LNG or Liquified Natural Gas has become increasingly important to the global energy markets, as we have seen a reduction of Russian gas supplies to Europe. And because Europe has an economy that is very dependent on Energy (Cars, manufacturing, etc), they needed an alternative.

1/ An environmental failure

The US was ready to “help“ Europe in this dire situation, by supplying expensive and dirty LNG to Europe. So we can see that all the green and leftist parties in Europe have done a terrible job at keeping their voting promises. A recent article by THE NEW YORKER said:

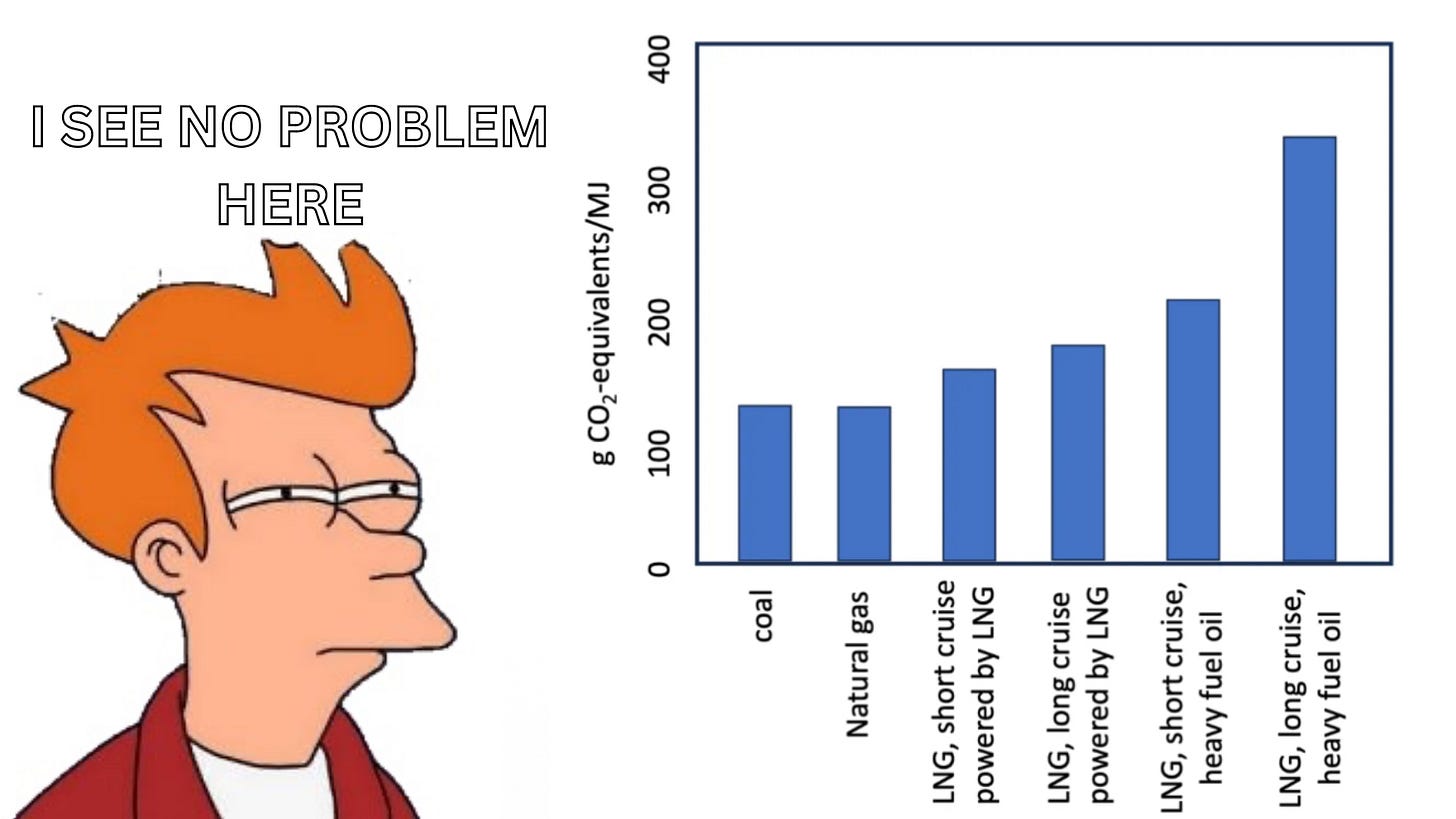

A new analysis suggests that L.N.G. exports may well be worse for the environment than burning coal. - Robert Warren Howarth (Cornell University)

Anyways, LNG is here to stay. And with increasing geopolitical tensions, such as in the Middle East, Europe needs a “safe heaven“ for it’s energy supply. The USA and Canada are both perfectly positioned to fill the gap between supply and demand for Energy to the global markets. While coal will also fill the gap, the narrative is that it’s dirty and bad for the environment, while LNG is great.

This is the power of media and especially social media !

2/ North Americaˋs new gold mine

The obvious winner from this is the U.S. followed by Canada and also Qatar. We can see below, that U.S. LNG exports are going trough the roof, which will position the U.S. as a key supplier of energy to Europe. 👇

Ironically, the countries that made themselves dependent on Russian energy imports (Germany, France, etc), and now making the same mistake a second time. This time they will become dependent on North America.

As politicians set the goal to focus more on renewable energy, they themselves know that this is a ridiculous goal. And in order to make this crazy goal happen (to some extend), they will need energy sources such as LNG in the transition time. So LNG is going to become the “next shale revolution“ over the next years and decades. This trend will not only be driven by Europe, but also by Asian nations that will see a massive increase in energy demand, as living standards rise and the population grows.

3/ Short term difficulties

Since LNG is basically natural gas in a liquified form, we need to get all this nat gas from somewhere. And with many LNG terminal being build in the U.S. and Canada, there will be increased demand for nat gas in North America going forward.

And this is where the problems start !

