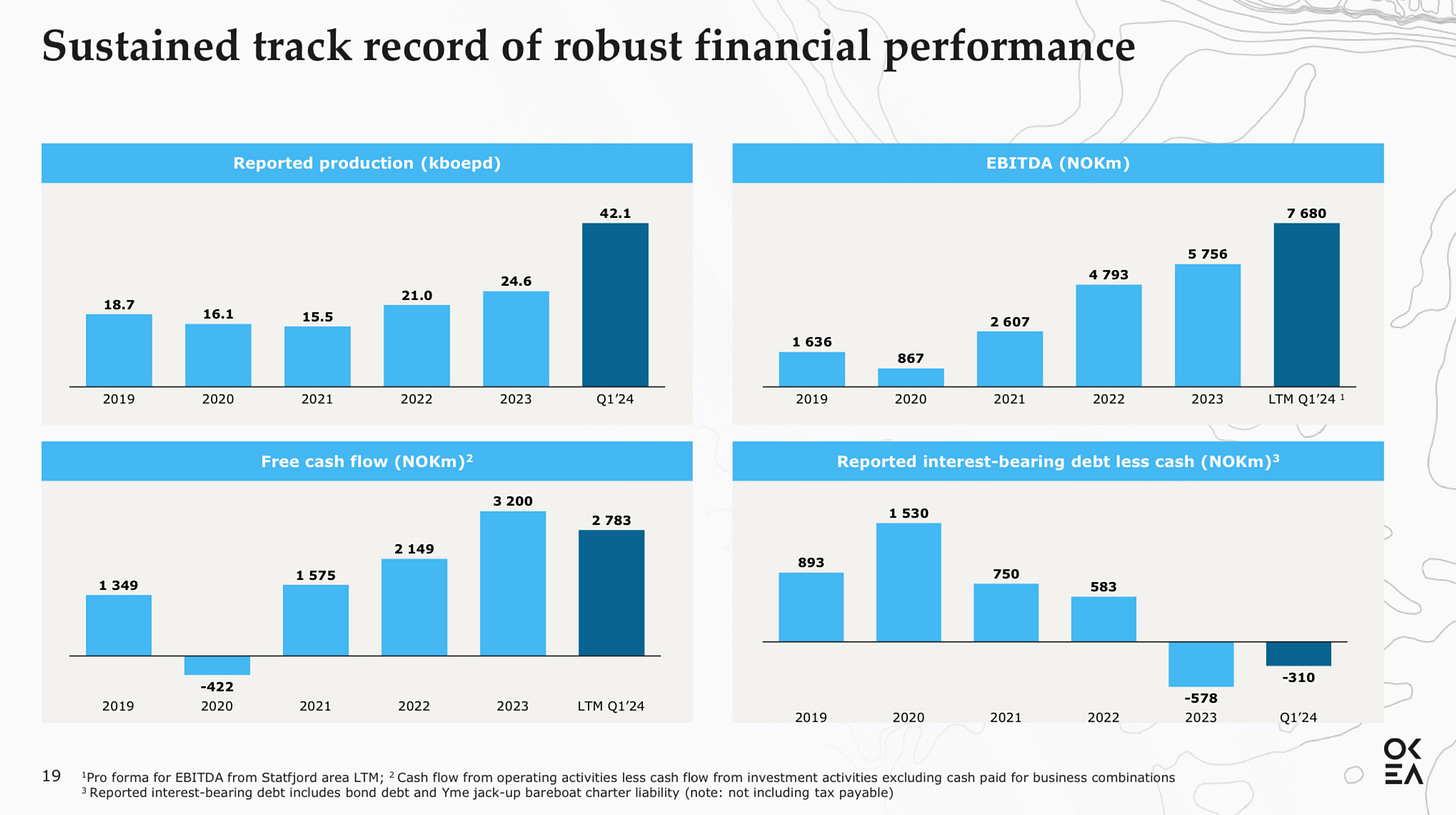

OKEA’s operational performance has been astonishing. The Statfjord deal closed, the company has hit a production rate of 42 kboe/d in Q1 of this year, and the stock is tremendously undervalued.

The stock market isn’t always efficient. That’s the reason why value investors exist. The case with OKEA is a textbook case of what happens when the market becomes to pessimistic about a stock.

