From Ore to Opportunity: The Case for Gerdau and Vale’s Comeback

A look at recent developments and why I buy more Vale & Gerdau at these prices…

Both Gerdau and Vale are established industry giants facing undervaluation due to macroeconomic pressures and market misconceptions. Gerdau, a steel producer primarily operating in North America and Brazil, is positioned to benefit from strong U.S. demand, ongoing cost-cutting measures, and management’s commitment to returning capital to shareholders.

Similarly, Vale, the world’s largest iron ore producer is undervalued despite robust operational growth, a strong dividend and steady production growth. Fears surrounding China’s economic slowdown and legal issues have contributed to these low valuations.

In this piece we will take a look at recent developments of both Gerdau and Vale and will explore why I continue to be long and add here.

1. Gerdau - Many Triggers for a sleeping Giant

In my original thesis on Gerdau I outlined how the steel producer headquartered in Brazil is highly undervalued. I acknowledged that the company was well run at the bottom of the cycle. Today, 5 months later, my view hasn’t changed. Actually, I’m more confident nowadays as the management team has shown its willingness to return capital to shareholders. But from the beginning, what does Gerdau actually do and why does this opportunity exist?

1.1| Recap & The Transformation of a Steel Giant

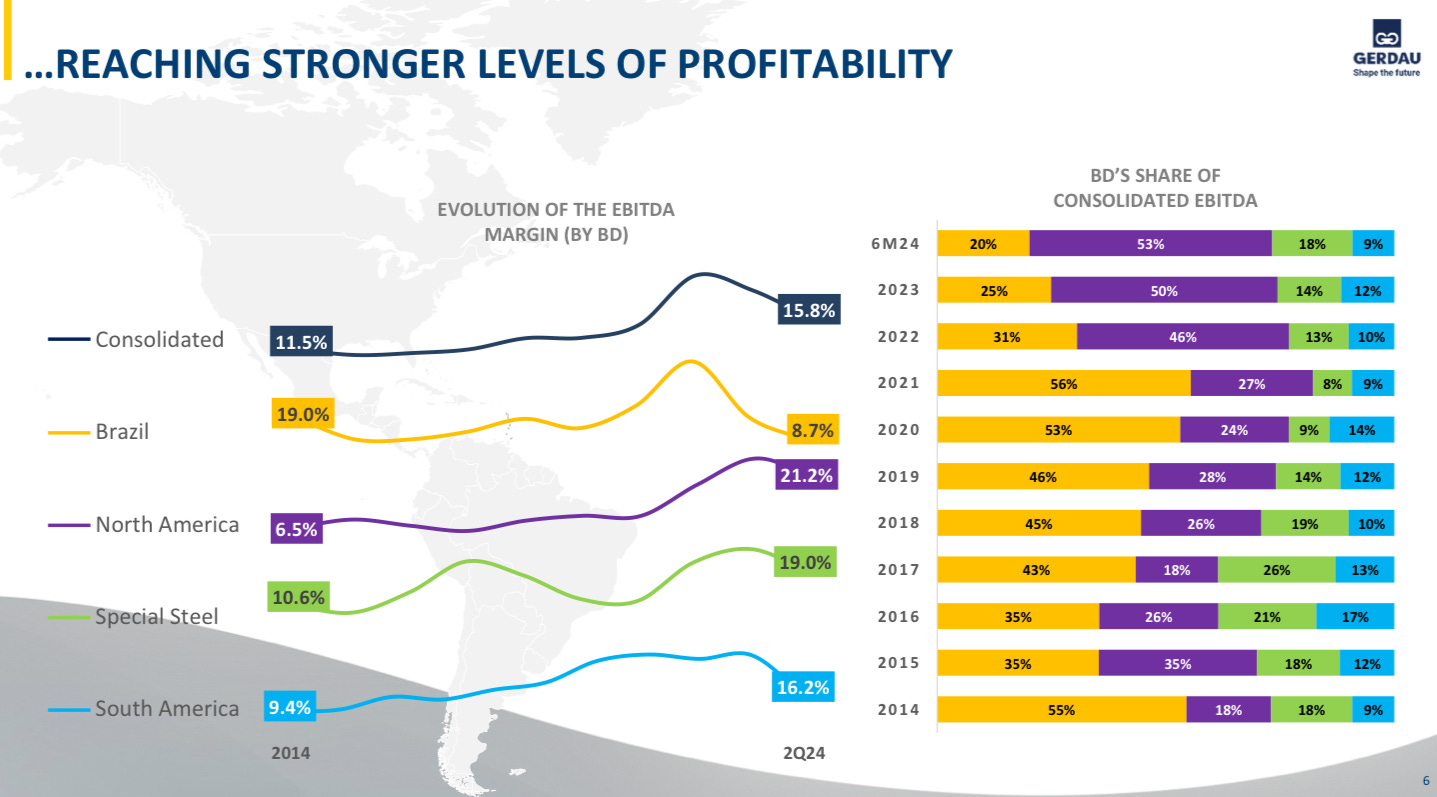

In short, Gerdau is amongst the largest steel producers in the Americas. The company was founded in Brazil and has its main operating assets in the U.S. and Brazil. This is a significant shift from just 8 years ago. In 2014, the company was active in 16 countries globally, reported revenues of R$43 billion, had an EBITDA margin of 11.3% and was highly leveraged with a Net Debt/EBITDA ratio of 2.4.

Gerdau went on to divest assets ranging from hydropower plants to real estate. In addition the company left many regions focusing entirely on the Americas from then on. Revenues went from R$43 billion to R$65 billion while EBITDA margins increased by 430bp to 15.8%. Net Debt declined to just 0.5x EBITDA and the company’s geographic mix transformed tremendously. 10 years ago Brazil accounted for 55% of EBITDA while North America accounted for a mere 18%. Fast forward 10 years and North America accounts for 53% of EBITDA, while Brazil’s share has declined to just 20% — a complete reversal.

1.2| Navigating harsh waters

Margins and revenues have been rather depressed the last 2 years as the global steel market continues to be pressured by oversupply and rather sluggish demand in China. A key issue has been the weak Chinese construction sector which led to larger exports of steel from China to other countries. This has pressured margins of most steel companies including Gerdau. The situation is stabilizing though, as Chinese stimulus is expected to stabilize the construction sector in the country. In addition we have seen tariffs being imposed on steel & iron products that are being dumped on the Brazilian market. Recently the tariffs have been raised to 25%.

“We expect that, in the second half of the year, the domestic steel market should begin to feel the effects of the trade remedies recently implemented by the Brazilian government with the mixed tariff rate quota system.”