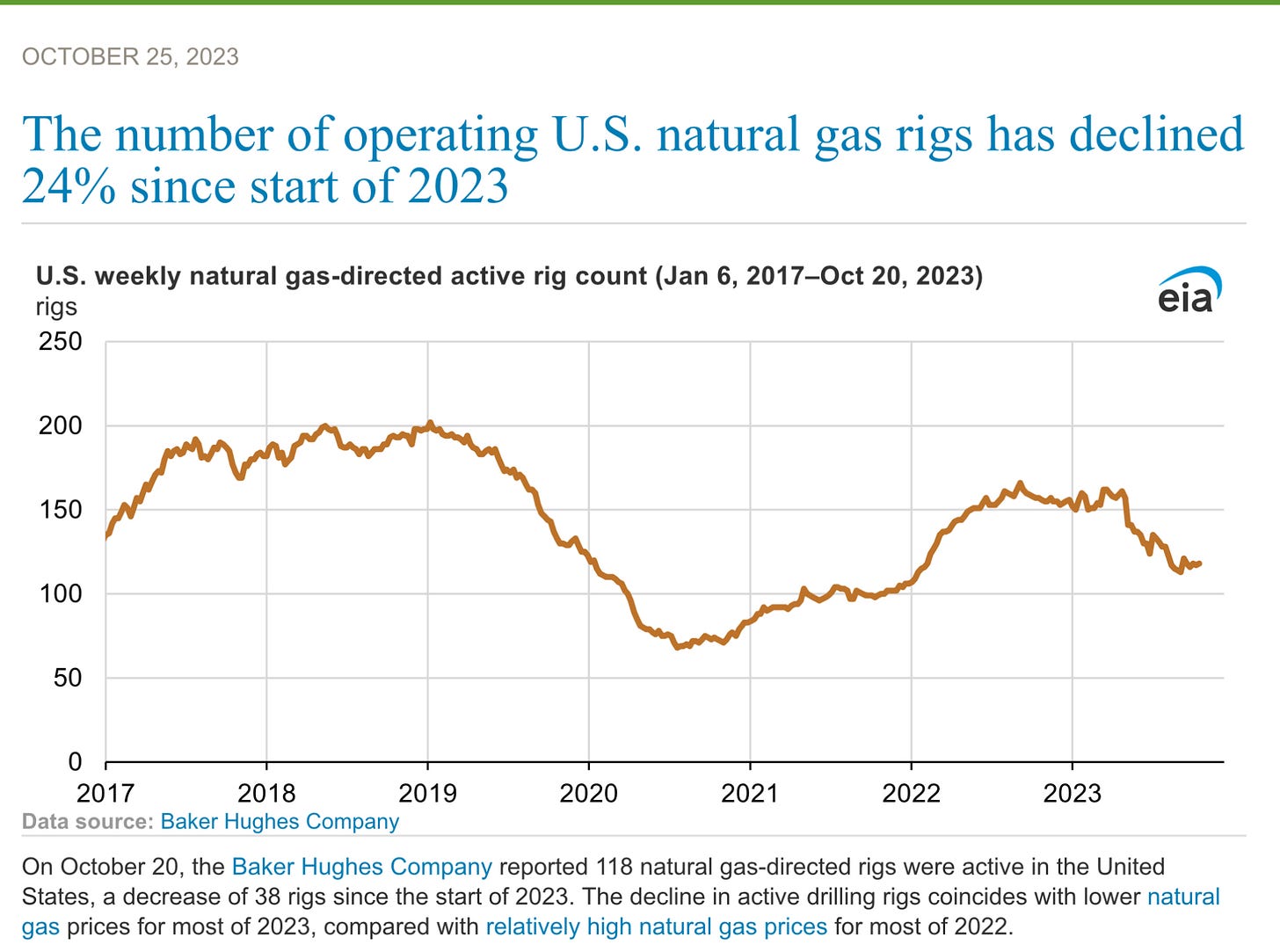

As a result of lower efficiency and lower nat gas prices, the U.S. natural gas rig count has dropped by 24% since the beginning of 2023 ! 👇

This means, that we need higher gas prices to support the ongoing demand for energy. Not only this, we will likely get into serious problems, when all those terminals are finished.

Goehring & Rozencwajg has definitely some of the best commodity investors letters out there. They recently described the situation as follows:

Over the next two years, an additional six billion cubic feet of LNG exports will come online at Golden Pass, Plaquemines, and Corpus Christi. Another 1.6 bc/d is due to come online at Port Arthur in 2027. Where will these facilities source their gas? […] Our models tell us [that] we have overbuilt our LNG export capacity without adequately considering where the upstream feedstock will come from. US natural gas remains by far the cheapest unit of energy globally by as much as 75%. Once demand, driven by LNG expan-sion, exceeds domestic supply, our expectation is that this discount will evaporate, sending US gas prices up several-fold, as US prices converge with international prices.

- Goehring & Rozencwajg Q2 2023 Letter

4/ The best gas stocks

The question becomes, what are the best North American gas stocks, that will profit from this trend ? Below you can find a quick list of interesting companies that are all high quality:

Tourmaline Oil

Canadian Natural Resources

Arc Resources

Coterra Energy

The thesis for all the above names is pretty simple, these are high quality companies with great projects, good margins and they return capital to shareholders. Sure, the stocks have run up a lot over the past months, therefore I still don’t have a position in either of them, but this cycle will continue for quite some time, and at one point fear will dominate because of some short therm narrative. This is going to be the time where you want to be greedy in the high quality names.

Yours sincerely,

MODERN INVESTING

Thank You 🤙🏼

Don't you think its time to build Position into a big name like CNQ or TOU? They are not cheap, but I dont a see a downtrend anytime soon to buy. Maybe the time is now.