At the low in February, OKEA had a market cap of around NOK 2.3B, while the company had a net cash position of NOK 578m. With an EV of NOK 1.72B, the stock was trading at what I projected to be a 116% EV/FCF Yield. Fast forward 2 months, and OKEA reported its Q1 2024 earnings report supporting my underlying thesis.

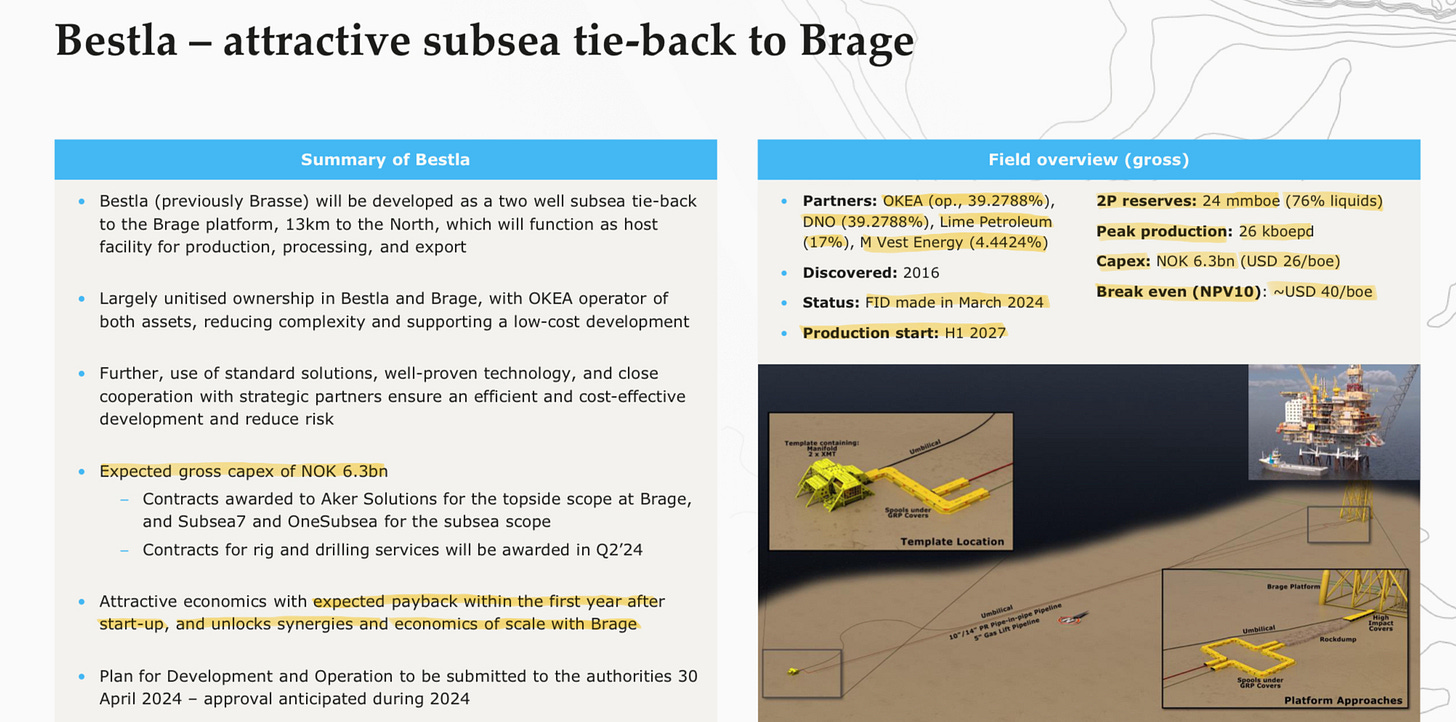

Revenues for the 1st quarter came in at NOK 3.4B which was 35% above analyst estimates. FCF over the last twelve months (LTM) ammounted to nearly NOK 2.8B, while FCF for Q1 2024 was slightly negative. This isn’t concerning as it’s related to the lifting schedule and the Statfjord acquisition. Most lifting happened in March and the payments will be received in Q2. The balance sheet is still in great shape with a net cash position of NOK 310m. In addition, OKEA has sanctioned the Bestla project that is expected to come online by 2027. The project will add around 10 kboe/d net to OKEA and will be realized in cooperation with DNO, Lime Petroleum and M Vest Energy.

