GeoPark — A Reset, Not a Retreat

Challenges faced, lessons learned and opportunities ahead for one of my largest positions

GeoPark became my largest portfolio position after I made a final increase in mid-April. This decision was driven by what I perceived to be a significant gap to fair value. As the share price dropped below $6 amidst the broad market sell-off, I bought and closed the screens. I had finally found inner peace. The memories of watching charts and discussing financial markets on Twitter/X and with friends faded, as my buy orders on some of my favorite beaten-down names filled. One month later, I am pleased with my decision to go to 0% cash. However, the path forward hasn’t been without unexpected challenges.

GeoPark has been my highest-conviction investment over the past few months. In this article, I’ll reflect on:

The failed Vaca Muerta acquisition.

GeoPark’s financials and cash generation.

My investment thesis moving forward.

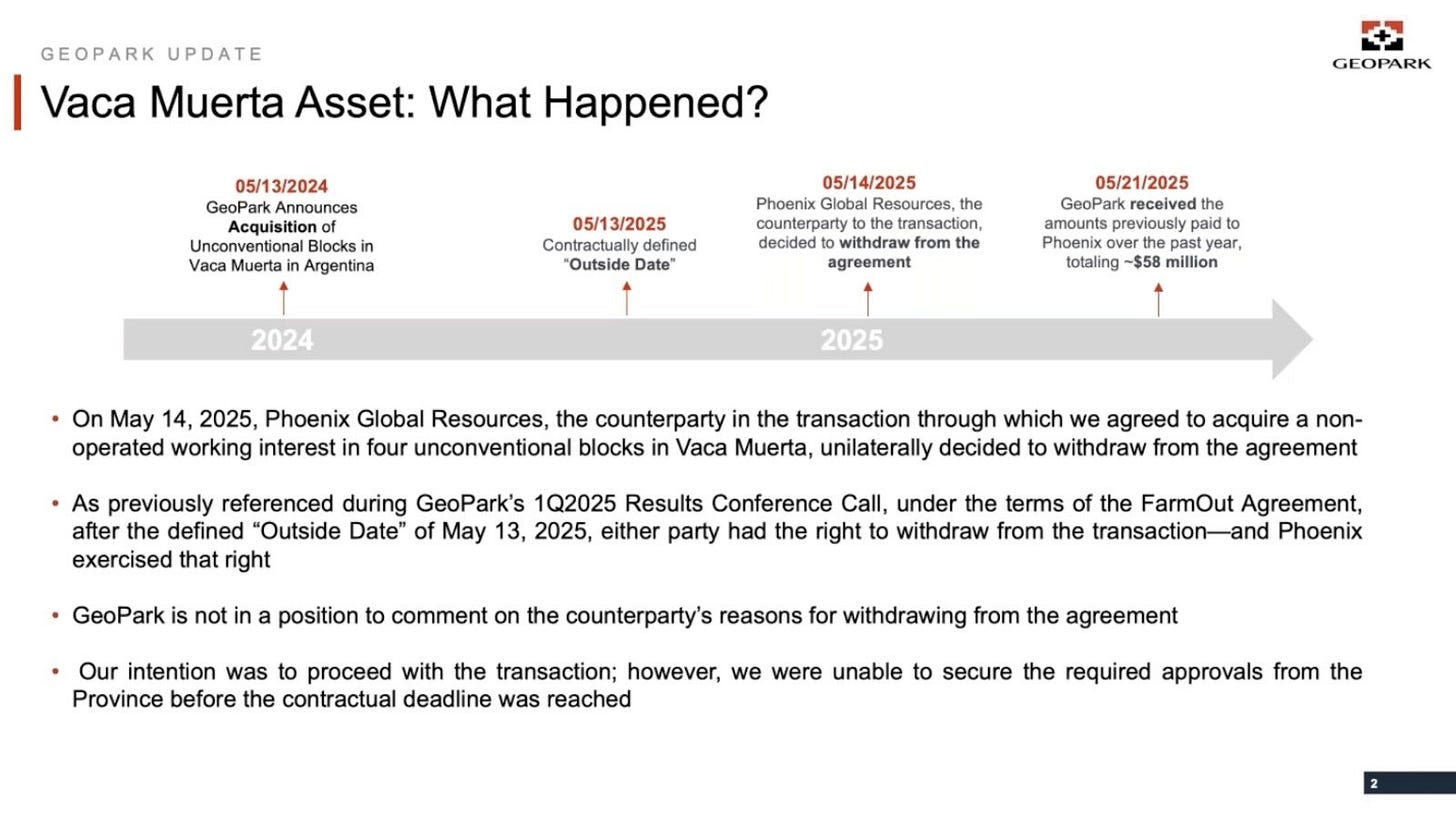

1.0 | Revisiting the Vaca Muerta Deal

In May 2024, nearly exactly one year ago, GeoPark signed a deal with Phoenix Global Resources to acquire:

A 45% working interest in the Mata Mora Norte block.

A 50% working interest in the Confluencia block.

Both are located in Argentina and have massive growth potential as the Vaca Muerta region has quickly emerged as one of the fastest growing shale oil formations. It’s necessary to understand why GeoPark wanted this acquisition so badly. A few months back they tried to buy Repsol’s Colombian assets for $530 million but the deal fell through as Ecopetrol used their right of first refusal and purchased the assets themselves. At this point, the company has tried in vain to acquire new assets both in Colombia and Argentina. Today the company is in a position of great liquidity and eager to step into the ring for a third time.

Now, the reason why the acquisition fell through is so shady that it should, in an ideal world, lead to an investigation into the politicians at the highest levels of the Argentine government. It’s one thing to be a country that has been ruled by socialists for decades, but damaging your country’s reputation among foreign investors takes a special kind of skill as a governor. If we look at the Vaca Muerta, it is undoubtedly one of the best emerging basins for hydrocarbons globally. In an age where we urgently need to find new oil supply, you would imagine the Vaca Muerta to be an incredible investment opportunity. You would imagine that oil majors from all around the world would compete for a piece of the cake. The reality looks slightly different. Exxon and Petronas have sold assets in the Vaca Muerta to local companies and have effectively left the space. Couple this with the fact that the governor of Neuquén, Rolando Figueroa, hasn’t responded to the issue involving GeoPark, and you get a pretty clear picture of why foreign companies are turning their backs on the Vaca Muerta.

