2023 is a historical year (like every year since 2020), especially for the financial markets, in march SVB collapsed. A bank that was funding startups and had 175 billion USD AUM (Assets Under Management). In the next few weeks other regional banks went under. Signature Bank, First Republic to name a few. The reaction by the FED was a bailout with billions of dollars coming in to the system (what caused inflation again ?). And when Credit Suisse collapsed, we knew that the crisis is not only limited to regional banks in the US, but also on big European banks. Even tough Credit Suisse got bailed out by the Swiss central bank, after they got acquired by UBS (60% below closing price), the crisis is far from over. In my opinion there will be more bankruptcies over the following months. But there is one bank that is well run, trades at an extremely low valuation and is growing earnings even in this environment.

1.0 Overview:

Halyk is the largest bank in Kazakhstan, with a market share of 32.7% on deposits. The company has shown consistent earnings growth and based on metrics used in banking, the bank is better run then companies like JP Morgan, Bank of America, Wells Fargo etc. With branches in Kazakstan, Georgia, Uzbekistan, Kyrgyzstan, Tajikistan (they left Russia in 2022). Halyk is a firm focused on Central Asia.

The firm has 14.3 Trillion Tenge in AUM (Assets under Manegment) which is around 32 Billion USD. Return on average equity (ROAE) is a ratio, that shows how much profit a company does on its average equity. Halyk bank had an ROAE of 31.7% in 2022, which is much higher than the 15% JP Morgan had. Don’t get me wrong, JP Morgan is a good bank, but Halyk bank is simply much better at allocating capital.

The company has around 10 million clients, which is 50% of the Kazakh population !

2.0 Financials

With a equity of 4.2 Billion USD and an market cap of 3.3 Billion USD Halyk bank is trading at P/B (price to book) of 0.79 which is low, if you take in account, that the company has seen consistent profit growth.

