Gerdau - Resilience Amidst Market Volatility

Margin growth, Dividends & Sentiment = Great Setup

In an ever-evolving global market, the steel industry stands as a pivotal player, Gerdau S.A. is among the key players in this industry. The company is Brazil's leading steel producer, with operations spanning North and South America. This article covers the investment opportunity of Gerdau in a challenging market environment for steel.

1| Gerdau S.A. Introduction

As noted, Gerdau is the largest steel producer of Brazil with operations in North & South America. The company has around 30k employees and is 123 years old. Below you can see a snapshot of Gerdau’s major geographical locations.

Over the last few months, Brazilian steel stocks have suffered drawdowns and many people threw the towel at Gerdau stock. To understand why the stocks of steel producers in South America have had big drawdowns in the last few months, we have to look at the other part of the globe. More specifically to China. A struggling real estate sector in China has resulted in less local demand for steel, which led to Chinese steel exports growing massively. The oversupply of steel in the global markets lead to prices falling, while China’s market share was growing. If we take Gerdau as an example, EBITDA declined 50% from Q1 2023 to Q1 2024. Furthermore, revenues declined by 8%.

The situation forced the Brazilian government to impose a 25% tariff on steel imports, in April of this year. This measure aims to strengthen the domestic steel industry by making them more competitive.

Recently, Gerdau reported Q1 earnings which showed first signs of a recovery in margins and saw a single digit revenue growth QoQ. Furthermore, Net Income grew by 48% QoQ.