1.1 | Why Did the Deal Fall Apart?

It’s not unusual to wait a few months for the approval of an acquisition, but to wait an entire year without any response is absurd. I don’t know why Figueroa hasn’t acted for over a year. Every day people tagged him on Twitter/X under tweets/posts related to GeoPark, but we waited for a response that never came. When GeoPark made it public that they had an agreement with Phoenix Global Resources stating that if the acquisition didn’t close within a year, both parties could walk away from the deal, it was basically guaranteed that the deal would fall apart. A couple days later, Phoenix Global Resources walked away from the deal.

Some people have argued that not only Figueroa, but also Phoenix Global Resources wanted the deal to fail. Whatever it is, the situation is frustrating. So, with the history lesson out of the way, let’s focus on the two main things I’ve learned from the GeoPark drama.

1.2 | Learnings

Making mistakes is part of the game. Making the same mistake over and over again is ignorance. From the GeoPark drama, I learned two things:

Don’t ever base your investment thesis on an acquisition that hasn’t closed yet.

Realize that there are always risks you haven’t thought about. Most things are not in your control, therefore it’s extremely risky to put half of your account into one idea.

Luckily for me, my investment journey with GeoPark started a few months before they announced the acquisition in Argentina. Therefore, I hadn’t based my entire thesis on the newly acquired assets. Still, it caught me off-guard. Would I do anything differently with my current mindset? I doubt it. Not because I am ignorant, but because I asked myself a couple months back a question. What is the risk/reward with GeoPark? I came to the conclusion that the stock is so cheap, that even if the acquisition falls through, the downside should be limited. The upside however was massive in case the approval came. Still, these lessons will be kept in mind for the future.

2.0 | Financials for the FY 2024 & Q1 2025

Let’s start with the financials for 2024 and then focus on Q1 2025 so we can get a better perspective on the cash generation of GeoPark.

