Navigating the volatile oil market

Why I’m building up positions in oil stocks …

Oil had 2 very volatile weeks, with reports, uncertainties and people turning from bulls to bears. But while all of this is happening I’m close to hitting the trigger of buying much more energy related stocks. And this dip is just another opportunity to add stocks with great fundamentals at a low price.

Without any further a do, let’s get into it:

1/ THE DEMAND:

At the beginning of this week we got a report by the International Energy Agency (IEA) , which highlited that the organization thinks that we will see peak oil demand by 2030. Further they say that demand for oil dropped massively last week. As a result the price of oil sold off rapidly and market participants got fearful. But if you are an investor like me, you will love to see, that there is fear in the market. It means opportunity !

As predicted 2 weeks ago on this tweet. The price of oil has fallen from around 93$ a barrel to 82$ a barrel. I think that we a near a bottom and I’m ready to push the buying trigger, as soon as I get a confirmation.

Now we have to look at the claims by the IEA and find out whether they are right or wrong.

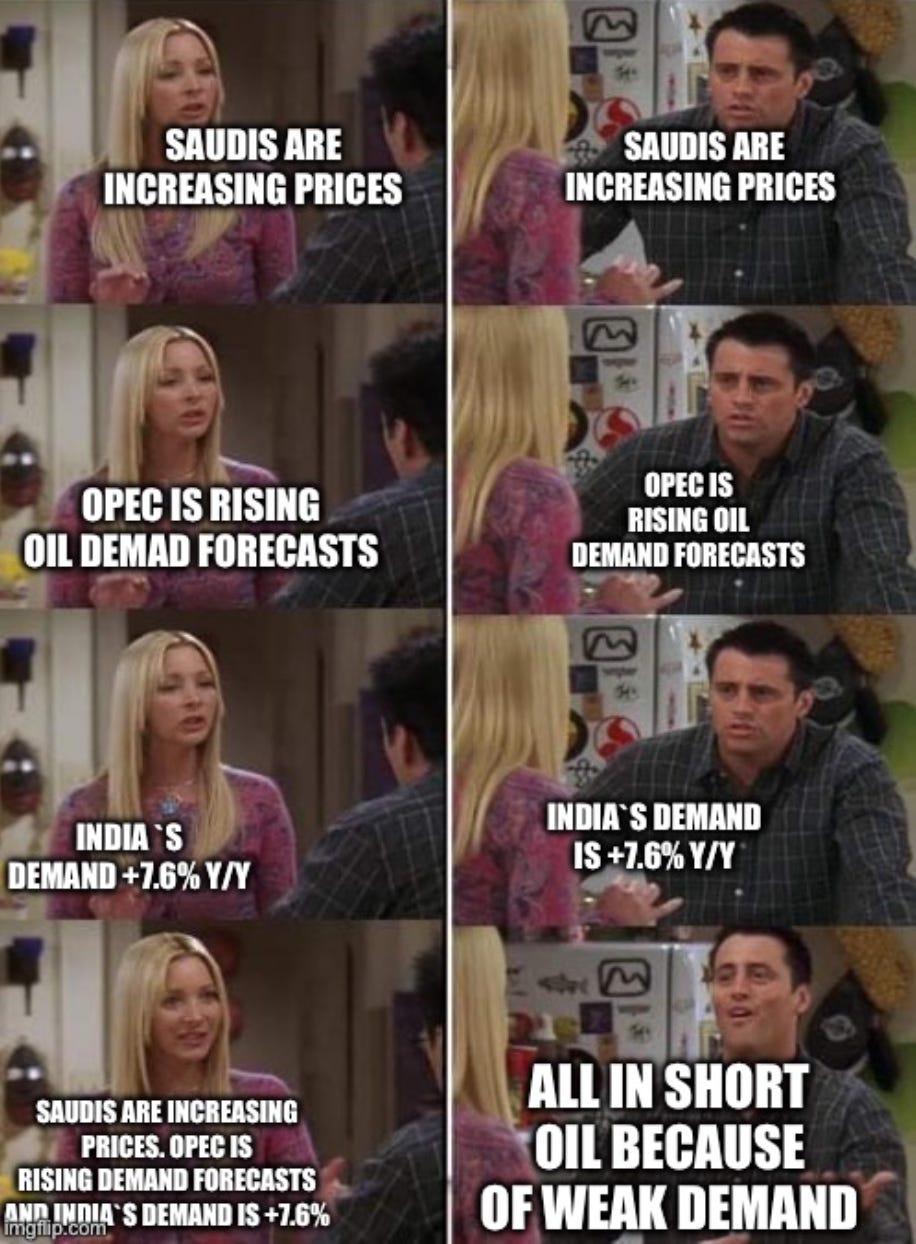

So looking at the global energy market and specifically at oil, we see the following:

IN SEPTEMBER INDIAˋS OIL DEMAND GREW BY 7.6% Y/Y.

SAUDI ARABIA INCREASES THE PRICE OF OIL EXPORTS.

OPEC RAISES MEDIUM AND LONG TERM OIL DEMAND FORECASTS IN FORTHCOMING WORLD OIL OUTLOOK REPORT.

ACCORDING TO GasBudy data THE GASOLINE DEMAND IN THE US IS UP 2.8% FROM A WEEK AGO.

