Allegro, the tech giant of Poland and soon Eastern Europe

High conviction stock from Poland with a lot of long term potential …

Allegro is Poland’s leading e-commerce market place with 15 million active customers inside the country and a further 5 million active customers within the Visegrad region. As the economy of Poland and the Visegrad region continues to grow at a fast pace, living standards will continue rising over the coming years/decades. Allegro is among the leading polish technology firms and will likely become a blue chip stock in the polish equity markets. With a great track record of growth and a large runway for growth, the stock seems undervalued compared to its future cash flows.

In summary Allegro:

Has compounded revenues at a 35% CAGR over the last 6 years.

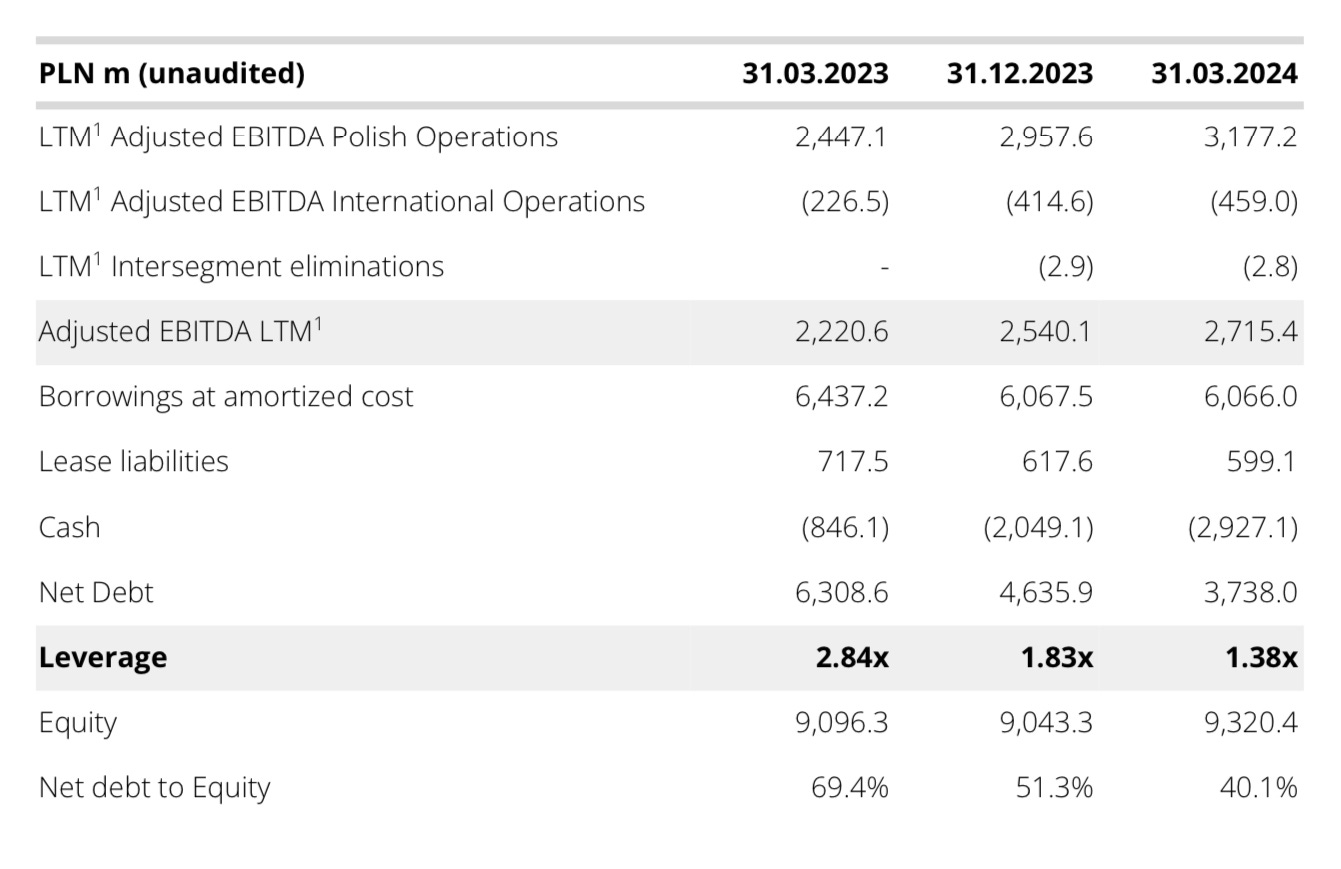

Has a healthy balance sheet with low debt.

Is expanding internationally into other Eastern European nations.

Is offering new products such as AllegroPay or Smart! to build a large ecosystem.

Is trading at around 15x FCF for 2024, while growing quickly.

In this article I will break down the business model of Allegro, industry tailwinds, the economic landscape of Poland, Valuation, etc.

1| Introduction

Allegro is a marketplace that started with a total focus on Poland, but has in recent years also expanded into some of its neighboring nations. The company was founded in 1999 in Poznań by the Dutch entrepreneur Arjan Bakker, who wanted to replicate the success of eBay in Poland. 25 years later, Allegro has become the largest player in the polish e-commerce industry with 15 million active customers in Poland and further 5 million customers in Hungary, Slovakia, Czechia, Slovenia and Croatia. The company has >7000 employees and is focused on growing through simplicity and further products for customers.