Due to the sanctioning of the Bestla project, CAPEX will be around NOK 400m higher for the FY 2024. My estimate of FCF for 2024 remains unchanged at NOK 2B because I already accounted for possibly higher CAPEX in my original assumptions. The stock of OKEA trades well below any reasonable fair value and is significantly undervalued compared to the FCF generation of the business, the operational performance of the company and the assets owned by the company.

Next year OKEA will be able to return cash to shareholders again, which should add huge value and will increase investor interest in the company. The impairments from the Statfjord transaction resulted in an accounting loss, which prevents the company from paying dividends under the conditions of its outstanding bond. The current market cap stands at NOK 2.67B and the EV is equal to NOK 2.36B. While the share price has appreciated to some extend over the last 3 months, the risks have gone down meaningfully.

2| Ithaca Energy

Ithaca Energy has similarities to OKEA. Both companies operate in markets that are hated by other market participants. OKEA is operating in the mid/late life market in the oil & gas industry. This area is under appreciated by the market and therefore OKEA can buy old assets at significantly reduced prices. Ithaca Energy is operating in the North Sea (UK) and expanding in this region via M&A, but also via organic growth.

Ithaca went public in 2022 and was spun off from Delek Group, which is among the largest and most important Israeli companies. Ithaca recently announced the merger with Eni UK, that will create the 2nd largest company operating in the North Sea by production levels.

Ithaca has been able to turn the odds of success into their favor. The unfair advantage Ithaca has, is a large poll of account tax losses. Thanks to the accounting tax losses Ithaca can reduce its tax burden by lot and thanks to this pursue a more aggressive approach than their competitors.

2.1| Windfall taxes

The UK’s energy market has become a shadow of its past. In the past, the North Sea became a lucrative place for oil majors to invest money in, due to the large oil & gas reserves. This changed rapidly after the windfall taxes came into place in 2022. From this point on, the windfall taxes alone ammounted to 35% of profits, while the regular taxes resulted in a total tax rate of 75%! The signal was clear, the UK wants to punish oil & gas companies for their record high profits. This is a pure hypocrisy, since the government didn’t rescue oil & gas companies in 2020, when many companies had to announce their bankruptcy. So at cycle lows, the government didn’t care about the crumbling energy industry, but at cycle highs, the government’s are announcing windfall taxes. Oil Majors followed with announcements, that they would divest from the North Sea and leave the market.

“Shell said it would review its 25 billion pound ($30 billion) investment plans in Britain due to the tax, known as the Energy Profits Levy (EPL).

Equinor said that “the EPL did not help investor confidence. Uncertainty makes it harder to take investment decisions, especially the uncertainty around the longevity of the EPL. The EPL means some companies could shut down depleted fields earlier than planned because they become uneconomical”.

— Reuters (Here)

