GeoPark Q2 Earnings & Oil Outlook

A roadmap for Oil going into 2025 and a review of GeoPark’s Q2 earnings …

GeoPark reported earnings on Wednesday after hours. The first reaction by the stock was a drop of 6%, as a lower net profit caught many off guard. At the end of the day, the stock closed down slightly above 4%. There are more components as usual in the earnings review, but we will take it all apart. In addition, I will provide an outlook for the oil market for the next few months, as there has been a lot of volatility lately.

1. Q2 Earnings Review

Production in the 2nd quarter amounted to 35.6 kboed, which is down 3% year over year. The main reason for the decrease in production was the exit of the Chilean business and a longer than expected down period for the Manati gas field in Brazil due to unscheduled maintenance. Importantly though, production was up 11% in Ecuador and 3% in Colombia, with the CPO-5 block hitting record high production levels. The acquisition in Argentina is progressing well and is expected to close in Q3 2024, with all the oil produced from now onboards being added to GeoPark’s production levels.

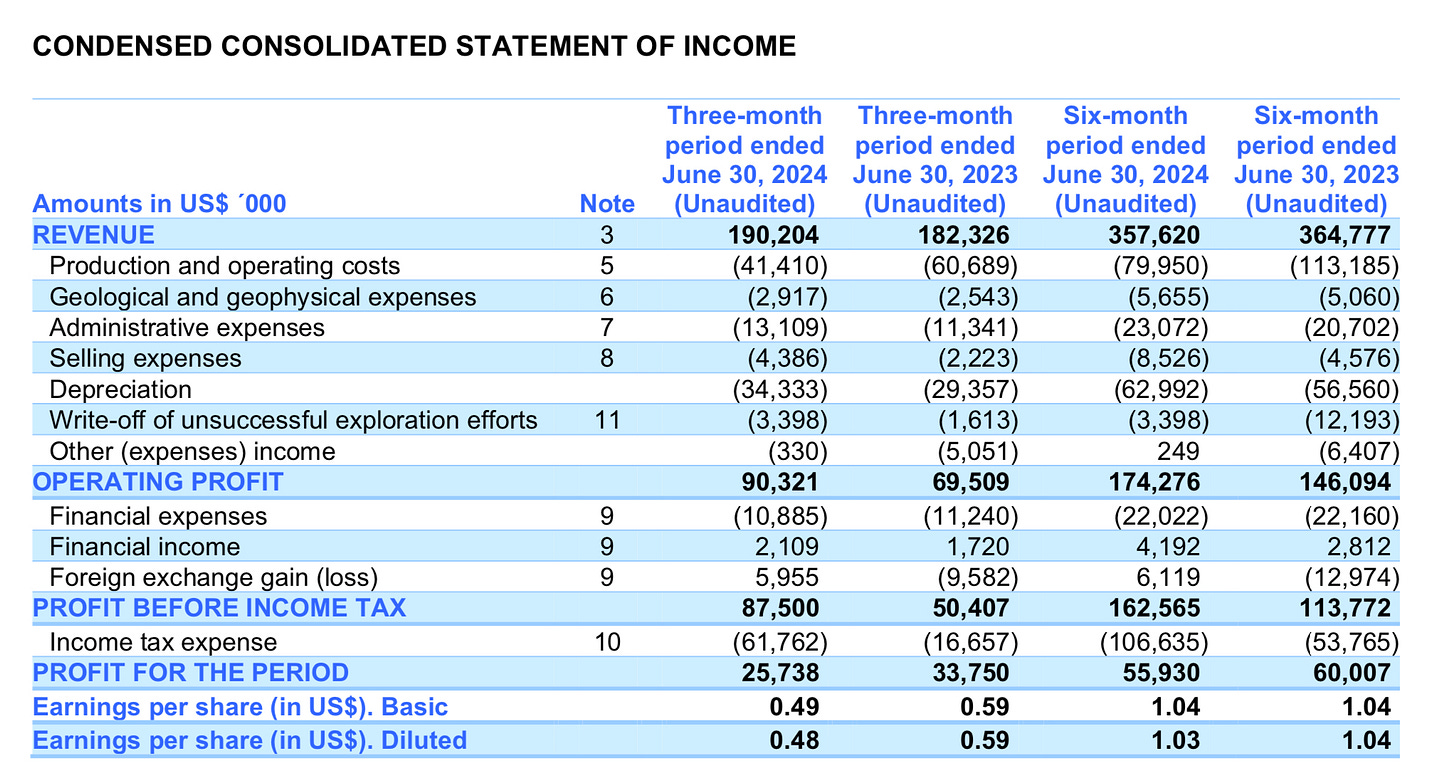

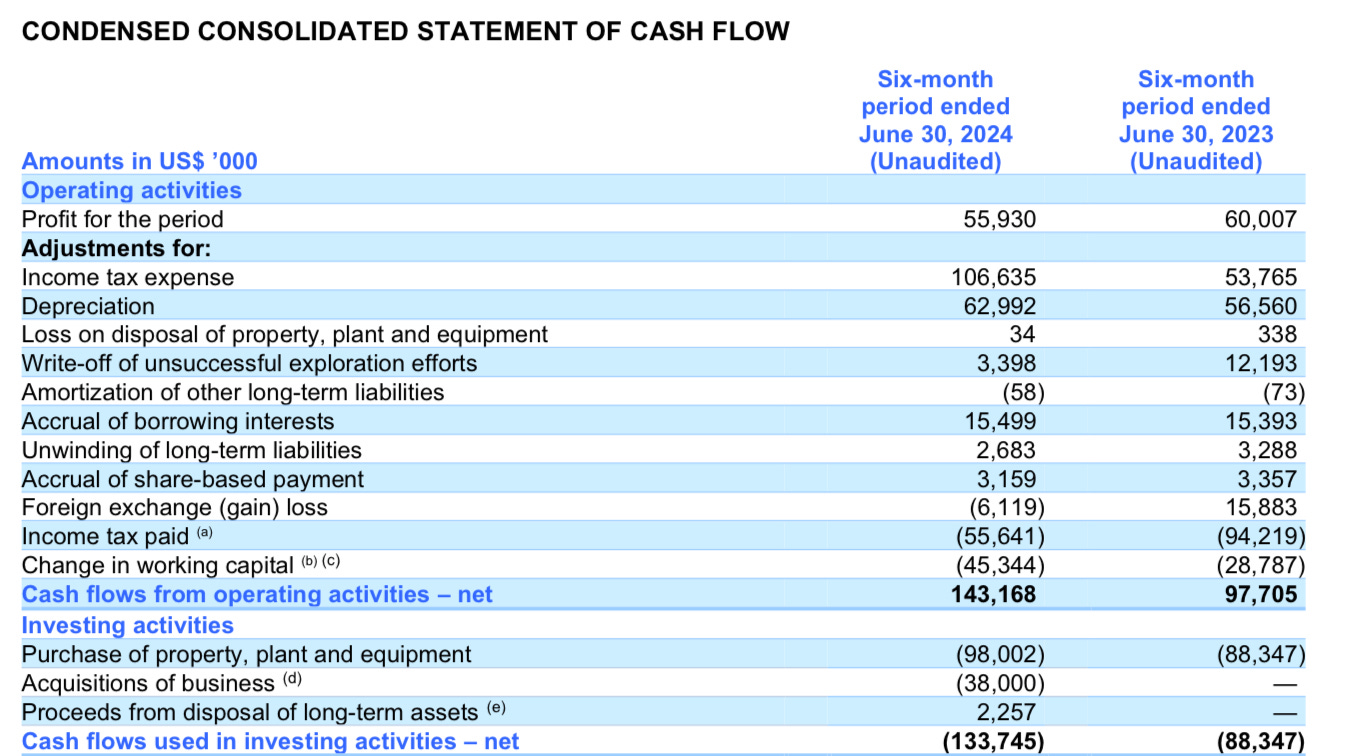

Revenues amounted to $190 million for the quarter, which was 4% higher year over year and 13.6% higher quarter over quarter. EBIT increased by 30% year over year and 7.5% quarter over quarter.