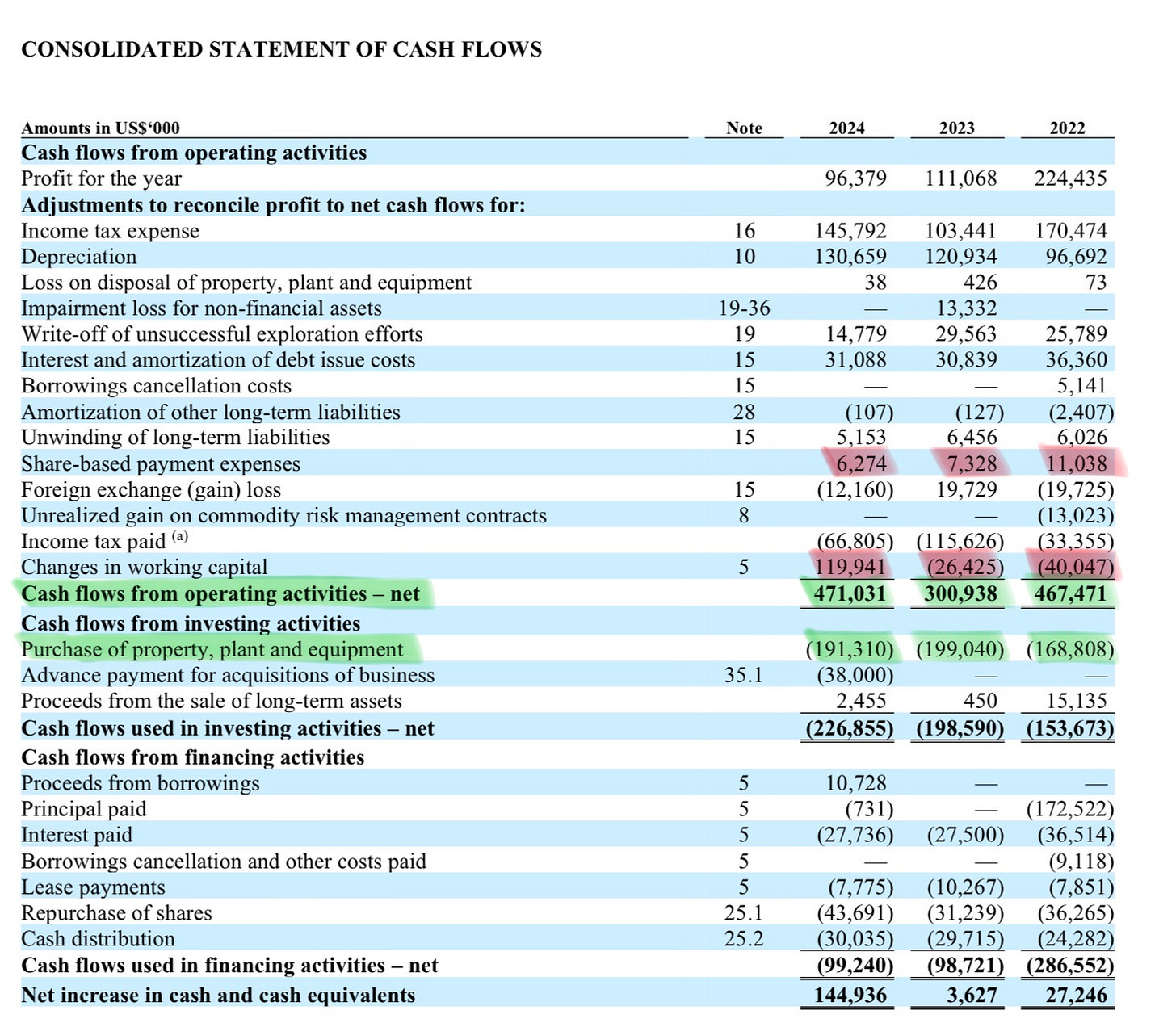

In 2024, GeoPark generated $471 million in cash flow from operating activities. However, this figure was significantly influenced by changes in working capital, which had a positive impact of nearly $120 million — contrasting with the negative impacts seen in both 2023 and 2022. This shift was primarily driven by a funding agreement with Vitol, through which GeoPark drew $152 million in capital, temporarily boosting working capital. Since then, the company has repaid $133 million of this credit line. Adjusting for this, the change in working capital amounts to roughly -$32 million. Additionally, share-based compensation totaled $6.2 million. Taking these adjustments into account, the company’s adjusted cash flow from operating activities for 2024 was $312.8 million. Capital expenditures (CAPEX) totaled $191.3 million, resulting in free cash flow (FCF) of $121.5 million for the full year. GeoPark currently has a market capitalization of $350 million and an enterprise value (EV) of $640 million.