As a market place, Allegro earns a commission for every product sold also known as “take rate”. Currently Allegro’s take rate is around 12% and the company is achieving most of its revenues via this way. While many market places also sell their own products (1P), Allegro isn’t really doing that at scale, but rather in a small mater.

In recent years, Allegro has followed a similar path as Amazon or Coupang (Korean e-commerce giant) by introducing memberships to enhance loyalty and expand the sphere of influence of the company. “Smart!” is one of these memberships that offers several advantages over non-members. “Smart!” is a logistical network from Allegro that offers free shipping and the returning of parcels at no extra cost. The service uses parcel lockers called “One Box”and couriers to deliver packages to members. Over the past few months, Allegro also uses parcel lockers from the state owned energy company Orlen to deliver parcels.

Every year on the 15th of May there is an event called “Smart! Week”, which is comparable to Amazon’ Prime Day and Alibaba’ Single Day. Members are able to buy many products at discount prices over the course the week. The membership costs PLN 14.99 a month or PLN 59.90 a year. As of Q1 2024, “Smart!” has more than 5 million members.

“[Smart!] has saved customers a total of nearly PLN 4 billion on free delivery and returns alone. The savings, the simplicity of the service and the ability to couple it with other benefits, e.g. special offers for Smart! members, access to presales and interest-free shopping credit with Allegro Pay, allowed the number of users to exceed 5 million!”

— Allegro

Apart from “Smart!” the company also has a payment service called Allegro Pay, which is basically a simple and safe way to pay digitally. The service is comparable to Buy-Now-Pay-Later (BNPL) services in the U.S. or in other parts of Europe. Currently, Allegro Pay has 1.4 million users and based on the latest customer survey 94% of users would recommend the service to friends.

To finance Allegro Pay, the company has an agreement with Banco Santander, on financing consumer loans up to PLN 3 billion. Last but not least, Allegro also has an advertising platform called Allegro Ads. This platform allows advertisers to strategically place adds on Allegro’s market place. Since its inception, Allegro Ads has grown significantly faster than GMV (Gross Merchandising Value) and is expected to continue growing faster than GMV over the coming quarters/years.

