GeoPark: Strong Earnings and Strategic Argentine Acquisition

Q1 Earnings commentary and a breakdown of a transformational acquisition …

Since I wrote my original article with my thesis on GeoPark, 3 months have passed and the stock is up by 22% excluding dividends. I gave an update in late March and decided to do the same now, as the company reported Q1 earnings and announced the acquisition of new assets in Argentina.

While the share price appreciated by 22% the stock hasn’t become much more expensive, because the company reported strong earnings. In addition, GeoPark repurchased 4.4m shares, which is around 8% of shares outstanding, in a Dutch auction (shareholders had the opportunity to sell shares at 9-10$ a share). The most interesting development however has been the announcement of the acquisition of assets in Argentina.

1| Q1 Earnings Commentary

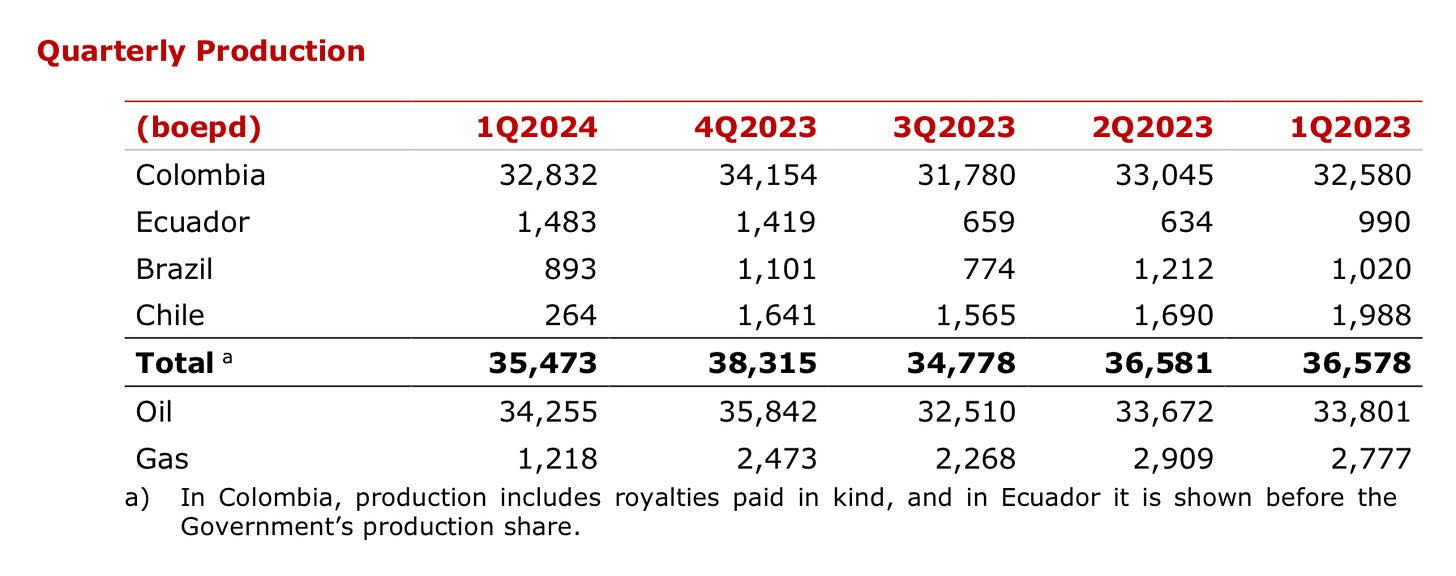

Production in the first quarter amounted to 35,473k boe/d, which was temporarily impacted by protests in Colombia. These issues are already resolved and production is back at 38k boe/d. Another factor that impacted production was the divestment of the Chilean assets (impact approximately -1.3k boe/d).

Production in the CPO-5 block (GeoPark WI 30%) reached a new record at 30kboe/d and the company continued to reinvest vast amounts of its profits into exploration. While revenues dropped by 8.3% YoY, production and operating costs dropped by 26.6%. The fall in costs outpaced the fall in revenues and resulted in Net Income growing by 15%. Lower revenues are explained by lower production in the quarter. With production back at 38k boe/d, revenues should recover from this temporary decline.

CAPEX in the quarter ammounted to almost $48.8m and the CEO stated that ROCE over the last 12 months was 35%. Net Debt stood at $344.3m, which was down $24m QoQ and $2m YoY. Free Cash flow stood at ~$41m, which compares to ~$47m for the same quarter last year.

