Markets in Panic: Rapid Positioning Shifts Create Opportunity – Here’s What I’m Buying

U.S. equity markets have fallen at one of the fastest paces ever. I have begun buying positions in these stocks ...

The year has started in a very volatile manner. On social media people posted their YTD performance in late January and many stocks saw increased investor interest following a weak 2024 (for cyclicals and foreign stocks). A few weeks later, sentiment has plummeted again, and fear is overshadowing logical reasoning. Earlier this year I wrote my 2025 oil outlook in which I also shared a few interesting companies. The ones I am most confident in have reported either strong earnings or positive news in general. However, equity markets seem to be disconnected from fundamentals once again. In this article we will take a look at current sentiment in equity markets and what to expect going forward. Furthermore, we will analyze recent operational developments of core portfolio holdings.

1. All but bearish sentiment

The past two weeks have seen extraordinary selling pressure across equity markets. Primarily in the U.S., fears over tariffs, inflation and deteriorating growth—alongside multi-year high valuations—have sparked concern amongst investors. While the S&P 500 and Nasdaq are down just 10% and 14% respectively, high beta names like small caps have seen far worse. Overall, sentiment has turned bearish with only 19% of market participants being bullish. This is down from 35% at the start of the year.

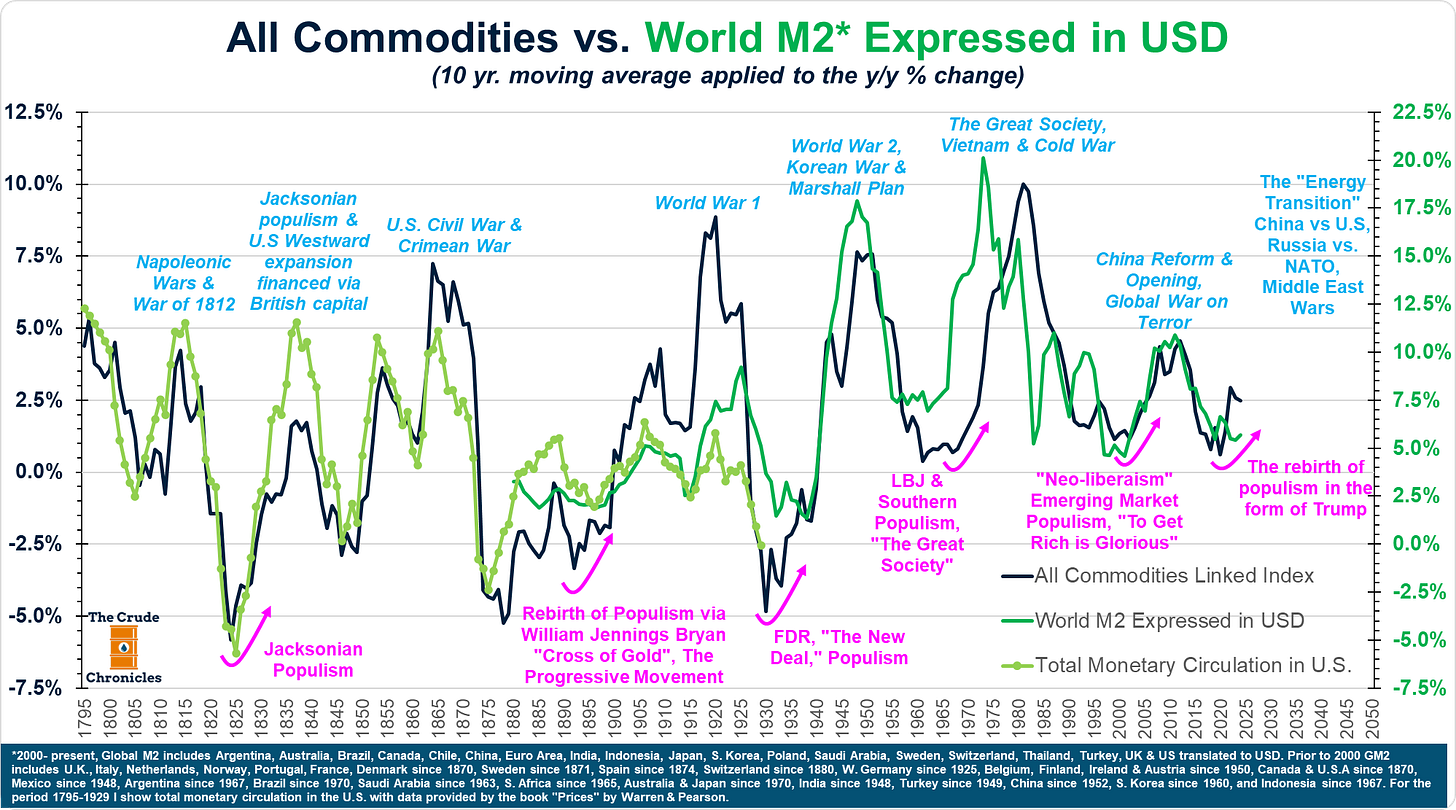

Historically, when most market participants turn bearish, the time to buy has arrived. Volatility has increased significantly since Trump’s second term with news of tariffs, negotiations and economic indicators resulting in sharp moves in the global financial markets. With valuation extremes similar to those of the Dotcom bubble, there is a lot of room for stocks to revert to the mean (mainly tech). I wouldn’t be surprised to see an attempted rebound here, followed by one final flush in the indices. While bears have valid concerns, I don’t think that the top for this cycle is already in. Especially if we consider that permabears are posting about 1987 and 2008 again. I do see a window of opportunity opening up to play the large amounts of liquidity that will flow into the global financial system over the coming months. Also, seasonality should start supporting equity markets from mid/late March onwards.