2| E-Commerce adaption and growth

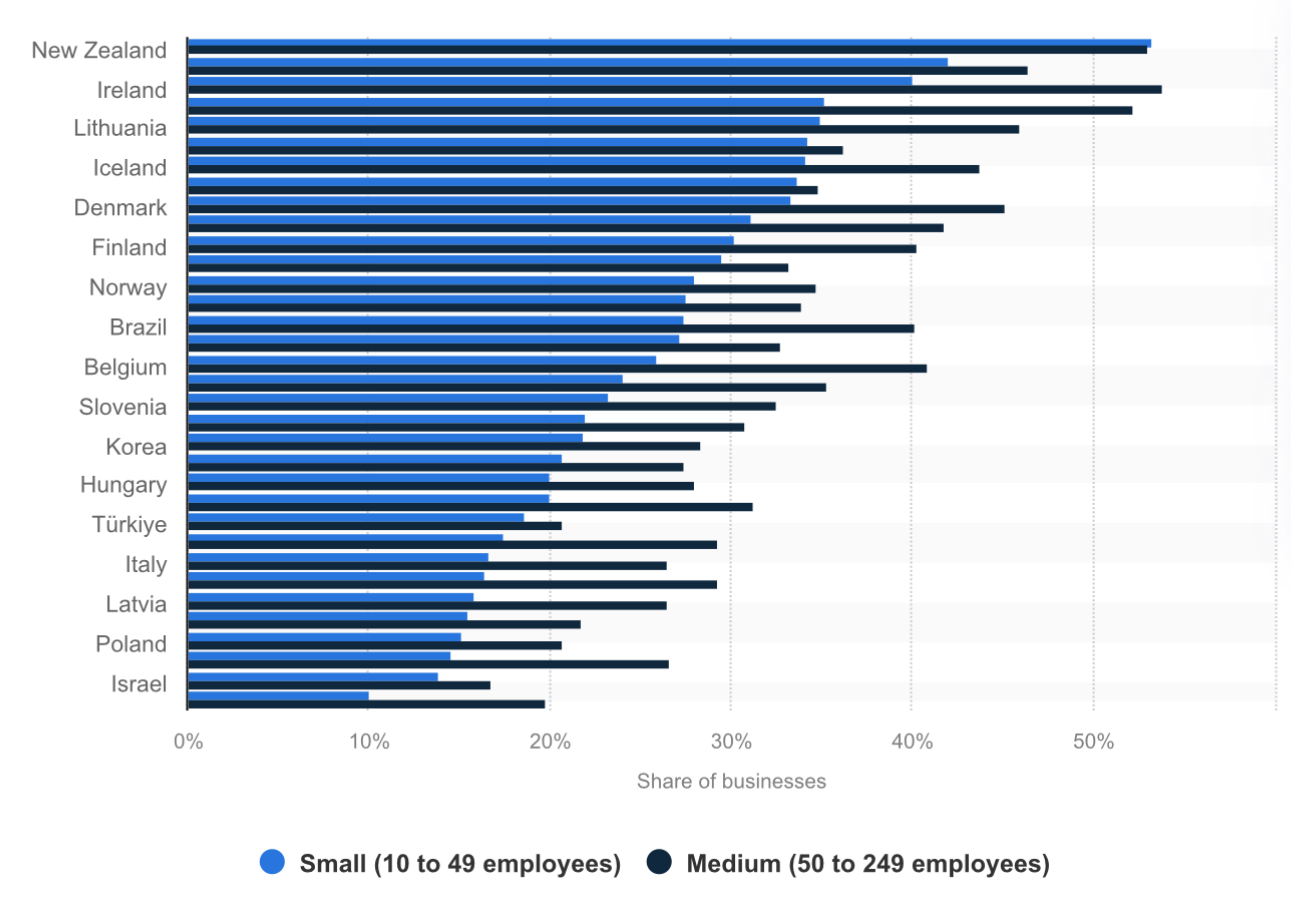

The e-commerce sector is poised to take advantage of the growing consumer market in Central/Eastern Europe. The move to sell products online is presented globally. The speed at which the push from traditional commerce to e-commerce takes place however is vastly different from region to region. If we look at the chart below, we can clearly see the share of small and medium sized businesses receiving e-commerce orders in Poland is quite low compared to other countries such as Denmark, Ireland, New Zealand, etc. 👇

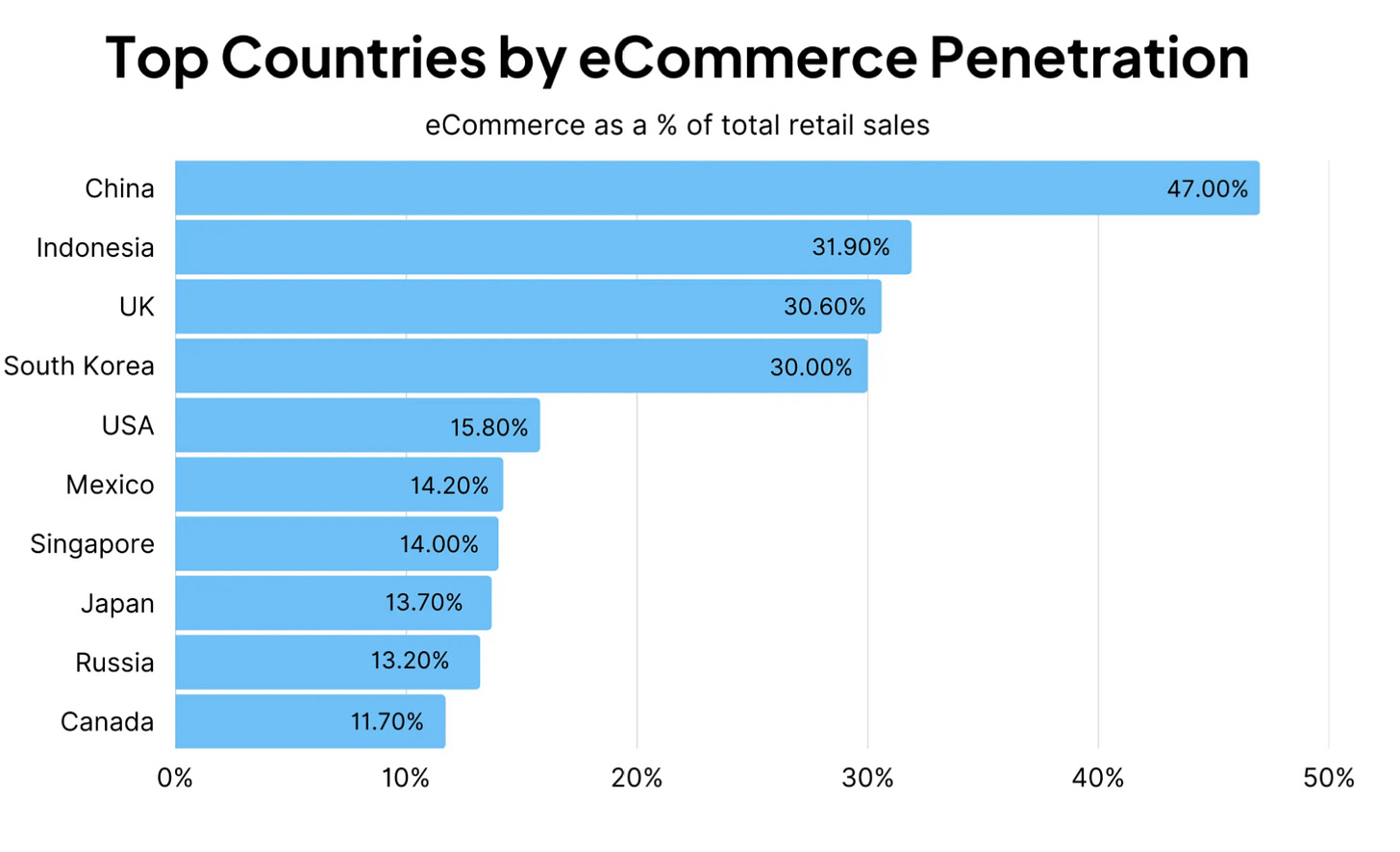

This is a growth opportunity, as the country will catch up to other nations over the coming years. In Poland e-commerce is responsible for ~9% of total retail sales. This is a low level compared to other developed nations such as the UK (31%), South Korea (30%) and the U.S. (16%).