2| Liquidity & CAPEX

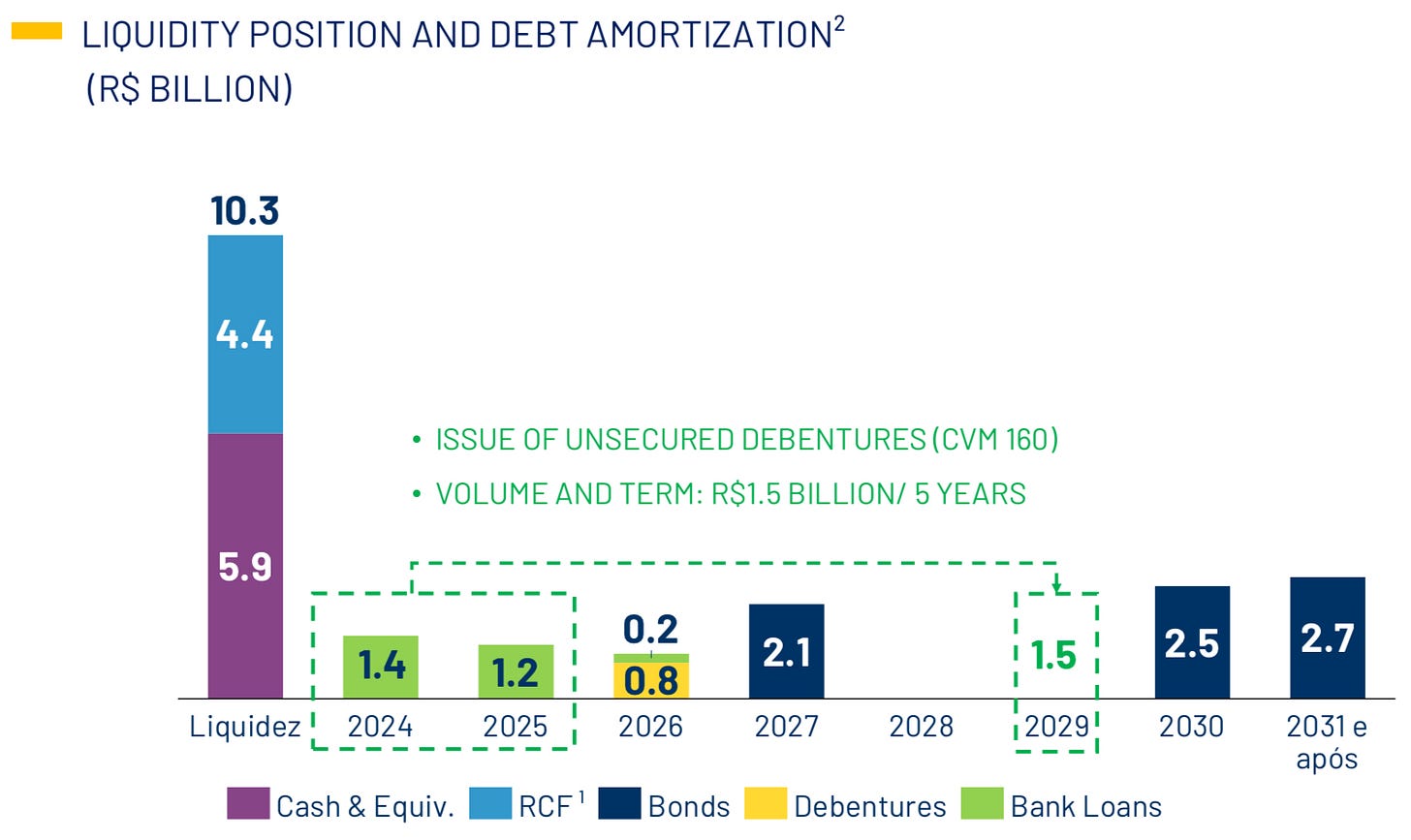

Commodities are cyclical, that’s the reason why I don’t apply leverage towards these kind of bets. Even more import is the liquidity position of the company, to ensure that the company survives a longer than anticipated downturn. Gerdau has a strong financial position with liquidity of BRL 10.3 Billion. Gross debt stands at BRL 11 Billion, while Net debt amounts to BRL 5.1 Billion. Recently, Gerdau refinanced R$1.5 Billion worth of bank loans with a new maturity dates in 2029. With that said, Gerdau’s debt has an average maturity date of around 7.7 years, while the average interest rate is around 5.5%.

