Poland and Politics - A volatile ride

Elections in Poland have changed the investment landscape for many companies. What is important ? And what do we have to look out for ?

Poland is probably the country with the biggest opportunities for value investors. There are many small companies, most fund mangers stay away from Eastern Europe, and as a result, valuations are insanely low compared to other countries. Just browse trough Twitter and ask the value investing community about their favorite stocks, I bet that there will be many polish names.

Now the main risks in Poland has always been politics. Many people claimed that the currency is a increased risk, I disagree with that. Because the economics and the fiscal state of Poland has and is very good.

Coming back to politics, we had ELECTIONS a week ago !

But firstly, let me give you a quick background on polish politics & it’s impact on polish stocks/financial markets:

1/ A never ending battle

There are 2 main political parties in Poland, PiS and KO.

KO has been in power from 2011-2015

PiS has been in power from 2015-2023

PiS has been responsible for the policies that made Poland the black sheep in the EU. Does this mean that PiS is bad ? No ! Poland has seen incredible growth since PiS came to power. The economy grew and Poland scores very high in eduction, safety, employment, etc. But this has come at a cost. Polandˋs relations with the EU are severely damaged, since the EU has another standpoint in topics such as migration, Ukrainian grain, LGBTQ, etc.

The election last Saturday were described: „As important as the elections of 1989, when Poland held it’s first democratic elections.“

Generally PiS is anti EU and KO is pro EU. In fact, Donald Tusk, leader of KO and potential next president (he already was prime minister), was president of the European Council from 2014 — 2019.

So a win of KO would be seen positively by the financial/capital markets, because Poland would have stronger and better relations to the EU, which could free the blocked EU funds, which where meant for Poland, but are currently held back by the EU. But this is just one side of the equation, on the other side, KO has deeply mismanaged state owned companies over it’s last term and Tusk has been responsible for some scandals.

A win of PiS on the contrarian side, would be in the short term negative for polish stocks, bonds & the Zloty, because they have bad relations with the EU. But as prior, this is just one side of the equation. PiS has very well managed state owned companies, has increased Foreign Direct Investment (FDI) and has dramatically increased the standard of living in Poland.

So putting it together, this is my view of the effect of a win by either party. 👇

2/ The Results

With that in mind, let’s have a look at the actual results:

