Back to the Future: The Economic Deja Vu of the 2020s mirroring the 60s and 70s

Drawing Parallels Between the Present and the Pivotal Moments in the late 60s and 70s

Economic history is just a very small part of human history. In comparison, the stock market was created in 1611 in Amsterdam. These are 413 years, or 0.2% of human existence. It’s no surprise, that human biology plays such a huge part in investing. Greed, fear, envy and euphoria never changes. It requires a lot of confidence and an attitude of going against the odds/crowd, to achieve success. My history teacher always said:

I don’t want you to memorize specific dates and events. Everyone can Google the answers these days. I will prove to you, that humans do the same mistakes all over again. The facts are, that we don’t learn from history. Looking at our past and reactions on specific events, will teach us about future conflicts and wars.

In this article, I want to go back in time and compare the current geopolitical and economic situation, with the one in the late 60s and early 70s. The MAGNIFICENT 7, interest rates, inflation, recessions, banking crises, wars, etc. are things that have parallels to the past.

Part 1/ Flash Crash

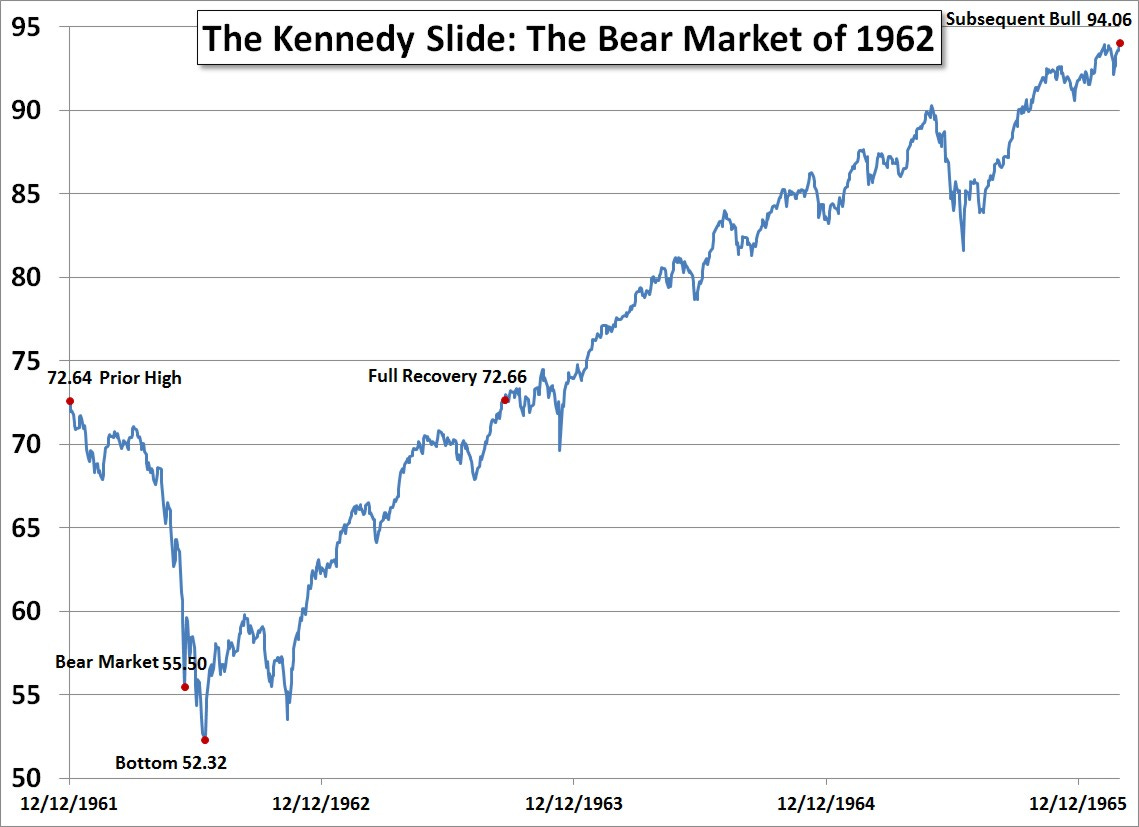

The Kennedy slide of 1962 was a flash crash, that resulted in a drop of more then 20% for the American stock market in the period of just a few months.