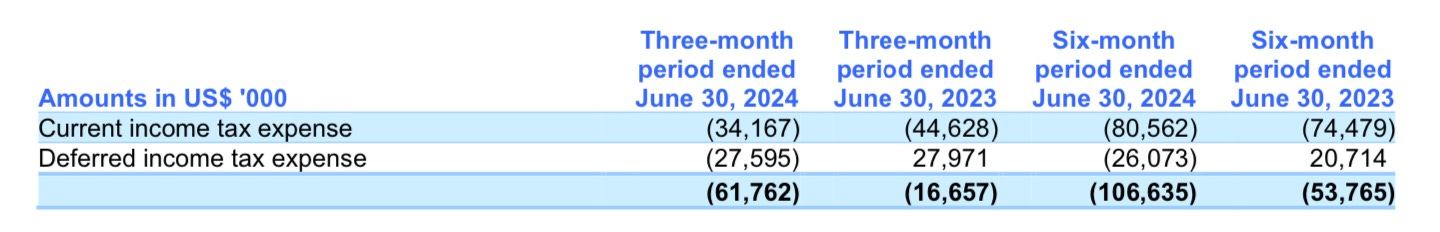

Net Income was down 25% year over year and 15% quarter over quarter. This was mainly driven by higher taxes, which grew from $16.6 million to $61.7 million. The reason for this lies in the devaluation of the Colombian Peso in Q2 2024.

“The Group's consolidated effective tax rate of 71% for the three-month period ended June 30, 2024, which is higher than the statutory income tax rate in Colombia as noted above, is mainly driven by the effect of fluctuations of the Colombian peso on deferred income taxes (the Colombian peso devalued by 8%, representing an approximately 15% increase in the effective tax rate for the three-month period ended June 30, 2024.)”

— GeoPark Q2 earnings report

The fluctuations in the Colombian Peso effect differed taxes. Per definition: “The deferred tax liability on a company balance sheet represents a future tax payment that the company is obligated to pay in the future.”

As the Peso moves up and down, this can be a positive if the Peso revalues higher or a negative if the Peso devalues. As you can see in the table below, deferred taxes stand at $27.6 million as of Q2. In the same period last year, this was at positive $27.9 million. Quite frankly a 180 degree turn …

It’s important to note that GeoPark hasn’t paid these taxes yet and a move higher in the Peso can reverse this jump in deferred taxes. The area between the 2 white horizontal lines represents the exchange rate of the Colombian Peso (CPO) versus the USD during Q2. As you can see, some of the selling pressure has already turned around and the Peso has strengthened into Q3 (as of now). This will result in lower deferred taxes and if the Peso revalues further, the large increase in deferred taxes could be nearly totally reversed.

For that reason I adjusted Net Income for a normal tax rate of 50%, which resulted in adjusted Net Income of $43.75 million or an 32% increase year over year and 45% quarter over quarter.

Cash flows were also negatively impacted by the lower stated Net Income, but my calculation of FCF still shows great cash flow generation. I like to adjust operating cash flow for foreign exchange gain/loses and changes in working capital. Based on this, adjusted operating cashflow for Q2 (using adjusted Net income as the base) was $85.8 million ($43.75m Net Income + $34.3m Depreciation + $7.7m accrual of borrowing interest).

Excluding the costs related to the Argentina acquisition, CAPEX was $49.2 million. Therefore FCF adjusted for the currency movements and changes in inventory amounted to $36.6 million. Using the CAPEX forecast from GeoPark for FY 2024 ($150-200m) and the adjusted operating cash flow number from above, we would end up at and FY 2024 adjusted FCF of $145-200 million.

1.1 Shareholder returns, Argentina and Valuation

Now coming to the fun part, shareholder returns and the acquisition in Argentina. I have already broken down the acquisition in detail in my Q1 earnings review. Nothing has changed and GeoPark made the first payment for the acquired assets. They stated in the conference call that everything is progressing well and that it’s even above their expectations (I assume they referred to the timing of the legal process). Including the Argentinian assets, which already contribute to GeoParks production as of July 1st, production is at roughly 41 kboe/d or 15% higher than in Q2. Over time the Argentinian asset will grow faster than the rest of the company, resulting in higher overal share of production volumes for GeoPark from the Vaca Muerta.

