The world’s energy requirements are rising sharply amid a catch up of Emerging Markets relative to Developed Markets. Technological breakthroughs including AI and IOT are only increasing the need for energy. Growing demand will be met with all kinds of energy. Fossile and Renewable Energies will play a key in meeting this demand. The narrative of peak oil demand is massively overblown and prior forecasts of it have proven to be false. As Vitol’s CEO noted:

“What we're saying today is that peak oil demand is about 10 years away. The unfortunate thing is, we said five years ago that peak oil demand is 10 years away”

— Vitol CEO, Russel Hardy

Amongst the best regions globally for oil & gas is Norway. The country is blessed with a huge amount of oil & gas resources and a political environment that prioritizes stability (taxes & permits). With the Ukraine War and the resulting sanctions on Russia, Norway has become the key supplier of natural gas to continental Europe.

Drilling requires services related to construction, engineering and abandonment. A small company listed in Norway is profiting from this situation, while being massively miss-priced by the financial markets. Odfjell Technology (Ticker:$OTL) is a position in my portfolio and following their Q3 earnings report I have doubled the position. In this article we will break down the results and the outlook for the company.

1. Earnings Overview

Odfjell Technology is a small cap. The company has a market cap of just ~$170 million, while 60% of the shares are controlled by the Odfjell family. As a Norwegian company focused on the oil & gas industry, most institutions will never consider investing in the stock. This can be seen as both a positive and negative, but I like the idea of accumulating shares in a deeply discounted stock with close to no competition. Since my original write up in November of 2023 the share price is roughly flat including dividends. Recently the company reported Q3 2024 earnings which led to an unjustified sell-off in the share-price. I doubled my position and reviewed the entire investment thesis.

In the 3rd quarter revenues increased 4.6% YoY, while EBIT declined by 8% over the same time frame. The bottom line is down significantly which is a result of much higher financial expenditures in the quarter. The logical reason for this is a refinancing that took place at the time. Excluding the one-off refinancing expenses, Net income would have been NOK 82.6 million (-10% YoY). Pre-tax profit would have increased 1% YoY.

1.1 Refinancing

Odfjell Technology repurchased its outstanding NOK 1.1 billion bond while issuing a new one for the same amount. The terms of the new bonds are much better than the prior terms, which indicate the confidence the market has, in the company’s ability to stay financially secure. Previously, Odfjell Technology paid NIBOR (Norway Three Month Interbank Rate) +7% in interest per annum. Thanks to the refinancing this has dropped to NIBOR +3.5%. A second benefit of the refinancing is the fact that the company has now more time till the maturity of the bond. Previously, February 2026 would have been the maturity date for the bond. Now it’s February 2028, effectively giving the company 2 years more time.

Interestingly, the Odfjell Family pre-subscribed NOK 200 million worth of the newly issued bonds. Combined with their 60% stake in the company, this is a strong sign of confidence in OTL. The company will safe roughly NOK 40 million in annual interest expenses from this transaction. However, one-off costs related to the refinancing amounted to NOK 44 million, negatively impacting Q3 2024’s bottom line.

1.2. Market Conditions

The oil and gas industry is at a critical spot. When OPEC’s general secretary Haitham Al Ghais was asked what keeps him awake at night he responded by pointing at the underinvestment in the sector [credit to @AzizSapphire for the video].

He isn’t wrong. While we have huge amounts of oil in proved & probable reserves, the required prices to make the drilling of those wells economically feasible is higher than the current spot price for oil. While the future of the spot price is debatable, there is something we should agree on. Oil demand will keep going up and drilling activity will pick up further. With population growth and Emerging Markets catching up to Developed Markets (in terms of energy demand), the agencies forecasting peak oil demand before the end of the decade will have a though wake-up call.

Odfjell Technology’s CEO mentioned that tender activity is strong right now, with many deals being agreed on at the moment, that will result in a strong 2025. Backlog remained stable during the quarter with major contract wins from Equinor.

Recently, we got a press release stating that the company has agreed on terms for a contract with Shell Brunei that will start in mid-2025.

The plug and abandonment market is seen as a market with a lot of long term potential for the company, as environmental issues alongside political incentives will require many of these methane-leaking wells to be fixed. With the acquisition of McGarian TDC Ltd. in May of this year, Odfjell Technology has effectively entered into the market for plug and abandonment of old wells. In the most recent earnings call it was mentioned that McGarian TDC is performing well in the U.K.

1.3. Shareholder Returns & Liquidity

When I first invested in Odfjell Technology the company paid a dividend of roughly 5% p.a. In Q3 of this year the company raised its dividend by 140% to NOK 60 million or NOK 1.52 per share. This indicates an annualized dividend yield of currently ~12%. Odfjell Technology has the financial means to pay this dividend even though they are reducing leverage.