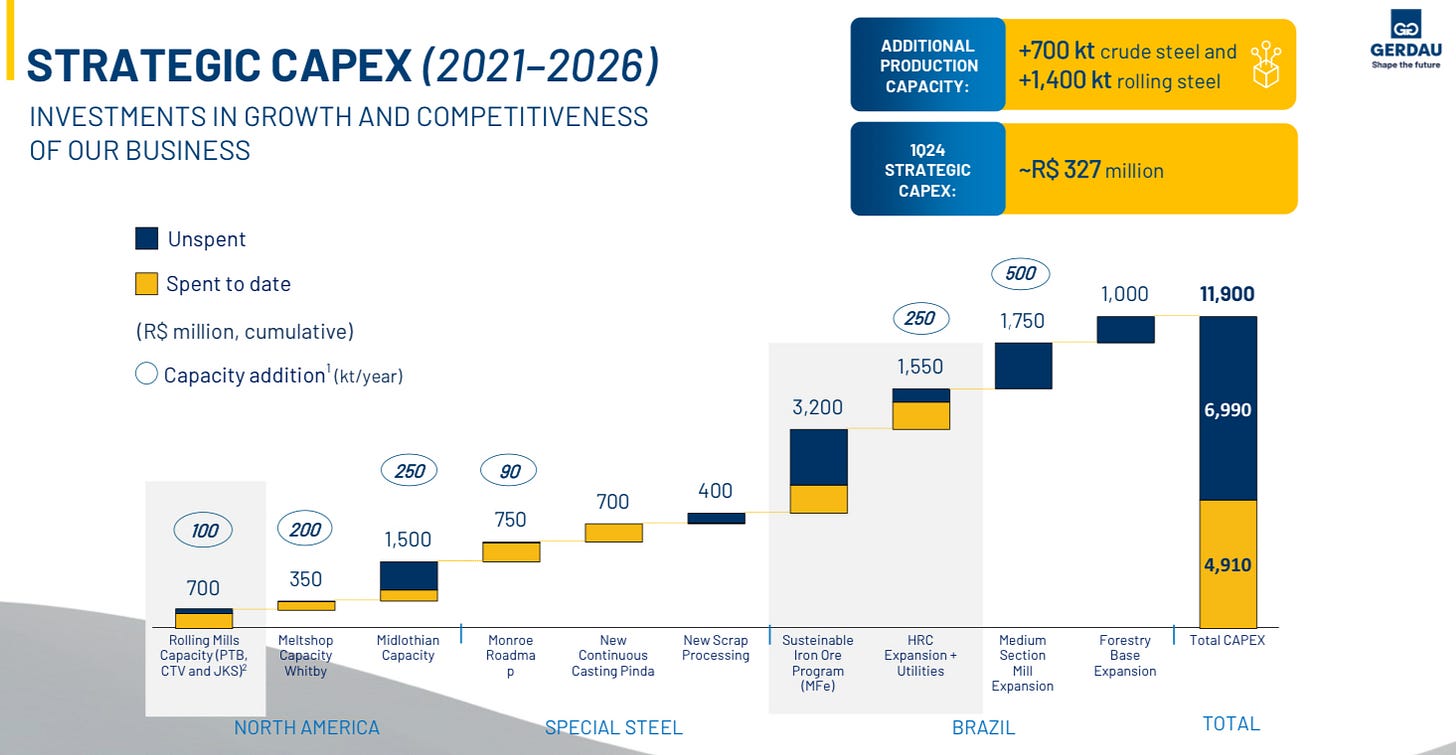

Gerdau is well managed and has remained financially stable during the ups and downs of the last cycles. The company is anticipating to invest R$11.9 Billion in CAPEX from 2021 to 2026 on CAPEX. To date, 41% of this CAPEX program is completed. The money will flow towards new facilities and the modernization of older facilities such as the Jackson Facility in the U.S.

The company guides for an additional 700k tones of crude steel and 1.4k tones rolling steel, that will be added due to the CAPEX program.