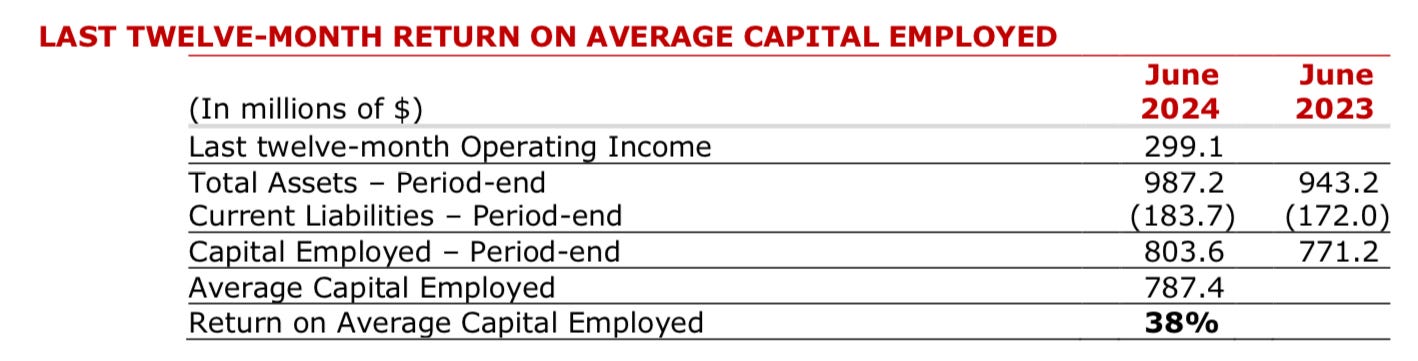

Dividends are flat at $7.5 million a quarter (~7% dividend yield) and the company bought back 8% of outstanding shares in April. The ROACE (Return on Average Capital Employed) has been at an outstanding 38% over past 12 months, as the company continues to print cash at current oil prices.

The valuation for GeoPark is extremely low considering their outstanding managment team, returns to shareholders, growth in Argentina, cash flow generation and assets with leading breakevens of roughly $30-35 a barrel. As the company has no debt maturities till January 2027 and a funding commitment from Vitol for $500 million, the company won’t have liquidity issues anytime soon. At a P/E of 3-4x and EV/FCF of 4-6, the stock is cheap considering its quality. As the company deleverages and Argentina scales up, the stock will look a lot more attractive in hindsight.

2. Oil outlook in year end & 2025

Oil has been trading in the $70-90 range for 1.5 years now, gold has been rallying recently and there is a lot of noise around supply, demand, inventories, etc.

In my latest article 2 weeks ago, I wrote down my thoughts on oil and highlighted that funds went nearly net short oil. This was for now (!) the bottom in oil, but the big picture hasn’t changed at all. Still, there are a few new points I want to make, mainly related to cycles and the supply side.

2.1 Supply outlook

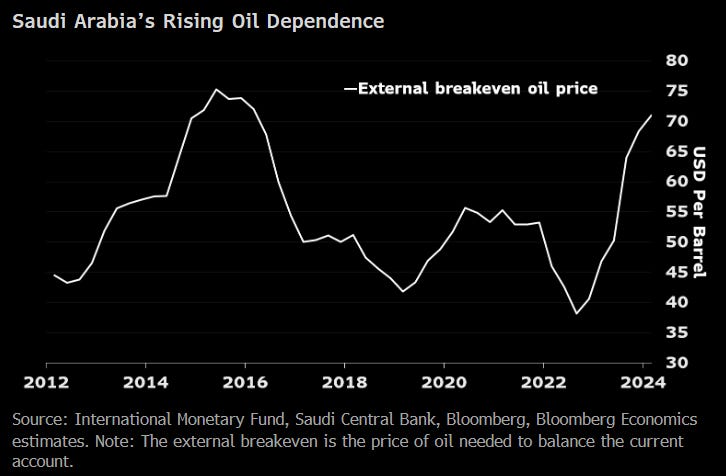

Supply is one of the most discussed topics in the industry, and still, there are two opinions. Either you will hear that someone is going to flood the market, or that oil supply will collapse. My balanced view on this is, that nobody will flood the market. Not the Saudis, as Saudi Arabia needs money for their large fiscal spending, nor the USA, as U.S. production is flat for the past 12 months and nobody else has the ability or incentive to flood the market. Saudi Arabia’s fiscal breakeven for oil is >$70 as the country has gone on a spending spree in recent years.

The country, which is among the leaders of OPEC has been navigating the volatile energy markets by imposing production cuts for as long as necessary, to ensure price stability. As the group expects demand to grow significantly this year, they plan to slowly role back the cuts. However, as mentioned in recent weeks, every decision is based around market conditions. My hunch is, that OPEC won’t return barrels to the market at current pricing. We currently trade in a tight wedge and crude is know for always overshooting in every direction. The risk of falling below key levels, which would result in a sell-off by algos, is just to high.