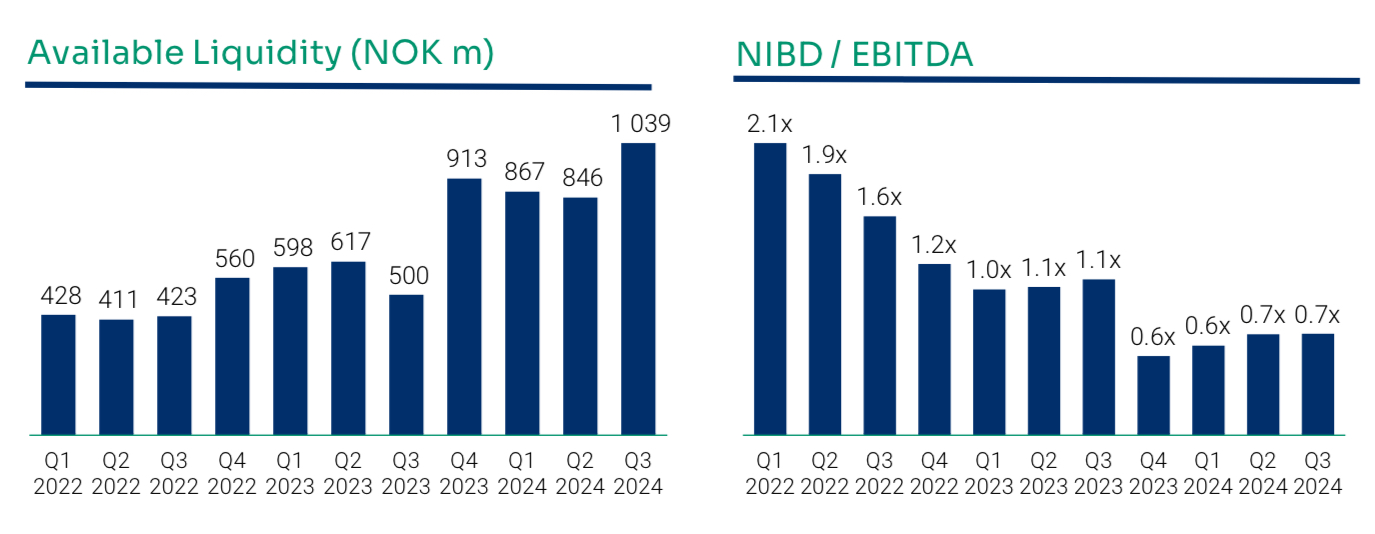

As part of the refinancing OTL has entered into a new RCF (revolving credit facility) of $50 million or ~NOK 553 million, replacing the old facility worth $25 million. At the current point in time the company hasn’t drawn the facility, resulting in available liquidity exceeding NOK 1 billion. NIBD (Net Interest Bearing Debt) stands at NOK 570 million or 1.15x EBIT.

1.4. Outlook

Softer market conditions and the postponement of some tenders into 2025 negatively impacted 2024 results. Still, Odfjell Technology was able to grow revenues, EBIT and adjusted Net Income (adjusted for the refinancing) by 7 to 8% in the 9M of 2024. 2025 should be another positive year with the refinancing saving NOK 40 million in interest expenses while backlog remains healthy. Recent contract wins in Southeast Asia and the Norwegian Continental Shelf solidify this point. In the conference call for Q3 2024 it was mentioned that CAPEX is expected to decline in 2025 to roughly NOK 250 million. This would be a NOK 30 to 100 million decline from the expected full-year 2024 CAPEX. With strong tender activity and a return to higher margin projects the management noted that margins should be positively impacted next year.

2. Risks

Odfjell Technology’s shares have a low trading volume of roughly $200k a day making the stock quite illiquid. This will prevent most institutions from ever buying into the company leaving the stock mostly with retail investors and the Odfjell family.

In addition, soon there will be a court appealing in which a subsidiary of Odfjell Technology will challenge the Norwegian authorities regarding potential tax payments. The issue relates to the question whether Odfjell Technology’s subsidiary had tax residency status in Norway in 2017. For shareholders of OTL this isn’t an issue because Odfjell Drilling has undertaken to hold OTL harmless in respect of any liabilities incurred by these matters. Odfjell Drilling will fund any interim payment of the potential liabilities to the Norwegian government. This has been a point discussed on social media that led to bearish views amongst some market participants. Henceforth, it’s important to understand the situation and the fact that Odfjell Technology will be held harmless by Odfjell Drilling.

Other risks include a potentially softer than expected market environment for oil & gas and potential inflationary pressures.

3. Conclusion

I personally view 2025 as a year of opportunity for Odfjell Technology to show how the past couple of months have changed the profitability and outlook for the company. Declining leverage, lower interest expenses, newly won contracts and a lot of M&A opportunities are great for the long term outlook of the business. Increasing shareholder returns in the form of dividends are a sign that the management team wants to create shareholder value. On the 15th of November, Simon Lieungh (CEO of OTL) bought shares worth ~$40k at a price of around 48 NOK a share. It’s a small amount, but a good sign for shareholders.

I view OTL as an attractive investment opportunity at the current point in time and have doubled my position recently.

Yours sincerely,

MODERN INVESTING

Does anybody understand the negative working capital during the year for Odfjell Technology $OTL $OTL.OL and why is it all released (positive) in the final quarter? There is a clear cyclicality. Any estimate for FCF Q4 2024 with this in mind?

Excellent content and very well written. Thanks for sharing!