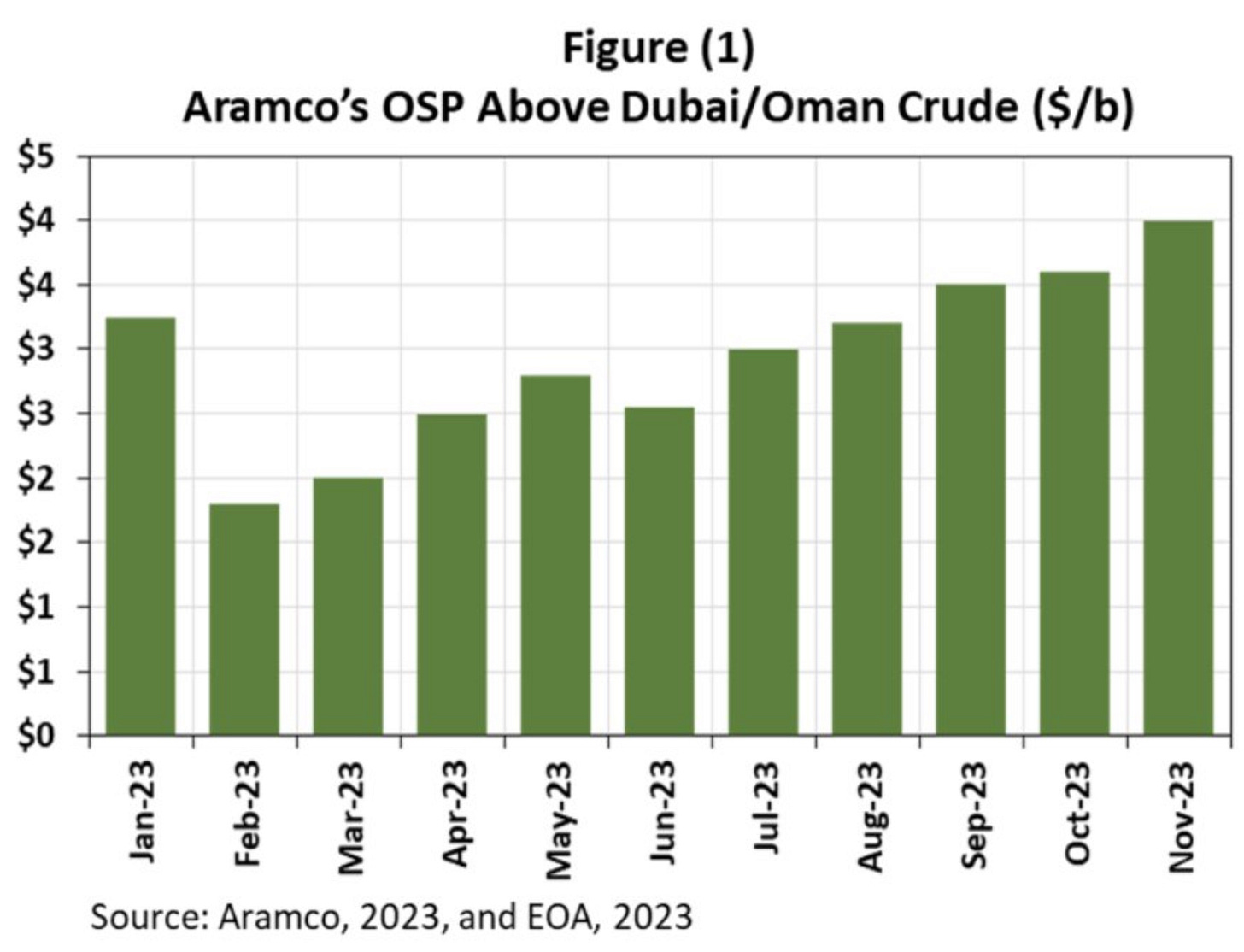

The chart below shows the price of Arab light crude over the last months 👇

We see that light crude prices got increased by the Saudis for November. If demand is really that bad, how can they do this ? Looking at the facts, there are no signs of oil demand having crashed over the last week/s. And the mid/long term outlook is even better.

2/ SUPPLY AND SIGMA 3 EVENTS:

Just looking at the Strategic Petroleum Reserves (SPR) from the US, we see that they are at extremely and dangerously low levels. 👇

If we imagine a scenario in which the US can’t export much Oil & Gas to Europe, because their might be a terrorist attack, a cyberattack or extremely bad weather conditions. The price of energy would skyrocket, since the US is Europe’s biggest supplier of Energy. This scenario is unlikely, but we have learned over the last 3 years, that the unlikely scenarios that seem impossible sometimes happen.