— Gustavo Werneck

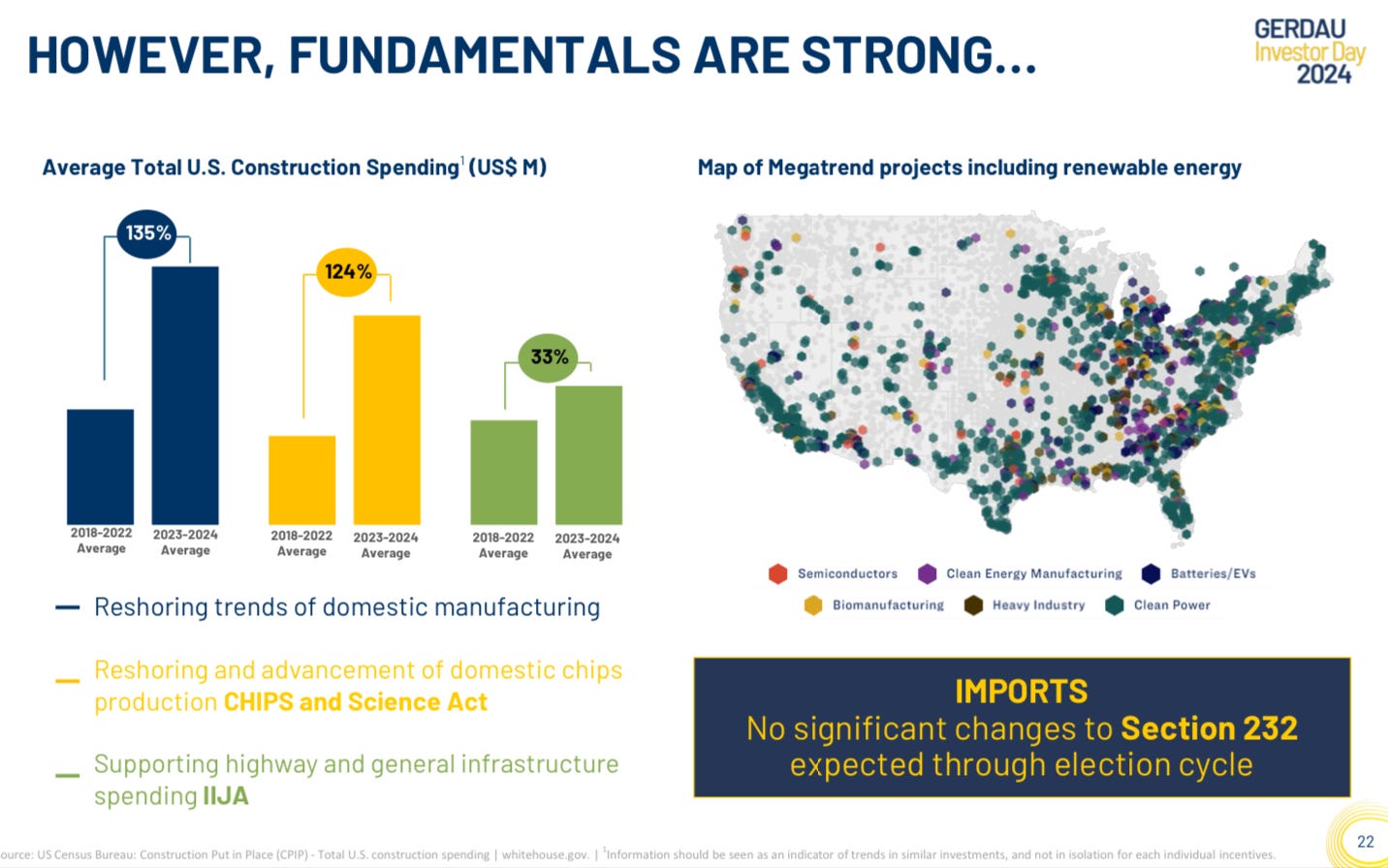

In North America there are already tariffs in place and demand is growing nicely, resulting in strong margins in this business division. The re-industrialization of the U.S. coupled with the CHIPS & INFLATION REDUCTION ACT are drivers behind strong demand for steel products.

Results for the second quarter reaffirmed my thesis. While margins were still under pressure, revenues were up 2.5%. Excluding one-offs, EBITDA was down 2%, which was mainly due to the generally still weak market conditions. The management team announced a small buyback alongside the dividend and signaled that there were early signs of improving market conditions.

“I think that the most difficult moment is already in the past, and now it is time for a rebound. That recovery will be slow. There will not be any out of the ordinary effect that will lead us to a very sudden change, but certainly everything that is happening is proof that our results will improve starting in 3Q24.”