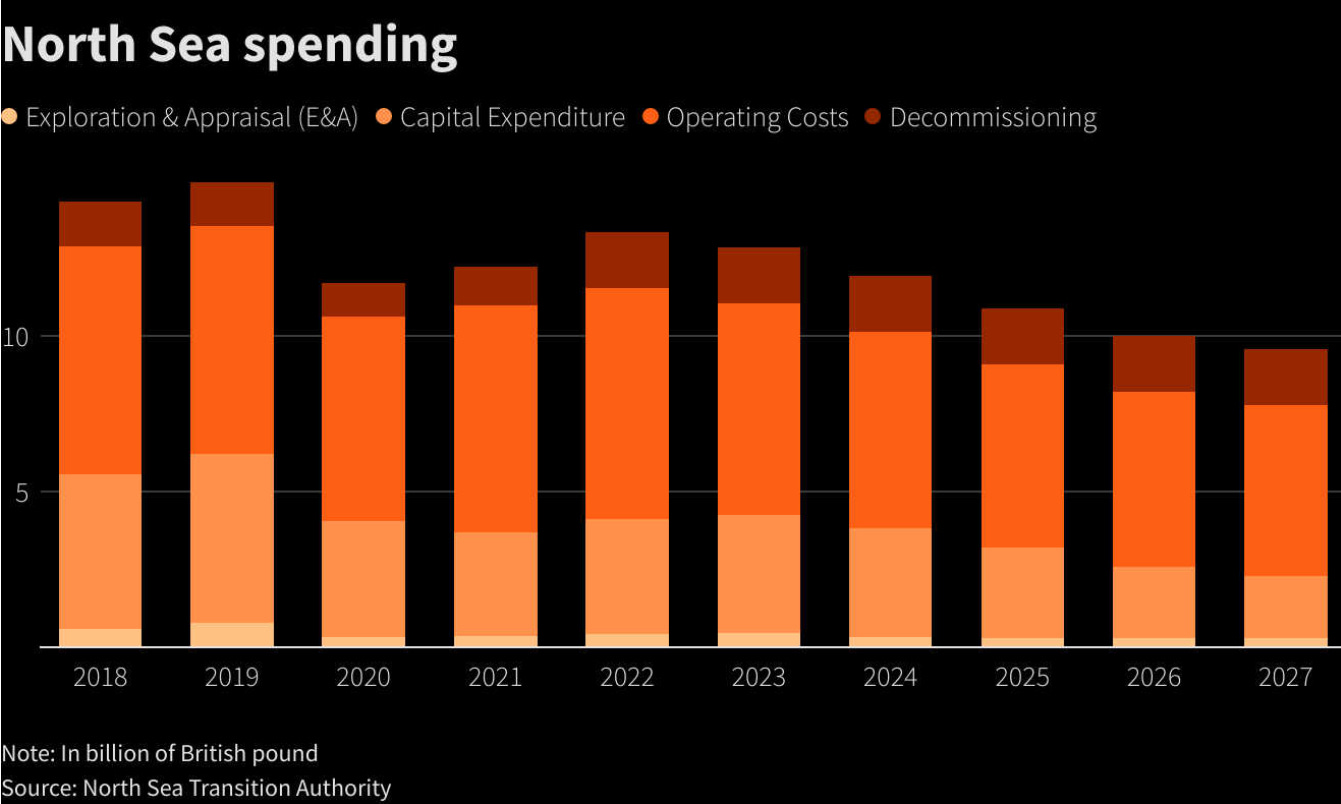

The chart below shows the spending in the North Sea and it’s not rocket science to understand that the underinvestment in this sector is primarily driven by the uncertainty of the tax system in the UK.