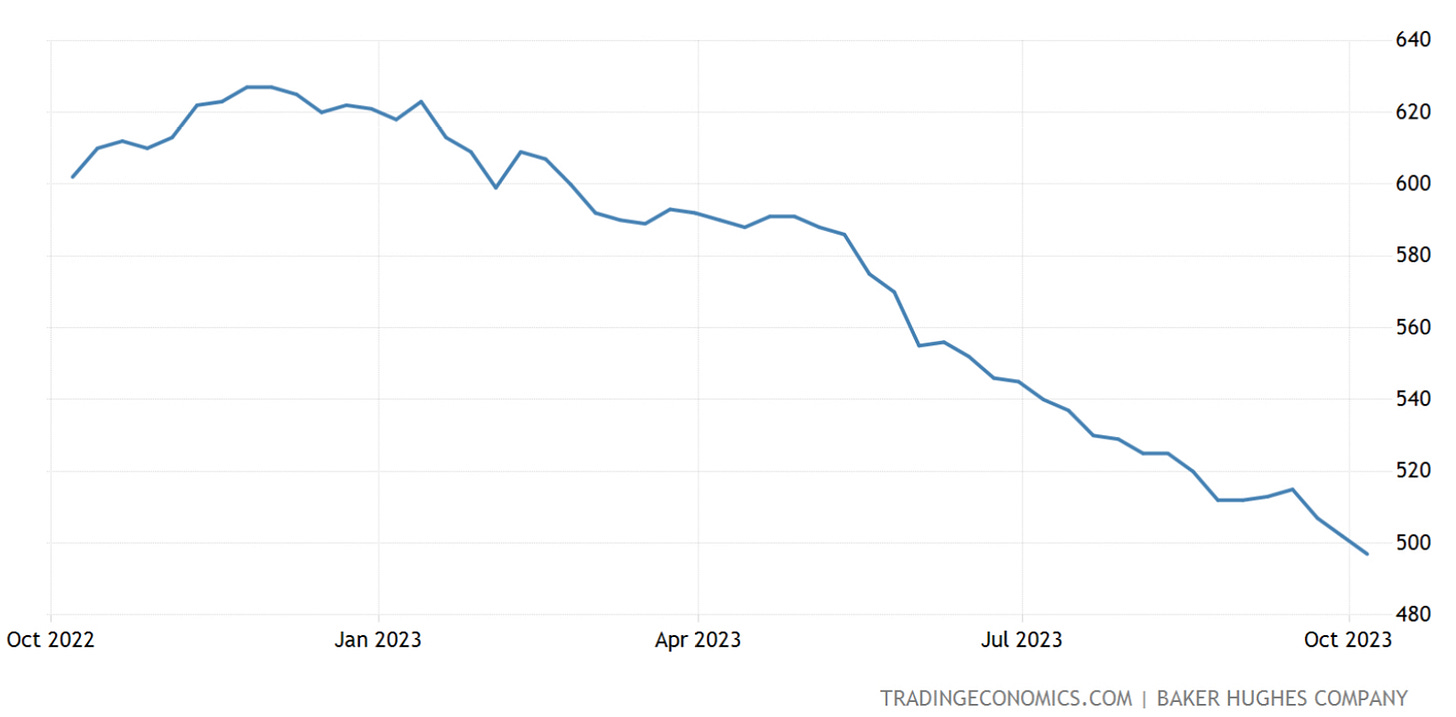

The US rig count dropped a lot over the last few months, therefore supply is going down. OPEC is keeping the production cuts and the US can’t release any meaningful amounts of oil out of it’s reserves.

3/ THE LONG TERM OUTLOOK:

The Long term outlook for oil very good. While western media tries to tell you otherwise, the demand for oil will go up. The demand might go down in the west, but to all those politicians: „The world is bigger then North America, Europe and Australia“.

If we look at barrels of oil consumed per capita in worldwide terms, then we can see that lower-middle income countries consume 15x less oil per capita then the USA. Over the coming 30 years the population of Africa will double, combine this with higher living standards, then it’s not hard to see why oil demand will only increase from here.

Therefore I remain bullish on oil and will increase my allocation to related stocks. My favorite stocks in this sector are:

VÅR ENERGI VAR 0.00%↑ :

Norweagian producer that will double it’s production by 2025. The company has high quality assets and low break even costs (around 30$ a barrel). They trade at 2x Price to Cash Flow from operations after taxes and pay a dividend of 15% currently. With a double in production I expect a dividend of 30% p.a. From 2025 onwards, at Brent prices of 80$. The CEO is buying shares worth millions of €ˋs and I will increase this holding meaningfully.

INTERNATIONAL PETROLEUM CORP $IPCO :