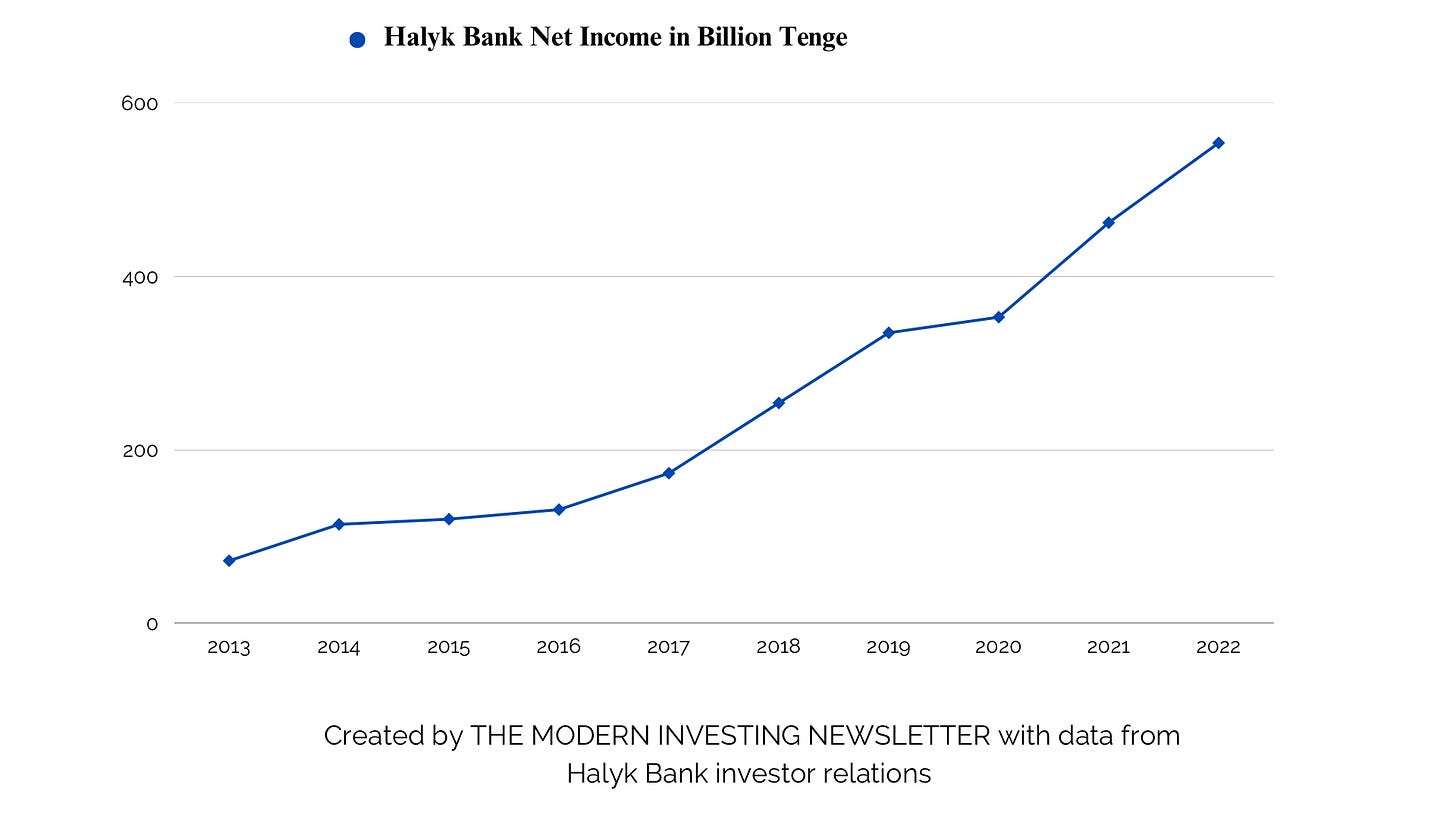

In 2022 Net Income stood at 554 Billion Tenge ( ~1.23 Billion USD), which was 19.8% above 2021 numbers. Total equity saw an increase of 21.5%, while cash on hand went up 41%.

The tier one capital ratio, is used to measure the financial strength of a bank. The higher the ratio, the better. Halyk bank is with 18.2% better positioned then Goldman Sachs, JP Morgan, Citigroup or Wells Fargo.

3.0 Digital growth

In order to generate high returns, Halyk bank is using every opportunity to grow it’s businesses further. They recently expended into Uzbekistan, and are growing there “lifestyle“ business unit. This unit consists of Kino.kz, Auto insurance, Halyk travel, Halyk marketplace and Halyk invest.

Trough Halyk bank retail investors can easily access the stock market. And with 34% market share, the broker owned by Halyk bank has quickly become one the biggest brokers in all of Kazakhstan. Halyk Invest is for retail investors only, Halyk finance is for institutional investors. This graphic shows the number of clients from the broker.

In late 2022 KazMunayGas (state owned gas producer) went on the stock exchange. The IPO was conducted via Halyk bank, which showed that Halyk has a very strong position in the investing community of Kazakhstan.

Another product in the lifestyle category is Kino.kz which is probably comparable to Netflix. It is growing very fast and already has 2.56 million users.

4.0 Valuation

Halyk bank is a very good bank, that shows strong growth and has a huge market share in different business units all over Kazakhstan. But the valuation is absurdly cheap. In 2022 Net Income stood at 554 billion Tenge (~ 1.23 Billion USD), with a market cap of 3.3 Billion USD, the stock is trading at a P/E of 2.7. Management recently guided to ~ 700 billion Tenge ( 1.54 USD) Net Income for 2023. Wich means, that Halyk bank stock is trading at P/E 2 for this year.

Using P/B (Price to book) Halyk bank is also cheap, with a ratio of 0.79.

5.0 Dividends

In 2022 Halyk bank paid out 1.08$ in dividend per share, which is a yield of around 10%. The payout ratio was last year 30%, which is relatively low for the company. But with a great earnings growth, the payout ratio could see a large increase. On top of this Net Income is also projected to go up. A 20% dividend yield wouldn’t surprise me in any way.

6.0 Risks

While I think that Halyk bank is a great investment, there are always risk associated with it.

The biggest risk for an investment in Halyk bank is geopolitics. The company is located in Kazakhstan, which is a country close to Russia. Western investors can only buy GDR’s, which in the worst case could be banned from trading in Europe (as it happened with Russian stocks).

7.0 Conclusion

All in all, Halyk bank is in my opinion a great stock to own. The company is showing consistent profit growth, and has a log track record of strong performance in the banking sector. With a dividend of 10% (conservative) and a P/E ratio of 2, the stock is very undervalued. There are geopolitical risks associated with an investment in the stock, but I think that the risk/reward is in the favor of the long term investor.

Enjoyed reading! Really interesting company. I’ve definitely found that there are some amazing and under-appreciated banks around the globe. Have you looked at Bank of Georgia - pretty similar situation

I have come across this stock as a holding by some EM funds. They sold their Russian interests... HOWEVER:

Kazakhstan’s Tycoons–Including Members Of Nazarbayev Family–Shed Billions As Stocks Plunge

https://www.forbes.com/sites/daviddawkins/2022/01/07/kazakhstans-tycoonsincluding-members-of-nazarbayev-familyshed-billions-as-stocks-plunge/?sh=142302b34186