1.0 The secret to China’s incredible growth

China’s growth is just incredible. The growth is something that can be described as a miracle. In fact 800 Million Chinese came out of poverty in a period of just 30 years ! This is unprecedented in human history.

The secret to this growth is human capital ! When countries realize that the biggest and most valuable asset they have are there people, great things can happen. Singapore for example has no natural resources, a low population and was a giant slum in the 1970s. Today it is one of the richest nations on earth, thanks to the policies from Lee Kuan Yew.

The Chinese middle class is growing at a rapid pace, to this day. In the western world, the middle class is shrinking ! This is one of the reasons China became successful, and will become the worlds richest country before 2030 !

2.0 Alibaba and E-Commerce

The biggest beneficiary of rising middle class in China is arguably the E-Commerce market. With GDP per capita growing 13x since the turn of the millennium. The by far biggest E-Commerce company in China is Alibaba, the giant that was founded by Jack Ma in 1999. In this write up we will look at:

The company from an operational view.

Further we will analyze the market position Alibaba.

Looker the financial development of the company.

Value the company.

And most importantly look at the regulatory standpoint.

1) Company Overview:

Alibaba operates through various segments, including:

E-Commerce

Cloud computing

Digital Media and Entertainment

Logistics

It’s flagship platforms, such as Taobao and Tmall are the most popular E-Commerce platforms in China. Alibaba also owns 33% of Ant Financial, which is a platform on which people can pay digitally, borrow money etc. It is comparable to an online bank focused on the Chinese market. Further, the company owns 83% of Lazada, which is an E-Commerce company focused on South East Asia.

After starting with E-Commerce, the firm expended into other markets, such as Logistics and Cloud. Alibaba is the 3rd biggest cloud platform in the world and is the leader in the Asian region.

1.1 Flywheel

The ecosystem Alibaba build is similar to the one Amazon created. In the center of all, there is the E-Commerce platform. This platform attracts customers and gives the company considerable leverage over competitors.

With the trust customers have into the platform and the company, they collect a lot of data, that is worth billions of dollars. Often these companies build advertising businesses around the main product E-Commerce.

As time goes by, the managment team starts investing money into areas such as Cloud, Logistics, Media, etc. In the main time the core business around E-Commerce continues expanding into other areas and geographic locations.

The Flywheel above is originally from Amazon, but can be easily applied to Alibaba.

In this process it is important to build a dominant market position, because at one point the Big Tech/E-Commerce companies will fight brutally for market share/survival. And there is no better way to achieve dominance, than having control over all the data people have, especially financial data.

All in all customers come to the platform because of low prices and a wide variety of products. This drives growth and makes products even cheaper (scale effects) and brings more sellers to the platform —> more products. This cycle repeats itself until the company dominates the entire market.

And here is where Ant Financial and the CCP comes in …

2) Regulation and the CCP:

Big Tech grow so fast in China, that a few companies dominated the entire digital landscape, namely Alibaba, Tencent and Baidu. After Jack Ma (founder of Alibaba) publicly criticized the CCP, the Chinese government decided to regulate the power of Big Tech. They did this by preventing the Ant Group to go public. It would have been the biggest IPO in history at that point.

Further, Big tech had to pay fines in the billions and was forced to create a more *friendly* environment for competitors. As a result the stocks of Chinese stocks, especially Big Tech where crashing for nearly 2 years straight !

It was painful to watch. But toady the situation has changed and Chinese Tech stocks have bottomed.

3) The Turnaround :

After the crash in Chinese stocks, the investment world is divided. The one side has the opinion, that there is way to much political risk and that these stocks are “uninvestable“. The other side says that these companies have deep value and that the stocks are a strong buy.

For me personally, nothing is univestable. At the right price everything is a buy ! But the right price is not everything, a turnaround/catalyst is also needed to make a good investment decision.

3.1) Spin Offs

For Alibaba we have seen the turnaround in the last few months. With the announcement, that the company would be spinning off six companies.