The latest S&P Global Commodity Insights Global Crude Oil Markets Short-Term Outlook expects non-OPEC+ crude oil production growth (including condensate) to be 390,000 b/d lower (829,000 b/d of growth) in second-half 2024 and 570,000 b/d lower (1.1 million b/d of growth) in 2025 than its previous month’s forecast.

— Oil & Gas Journal

Some growth will come from Kazakhstan and Canada , but apart from that supply won’t grow meaningfully. The U.S. has entered a regime of lower growth, and a potential presidency of Donald Trump won’t fix this. He will openly talk about his plans to cut the oil price in half, but everyone looking at the data will cry for laughing hearing this. The only thing stopping producers to not increase production now, are their shareholders and spending plans. The base decline is large, so existing producers are already happy to report slow growth instead of a decline. Many DUC’s (Drilled but Uncompleted Wells) which have already been drilled years ago still haven’t entered production, and probably never will.

2.2 Russian crude exports

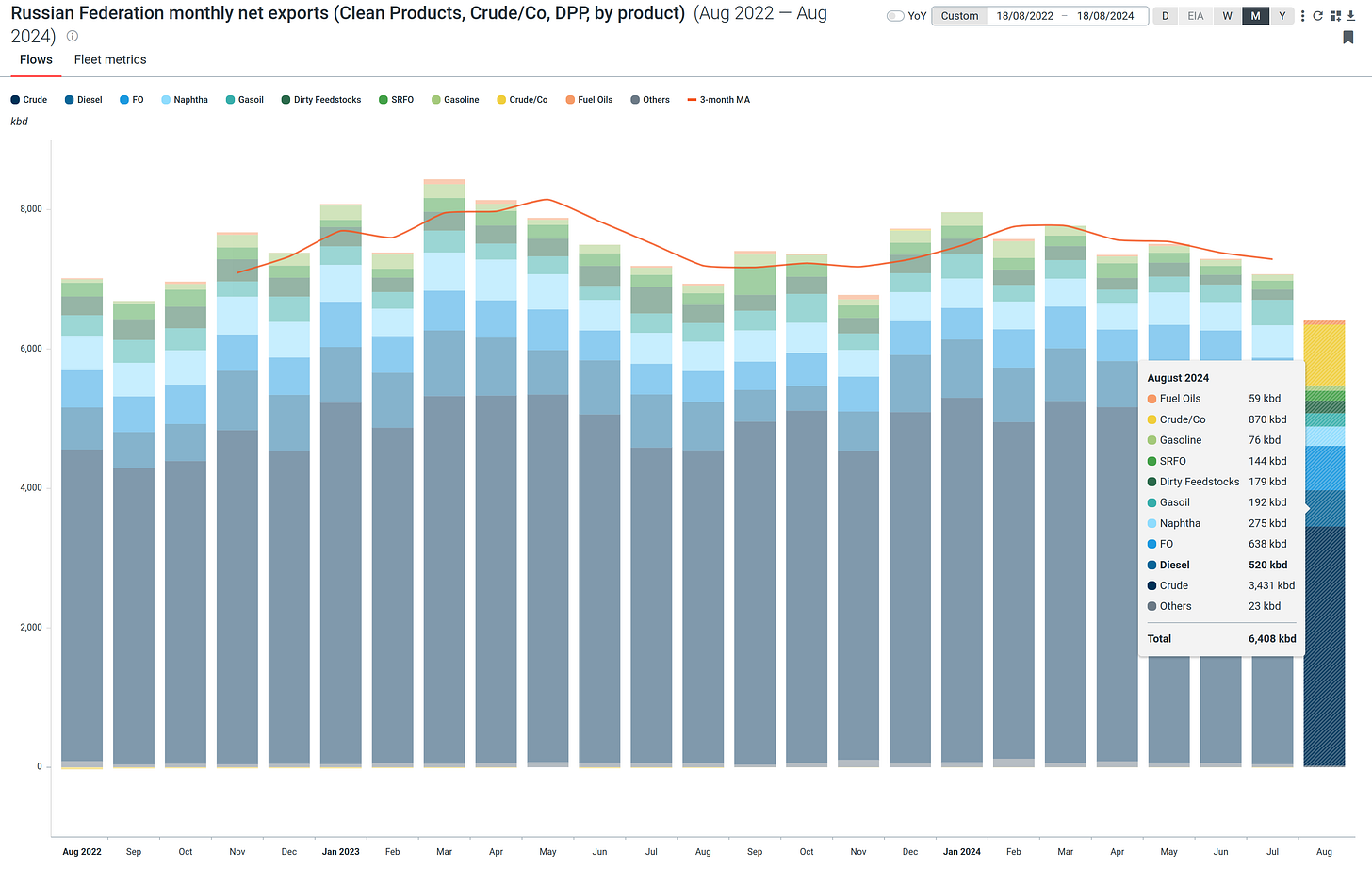

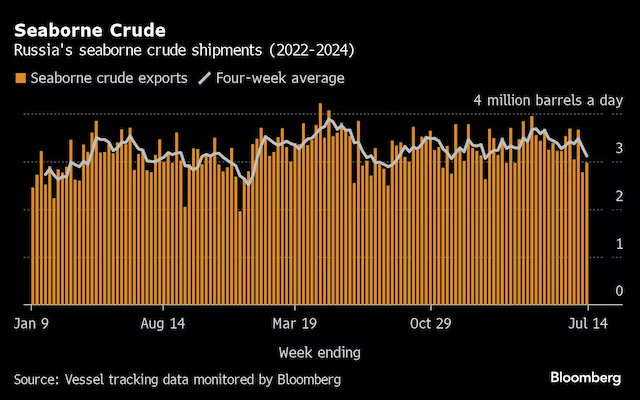

On supply, there is one large player that I haven’t mentioned yet. Russia! The country’s crude exports declined significantly to just 6.4 mboe/d this month.

Bloomberg reported that Russia’s four-week average crude exports fell to their lowest since January with a drop of around 570 kboe/d from the recent peak in April. The article highlights that shipments from Russia’s Baltic ports slumped by 30%, while shipments from the Black Sea terminal at Novossiysk got cut in half.

I have no clear explanation for this, but there are a few potential reasons and the answer is probably a combination of all the possible factors. Firstly, Russia has been more committed to the targeted OPEC+ production cuts, after the country’s production was above the quota targeted by OPEC+. Secondly, this is also a seasonal pattern, as many ports have maintenance schedules this time of the year. Lastly, there is no doubt that the attacks on Russian refineries by Ukrainian drones directly impacts Russia’s exporting capabilities.

There has been the theory that Russian oil equipment is falling apart after many western companies left the region, but I’m a bit skeptical on that. Schlumberger for example is still operating in Russia. A key reason for the slump in exports is also that during the 2nd half of the month, they will probably get better pricing for their crude (because demand is high). I will monitor the situation in Russia closely, but for now the story seems to be softer Russian crude exports, benefiting the oil price.