3| Margins

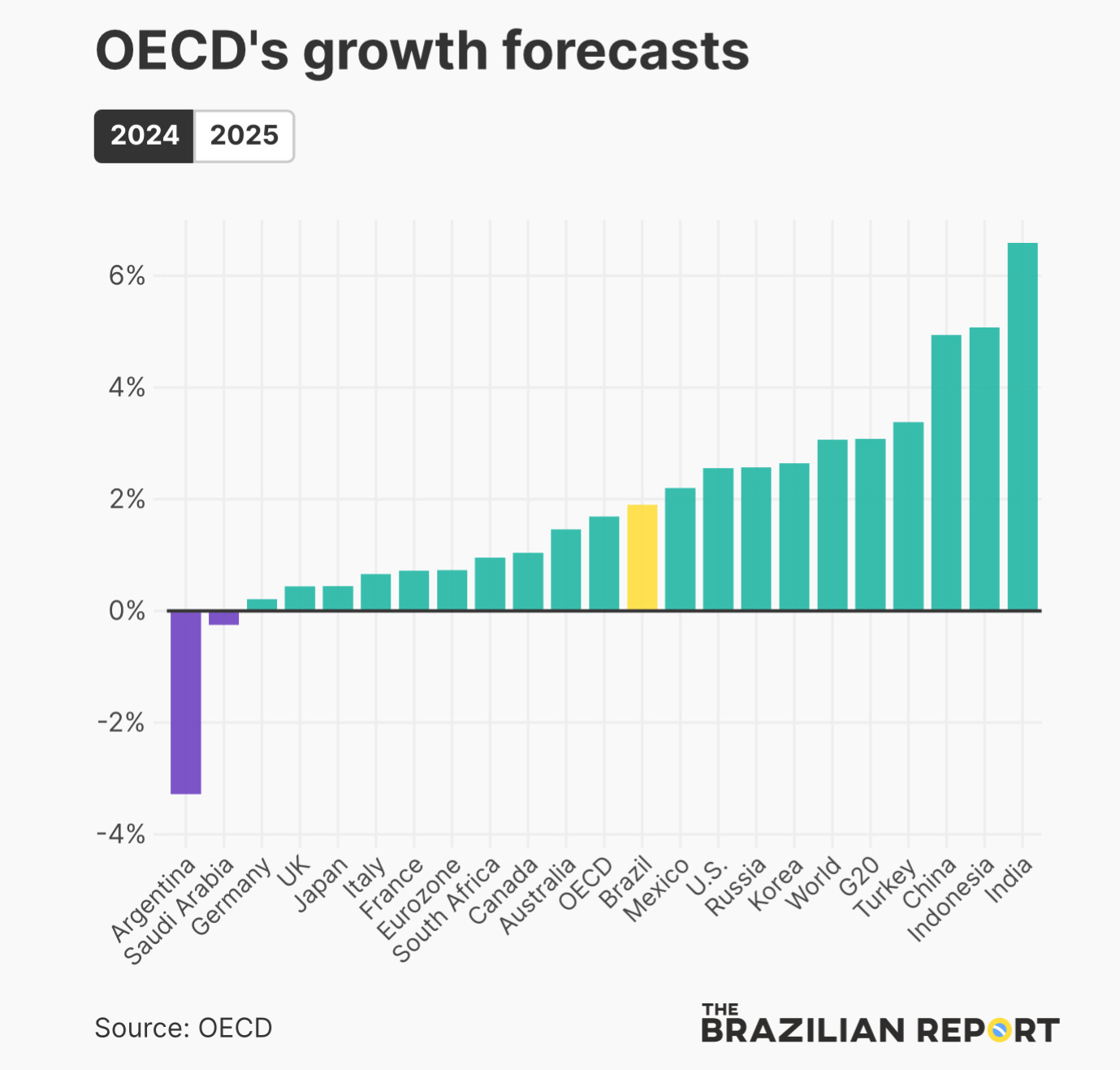

While the North American market is very strong right now, we have had some issues recently, regarding the operations in Brazil. This is expected to turn, as the Brazilian market will radically change over the coming months/years. Previously, Gerdau used its Brazilian facilities to export to other countries, but due to competition from China and tariffs, Brazil will become a more and more closed steel market, that will mostly be supplied by domestic producers. Demand is strong in Brazil and is expected to grow further, as the economy is strong and interest rates fall from record high levels.

I would also like to comment that we continue to expect the development of some positive indicators for the Brazilian market, especially with regard to the construction industry, and a more significant drop in interest rates. One example is the federal government's signaling that it will introduce measures to release around R$300 billion for real estate loans, which should help boost this market.

— Gustavo Werneck, CEO of Gerdau

With the recently announced tariffs, production and shipments in Brazil should grow, which would result in operating leverage, and in turn higher margins.

We were very pleased with that measure (tariffs on imported goods). It was a major progress, because we worked together with the government for a few months and that ended up in these measures, which can help us to increase our operating leverage with increased sales volumes and increased shipments.

Rafael Jaipur, CFO of Gerdau S.A.