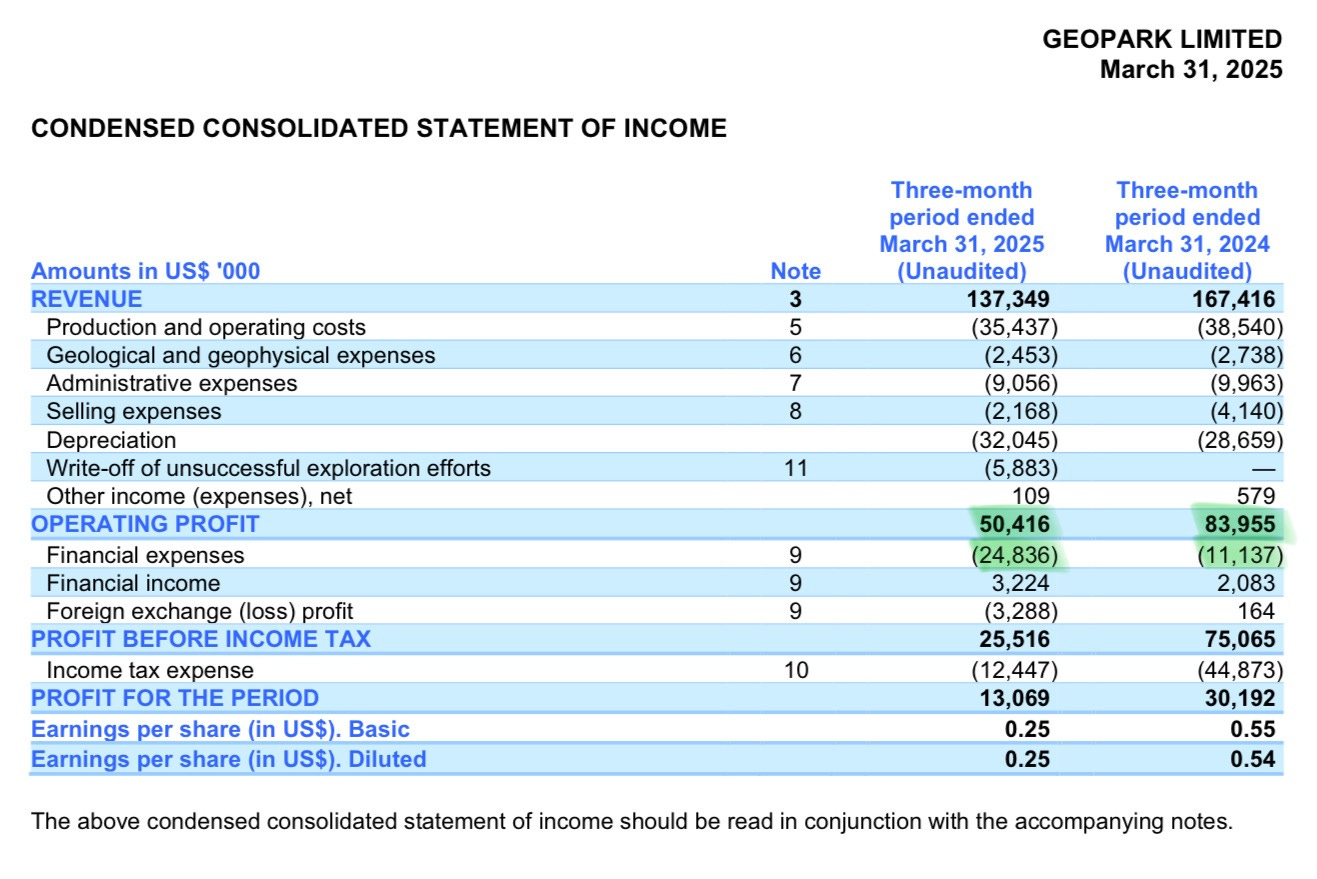

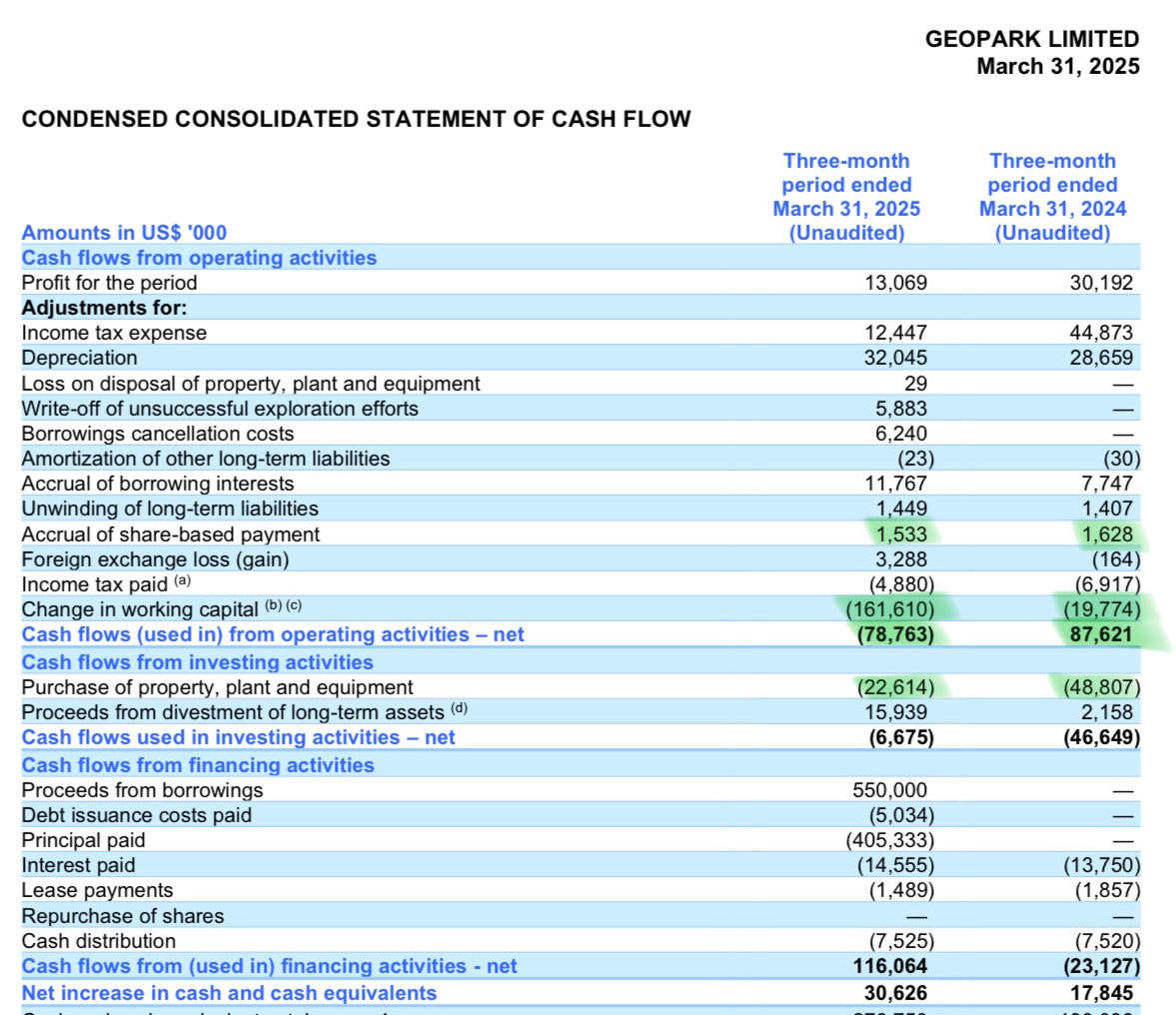

Now, let’s jump to Q1 2025. Revenues declined by 18% as production came in at ~29 kboe/d (down 15% YoY). EBIT was down 40% on the back of this. Net income came in at just $13 million (down 56.66%). But if you dig deeper, things look better.

