1.0 Luxury never goes out of fashion !

What is the most iconic car brand in the world ? If we talk about luxury car brands, Porsche, Lamborghini and Ferrari are at the top of the list. Of these 3 companies two are public: Porsche AG and Ferrari. Since Porsche went public only recently, we don’t have much history to study. But with Ferrari we can see that the stock had tremendous success.

Lamborghini and Porsche are under control of Porsche SE. A holding company with stakes in several businesses, but most importantly at 31.9% stake in Volkswagen (VW) and a 12.5% stake in Porsche AG (the car manufacturer).

Porsche SE is one of the most undervalued stocks right now, and I believe that the stock will perform very well over the next years.

In this write up, I will:

Explain the structure of the company

Analyse the Porsche AG IPO

Look at the automotive market

Discuss their financials

And value the company

2.0 Company structure

The structure of the company is not that complicated, but because of the similar names of Porsche AG (car manufacturer) and Porsche SE (holding company) many people are confused. This is probably one of the biggest reasons behind the gap between value and price of the stock.

So Porsche SE is the holding company that has the majority of the voting rights of Volkswagen. With 51.7% of the voting rights and 31.9% ownership in the company.

Trough this stake Porsche SE has control over Volkswagen and all of it’s subsidiaries, like Audi, Seat, Skoda, Bentley, Bugatti, Lamborghini, Ducati, Scania, MAN and of course VW.

But the story doesn’t end here, Porsche SE also owns a 12.5% stake of Porsche AG (car manufacturer), with 25% of the voting rights.

Volkswagen also has a stake in Porsche AG (car manufacturer) of 75.4%. With 75% of the voting rights.

Porsche AG went public in February 2023, under the name Dr. Ing. h.c. F. Porsche AG.

The founding families of the Porsche car manufacturer want to have as much power and control as possible over the different car brands. Therefore it is common for Porsche SE to have a large part of the voting rights, but a smaller share of the company.

To summarize, Porsche SE is the top-level company that owns a stake in Porsche AG and also has a significant influence on Volkswagen, which is the second biggest automotive group only after Toyota.

3.0 The Porsche AG IPO

On September 26th 2022 Porsche AG went public. It was one of the biggest IPOs in history and was highly anticipated. Porsche AG is a great company with a strong brand and a lot of reputation.

The company was spun off from Volkswagen, which owned 100% of the company before the IPO took place. In the process 12.5% of the company was listed on the stock exchange and Volkswagen collected 9.3 Billion EUR from investors.

This money was paid out in special dividends to shareholder of Volkswagen. As we know, the biggest shareholder of Volkswagen is Porsche SE. Porsche SE made 3.1 Billion EUR just from this special dividend.

But the story continues. With the 3.1 Billion EUR and another 7.1 Billion that was financed trough debt, Porsche SE bought a 12.5% stake in the new Porsche AG.

Many people criticized that Porsche SE took on 7.1 Billion in debt to finance the stake in Porsche AG. But the deal is great if you look deeper into it.

Volkswagen let Porsche AG go public. As a result they earned a lot of money. To be precise 9.3 Billion EUR. They paid out this money as a special dividend to shareholders such as Porsche SE. Porsche SE took that special dividend of 3.1 Billion EUR and borrowed a further 7.1 Billion EUR from Investors and Banks.

The real cost was only 7.1 Billion for the company. But they bought shares for around 10 Billion EUR. Currently this position is worth ~ 13.4 Billion EUR, because the IPO was a big success. This is a 88 % profit on the investment, which is financed by debt !

4.0 Recession ?

It is now official that Germany has entered a recession. Many countries will follow Germany in a recession. Geopolitics, interest rate hikes by several central banks and inflation are putting pressure on the worldwide economic situation.

Fears are that car sales will suffer in the case of a recession, and with it the worlds biggest automotive companies (like Volkswagen and Toyota). But recent numbers show a different picture.

Porsche AG sold in the first quarter of 2023 18% more cars then in the quarter the year prior (here). This rise is partly fueled by the higher demand for cars in China.

Volkswagen reported an increase in sales in the first quarter by around 6.5% (here). Further the company gave a very good outlook for the year 2023.

“Deliveries expected to rise to about 9.5 million vehicles; sales revenues to increase by between 10 and 15 percent“ — Volkswagen Group

The worldwide situation is very complicated for the automotive industry, still deliveries and sales see new records for Volkswagen and Porsche AG.

5.0 Financials

Volkswagen pays out around 26% of it’s profits in dividends to it’s investors. The dividend of Porsche AG is minimal and small compared to that of Volkswagen. This graphic shows the yearly dividend income of Porsche SE, trough it’s holdings (Volkswagen and Porsche AG).