2. Global flood of liquidity

Under Yellen‘s term as treasury secretary, the U.S. issued a lot more short term debt. This debt will have to be refinanced very soon. In 2025 alone, the U.S. will have to refinance roughly 33% of its entire debt.

In general it’s very interesting to listen to Scott Bessent (current treasury secretary) and his view on the markets. His main priority seems to be related to interest rates and control of debt. In a recent interview on CNBC he pointed out that the Trump administration should get more credit for what it has already done, namely bringing energy prices down by 15% since the inauguration. But most importantly by bringing the 10Y yield down. His view is evidently skewed toward interest rates and the housing market.

To refinance this huge debt burden without causing too much disruption in the financial markets, liquidity has to increase. The U.S. can’t afford to pay higher interest rates while its debt burden keeps growing every year. With all of this at hand, Beijing is waiting patiently for its move. The reality is that China is facing economic difficulties. The restructuring of the economy from heavy industries towards more future oriented sectors has been a painful journey in the medium-term. But China is not going to collapse as pessimists say for years already. It would make sense for the country to stimulate its economy and increase liquidity. The Yuan however would probably devalue in this case. This is unacceptable for the CCP, as the country has the clear goal to de-dollarize. You can’t become a world superpower and trade in your rivals currency. Therefore, the government would not allow for the Yuan to devalue significantly against the USD. Such events would mean a loss of face on the international stage and Xi Jinping would likely accept a lot of pain on the Chinese economy to prevent such a scenario. So, when will China stimulate? The right time will likely be when the U.S. significantly increases liquidity. At this point the PBOC can stimulate without having to fear an all out collapse in the Yuan.

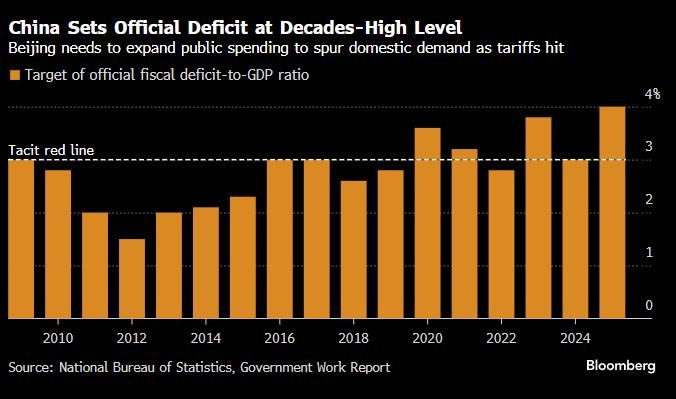

In recent months, Chinese policy makers have expressed the openness to stimulate the economy with lower interest rates, and the issuance of debt.