— Gustavo Werneck

1.3| Balance Sheet excellence in hard times

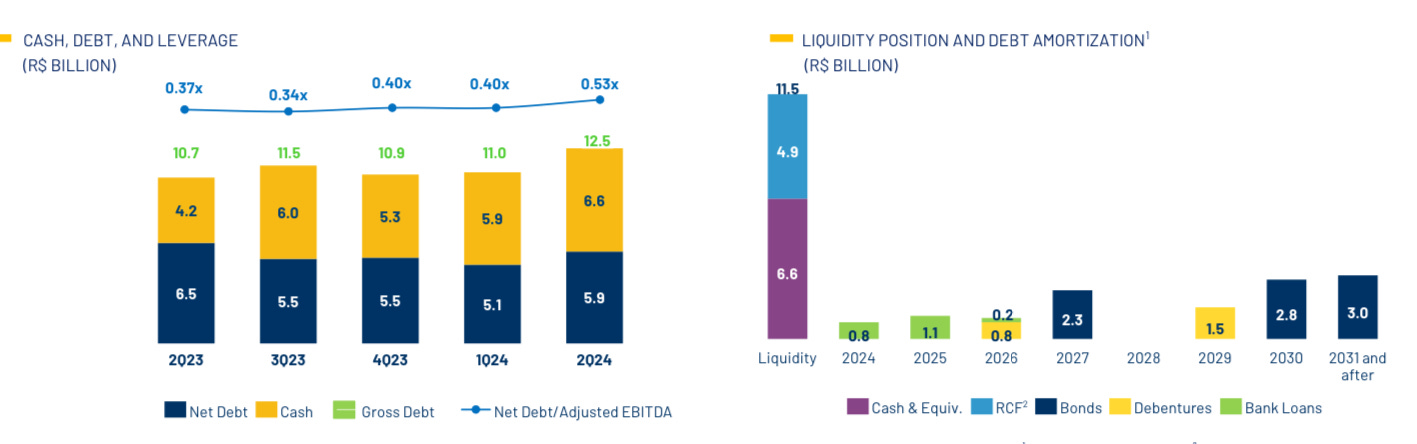

It’s worth pointing out that Gerdau is in great financial condition with low Net Debt of 0.5x EBITDA an average term of 7.2 years and fixed interest rates of 5.5%. The liquidity of the company (57% cash & 43% RCF) is roughly the size of total debt. Recently Gerdau’s credit rating has been upgraded by Moddy’s which supports this view.

1.4| Valuation

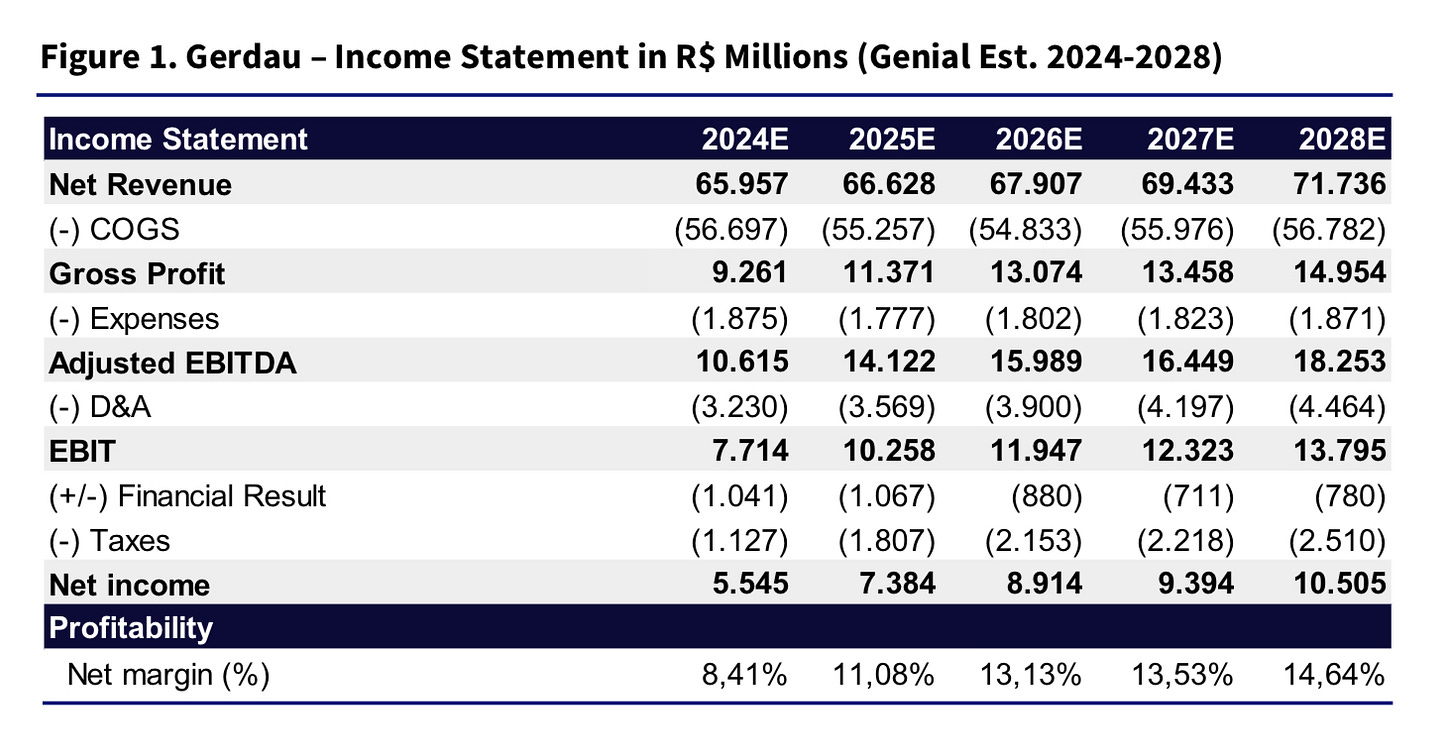

The main misconception about Gerdau is that the company is just a Brazilian steel producer. As you have seen, the company’s major business division is located in North America. This however isn’t reflected in the share price. Gerdau is valued at R$36 billion, which is just 4.9x 2025E Net Income.