The fact is, that the world is moving towards more digitalization. E-commerce will keep growing faster than traditional retail. As the economy of Eastern Europe continues to grow at fast rates, the e-commerce adaption will reach levels closer to Western Europe. The spending power of the population will follow the trajectory of GDP over the coming years/decades.

A great thing about the e-commerce industry is, that we have a clear handbook on how to scale and achieve success. This guide has been given to us in the form of Amazon, which has functioned as a role model for all the other e-commerce companies globally.

In short, the business model is to have as much customers as possible that allow you to dominate the market. This attracts more merchants, which increases the variety of products, which in turns increases the amount of customers. Via a low cost structure, Amazon can outcompete the competition and attract customers with lower prices. As the wheel starts spinning, Free cash flow will start flowing in. To grow further, Amazon started to launch services that increase customer loyalty.

This model has been repeated countless times all around globe with great success. Examples include Meli in South America, Sea Ltd in South East Asia and Allegro in Eastern Europe. Allegro dominates the e-commerce industry in the Visegrad region and has outcompeted both Amazon and Sea Ltd in the region.

3| Early struggles post IPO

In 2021, Allegro IPO’d at a share price of PLN 50 a share on the Warsaw Stock Exchange. Following the IPO, Allegro faced several challenges, including higher staff costs, competition from Asia, etc. However, the company has only emerged stronger from this difficult time and is now in a position to grow further.

3.1| Competition from Asia

One of the challenges that still hasn’t been resolved entirely is competition from China. More specifically Temu and SHEIN, which are popular market places from China, which have become very popular globally over the past 2 years. Interestingly, during the latest Q&A session in the Q1 conference call, many question covered concerns regarding Temu and SHEIN as competitors. However, Allegro is still dominating the market in Poland. 👇

“And we're still seeing when we look at share of transactions, our estimates based on these surveys are that the 2 together, Shein and Temu, are in the mid single digits in terms of the segment share in the market at this point in time.”

- Conference Call Q1 2024

Furthermore, Allegro is spending a lot on marketing to defend market share. It’s important to consider that 33% of Allegro’s customers (in Poland) are also users of “Smart!”. This increases loyalty towards the company and is beneficial for both Allegro and the customer. Most importantly though, we should look at the situation that Allegro faced when competing with Sea Ltd a few years ago. There is a massive difference between just throwing money at a market by slashing margins into deeply negative territory, and offering real value to customers. Allegro has build a strong brand in Poland and has a wide variety of products to offer. Needles to say, Sea Ltd withdrew from the polish market as they realized that they wouldn’t win the fight with Allegro.

Agnieszka Górnicka, the president of Inquiry (an Eastern European research firm), noted the following:

“When the company [Sea Ltd] withdrew from our country, it could be due to a misunderstanding of the Polish market and a strong position of Allegro. Models previously used in Asian markets do not work in Poland.”

Today, Allegro is even better capitalized than 3 years ago and the company has an even stronger brand with loyal customers (through “Smart!” and Allegro Pay). Allegro clearly understands the business model of Asian e-commerce businesses and utilities its strengths to outcompete them over the long run. Marketing spending is moving higher and the company is only going to emerge stronger from this war.

3.2| Labour costs

During 2022 and 2023, inflation was globally elevated due to higher energy prices and the flood of liquidity that had occurred during 2020 and 2021. In Poland, this was especially evident with inflation running at >18%!