In February of this year we got the news that China was ready to injects tens of billions (headline above) into the banking system, as part of their stimulus program. Only recently, Beijing set the target for the deficit at a record high level of 4%, indicating the intent to support the local economy.

On another note, Europe has started to wake up and seems willing to take on more debt to fund infrastructure and the military. It’s an astonishing turn of events but we are moving towards a scenario in which the manufacturing powerhouse of the world (China) alongside the consumption powerhouse of the world (USA) are starting to increase liquidity, while another large consumer market (Europe) seems to be waking up from two decades of underinvestments in critical industries such as infrastructure, technology and defense. These are promising prospects for assets, especially real assets such as commodities.

Thanks to

for sharing!While we have emerging worries such as slowing economic growth, these issues can be pushed down the timeline by a few months with a large injections of liquidity in the global financial system. Until of course, both the economy and liquidity decline together, which will result in a recession sooner or later. Are we already at this point? I doubt it. But we have to closely monitor these aspects.

3. Flows and Positioning

Flows have largely driven the equity sell-off over the past two weeks. Until the February. 24th, global CTA positioning remained at the upper range of the long-term channel. Since then we have sold of massively with headlines that CTAs have flipped net short.

The NASDAQ and the S&P 500 are at oversold levels. Positioning among major speculators has cooled significantly, meaning that the risk is skewed to the upside rather then the downside. However, not only equity markets have seen significant unwinding of positions by speculators. Below, we can see the net positioning of commercials (black) and non-commercials (blue) over the past few years.

Clearly, large speculators (non-commercials) have amongst the lowest net positioning in recent history. At the same time, commercials consisting of mainly producers and merchants (the smart money), have amongst the highest net positioning in recent history. This diverge is visible in the oil price as well as the price of energy stocks (XLE). The short positions on the XLE Energy Index by managed money for example have gone parabolic in recent weeks. As oil prices are mainly impacted by the financial markets in the short run, the rapid shift in positioning has let prices tumbling down.