The company will cut costs by R$1-1.5 billion in Brazil and new projects that will increase production will come online soon. But let’s just assume that the South American operations are worth 0. In this case the North America operations of Gerdau are worth the entire current EV. North American operations will do ~R$6 billion in EBITDA this year. American peers trade on average at 6.3x EV/EBITDA, which would imply a market value of ~R$37 billion. That is equal to the current market cap. The company still has roughly R$6 billion Net Debt, but in my opinion the North American operations alone are worth ~R$30 billion. The other half of the business is basically free and margins should improve soon.

2| Vale - Absurdly priced due to fears surrounding China & London

Gerdau is in the steel business and Vale is the big uncle of Gerdau, as the company is the largest iron ore producer globally. The stock is trading at depressed multiples as the market is highly bearish on the Chinese economy and is afraid of lawsuits. Vale is trading at roughly 5x 2025E earnings, the company is paying double digit dividends and has recently hit near record high production levels of iron ore.

2.1| Missing the Forrest for the Trees

The main reason for depressed sentiment is probably negative sentiment towards the Chinese real estate/construction sector. Recent efforts by the Chinese government to stimulate the economy will hopefully bear results. But this is where most people start to miss the forrest for the tress. China has been the main source of iron ore demand growth over the past 2 decades.

“Worldsteel sees Chinese consumption racking up a fourth year of declines in 2024 to 869-million tons, while demand in the rest of the world rises 1.2% to reach 882-million tons.

India’s market will grow by 8% this year — after rising 14% in 2023 — to 143-million tons, while other emerging and developing economies will see growth of around 7% for a second year running, according to Worldsteel

— Mining Weekly

The fact that China’s share of global steel demand has dropped over the past few years, while emerging markets like India are growing fast, has made the steel market less dependent on China. Therefore most analysts continue to be too bearish Iron Ore over the mid/long term.

2.2| Q3 2024 Earnings report

Vale’s earnings report for the 3rd quarter was generally above market expectations and painted a pretty clear picture of a company that is growing operationally. The production of Iron Ore increased by 5.5% y/y, while pallets production rose 12.9% over the same period. Copper & Nickel production increased by 5.3% and 11.9% respectively.

Iron Ore production reached the highest level since 2018, after the catastrophic damn collapse. Realized prices however dropped across the board with the only exception being Copper whose realized prices rose 16.6% y/y.

Lower realized prices lead to a 10% decline in revenues y/y to $9.55 billion. Total costs & expenses declined by 2% y/y but weren’t able to offset lower realized prices. Net Income declined by 15% to $2.4 billion, which was above analysts estimates ($1.7 billion). Iron ore fines’ C1 cash cost declined 17% q/q and 6% y/y reaching US$ 20.6/t.