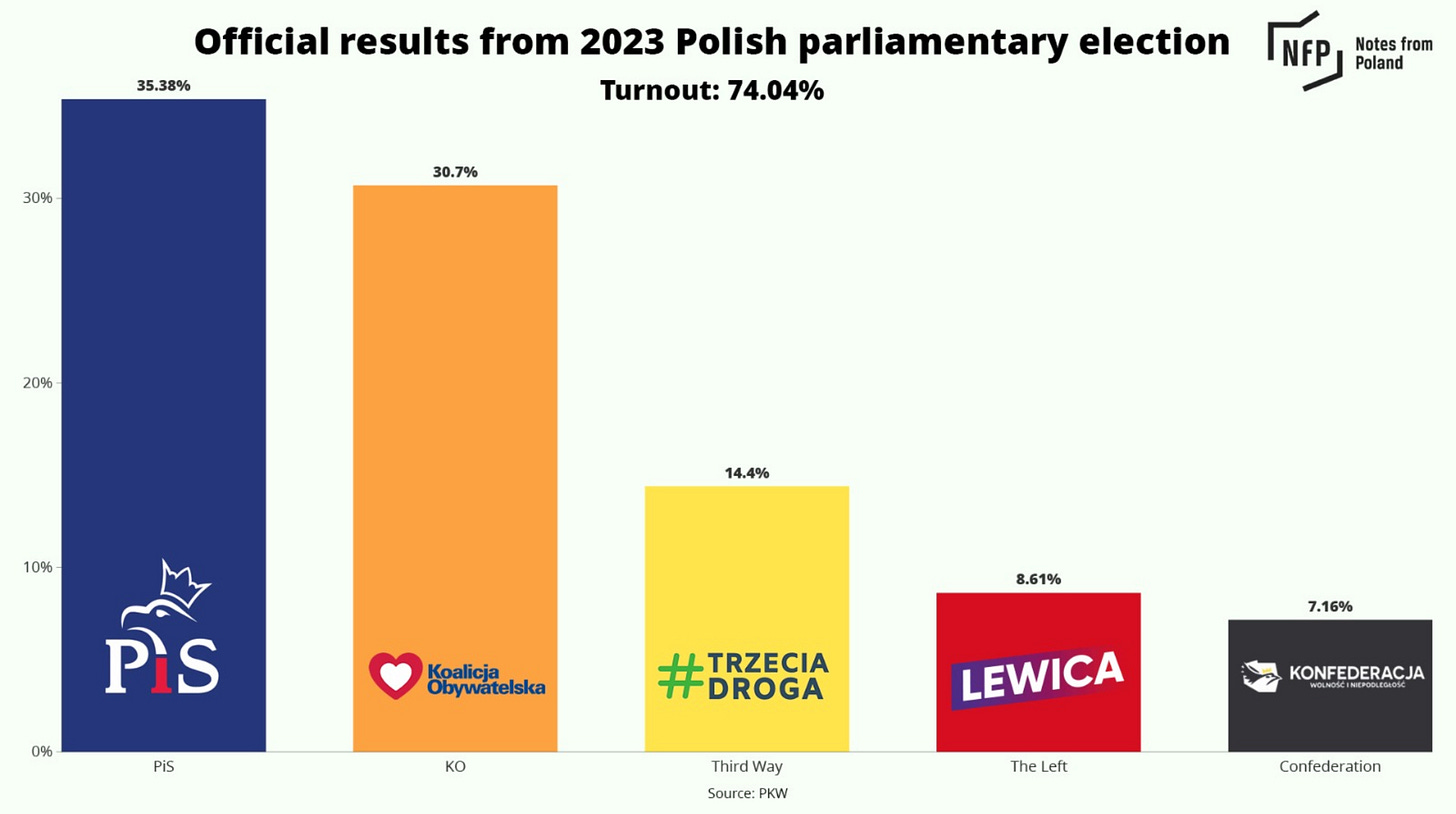

PiS got nearly 36% of the votes, while KO got 30% and TRZECIA DROGA got 14%. Looking at this, one might assume that PiS won the most votes and therefore will create the government. But in reality things look a bit different.

Because the „civic coalition“ eg. KO, TRZECIA DROGA & Lewica have combined 53.7% of the votes (30.7+14.4+8.6= 53.7), they have the ability to form a new government without PiS. While I personally am against coalitions like this (since most people voted for PiS), we have to accept the fact that the opposition will likely form the new government.