Until today, there is no real explanation to justify this sell off. After years of a massive bull market, the markets cooled of very quickly. Following the unexpected crash, the S&P 500 rallied to new record highs.

While there wasn’t a pandemic, that caused the rapid sell off and incredible recovery, the chart looks nearly identical to the S&P 500 from 2019/2020-2022. Interestingly, JFKs slogan was Get America moving again. This sounds very similar to the modern version of Make America great again, by Donald J. Trump.

Part 2/ Wars, Deficits and Banks

The war in Ukraine has come as a surprise for many people and so called experts. The U.S. has send ~112 Billion USD in „aid“ to Ukraine, while running a massive deficit. Without getting to much into politics, we can see, that the war in Ukraine hasn’t been a success for the West. The European economy has suffered greatly, the population is more divided then ever before, and Russias economy is doing pretty fine in comparison to other ones. Too fund the so called endless wars, while simultaneously running a gigantic deficit, the U.S. is dependent on borrowing trillions of dollars.

Where the army is, prices are high; when prices rise the wealth of the people is exhausted.

— Sun Tzu, around 500 BC

Interest rates have risen greatly, as a result of higher inflation. The result has been a small banking crisis, that was resolved after the FED pushed liquidity into the markets and basically bailed the banks, that had no risk management out.

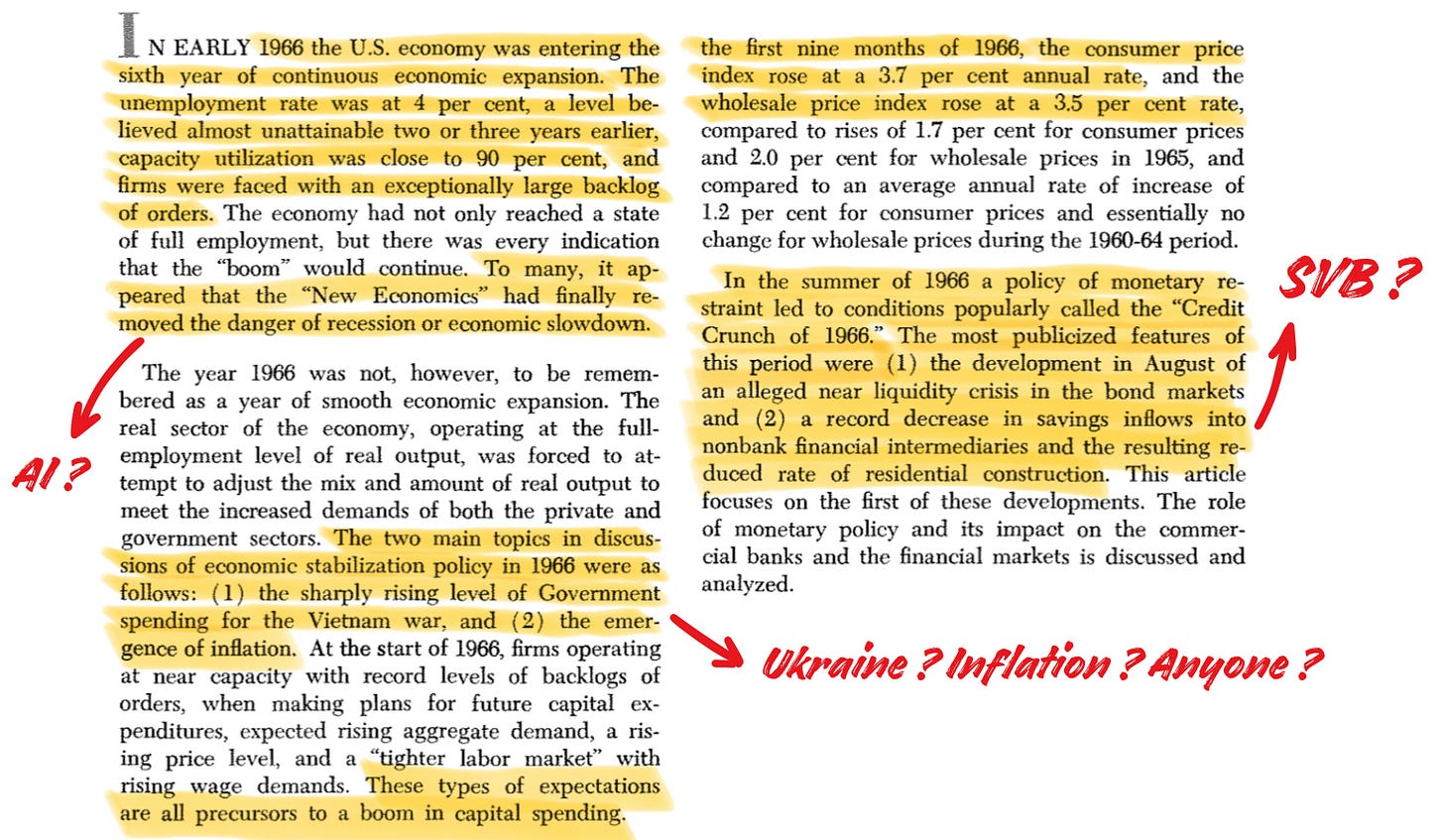

How does this correspond with the war in Vietnam ? In 1966 the war reached its peak, with the U.S. wasting billions in an proxy war thousands of miles away from its borders. The total cost of the Vietnam war is estimated to be 168 Billion USD or 1 trillion adjusted for inflation. Nonetheless, money alone can’t win wars (as we have seen with Yemen in modern history). As we all know, the war in Vietnam was a total humiliation for the U.S. army, that lost after 20 years, billion of dollars and 58k man. This war was also funded by debt, as the U.S. was running a huge deficit at the time. With inflation accelerating, interest rates rose fast. It didn’t take long for the banking sector to get punished. In 1966 interest rates on T-bills were much higher, then the rates offered by banks. As a result, people moved their money away from banks, and to T-bills (or other comparable financial products).

With banks having close to no money to lend, the U.S. came dangerously close to a massive financial crisis. Luckily the FED stepped in and allowed banks to offer higher rates, while they simultaneously eased the monetary policy. This stimulated the economy and combined with war spending, the U.S. economy and financial markets reached record highs in no time.

This is obviously very similar, but the actions by the FED to push down inflation in 1966, compared to the actions by the FED in 2022 are very similar too. The high interest rates created a short banking panic, but the purpose of reducing inflation was more or less achieved.