2.3 Healthy demand & Gold as a leading indicator

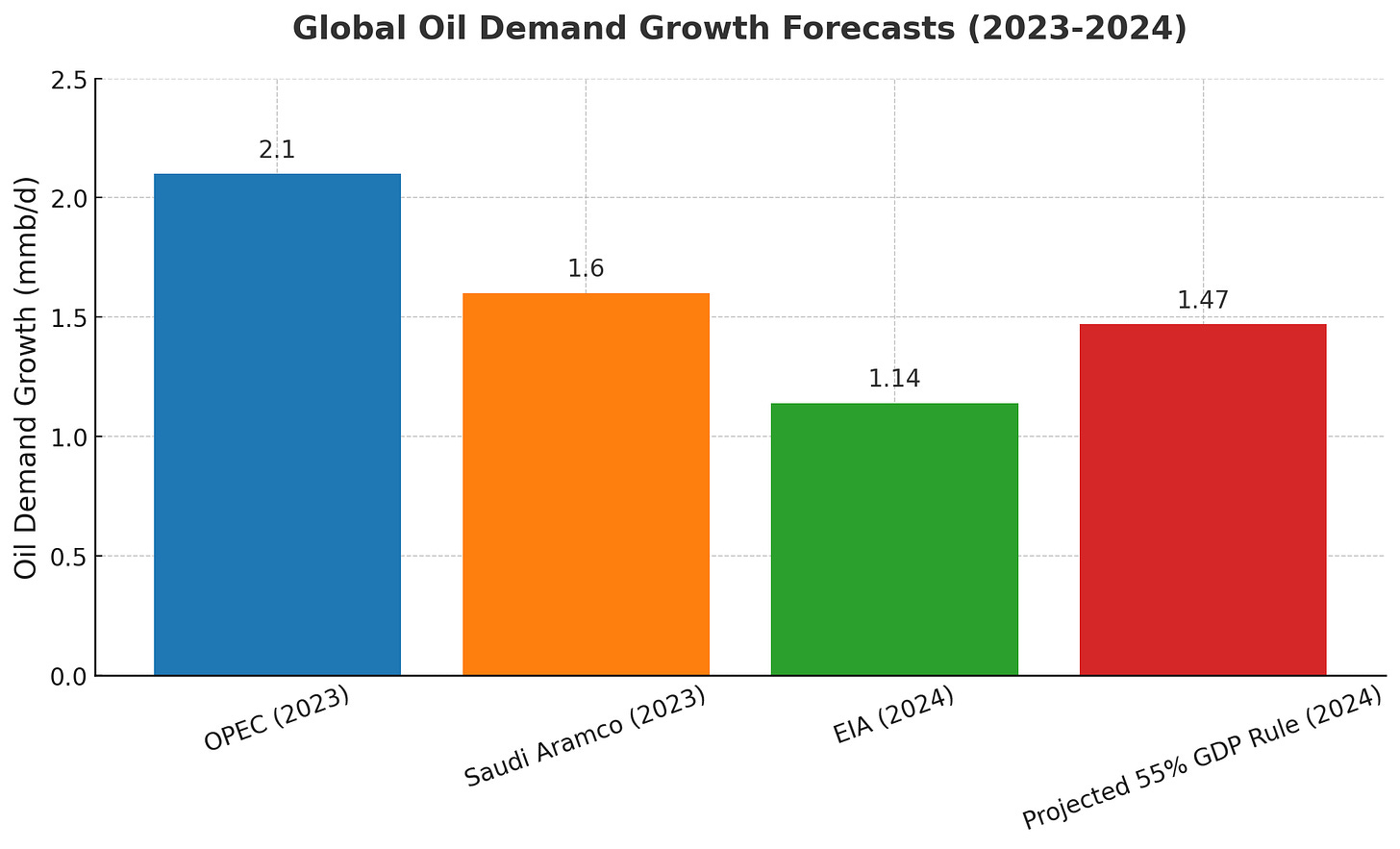

The fear of a collapse in demand and a recession aren’t anything new to energy investors. Every once a month you hear that recession fears have increased and that oil demand will drop, resulting in people losing their minds on social media. The reality is, that we have healthy demand growth this year. Whichever forecast you use, it all points to growth in demand >1 mmb/d. OPEC takes the lead with anticipated demand growth of 2.1 mmb/d this year. The EIA takes the low end of estimates and predicts 1.14 mmb/d of demand growth in 2024. As many have argued that OPEC is too bullish, we can also add Saudi Aramco’s forecast, which stands at 1.6 mmb/d demand growth for this year. Global oil demand is seasonally higher in H2 than in H1, therefore, we can expect growth to be somewhere in the range between EIA’s and OPEC’s estimates. There might be some demand weakness in China, but this is compensated by growth in other EM’s. As a general rule, oil demand growth is equivalent to ~55% of global GDP growth. For 2024 it’s expected that global GDP growth will be roughly 2.6% (in line with the 10-year average). This would result in 1.43% oil demand growth or 1.47 mmb/d growth compared to 2023. Since 2010 (excluding 2020 due to COVID), global oil demand growth as a percentage of global GDP growth has been around 61%, with higher levels post COVID.