2| Swiss Commodity Traders partner with Geopark

Over the past months, GeoPark has struck an offtake agreement with the Swiss commodity trading firm Vitol for at least 20k boe/d from the Llanos 34 Block. This agreement improves GeoPark’s realized price per barrel by $0.15 compared to the current realized price. The best thing about the deal however, is the $500m funding facility by Vitol, that GeoPark can draw whenever needed. The terms for this funding would be SOFR (Secured Overnight Financing Rate) plus 3.75%. This amounts to 9% at the moment. In the latest conference call it was highlited that these are terms, that GeoPark would also get in the market right now.

While the terms aren’t cheap, GeoPark will draw approximately $150m from this facility to fund the acquisition in Argentina. In addition, the funding facility will reduce uncertainty surrounding the $500m debt maturity in 2027.

The acquisition in Argentina will be made between GeoPark and Phoenix Global Resources, which is a company owned by Mercuria. Mercuria is another large Swiss commodity trader with revenues exceeding $100 billion last year.

3| Acquisition in Argentina

Last month, GeoPark formally disclosed that they had agreed with Phoenix Global Resources (PGR) to acquire a 45% Working Interest in the Mata More Norte (MMN) Block, which is part of the Vaca Muerta Shale in Argentina. The acquisition is expected to close in the 3rd quarter of this year.

The Vaca Muerta is the fastest growing unconventional oil play in the world with a current production of >300k boe/d. This number is expected to grow to 1 million boe/d till 2030!

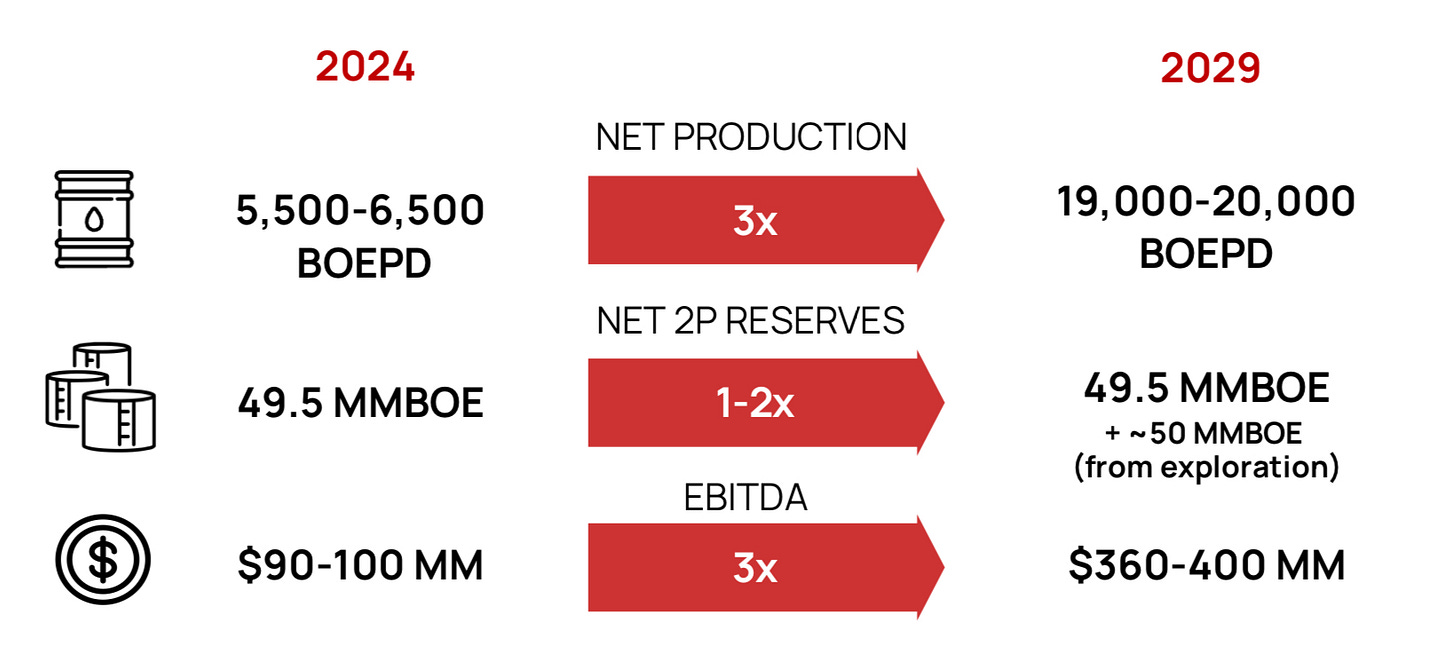

MMN currently produces around 12k boe/d and will add between 5.5 to 6.5k boed/d to the production of GeoPark. Due to a large drilling program over the next few years, Geopark expects that production will increase by 3x to around 19-20k boe/d by 2029. This is equivalent to a CAGR of 35-40% over the next 4 years.