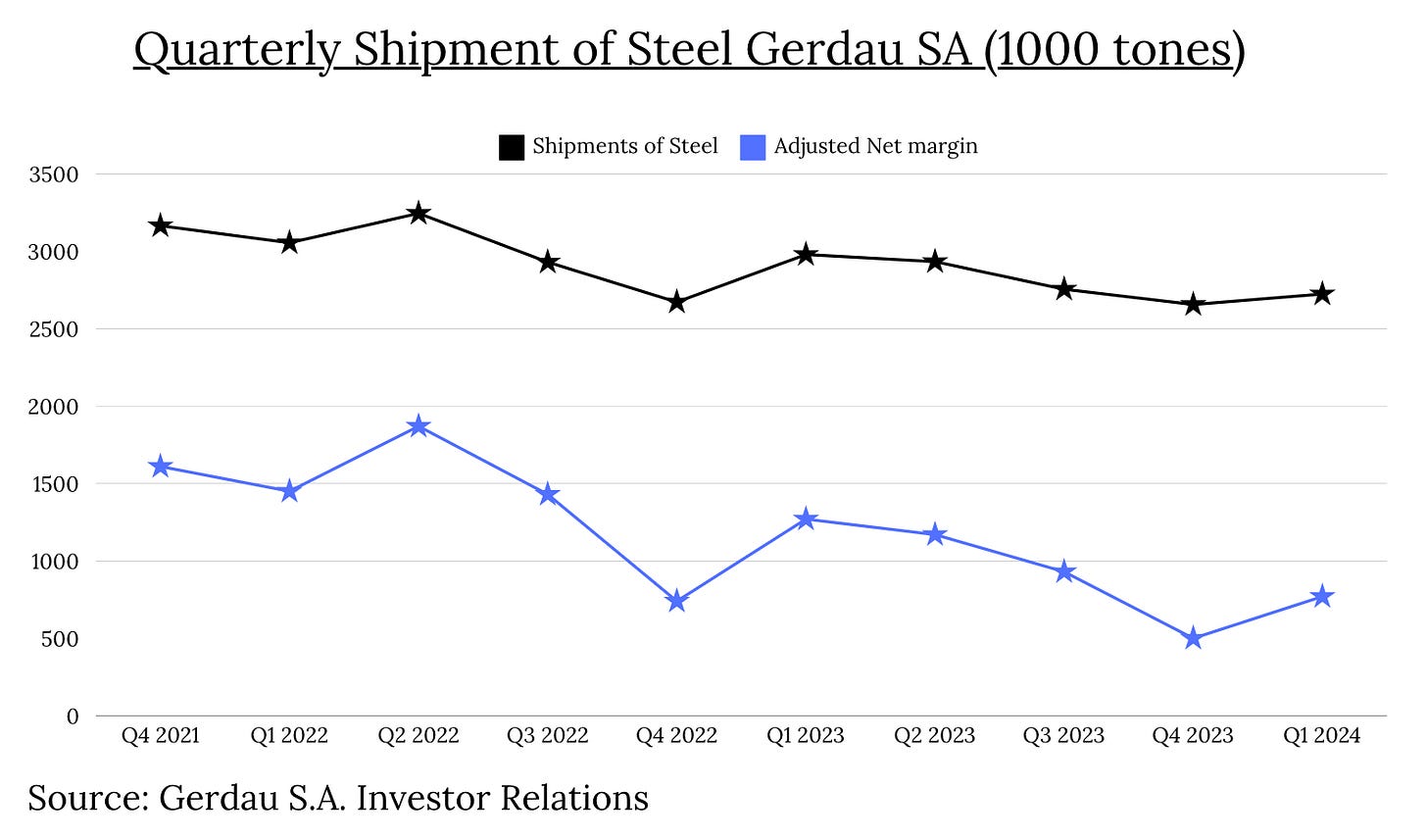

Historically, Gerdau’s margins move in line with shipment levels (due to operating leverage). If production were to increase, margins would most likely follow.

This is in line with comments made in the latest conference call. Gustavo Werneck, CEO of Gerdau stated the following:

Margins in the United States and North America higher than Brazilian margins. I would say that we are doing well over there.

What we cannot accept is that we have the Brazilian margins that we currently have (!). So we are not working to increase margins in North America, but to bring the Brazilian margins to the same levels we see in North America.