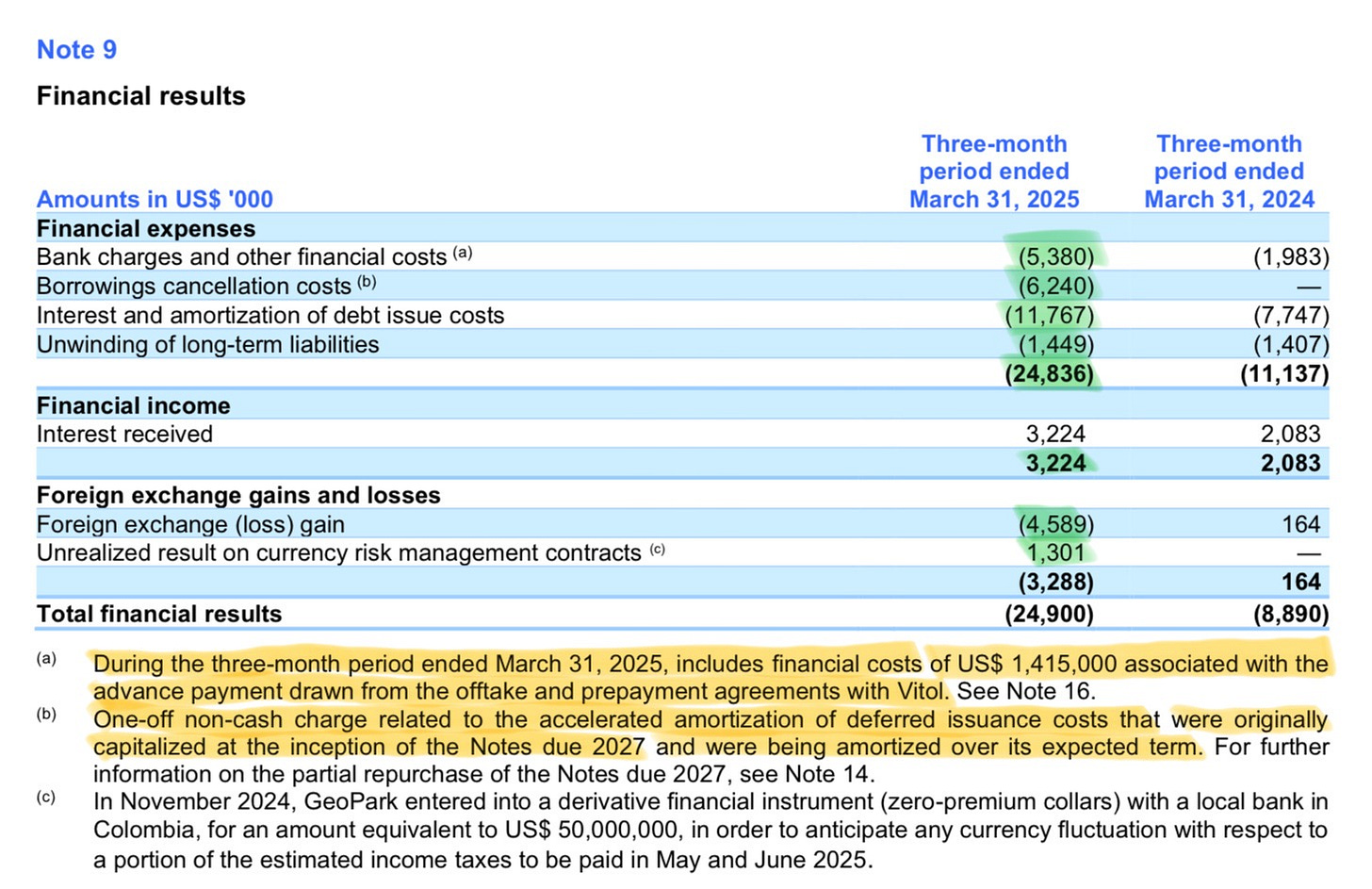

The net financial result was -$24.9 million compared to -$8.89 million last year. Foreign exchange losses amounted to $4.6 million, while there was a $1.4 million one-off related to the Vitol credit line. Furthermore, there was a $6.24 million one-off expense due to GeoPark‘s decision to repurchase some of the bonds due in 2027.