“Chinese e-commerce giant Alibaba announced in November 2022 that it would be spinning off six companies (…) Alibaba stated that it was restructuring as a holding company focused on capital management. The company seeks to focus on its core business and enhance shareholder returns.“

— Nasdaq

The spin offs will create huge value for shareholders. This is the case, because investors will realize the immense value, all the entities of Alibaba have. Secondly, this move will result in less political risk.

“The spin-offs will help Alibaba comply with Chinese regulators regarding anti-monopoly regulations.“

— Nasdaq

The main problem Alibaba had with regulators, was the fact that Alibaba is so large, that it is regarded as an monopoly. Therefore the firm had to pay 2.8 Billion $ in fines in 2021 !

But with the spin off, Alibaba is just a holding company and all the entities are individual companies that are not even close to be considered monopoly’s. This article gives more insight into the spin off.

3.2) Share Buybacks

In the last few months Alibaba bought back shares worth 12.2 Billion USD. This is part of the massive 25 Billion USD share buyback program, that was announced in march 2022. Bellow we can see that share outstanding went down drastically over the last 3 years.

Source: Koyfin

The focus from Alibaba is now on Free Cash Flow generation and buybacks. This is a trend, that I as a value investor like very much. The company has a very strong balance sheet with 63 Billion USD in Net Cash, which allows it to buy back a lot of shares.

4) Competition :

Alibaba has created the E-Commerce industry in China and therefore had the first mover advantage. With 50% market share in the region, the firm is dominant. But great business models attract competition. This graph shows the market share of different companies in the Chinese E-Commerce market.

Source: Graphic made by THE MODERN INVESTING NEWSLETTER with data from International Trade Administration

The biggest competition to Alibaba comes probably from JD.com, even tough JD is a great company, they have just 15% market share. So I think that the large companies can co-exist in this very large market.

But the biggest advantage Alibaba has, is it’s culture and understanding of the Chinese consumer. In the early days of Alibaba, the company had to compete with E-Bay. Everyone tought that E-Bay would easily destroy Alibaba. But they underestimated Jack Ma.

E-Bay may be a shark in the ocean, but we are a crocodile in the Yangtze River. If we fight in the ocean, we lose, but if we fight in the river, we win.

— Jack Ma

Because Alibaba knows the Chinese consumer and the market so well, E-Bay had no chance competing against them. If we look at the Annual report 2022, this what we can see on the first page:

I like the long term view and vision the company has, this combined with a deep understanding of the regional market is a strong advantage over competitors.

5) Financials :