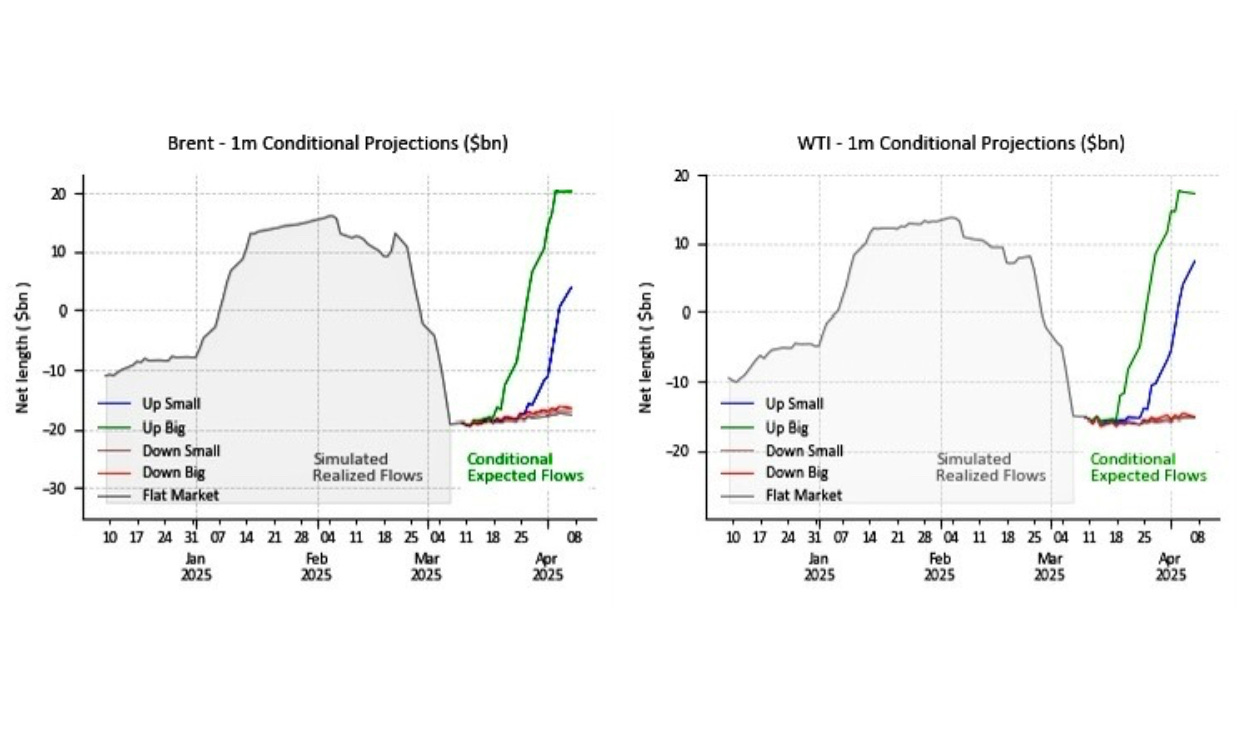

Below we can see the expected flows for Brent and WTI over the next month. It’s clearly visible that even if net length increases just slightly, the flows will be significant, while the downside is limited.

4. Recent Developments of Selected Portfolio Holdings

Considering everything we laid out above, it doesn’t come as a surprise to see many core portfolio holdings have been caught in the storm. In times like these, it’s important to understand what we own and why we own it. Therefore we will take a look at 2 portfolio holdings that have traded down while reporting earnings.

4.1. GeoPark | De-risking the balance sheet while creating value in Argentina

A lot has changed over the past year at the GeoPark HQ. The expansion into Argentina with the acquisition of assets in from Phoenix Global Resources, the issuance of a new bond that will mature in 2030, political turmoil in Colombia and volatile energy prices. I am of the opinion that the value of the company has grown significantly in 2024 driven by the strategic change of direction the company is taking. Acquisitions and M&A have always been part of GeoPark. When the company bought the Llanos 34 asset for $30 million in 2012 and the COP-5 block in 2020 for ~$250 million, these assets defined the course of GeoPark in a significant way. The acquisition of assets in the Vaca Muerta will be just as transformative as the previous two acquisitions. Still, the equity markets don’t see the potential of the shift from Colombia to Argentina. With declining production and CAPEX in Colombia, the production profile will gradually change from being entirely based on Colombia, to a quickly growing production base in the Vaca Muerta.

4.2. Disconnect between Credit and Equity markets

The price of a stock is vastly more volatile then the underlying bond. However, if the share price moves down while the price of the corporate bond moves higher or stays flat, a disconnect between both sides emerges. Comparing bonds directly against the underlying stock doesn’t make sense, since bonds are impacted by more then just the trajectory of the company. Interest rate movements and duration are two drivers behind bond prices that aren’t controllable from a corporate standpoint. For our diagram we will take GeoPark‘s bond with maturity in 2027, since this is the bond with the longest available trading information (e.g. chart). The bond pays a coupon of 5.5% and has remained stable at roughly par (100%).

For our diagram we still need to adjust the interest sensitivity factor. Therefore we will divide the price of the GeoPak 2027 bond by the price of SHY, which is a 1-3 year bond ETF by iShares (e.g. BlackRock). Since a change in interest rates will move both the price of the GeoPark 2027 bond and SHY, we have adjusted for this.

In the white graph below we can see the price of the GeoPark 2027 bond divided by SHY and the share price of GeoPark itself. If the white graph moves significantly higher, credit markets and equity markets diverge. If a stock moves higher in the long run, the ratio (white line) will fall gradually. This is nothing out of the ordinary. It becomes interesting when the share price drops significantly while bond prices remain stable, resulting in an explosion of the white graph.

As can be seen above, the last 2 times we have seen such a divergence between the share price of GeoPark (blue) and the credit to equity ratio, the share price bottomed quickly.