Part 3: The Nifty 50, Inflation and Recessions

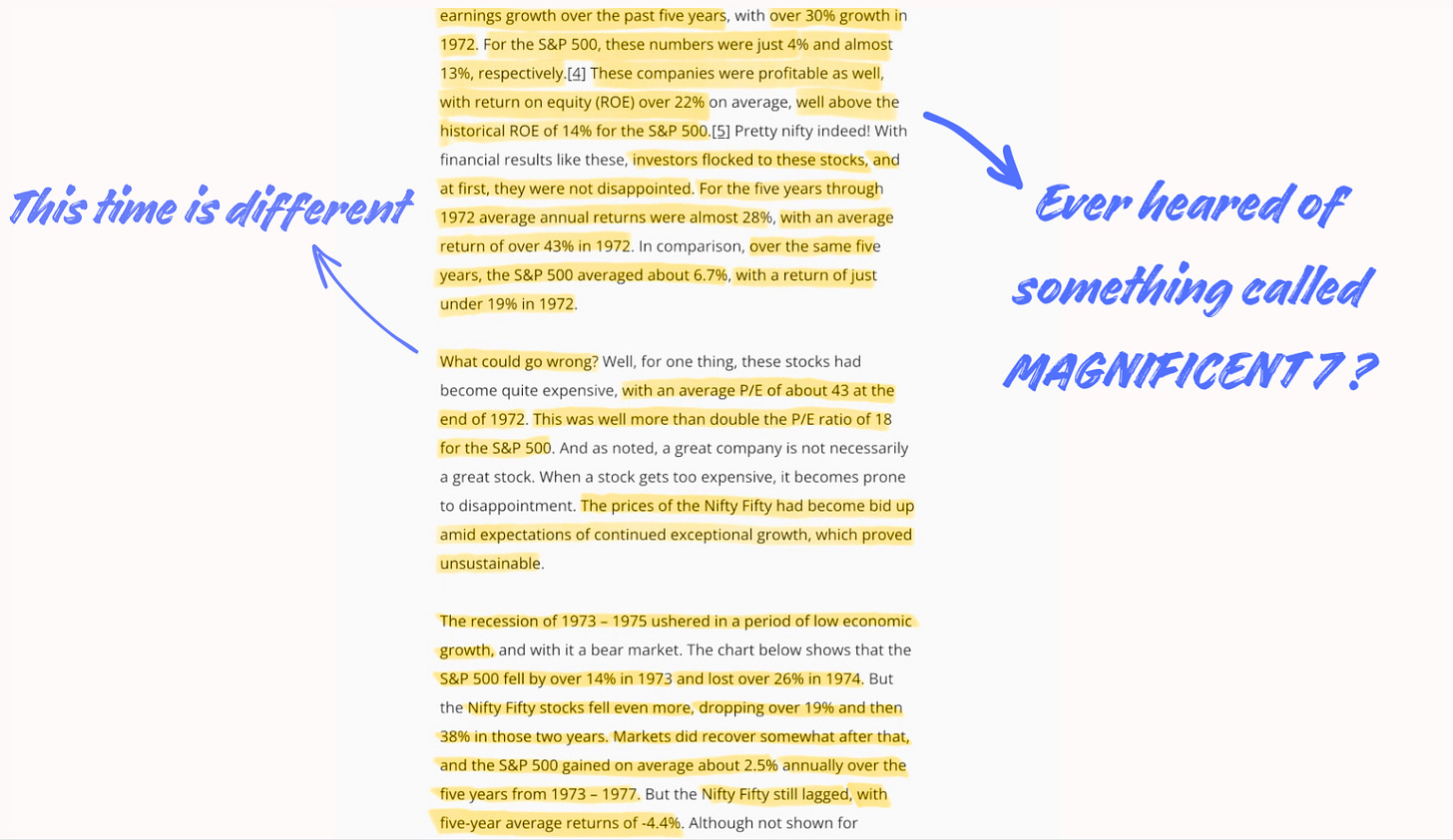

The Nifty 50 was a list of 50 companies, that were regarded as high quality blue chip stocks, such as Coca Cola, Pfizer, 3M, Xerox, American Express, Bleck & Decker, Eli Lilly, First National, Johnson & Johnson, McDonals, Walmart, Disney, etc. The believe was, that you can buy and forget these stocks. At the time the companies were growing quickly and were high quality. As a result, valuations went into the stratosphere, with an average P/E ratio of 43 ! McDonald’s for example had a P/E of 70 in 1972 !

Today we’re in a very similar situation, the MAGNIFICENT 7 compromised of Tesla, Apple, Amazon, Alphabet, Nvidia, Microsoft and Meta have been the hottest topic of 2023. The companies are high quality and are growing quickly. But valuations are insane too. Just a look at Nvidia and Tesla is enough, to see the parallels between today and 1972.