2.3| Lawsuits

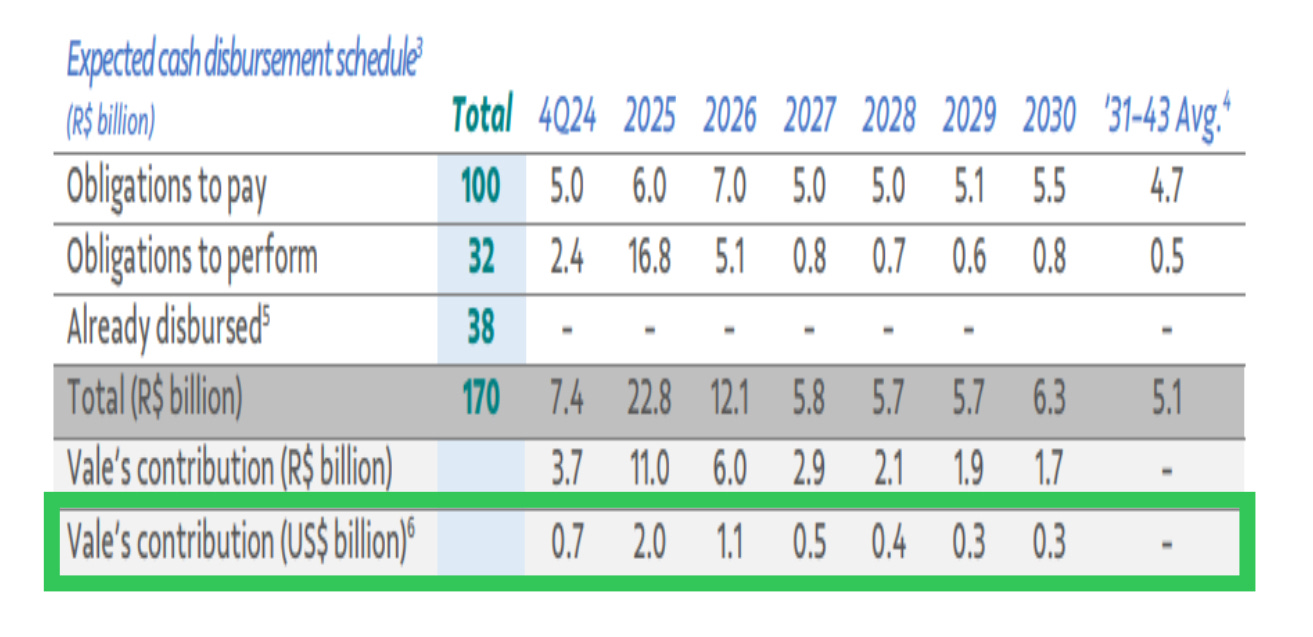

Today, Vale and BHP signed a final agreement with the Brazilian government over reparations and damages stemming from the 2015 Mariana dam disaster. The final amount is R$170 billion (USD 30 billion) and Vale’s share will be 50%. The amount is broken down into 3 parts:

R$38 billion already paid.

R$100 billion over the course of 20 years.

R$32 billion for environmental & social reparations

Basically it comes down to R$132 billion of which most will be paid over the timeframe of 2 decades. That’s R$2.5 billion each year that Vale will have to pay. In other words USD 400 million for a company that makes >USD 8 billion in Net Income.

The company has already set cash aside for the lawsuit and notified the market that they expect an additional R$5.3 billion in liabilities from the case that wasn’t considered earlier. In conclusion the final agreement regarding the Mariana disaster is manageable for the company and could have gotten way worse. Furthermore, the agreement serves as support in other lawsuits regarding the case. There is still some uncertainty on the outcome with a lawsuit in London that was filed by victims of the Mariana disaster, but the settlement is a step in the right direction.

2.4| Valuation

Vale is performing well operationally and is delivering good results even in such difficult times. Bad sentiment towards China and uncertainty regarding lawsuits has led to the share price trading near its lows. However, we have seen many positive signs from China recently and the lawsuits are also progressing quite well. So let us have a look at the valuation of the company.

Vale’s base metals division (VBM), which focuses on copper and nickel is a highly valuable asset. Saudi Arabia has bought a 13% stake in VBM valuing the company at an impressive $26 billion. In the past there have been many rumors of potential buyouts, as the company owns key assets and will grow production of copper quickly over the next few years. The company is planning to IPO at some point in the future. The absurd part is, that Vale’s 90% in VBM is worth $22.6 billion based on the terms of Saudi Arabia’s investment. Vale’s market cap currently stands at $45 billion implying that the Iron Ore division is worth just $22.4 billion. If you were to believe Mr.Market, 90% of VMB would be worth more than the entire Iron Ore division. As a gentle reminder, the Iron Ore division will make $8-10 billion in profits this year! The company is also paying a dividend that is currently in the double digits.

3| Conclusion

In conclusion, both Gerdau and Vale continue to be great investment opportunities and my view hasn’t changed over the past months. Gerdau will reports earnings soon, so I will keep an eye on this. The markets reaction after Vale’s earnings (+4%) was a promising sign that investors are more confident about the future of the company again. Over the past 2 days I have started to slowly buy more shares of both stocks as I see the current share prices of both companies as great long term entry points.

Yours sincerely,

MODERN INVESTING

Hi! Nice write-up. My question as a value investor is... What if iron ore price goes down under $100, or $90, or $80? That was the case in the past and if recession comes this is possible scenario. Market is irrational and both stock prices could go down 40%, 50%. What would you do then? As I want that my investment prevents a lot of money from becoming a little.

Thanks for the write up. I agree that steel ain’t going anywhere anytime soon. Copper as well. I need to look more into this. Thanks