4.3. Earnings Commentary

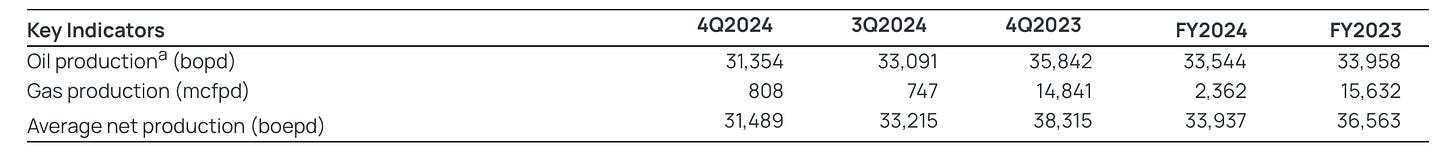

Geopark reported earnings for Q4 2024, which came in roughly in line with expectations, as we already knew about the production data due from the Q4 2024 trading update.

Blockades have been the determining factor for a decline in production, while realized prices have fallen below last years level. This has been a trend in the industry, but the combination of these factors coupled with one off factors have made the earnings look weak. If one has the ability to cut out the noise and focus on the operational performance and strategy of the company, this is an incredible opportunity for long term investors.

“Temporary production disruptions and decline in our core Llanos fields made 2024 a challenging year for GeoPark. Despite this, we extended our reserves life, made a game-changing acquisition in Vaca Muerta, held true to our commitments on efficiency, safety and sustainability, returned over $73 million to shareholders, and proactively enhanced our financial flexibility through refinancing senior notes and repaying debt. Our ongoing 2025 work program includes Vaca Muerta and provides a solid foundation for future growth and value enhancement.”

Andrés Ocampo, Chief Executive Officer of GeoPark

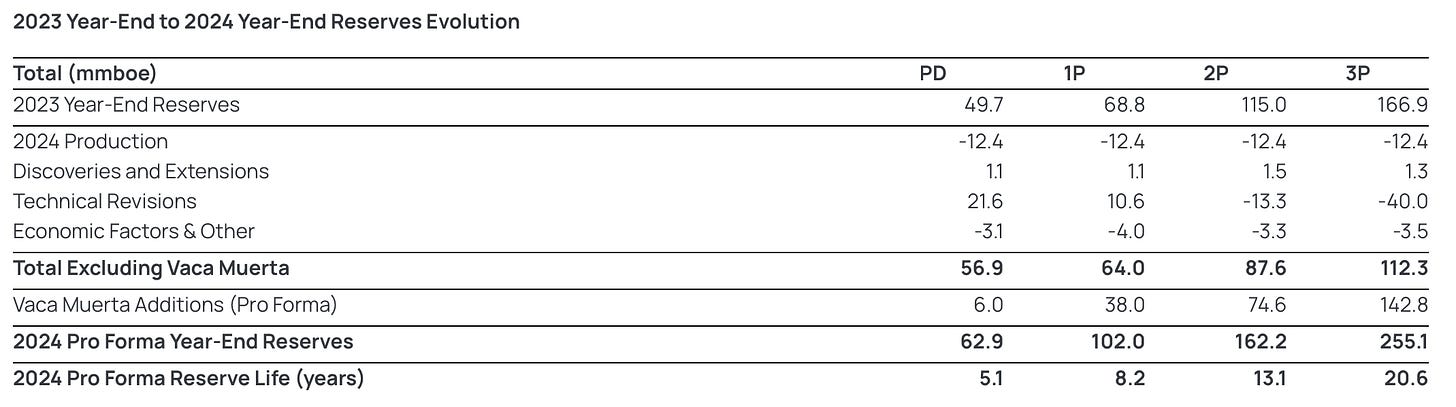

Even when facing all of these challenges, GeoPark has been able to generate an operating margin of 41%, up from 36% in 2023. It’s a remarkable achievement in terms of cost management, when a 13% revenue decline doesn’t lead to an operating profit decline, but an 1% increase. Only recently has the company announced a 480% 2P reserve replacement ratio, which has been the effect of the acquisition in Argentina. GeoPark holds 2P reserves of 74.6 million boe in one of the best regions for hydrocarbons in South America and the world.

Obviously there are also risks associated with the stock. My main thesis is that the company’s transition towards Argentina will pay off, as the company’s valuation will be closer to that of Argentina peers. At the same time, there are no liquidity constraints and investors receive a nice dividend yield of 7.5% p.a. What I consider to be a risk, would be the continued blocking of the acquisition by the government of Neuquen. GeoPark is still waiting for the final approval, which is also why the company doesn’t include the Argentinian assets in their earnings yet.