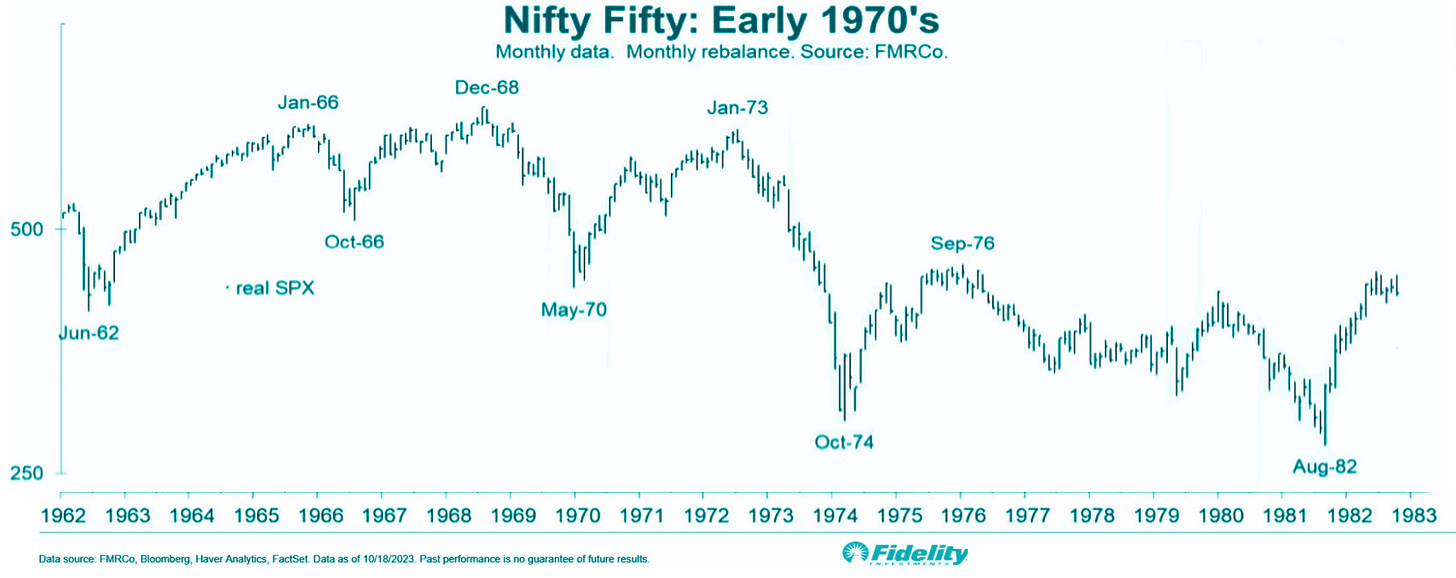

During the late 60s, inflation was constantly rising to around 5% by 1969. With inflation rising and unemployment at 3.5%, the FED attempted to tighten the monetary policy. This resulted in the recession of 1969, that led to lower equity prices.

If we look carefully at the chart above, we’ll see that the price of the real S&P 500 from the 60s is matching that of today very well. The top was reached in Jan-66 with stocks falling based on recession fears, a credit crunch and rising deficit spending. When the recession didn’t materialize, the market bottomed around Oct-66. Equities made a new high and peaked just before the recession hit in 1969. Drawing conclusions for today, the S&P 500 would have top in December 2024 if it were to continue following the market pattern of the late 60s.

Part 4: Oil and Shipping

The 60s and 70s were marked by wars and conflicts in the Middle East, that had impacts on the global economy. The Suez Canal and Red Sea were blocked and wars broke out between Israel and several arab nations.

The Six Day War had its origins in disputes between Israel and Egypt over the rights of Israeli shipping to pass through the Suez Canal and the Red Sea.[…] Egypt's ruler Gamal Abel Nasser decided in 1956 to nationalize the Suez Canal and deny passage to Israeli ships both there and in the Straits of Tiran that led to the Red Sea. Israel responded by invading and occupying the Sinai Peninsula for several months […]. In late May 1967, Nasser told the U.N. force to leave Egypt and again closed the Straits of Tiran to Israel.

— PBS

This is another thing in common with the situation of today. The war between Palestine and Israel has escalated and Yemen is partly blocking the Red Sea with attacks on ships in the area. With a much bigger conflict looming between Iran and Israel, we are dangerously close to repeating the same tragedies again.

Apart from shipping, oil played an enormous role too, as the commodity price is correlated with inflation, and with it the economy.

With OPEC reducing oil supply and enforcing an embargo on the U.S. and a few other nations (for the support of Israel), the oil price went up by around 10 fold in the 70s ! The obvious consequence was stagflation in the U.S., that required Paul Volcker from the FED to raise interest rates to nearly 20% !

Conclusion:

All in all, the economic and geopolitical situation of today is in many ways similar to that of the late 60s and 70s. With inflation, interest rates, wars, oil, shipping and the chart of the S&P 500. I personally stay more conservative, as I think that the likelihood of a recession next year is elevated. The stock market would in this case perform quite well this year, while performing badly next year. We will see wether this will hold true or not, but 2024 will probably be the year to building some cash and diversify away from big-tech to value and energy. If you are more interested into geopolitics, you can read my piece on geopolitics below 👇

Navigating the 2020s in the Footsteps of Napoleon’s Missteps

In June 1812 Napoleon Bonaparte gathered an army of 500.000 man, to invade Russia. Since his tactics relied on speed, his army would try to be as quick and aggressive as possible, in order to defeat the enemy quickly. At first Nopoleon had a huge success, by winning several battles and moving towards Moscow. But the Russians would move deeper into their…

Yours sincerely,

MODERN INVESTING

Helping Ukraine now will be much more cost effective than allowing the Soviet Union to come back - the fall or which Putin considers a “geopolitical catastrophe”. Not to mention helping entire countries falling to slavery is the right thing to do.