GeoPark will add 49.5 mmboe in 2P reserves and expects EBITDA of $90-100m for the full year 2024 (from its working interest). This number is expected to triple over the next 4 years, in line with production growth. Furthermore, the company expects to have flat reserves, (although the company produces oil) due to several drilling campaigns.

Current lifting costs in the MMN stand at $5.80 per boe and have constantly decreased since the start of production in 2022. It’s expected that lifting costs in 2024 will amount to $5.10 per boe.

It's important to remind that the drilling costs 2 years ago was close to $16 million per well. Now, they ended the year with $14.3 million per well, so that's a tremendous improvement. […] So that's the trend that we see for the future in the model we used for the next 2 years, $14.3 million per well.

But after '26, with an extra drilling rig in area, we are talking about $13.6 million per well.

— Rodrigo Dalle Fiore; New Developments and Portfolio Director

The total acquisition price for the stake GeoPark is buying consists of multiple components. The upfront consideration amounts to $190m, while net exploratory commitments, bonuses, etc amount to a further $78m. The total acquisition price amounts to $268m.

During the latest conference call, the management team stated, that the IRRs of the wells would be in the range of approximately 30 to 70%. We don’t have exact numbers on breakevens of the new assets and my request to the IR team has not been answered yet. Therefore I will just assume that breakevens and margins are similar to those of the competitor Vista Energy. The company has lifting costs of $4.30 per boe, which is very similar to the assets Geopark is acquiring. Geopark estimates that the MMN will generate a 68% EBITDA margin for 2024, which is very similar to Vista Energy, with a 66% EBITDA margin for Q1 2024. Until we have further data, it makes sense to compare MMN to Vista is terms of margins, valuations, etc.

Vista has converted roughly 37% of EBITDA into Net Income in Q1 2024. Vista trades at EV/1P reserves of 15.7$ per boe. This corresponds to $7.1 per boe for MMN. On a price per flowing barrel (EV/2024E daily production), Vista is valued at ~$70k. This corresponds to $22k for MMN. Vista trades at around ~5x 2024 EV/EBITDA, while the MMN deal was valued at ~3x EBITDA.

Vista Energy has the ambition to grow production by 2x till 2030, from 2024 levels. This corresponds to 3x for MMN till 2029. Vista Energy is a fantastic company with great assets, low lifting costs, fast growth and large reserves. MMN has similar lifting costs, faster growth and a much lower valuation. Vista Energy deserves to trade at a premium due to larger size, but the discount is in my opinion to large. This makes for a compelling case, that GeoPark struck a great deal.

4| Conclusion

I continue to hold GeoPark shares in my personal portfolio, as I see the stock as vastly undervalued compared to its fundamentals. The stock trades at 3.7x FCF and a P/E of 4.4x (both FCF and Net Income Q1 annualized). While there was a lot of uncertainty regarding the maturity of the 2027 bond, this is no issue anymore, as the funding facility of Vitol in combination with large cash flows will cover this. Amidst recent volatility in global energy markets, it’s important to prioritize companies like GeoPark with low breakevens (~30$) and experienced management. Thanks to the reduction in outstanding shares, our share of the pie continues to grow, while the company continues to grow and pay dividends. In addition, the acquisition in Argentina will increase the fair value of the company, while serving as a foot in the door for potential further M&A in Argentina.

Yours sincerely,

MODERN INVESTING

Prefer Parex with complete focus on colombia and for Argentina, Pampa energy.

Just saw your post and I linked to it in my links post for today: Emerging Market Links + The Week Ahead (June 24, 2024) https://emergingmarketskeptic.substack.com/p/emerging-markets-week-june-24-2024 I did a piece about them last year: https://emergingmarketskeptic.substack.com/p/geopark-ltd-latin-america-oil-boom/comments + https://emergingmarketskeptic.substack.com/p/vista-energy-largest-non-na-oil-gas-shale-play/comments

Had noted this messy situation though: "GeoPark’s two founders had a messy falling out in 2021 with the ousted Chairman and Company making various claims or statements about each other."