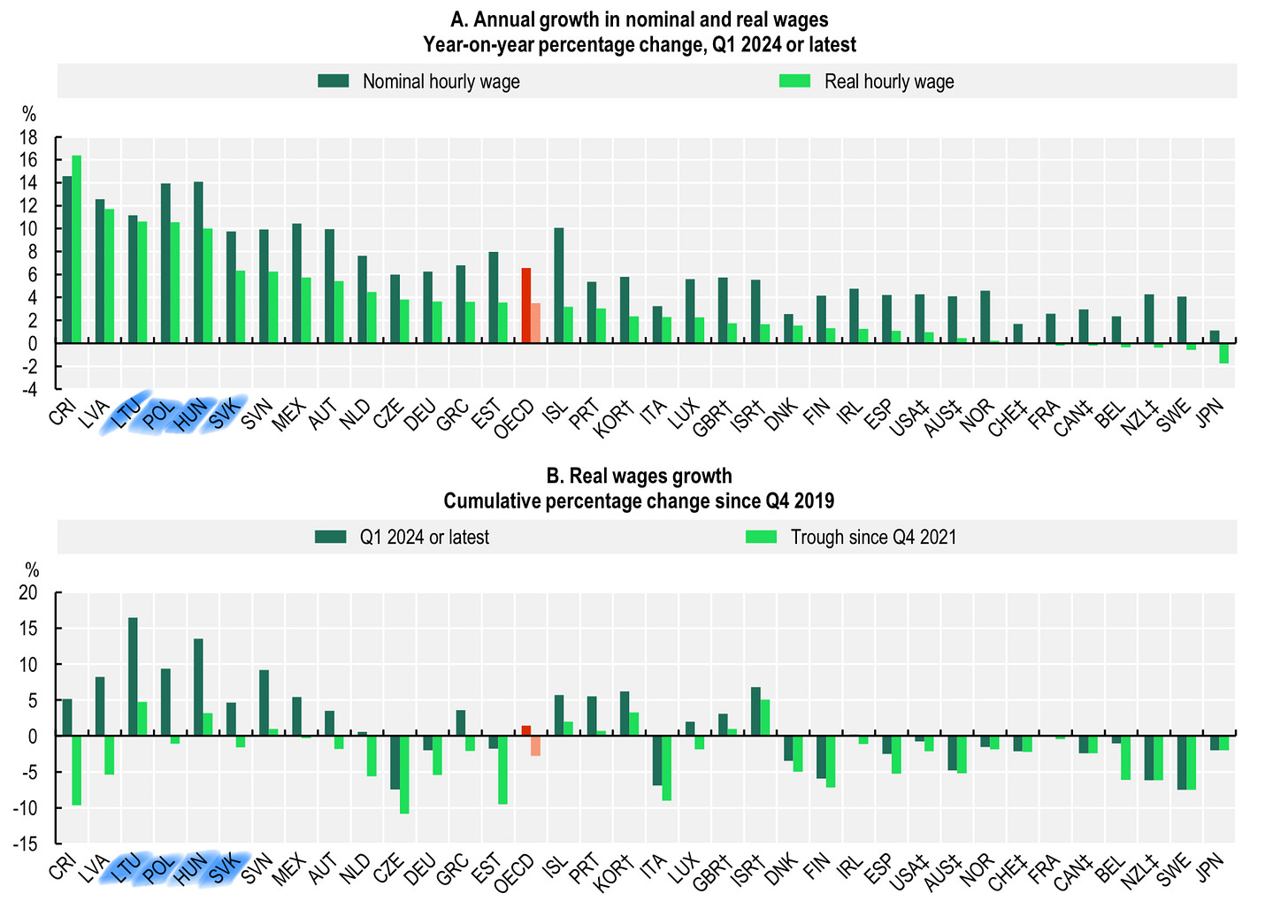

Since the high in 2023, inflation has come down a lot. But make no mistake, just because the rate of growth is slowing doesn’t mean that things are getting more affordable! This is a phenomenon in most countries that have experienced a sharp increase in inflation followed by a large decline in headline inflation. Prices are still sky high and business as well as consumers have to deal with this. In Poland, falling inflation levels and rising wages have contributed to an 10% increase in real hourly wages YoY. Since Q4 2019, Poland, Lithuania, Hungary and Slovakia have experienced large increases in real wages.

This increased labor costs dramatically for employers such as Allegro. During the latest conference call, the following was noted on labor costs.

“I mean, you've got significant pay increases a year ago, right, when there was very high inflation at the time. So the pay rises happening in April last year are reflected in the year on year growth in Q1 of this year.

The headcount is growing, not significantly, but faster than [before] when we basically had a freeze.”

— Allegro Q1 2024 Conference Call

While labor costs have been an issue, I would say that the worst times are behind us and that Allegro is prepared for situations like this in the future.

4| Expansion Abroad

As a result of the large efforts the team of Allegro has made towards building a strong brand and creating value for customers, it was only logical for the company to expand their operations into neighboring countries at some point.

As of now, the business outside of Poland isn’t profitable. Most of the ventures have been established only a short time ago and Allegro needs to firstly build a reputation, in order for them to maximize profits. The great thing about this expansion is, that most of Central/Eastern Europe moves in similar cultural, political and economical directions.

4.1| Visegrad nations

The Visegrad group is a success story in the league of Asian nations. After the members of this group, namely Poland, Slovakia, Hungary & Czechia, got totally destroyed following WW2, they fell to communism. Only around 4 decades later did they regain their full independence and started to adopt capitalism. Poland has emerged as the leader in terms of economic and military size, while all members of the group prospered and have seen massive increases in terms of living standards.

“As late as 2000, the GDP per capita at purchasing power parity of the V4 countries accounted for 45 per cent of the EU-15 average; the indicator jumped to 72 per cent in 2019.” - Polish Economic Institute [LINK]

Since the global pandemic in 2020 the economic growth in Poland compared to Western European EU members has diverted further, bringing the GDP per capita at PPP to nearly 82% of the EU’s average. In terms of trade, the exports of the group have increased by 19x from 1995 to 2019, while imports increased by 16x. The Visegrad group is an increasingly important consumer market with a population of 60 million people, that has growing disposable incomes. In the chart below you can see how much the gap between the GDP per capita at PPP narrowed between the Visegrad group, France and the UK.