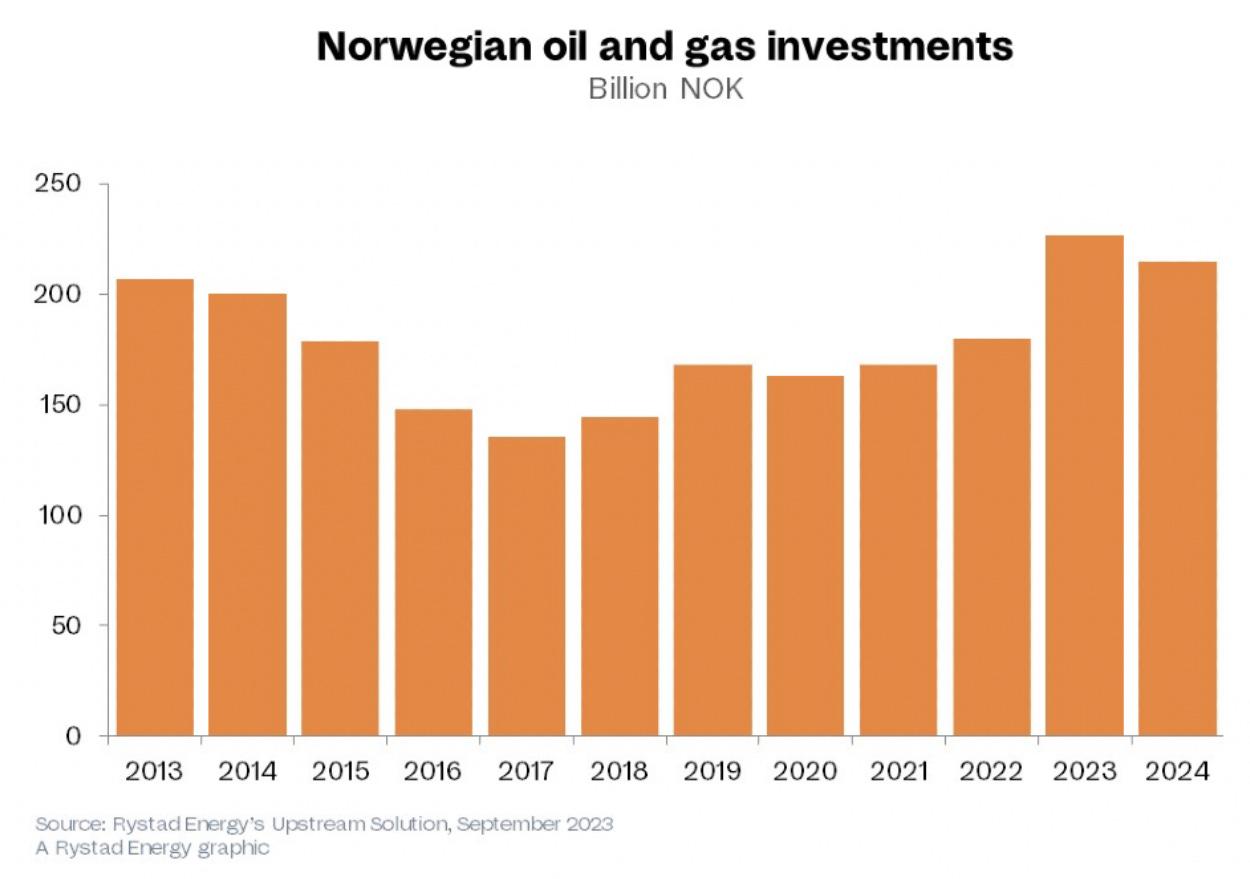

Contrary to that, the spending in the Norwegian Continental Shelf (NCS) is more healthy. Even though Norway has very high taxes, companies are willing to invest there, because Norway has proven to have a stable tax regime.

2.2| Ithaca post merger

Politics aside, the UK still needs energy. Energy security is more important than ever before, with geopolitical instability globally, and rising energy prices. While all those majors are divesting from the North Sea due to windfall taxes, Ithaca is expanding aggressively with the support of Eni and Delek Group.