The yearly dividend income went from 756 Million € in 2021 to approximately 1.5 Billion € in 2023. In 2022 the dividend income was much higher then highlighted in the graphic above. This was because of the special dividend from Volkswagen as a result of the Porsche AG IPO.

5.1 Porsche AG financials

Bellow you can see the revenues and profits of Porsche AG in the 1Q 2023 compared too the 1Q 2022.

While revenues grew 25.5 %, net income grew 39.1% over that period. This is a sign of margin expansion, which in this economic environment is remarkable for a company of this size. Over the long term Porsche AG has been able to grow revenues at an rate of around 9-10 %.

Especially since COVID earnings grew at an much faster rate then historically, which is in my opinion the result of inflation. Because inflation is hurting the poor and benefiting the top 1% worldwide. Companies such as LVMH (luxury conglomerate) or Ferrari are currently earning record profits because of this. And the Porsche brand is no exception.

5.2 Volkswagen financials

Volkswagen is the second biggest automotive company in the world and had 280 Billion € revenue in 2022. With an operating income of 22.5 Billion €.

We can see, that revenue and operating profit went down in 2020 as a result of the COVID pandemic. But with the reopening of China and a new focus on electric vehicles, revenue and operating profit are surging to record high levels.

6.0 Valuation

If we value Porsche SE, we will simply add up everything the company owns, and subtract the debt. The 12.5% ownership of Porsche AG is worth around 13.4 billion euros. The 31.9% ownership of Volkswagen is worth approximately 21.7 billion euros. However, Porsche SE also has a debt of 6.6 billion euros.

If we add up the values: 13.4 billion + 21.7 billion - 6.6 billion, we get 28.5 billion euros.

At present, Porsche SE is worth around 28.5 billion euros or 93 euros per share. But these numbers may not be accurate because Volkswagen’s stock has dropped by 52% from its peak.

Now, let’s break down the true value of Volkswagen, which is a big part of the value of Porsche SE:

Ferrari, a competitor of Lamborghini, produces 13,200 cars per year, while Lamborghini produces 9,200 cars annually.

Ferrari’s market capitalization is 67 billion euros, which means it is valued at 5 million euros per car (67 billion / 13,200). If we value Lamborghini at 2.5 million euros per car (since Ferrari is overvalued), the total valuation of Lamborghini would be 23 billion euros.

The remaining 75.4% ownership of Porsche AG, which is owned by Volkswagen, is worth an additional 80 billion euros.

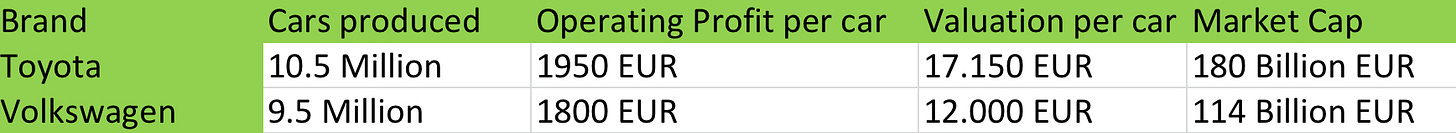

Now, let’s focus on the rest of Volkswagen, which includes brands like SEAT, SKODA, and VW. We can value them similarly to Toyota since both companies are large automotive companies with similar characteristics.

Toyota produces 10.5 million cars per year, and Volkswagen will produce 9.5 million cars this year. Toyota’s operating profit per car is around 1,950 euros. If we subtract the profits from Porsche and Lamborghini, the operating profit per car for Volkswagen would be around 1,800 euros.

Considering the similarities between Toyota and Volkswagen, we can assume a similar valuation. Toyota’s market capitalization is 180 billion euros, and it is fairly valued with a P/E ratio of 10 or 17,150 euros per car.

If we assign a valuation of 12,000 euros per car for Volkswagen (30% less than Toyota), the brand’s fair value would be 114 billion euros (excluding Lamborghini and Porsche).

So, the calculation would be: 114 billion euros (Volkswagen) + 80 billion euros (Porsche) + 23 billion euros (Lamborghini) = 217 billion euros.

Porsche SE owns 31.9% of Volkswagen, so their stake would be worth 69 billion euros at fair value. If we add the 13.4 billion euros from Porsche AG, the total fair value would be 82.4 billion euros, or 270 euros per share. It’s unlikely to reach such high numbers, but even if it reaches 150 euros, it would still be a significant return.

7.0 Summary

Porsche SE is a great opportunity for investors with a long term view. It gives us the opportunity to buy great assets, like Volkswagen and Porsche AG at discounted prices. And while we wait until the stock goes up, we collect dividends of 5 % per year.

I have a position in the stock and remain bullish.

This is not financial advice. Everyone has to make financial decisions himself, based on the risk the person tolerates.

thanks for the writeup. what do you think the catalyst here is considering Porsche AG has already been listed?

there is an australian value investor long this stock