Especially since Covid, Poland has grown a lot, while the UK and France more or less stagnated. The chart above sadly only has data dating till end 2022, but Poland’ GDP per capita at PPP has grown to $39.4k in 2023, while the UK has stagnated since.

“GDP growth in 2024 will be 2.6 percent, and in 2025 – 4.1 percent. Inflation in those years will be 3.6 percent and 4.6 percent, respectively. The unemployment rate will remain one of the lowest in the entire European Union. By the end of 2024, the registered unemployment rate will be 5.3 percent. Also, wage growth in 2024 will maintain a double-digit pace – averaging 12.3 percent.”

— Polish Economic Institute.

Interestingly, Poland is expected to surpass Japan’ GDP per Capita at PPP in 2026! There is no doubt, that the Visegrad group is a perfect target for the expansion of Allegro’s business model.

4.2| How to expand the Allegro way

It’s part of Allegro’s philosophy to only enter a new market, if the company can provide value to customers.

“We want to go to places where we are welcome. And welcome is, I think, a factor of things. First one is, do we have something to offer that's not already available in the market? Most of these markets tend to have very fragmented e commerce landscapes with relatively low Internet penetration and we do have a bit of experience in doing that. We certainly have been quite successful in introducing them to categories that they may not have been shopping online with before. Specifically to either Czech or Slovakia, we offer 10 times the selection and by and large with much better prices than that what they're used to.

We're looking to building relationships, leveraging our relationships in Poland, merchants in particular, but also acquiring cooperations with local logistics suppliers. We recognize that we need to do this in a very low cost way. You've seen our entry costs into Slovakia, in particular, that have already come down dramatically than our first investment in the Czech Republic. And I think the light footprint approach means that we can fit spaces, reaches corners that not everyone can reach, yes?”

— Allegro Q1 2024 Conference Call

Unlike Temu or AliExpress, Allegro is a company that doesn’t try to come into a market where there is already one existing company that is domination the industry. This means that they won’t have to spend billions in massive marketing campaigns alongside losing tons of money as a result of deeply negative margins. I have written about this already in the section covering competition from Asia, but it helps to reinforce the differences between the strategic approach Allegro and Temu are pursuing.

5| A vision for the future

Allegro will grow its ecosystem further, via “Smart!” and Allegro Pay. I can very well imagine further products being launched with similarities to Amazon’s ecosystem. With the impressive economic growth of the Visegrad Group, disposable incomes of customers will rise, which will naturally increase the GMV per customer from the current levels. Over time, Allegro will have a similar reputation in Czechia, Hungary, Slovakia, etc, as in Poland. The effects of this will be more customers, higher GMV per customer and likely a further expansion of additional services (e.g. “Smart!” and Allegro Pay) into those areas.