There was also a positive one-off related to financial agreements with a Colombian bank. If we adjust for all these one-offs and exclude foreign exchange losses, the net financial result would have been -$13.9 million. With that, EBT would have been $36.5 million. Cash flow from operating activities was -$78 million, again heavily impacted by changes in working capital. These changes amounted to -$161.6 million, compared to just -$19.7 million the previous year. Share-based compensation remained flat at approximately $1.5 million, while CAPEX declined by 54% to $22 million.

If we read the notes on working capital, the situation makes perfect sense. Remember that FY 2024 results were artificially boosted by the credit line from Vitol? Well in Q1 2025 GeoPark paid back $133 million of that $152 million credit.

Adjust the cash flow from operating activities for this and the share-based compensation, we arrive at an adjusted cash flow from operating activities of $52.5 million. Subtracting the $22.6 million in CAPEX and we arrive at an adjusted FCF of $29.9 million or ~$120 million on an annualized basis.

3.0 | Updated Thesis on GeoPark

With the failed acquisitions of assets in Argentina and Colombia (from Repsol) the company is back at square one. The assets in Colombia are great and cash flow productive, but their reserve life index (2P reserves) stands at roughly 7.2. Therefore, the management team of GeoPark will continue to push for acquisitions. The great thing is that the company is now in a position where they have a lot of available liquidity, meaning they shouldn’t have too much difficulty funding future transactions. As of May 4, 2025, GeoPark had cash and cash equivalents of $330 million. They have now received back the $58 million that they had prepaid to Phoenix Global Resources, meaning their cash balance is likely around $390 million by now. I am convinced that we will see another attempt at an acquisition by GeoPark this year. Will they stay in Colombia or try their luck in Argentina again? This remains to be seen, but I am pretty bullish on South America in general, and Colombia especially. The shift from socialist politics to right-wing pro capitalist politics is a significant trend in South America. In 2026, Colombia will hold presidential elections and current president Petro seems on the losing side for now.

Internally, GeoPark has embarked on a cost-cutting program which aims to reduce costs by $5-7m annually. To date, 90% of the targeted savings have already been achieved. The great thing is that at the current point in time, GeoPark has a lot of opportunities to deploy capital. They could repurchase shares, like they have in early 2024, repurchase outstanding bonds, as they did earlier this year, or pursue a major acquisition. Whatever course the company will take will be decided by the management team. On April 24, the current CEO, Andrés Ocampo, announced his step-down after working for the company for 15 years. The new CEO, Felipe Bayon, was from 2017 - 2023 the CEO of Ecopetrol. This is important to note, as we now have the CEO as well as the CFO of GeoPark being ex-Ecopetrol executives. André Ocampo remains shareholder of the company.

My investment thesis hasn’t played out ideally, things could have gone much better, but it is what it is. I still hold shares in the company and am convinced in the long term potential of GeoPark. At the current point in time, GeoPark trades at 5-6x EV/FCF and has hedged 87% of its expected 2025 production at prices ranging from $68 to $78 a barrel. The dividend of roughly 9% is covered at current spot prices and the elections in Colombia could elevate the company’s share price.

4.0 | Conclusion

Considering the failed acquisition, GeoPark’s share price has remained resilient. Volume spiked on May 14 to the highest level since May 11, 2016, the day GeoPark bottomed.

Looking at the volume area, the range between $6.60 and $6.44 is an important support zone. We don’t want price to fall below this zone, as this would signal a change in trend. On a longer timeframe, the most important thing is just that the low from mid-April at $5.66 holds.

Overall, I remain bullish, but I have to admit that things didn’t go according to plan. This is life, an unpredictable world that doesn’t behave like Excel spreadsheets. You have to embrace the volatility, get comfortable with it and always stay positive. I am confident that GeoPark will pursue another acquisition in the coming months. In the meantime, the company has hedged most of this year’s production at favorable prices, while paying a dividend yield of roughly 9%.

Yours sincerely,

MODERN INVESTING