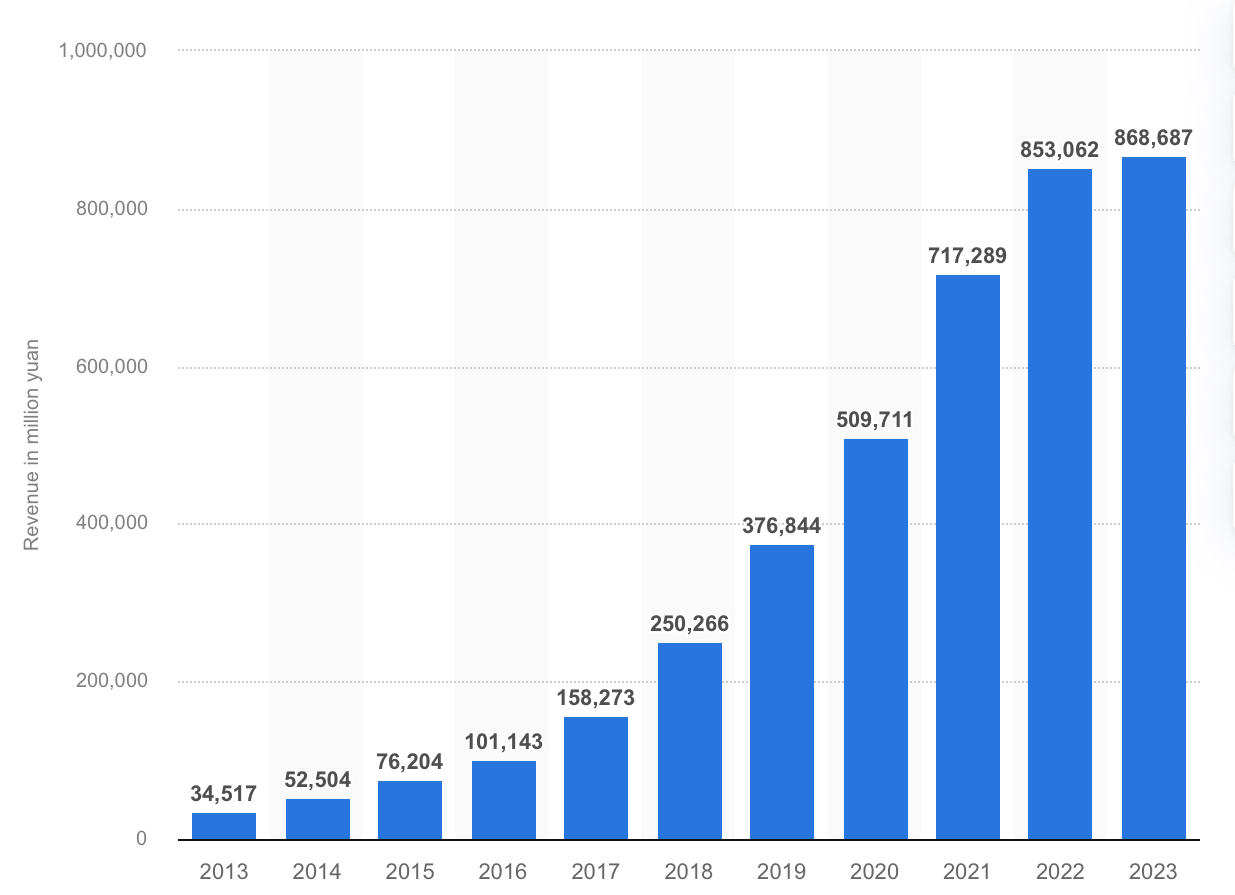

The chart below shows the revenues of Alibaba from 2013-2023.

Source: Statista

Revenues grew over the last 10 years at an staggering rate of 34% p.a. ! Free Cashflow and Net Income didn’t grow that fast, because the focus was definitely on growth. Now after the transformation, Alibaba is focusing on Free Cashflow generation and capital allocation.

In the period from March 31, 2022 to March 31, 2023 Alibaba grew it’s revenues by just 2%. But Free Cashflow amounted to 25 Billion USD, which is an increase of 74% ! EPS grew by 35 % during this period, further Alibaba has a huge Net Cash position of around 60 Billion USD.

6) Valuation:

Alibaba is valued at 248 Billion USD. While generating 25 Billion in Free Cashflow over the last 12 months. The company is buying back aggressively it’s own shares, and has a dominant market position in the Chinese/Asian market.

Historically Alibaba has grown revenues at a rate of 34% per year, with the focus on Free Cashflow I think that FCF will grow slightly faster then revenues.

For the valuation I assume:

Revenue growth of 11% p.a.

FCF per share growth of 14% p.a.

A multiple of 15x FCF in 2028 (currently 10x, but with pessimism over China)

A 15% discount rate

Based on these estimates we arrive at an future value of 282 $ per share in 2028. With the 15% discount rate we end up at an current fair value of 141 $ per share. Or an upside of 57%.

7) Conclusion

Alibaba is the most dominant company in the Chinese E-Commerce and Cloud market. The stock is deeply undervalued and the company is buying back aggressively it’s own shares. Trough it’s culture the company is positioned to thrive over the next years. I am bullish on Alibaba.

This is not financial advice. Everyone has to make financial decisions himself, based on the risk the person tolerates.

I agree on your bullish stance of Alibaba. Although you overstated China's growth factors considering it's high youth unemployment rate, and mounting pressure in e-commerce from micro video channels. China's post COVID recovery looks sluggish at best for 2023. Alibaba's pivot and separation from its cloud business is worrisome. The cloud business was its best asset. Competition is ramping up from companies that understand the younger Chinese consumer a lot better than Alibaba does. So while I think the stock is undervalued, there are many important caveats.

15% discount rate is a way too high! What would be value with for instance 10% discount rate?