6| Financials & Valuation

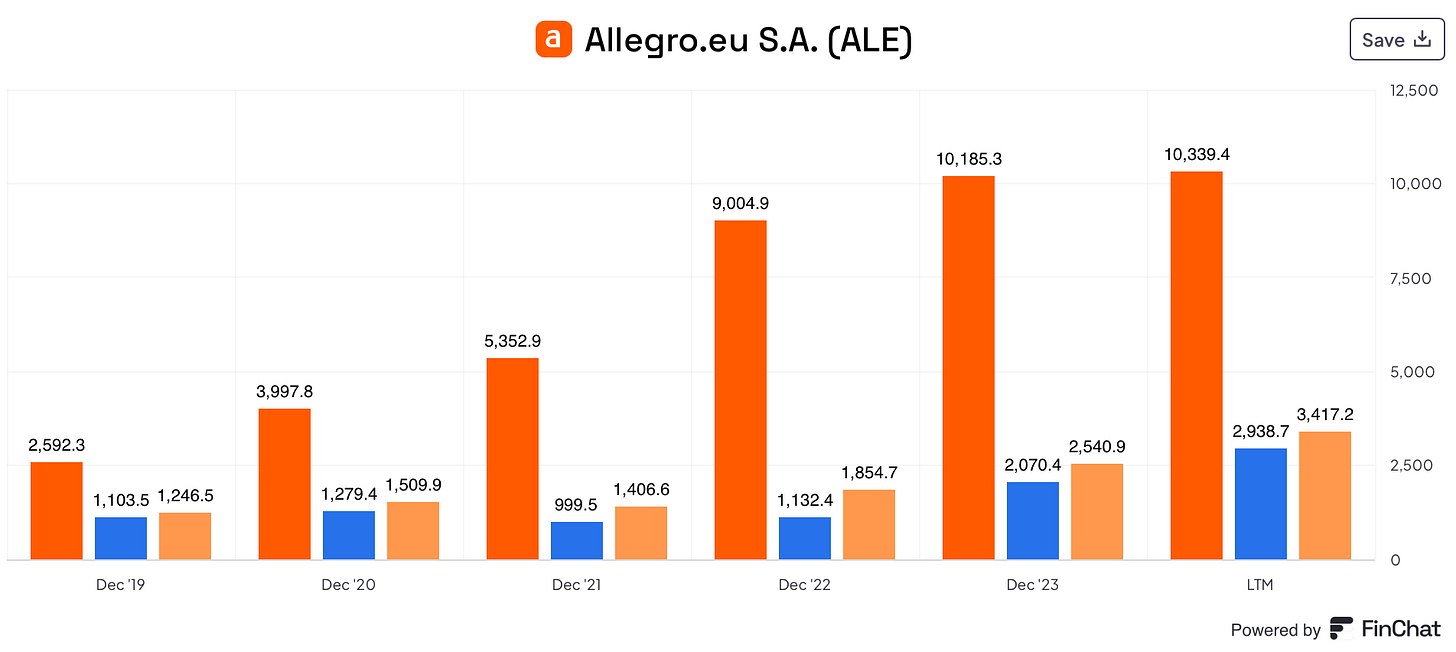

In the graph below we can clearly see, that the Revenue (orange), FCF (blue) and operating cash flow (light orange) is in a nice uptrend since 2019.

In fact, Revenues have compounded at a 40% CAGR from 2017 to 2022, while EBIT has grown at a 17% CAGR over the same period. Allegro has had a very high FCF conversion rate of 82% of adjusted EBITDA in 2023. In terms of liquidity and debt, the company is well positioned to deleverage over the coming quarters. Currently the company had a Net Debt position of PLN 3.7 billion, which is quite low if you consider that the company generated PLN 2 billion in FCF during 2023 and PLN 1 billion during Q1 2024.

Over the LTM (last twelve months), Net Debt has declined by PLN 2.57 billion, while FCF and EBITDA improved significantly. I expect the deleveraging to continue over the coming quarters, even though CAPEX and loses from the international business will rise.

The company is guiding for GMV growth of 9-10% YoY in Q2 2024, which is a bit more on the conservative side, as noted on the latest conference call. Revenue is expected to grow by 11-14% YoY and Adjusted EBITDA is expected to rise 22-27% YoY. CAPEX, as noted earlier will rise due to higher marketing expenses by 31-47% QoQ. My take on Q2 2024 is, that GMV will grow nicely and revenues are expected to grow faster than GMV. In addition, Adjusted EBITDA will likely grow faster than Revenue. This should lead to nice operating cash flow and EBITDA. While higher CAPEX is a headwind, the impacts from top line growth should more than offset this.

Currently Allegro is valued at around PLN 38 billion. The company generated PLN 1 billion in FCF in Q1 2024 and Q2 is expected to be a very good quarter too. I think we can agree, that FCF will be higher than in 2023. So a realistic estimate is probably around PLN 3 billion. Let’s be conservative and say PLN 2.5 billion in FCF for 2024. This would put the current valuation at 15x P/FCF. As the company continues to deleverage, Net Debt should drop towards 1x FCF quite fast. Now how much is the dominant e-commerce company in Poland worth? A company that is expanding aggressively and generating healthy amounts of FCF. To answer this question I will break down the key points that decide how the company’s future will look like.