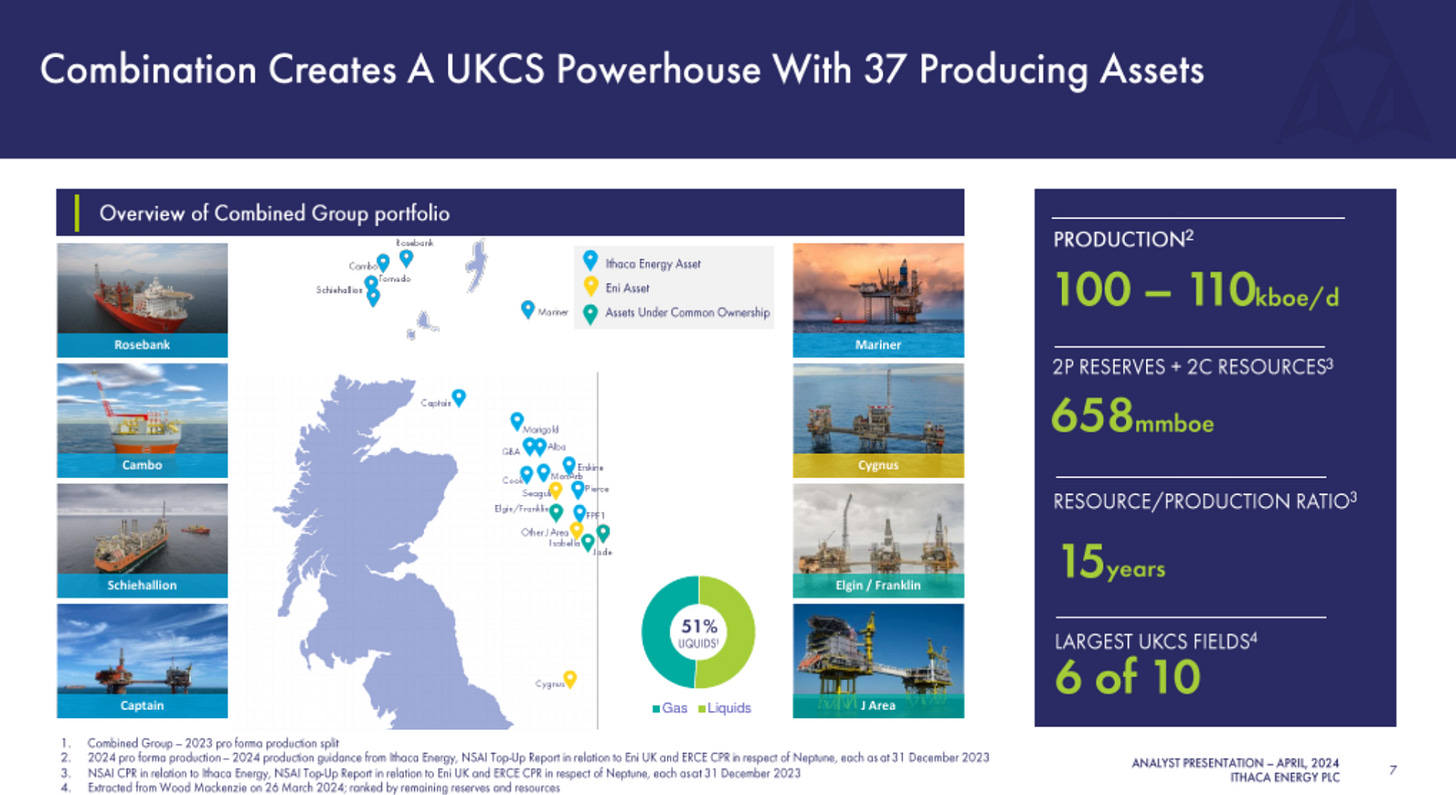

When the deal between Eni and Ithaca closes, the company will produce around 110 kboe/d, have 600m boe in 2P reserves and a reserves life of around 15 years. The $4.5B accounting tax loss pool is protecting them from a large part of the horrendous tax, and allows them to invest aggressively into new projects such as Rosebank and Captain.

Post merger, Delek group will own around 52.7% of the company (down from 54.5%), while Eni will hold a 37.3% stake. The free float will increase from 7 to 10%, since this is a requirement for the deal to get approval.