4.4. Woodside Energy | 2026, the year where it all comes together

Woodside Energy ($WDS) is an Australian energy company with a focus on LNG. The company has their core assets located in Australia, while investing heavily in assets in Africa, North America and its home country. Earlier this year, WDS reported Q4 2024 & FY 2024 earnings, which have underlined my expectations, leading me to increase my position following the ex dividend date.

In 2024, Woodside Energy produced 193.9 million boe, which came down to 44% LNG, 32.6% crude oil and 24% pipeline gas and NGLs. This corresponds to roughly 530k boe/d for the FY 2024.

Woodside Energy generated $2.9 billion in underlying NPAT and reduced OPEX per barrel from $8.3 per boe to $8.1 per boe, which lead to an industry leading EBITDA margin of 70%, up from 67% in both 2022 and 2023. This is remarkable considering that average realized prices went down $5 a barrel comapred to FY 2023. Woodside announced a dividend for the FY 2024 that corresponds to ~8.5% of the current market cap.

4.5. Overview of Woodside’s Core Assets

In 2024, Australia accounted for 72% of Woodside Energy’s production, while international operations accounted for the remaining 28%. To understand Woodside, we need to break their assets down into producing assets, and assets still under construction. In Australia, Woodside operates Pluto 1 and the North West Shelf Project, while holding a non-operating interest of 50% in the Bass Strait. These are the company’s most important producing assets in Australia as of today. The crown jewel will be the Scarborough project that is expected to come online in 2026. The projects is to 80% completed and WDS has sold 25.1% of the asset for $2.31 billion to LNG Japan and JERA. This leaves the company with 74.9% of the JV that is worth ~$7 billion if we apply the same valuation as Woodside Energy has achieved in private markets.

This video on Woodside Energy’s YouTube channel is a short representation of how far the Scarborough project is already.

On the international side, Woodside is the operator with 82% working interprets in the Sangomar oil and gas field offshore Senegal. The FPSO achieved first oil in June 2024, marking the start of the Sangomar field, which had a total construction cost of $5 billion. This assets has the capacity to produce 100k boe/d. In addition to the Sangomar field, Woodside Energy holds non-operating participating interests in several conventional oil and gas fields in the U.S. Gulf of Mexico. In the Gulf of Mexico, WDS is the operator of the Trion asset, which is expected to have first oil in 2028. This projects is to 20% completed and targets to produces 100k boe/d. Woodside Energy holds 60% of the asset.

In September 2024, WDS acquired the Beaumont new Amonia project from OCI, that at the current point in time is 83% completed and targets first production in H2 2025. Lastly, the company acquired the Louisiana LNG project in July 2024 trough the acquisition of Tellurian Inc. The asset is a big opportunity but is still pre FID (Final Investment Decision). The company is currently looking for partners and is expecting to make a decision this year. Considering Woodside Energy’s track record of investing in projects, finding partners and selling stakes of their working interest, the Louisiana LNG project can very well become one of the core assets of Woodside in the future.

4.6. The thesis

My thesis on Woodside Energy is simple. LNG demand is going to grow massively primarily in South East Asia, India and to some extent China. With assets such as Scarborough, Sangomar and Trion, WDS will supply the world with the hydrocarbons it needs. When Scarborough finally comes online in 2026, CAPEX will start to drop, production will grow and cash flow will come in. With access to large lines of liquidity, Woodside Energy is in a position to finance all their projects. With a dividend yield of ~8.5%, we get rewarded for holding shares in a company that is developing world class assets that will benefit us and the world for decades.

5. Conclusion

The past two weeks have been rough. My portfolio remains slightly in the green, largely due to my German and Chinese positions. I bought positions in many energy names such as Woodside Energy, Vår Energi, Petrobras, GeoPark, etc. in the recent sell off. Considering flows, the rapid change in positioning and extremely bearish sentiment, I think the risk/reward is attractive. I still expect higher equity prices going into summer, driven by increasing liquidity.

Yours sincerely,

MODERN INVESTING

Hello there,

Huge Respect for your work!

New here. No readers Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing poetic take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

Built to Be Left.

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e