2.4 Gold & Norwegian Krone leading oil?

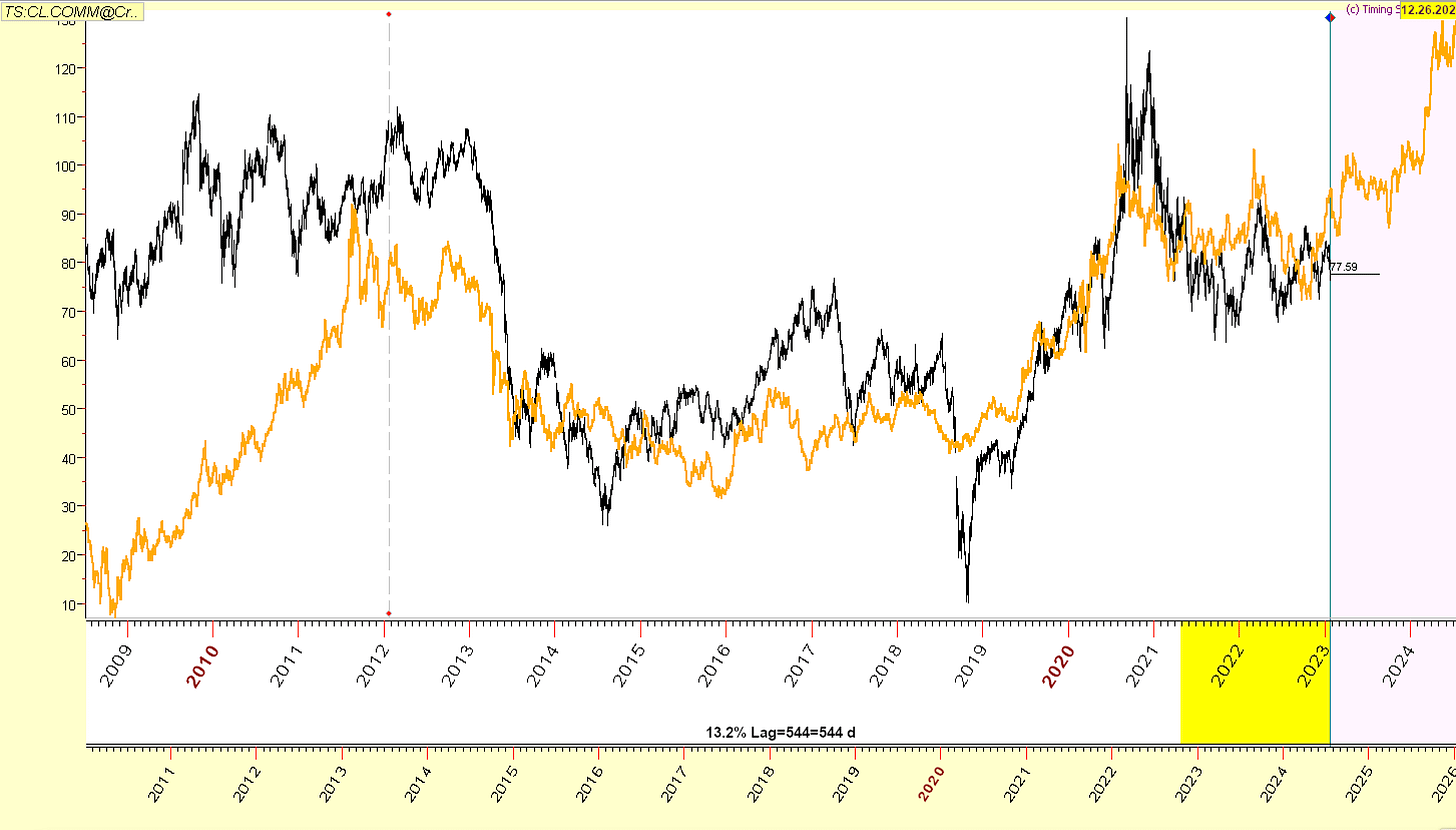

The fact that gold broke >$2500 made headlines and sparked euphoria, but there is a little know correlation between oil and gold. Typically gold leads oil with a lag of approximately 18-20 months. The below chart by Namzes [LINK] illustrates this pretty well (gold in yellow and oil in black).

Of course it’s never perfect, but if oil just goes into a similar direction as gold, then we will be talking about inflation in a few months again. Another leading indicator for oil in the Norwegian Krone or NOK. If you look closely at the chart below (excuse my artistic talent), you will see that the NOK is leading oil typically by a week or few at max.

If the NOK is a good indicator for what’s about to come next, that would be very nice, as the market needs a structural impulse to leave the tightening wedge in which the oil prices have been stock for 1.5 years already.

3.0 Conclusion

All in all, the oil market is trading nowhere as of now. Recession fears and tensions in the Middle East dominate markets, as supply and demand dynamics are favorable going into the end of 2024. Russia’s slump in exports remains to be a wildcard with potential supply disruptions in some areas. The gold price and the exchange rate of the Norwegian Krone vs. the U.S. Dollar as leading indicators support the idea of higher oil prices in the coming months. I will continue to monitor the market closely, and will adapt to changes as soon as they happen. GeoPark reported great earnings that showed remarkable growth in earnings, excluding deferred taxes. The Colombian Peso has already rebounded to some extend and the stock is more undervalued than at any other point over the last months.

Yours sincerely,

MODERN INVESTING

I learned now, that Geopark has a high leverage in case of a rising oil price than some majors.