IPCO is a Canadian producer of oil. The company was spun off from Lundin Energy and has an excellent managment team. They are buying back shares at a very fast rate (around 8% per annum) and the Blackrod project will come online in 2026. As soon as this project comes online, shareholder return will skyrocket and the company trades currently at a Free Cashflow Yield of around 25% excluding the Blackrod CAPEX. Further the company has a net cash position and trades at a 70% discount NAV.

PETROBRAS PBR 0.00%↑ :

As many know, PBR is the biggest company in Latin America. It’s one of the best and cheapest oil producers in world. Petrobras has low break even costs, pays a dividend of around 16-20% and has still many undeveloped oil fields that are like free call options for shareholders. The company trades at a P/E of ~4 and is buying back it’s preferred shares, which trade at a discount to ordinary shares.

4/ CONCLUSION:

All in all the demand for oil is still high. There are no signs of a demand crash and the supply side is still very weak. With decade low inventories and low production by OPEC, the thesis of oil hasn’t changed. At 90$ per barrel the above mentioned stocks were extremely undervalued. But with the small selloff we have seen over the last 2 weeks, the investment case has only become stronger. And with many of these stocks we are getting paid 10% plus p.a. to wait.

Yours sincerely,

MODERN INVESTING

how big is the % tax dividend

may i suggest adding links to your prior article on each company discussed? thx.