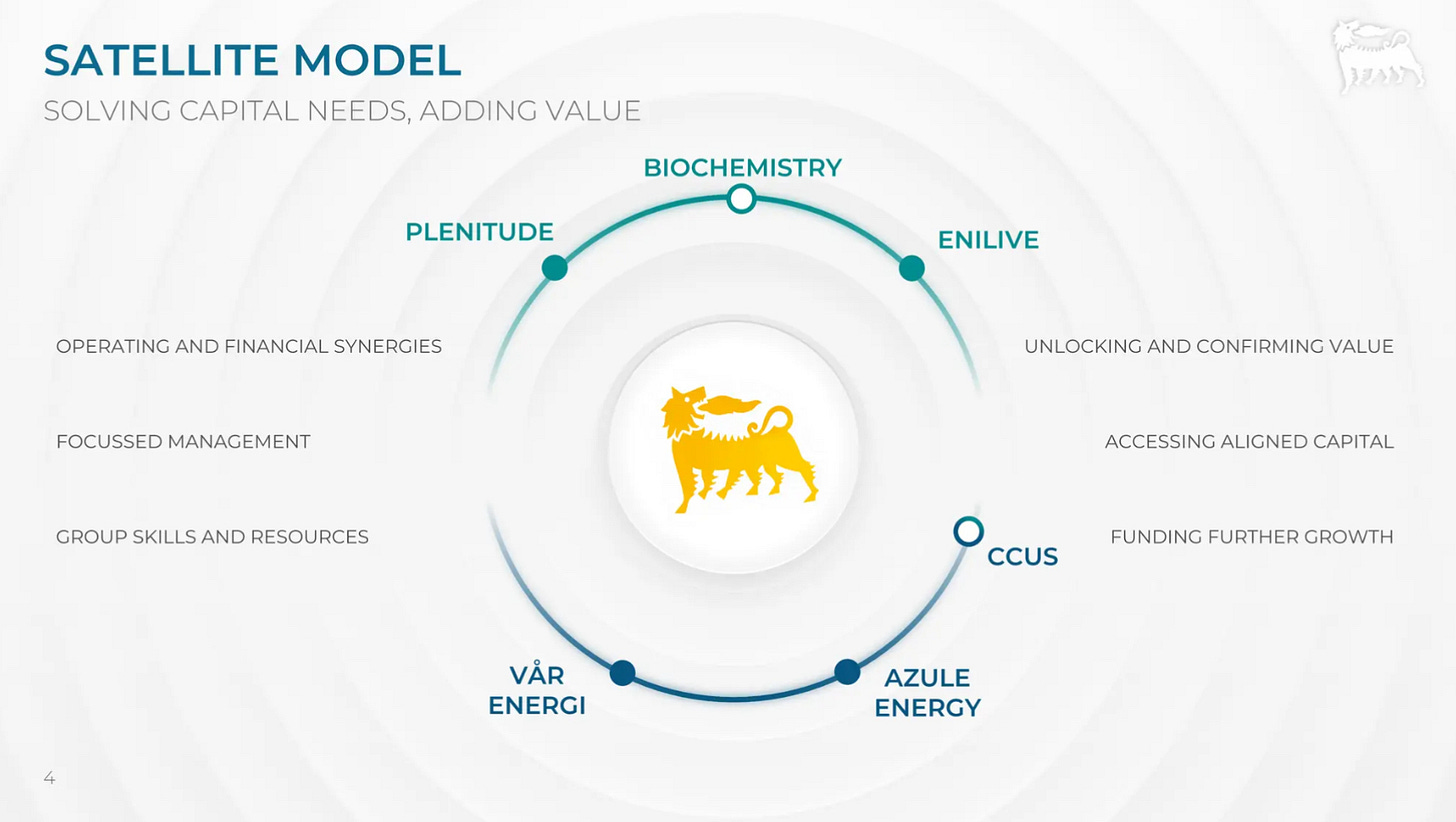

During the conference call, the management of the company especially highlighted that the deal is inspired by the success of Vår Energi (I happen to be a shareholder). Vår Energi operates in the NCS and has made a similar transaction with Eni as Ithaca is currently doing. Eni’s strategy of merging their assets with that of smaller companies has proven to be very successful with examples being Vår Energi in Norway and Azule Energy in Angola. In addition, the deal will certainly have some synergies that will positively impact the company’s future.

Among them mostly financial synergies that will lead to better credit ratings.