— Gustavo Werneck, CEO of Gerdau

4| Dividends & Valuation

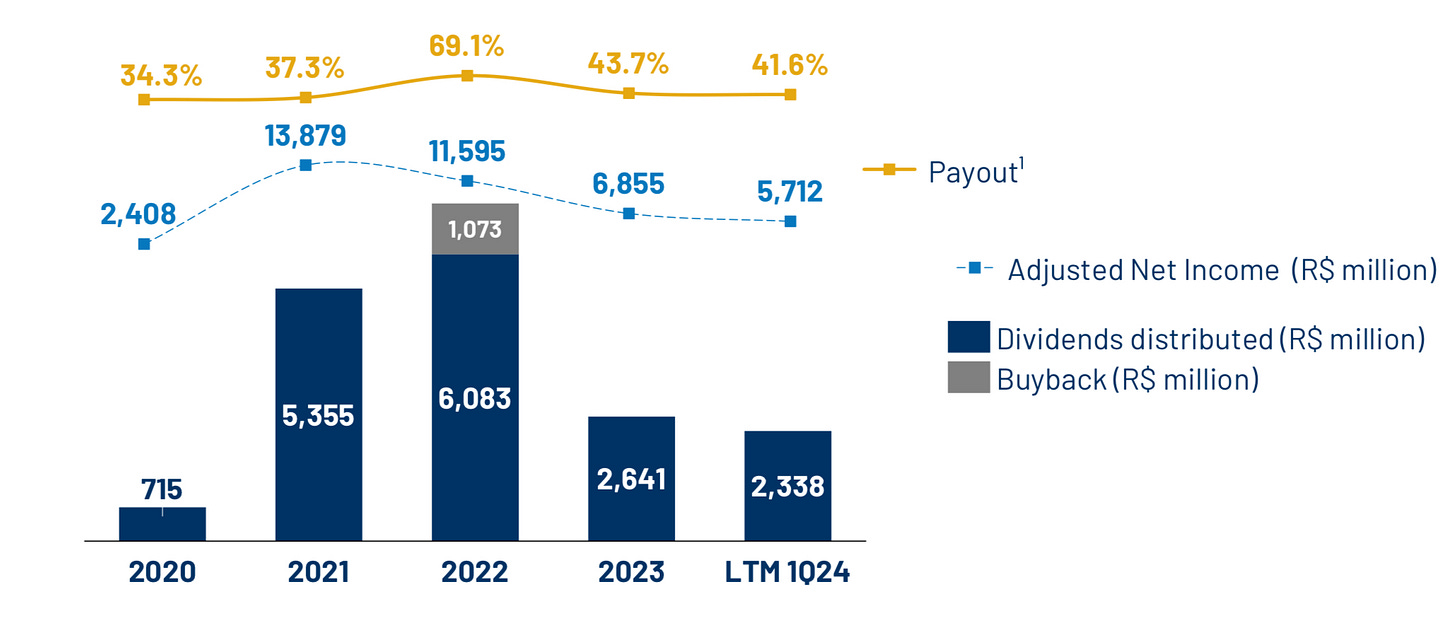

In addition to growth, Gerdau is also returning cash to shareholders via dividends and occasionally buybacks. The company has a policy of distributing at least 30% of Net Income.

The current dividend yield based on Q1 numbers is ~7% with significant potential for improvement, as earnings in Q1 were quite depressed compared to other years.

Adjusted Net Income (typically lower then Net Income for Gerdau) over the LTM (last twelve months) amounted to R$5.7 Billion, while in Q1 2024 Adjusted Net Income ammounted to R$1.25 Billion. This was 48% lower than in the same quarter last year and underpins the pressure steel producers face because of competition from China. As a result of the increased tariffs on imported steel, margins should increase again, and with it the profitability of Gerdau. In my base case however I just annualize the results for Q1 2024. Even in such a difficult market environment, Gerdau would generate R$5 Billion or US$1 Billion in Net Income. With that, we arrive at a current valuation of 7x Net Income for the leading steel producer in Brazil with operations in my other South American & North American countries. The financial liquidity of the company is very strong and Gerdau won’t face difficulties in serving debts anytime soon. In addition, increased tariffs support the underlying business and the company is returning cash to shareholders via dividends.

5| Conclusion

The chart of Gerdau looks good, after the stock consolidated for 2 years. Better then expected earnings resulted in an impulsive move to the upside and Im quite confident that the bottom in. Furthermore, the MACD is indicating positive momentum.

In conclusion, Gerdau is a highly interesting stock that trades at a low valuation, while the core profitability of the company is improving. The stock pays an attractive dividend that is easily covered by earnings. Im about to enter a starting position and plan to gradually increase the position if the thesis plays out. If you have anything to add, just comment down below👇

Yours sincerely,

MODERN INVESTING

Good find. The case for Latam is steel is particularly stronger now considering the new tariffs in North America this week, brilliant timing.

* Key tariff rate of steel and aluminium products increase from 7.5 to 25%

Don't you think, that VALE S.A. would be a better option?