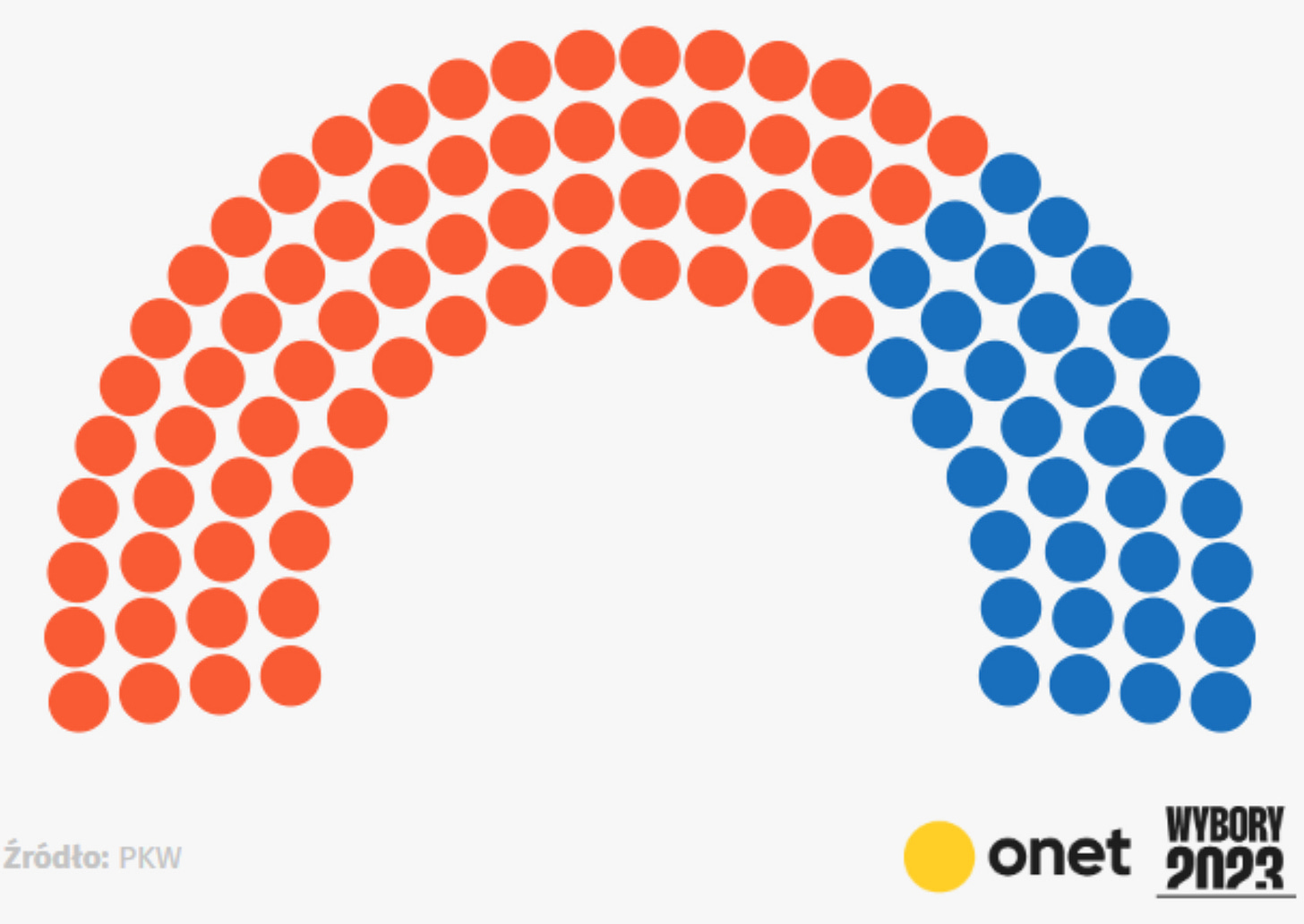

As can be seen below, the opposition has a majority compared to PiS 👇

If we learned anything from Germany over the last 2 years, then that a left wing political agenda of the ruling party can result in catastrophic consequences for the economy and it’s people.

But it’s still not 100% sure which political parties will form the new government, since PiS is in talks with every party to create it’s own coalition. I view this as unlikely, since the opposition has nearly 54% of the votes. Therefore PiS would have to convince at least 1 of the party’s, which form the opposition, to join them in an effort to win the majority and form a government. I see this as highly unlikely, since the political goals of PiS materially differentiate themselves from the goals the opposition and especially the left have. Still, nothing is impossible, especially in the context of politics. As a result, we have to look at the impact of these elections on each of our polish stocks that might seem interesting.

3/ Relative Losers & Winners

There is going to be increased risk from holding stocks that are related to the government, compared to stocks that have nothing to do with the government. Relative Losers are state owned companies and companies that rely on government subsidies.

Interestingly, the polish Zloty has shown incredible strength after the elections. And the combination of a strong currency and a strong stock market resulted in one of the best weeks for polish stocks in a long time.

As many might know, I hold shares of Orlen in my personal and the MODERN INVESTING portfolio. The thesis was that Orlen is going to become an European energy giant, that has support from the government (they own 49.9% of the shares). The valuation is incredibly low at a P/E of 2-3 and the dividend of at least 10% is a nice bonus on top. The stock soared by 20% in 2 weeks as a result of higher energy prices and the elections. I still hold my shares, but will likely sell them once the bullish sentiment has reached it’s peak. The thesis could still play out, but with the opposition probably forming a government, there are increased risks of higher taxes, larger investments into ESG and corruption.

Relative winners will likely be companies that are not related to the government in any way and simply do their business on their own. The relative outperformance will likely be driven by higher valuations, as the valuation gap between Western and Eastern European stocks gets reduced. Stocks that come to mind are Monari Trade, Eurosnack, Spyrosoft, and possibly Synektik.

4/ Conclusion

All in all, it’s typical polish politics. For foreigners it can be sometimes difficult to understand what is going on, but I hope that you got a clearer picture of what the situation looks like as of right now.

I still hold my ORLEN positions, but admit, that the thesis has changed and that the political risks have increased to a large extend after the election. Nonetheless, bullish sentiment in the polish financial market should persists over the medium term and will probably lead many stocks higher.

Yours sincerely,

MODERN INVESTING