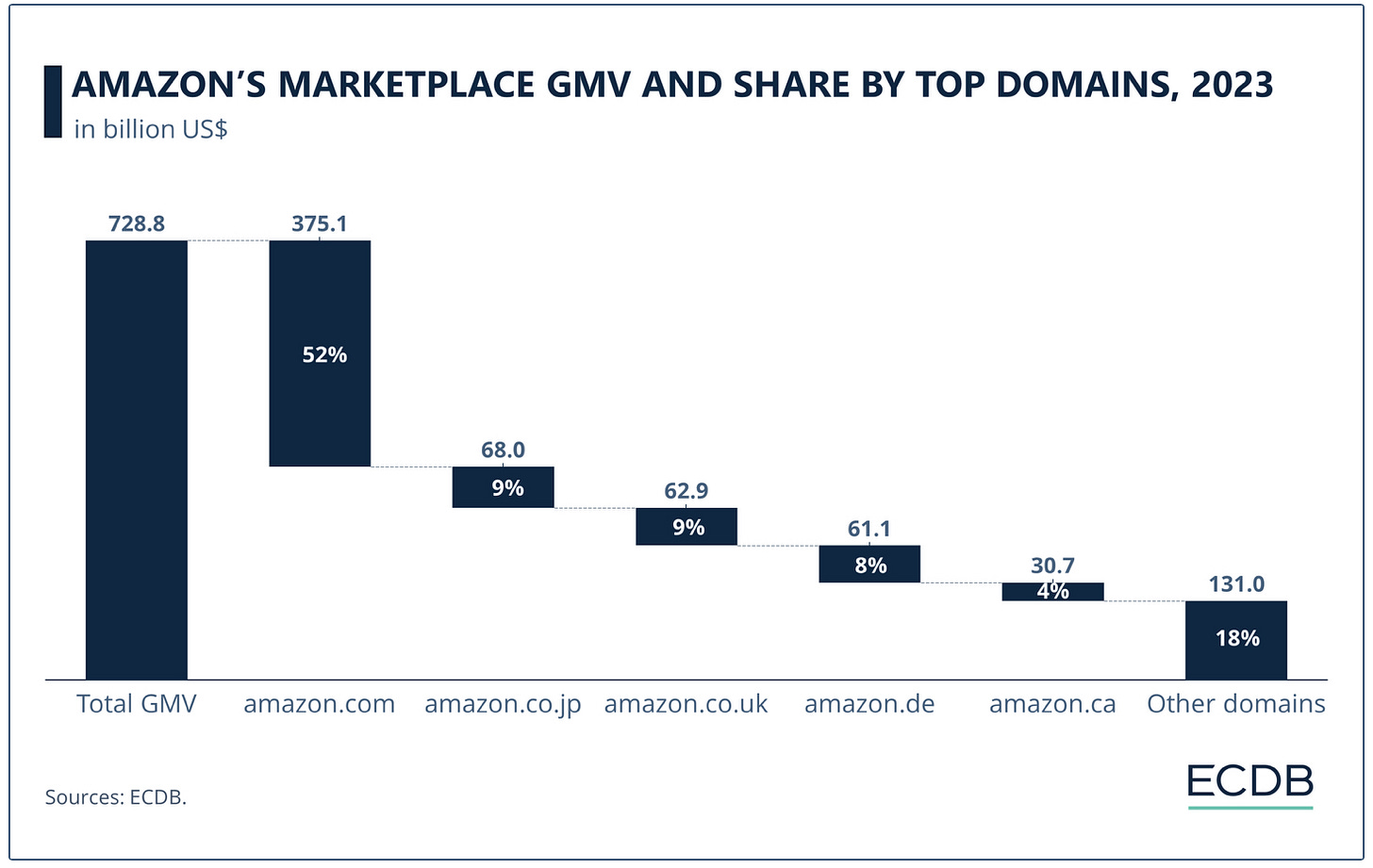

Firstly, Allegro has 15 million customers in Poland. I think we can assume that this number will stay more or less flat, even though the continued decline of traditional retailers will benefit them. GMV per customer in Poland currently stands at PLN 3.7k which is around $950 at the current exchange rate (the PLN strengthened recently). Amazon’s GMV per customer (globally!) is estimated to be around $2.3k. It’s important to consider that the GMV per customer is especially high in the U.S, while being lower in the rest of the world. The UK and Germany have together a GMV of $124 billion for Amazon.

It’s hard to find out how many active customers Amazon has in both countries, but we know that Amazon’s monthly traffic in the U.S is ~10x bigger than the amount of active customers. If we apply the same thing for Germany and the UK, which have together ~800 million monthly visits, then we arrive at a GMV per customer of ~$1.6k. Considering the trajectory Poland is going and the growth in real wages as well as the economy, we can assume that GMV per customer will reach levels closer to that of Western Europe. My estimate is around PLN 5k per customer or $1.28k at the current exchange rate.

In the valuation model I also assume that the international business will reach a breakeven point In let’s say 4 years. Based on the math outlined above we arrive at a GMV for the polish operation 4 years from now, of PLN 75 billion (15 million customers * PLN 5k). Currently Allegro converts 6% of GMV into adjusted EBITDA and has a conversion rate of around 80% (adjusted EBITDA into FCF). This would mean a FCF of PLN 3.6 billion 4 years down the line. We haven’t included any new services such as Allegro Pay or Allegro Ads in this calculation, even though they will play an increasingly important role in the future. So I would say that PLN 4-5 billion FCF isn’t unrealistic in the future.

The question that arises, when a company generates these amounts of FCF is obviously how the cash will be deployed. In the short term deleveraging is the priority, while the management said that they are open to discussing further options regarding capital allocation. I expect Net Debt to come down significantly over the coming years and with excess cash the company will either grow more aggressively (e.g. acquisitions & CAPEX) or return cash to shareholders in the form of dividends or buybacks. There are different ways to value stocks like these, but I think that over the next 3-5 years the stock can very well double in price, as the cash flow generation starts picking up and valuation increases. Further appreciation is possible if the company returns capital to shareholders in a value creative way.

7| Risks & Conclusion

Allegro is a mid-cap for western standards and a large cap for Eastern European standards. The dominant market position and the high FCF generation in combination with a reasonably low leverage ratio reduces risks for investors. The valuation is quite low if the company continues executing and the company is transparent to investors. Nonetheless, there are always risks involved in investing. The two main risks for Allegro are firstly, that growth is below expectations and disappoints to the downside. Secondly, a risk that can’t be underestimated is competition from Asia. While Allegro has handled the situation with Sea Ltd very well, there are always risks that can’t be predicted. When analyzing polish stocks I always ask myself the question whether this stock has a better risk/reward setup than Allegro. I think that the company can become the tech giant of not only Poland but also the region, and will attract more interest from investors over time.

I have bought my first position in late April and am up around 10% on my position but would love to see the stock retesting the purple support zone below, to add to my position significantly.

Thanks for reading and as always, if you have any questions or feedback please share them in the comment section below.

Yours sincerely,

MODERN INVESTING

Very interesting! The debt will be a drag but looks like it could be a huge opportunity long term. Out of curiosity, why does a oil company (Orlen) have community lockers?

how do you analyze the risk that amazon moves into eastern europe?