2.3| Liquidity, Financials & Dividends

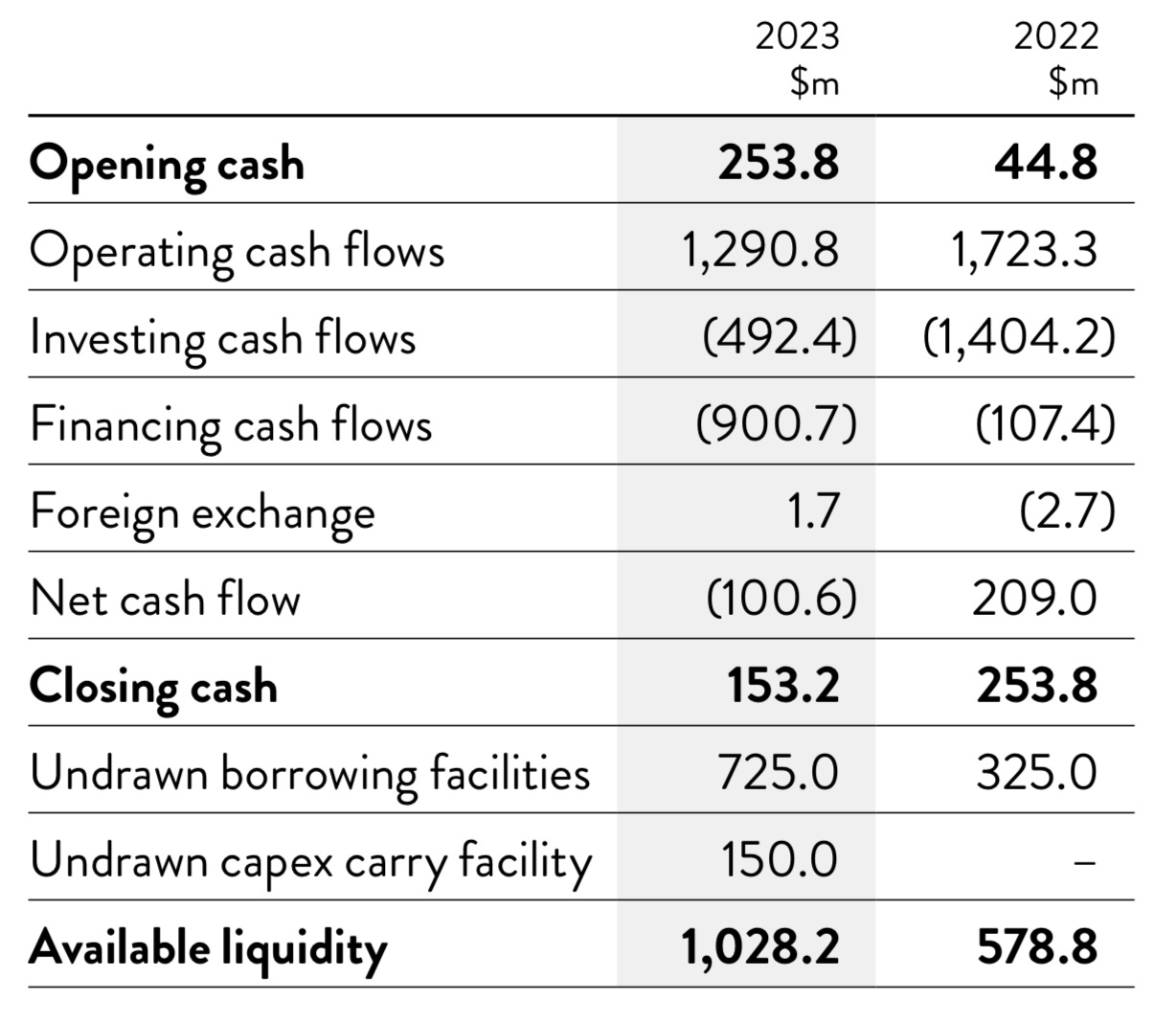

Ithaca has gross debt of $725m, and liquidity of $1B, which is comprised of $153m cash and an undrawn credit facility of $875m. With net debt of $572m, the net debt of the company is quite low compared to the cash flow generation of the company.

In 2023, Ithaca generated CFFO after taxes of $1.29B, while cash flow used in investment activities ammounted to $492m. This resulted in FCF of $800m, from which $400m were paid out in dividends. This was in line with the policy of distributing 15-30% of CFFO after taxes to shareholders via dividends. Furthermore, the FCF was used to repay debt worth $500m.

Ithaca outlined their plan for dividend payments for 2024 and 2025 in the most recent conference call, in which they stated that they plan to distribute $500m in dividends each for the FY 2024 and 2025. The dividend yield from this guidance would amount 20% on the market cap post closure of the deal. Based on my calculations around 35-45% of the production in 2024 (pre Eni deal) is hedged via derivatives.

I mentioned the accounting tax losses earlier, but want to highlight how valuable this “asset” is for the company. While other companies operating in the North Sea have to pay huge windfall taxes also known as EPL (Energy Profits Levy) , Ithaca has a below average tax expense, which is due to a $4.5B accounting tax loss position.

Following revisions to the Energy Profits Levy in November 2022, that saw the rate of EPL rise to 35%, the Group incurred current EPL charges of $333.4 million in the year (2022: $131.4 million), with the charge payable in October 2024. The Group's cash flows continue to be protected by our tax efficient structure with a material ring fence corporate tax and supplementary charge tax loss position of $4.5 billion at year-end.

— Ithaca Annual Report 2023

Ithaca won’t be able to avoid taxes completely, but will be able to reduce its tax expense quite meaningfully due to the tax loss position.

3| Conclusion

In conclusion, OKEA and Ithaca are creating value for shareholders by investing in areas that are hated by many investors. Investing where others are leaving is a strategy that has resulted in fast growth in production for both companies over the last years. M&A is among the most important strategic priorities for both companies and I remain long OKEA. The stock is trading at a significant discount relative to its intrinsic value, and there is a clear path forward for dividends coupled with growth. Ithaca will likely become a new position in my portfolio, as the merger with Eni is going to create one of the largest E&Ps focused on the UK. The stock is trading at an absurd valuation if you consider that the company has a large reserve base (2P RLI of 15 years). The dividend yield for Ithaca should be around 20% and the most valuable assets of the company is its large tax loss position, that allows them to invest more aggressively, and generate large amounts of cash flows for years to come.

Yours sincerely,

MODERN INVESTING

Great write up thank you.

What is the downside protection of the OKEA thesis? Have you accounted for the worst? 4 of their assets stop production in 2.2 years. Brage+Gjoa+Yme+ I. Asen=15.6MBOE of 2P. they produce 19.4 kboepd in total => 15.6/19.4*1000=804 days = 2.2 years. 2C oil is not included in worst case scenario as we should not rely on what management thinks and estimates.

So in 2026 we will have at least 19.4 kboepd cut from 42 kboepd => 22.6 kboepd. What is a fair value including this, assuming no further aquisitions until then? What happens when they milked the last drops of these assets, just write them off as worthless in the balance sheet? Impairment, depreciation?.

Im trying to figure out, what is the absolute floor level here

thanks