Rumo | The most crucial asset in the agricultural industry

A company that owns the logistics behind the Brazilian commodity sector…

Amidst Trump’s 2nd trade war, the global financial markets have experienced unprecedented volatility with violent moves to the up and downside. During this chaotic period South American stocks have remained remarkably resilient. The weakening dollar has been a positive factor for emerging markets in general, but it seems like there is more to this outperformance of South America than just forex.

In this context we will together break down which effects this situation has on South America and will analyze Rumo Logistica, a highly interesting company at the heart of these chaotic times.

1 | The China / U.S. trade balance and Brazil as a potential winner in the tariff mess

The reciprocal tariffs applied by the U.S. were delayed by 90 days for all countries who didn’t retaliate. Still, Brazil and other South American nations got hit with the lowest tariffs of 10% each. Now that the Trump administration will likely attempt to strike deals with most countries and economic unions, the real importance of Brazil will be seen. The U.S. and China are in another trade war, so let’s examine the trade balance between both nations.

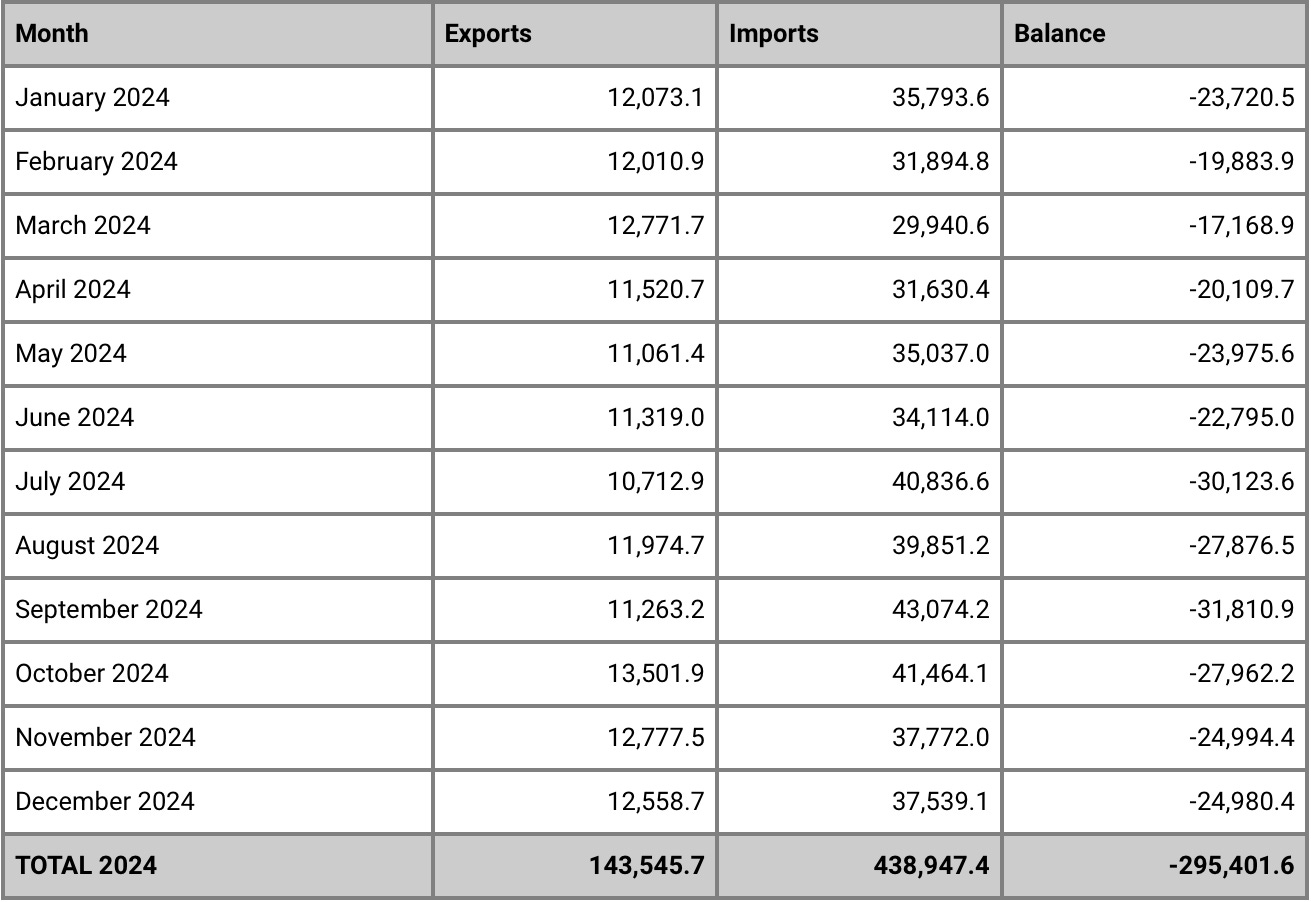

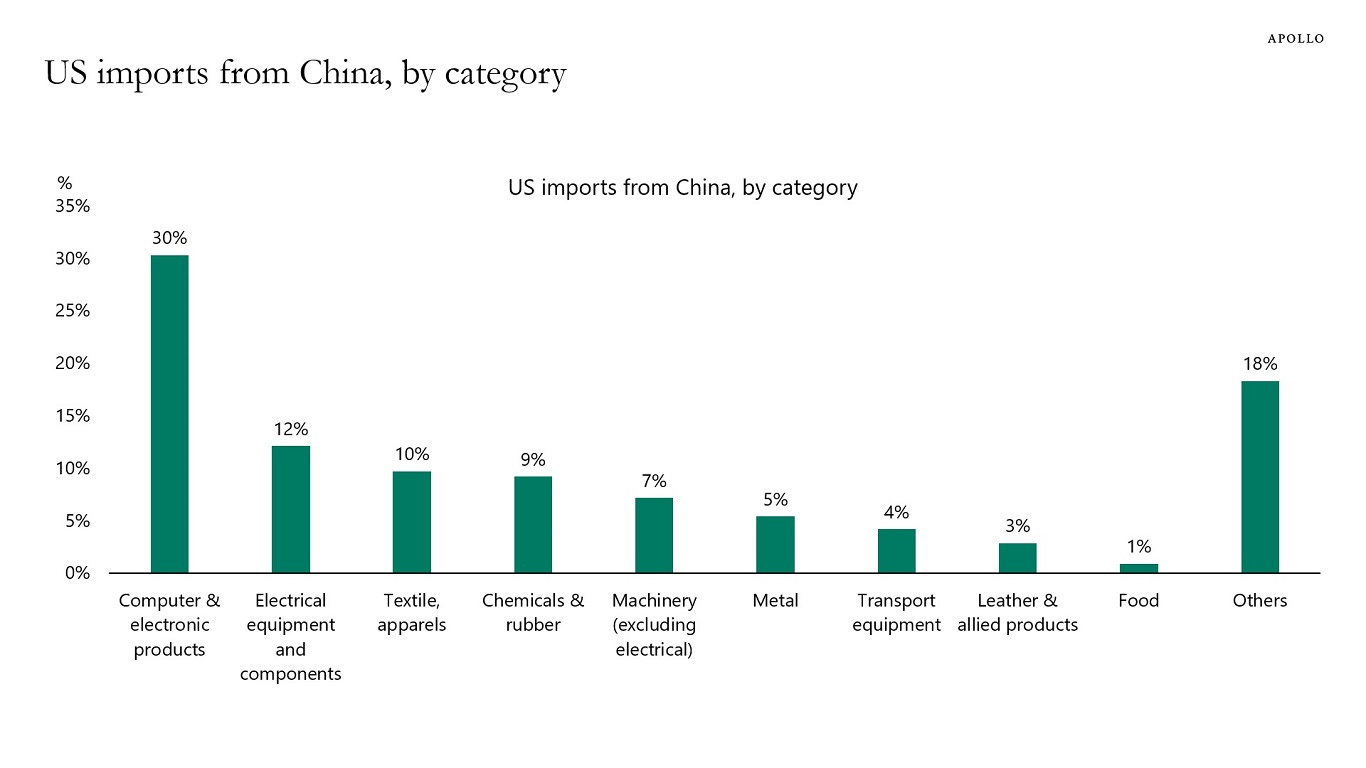

First of all, the U.S. has a massive trade deficit with China, which amounts to nearly 300 billion dollars a year. This isn’t surprising in any way as China has become the manufacturing powerhouse of the world while the U.S. has remained the consumption powerhouse of the world. If we break down how the trade balance looks like in detail, we can see a clear trend. The U.S. imports mostly electronics, electrical components, textiles, etc. from China. Products that are very difficult to obtain elsewhere.

To build a supply chain focused on electronics and hardware domestically would require years, which is probably why the White House announced on Saturday, April 12th that these products would be exempt from the tariffs.

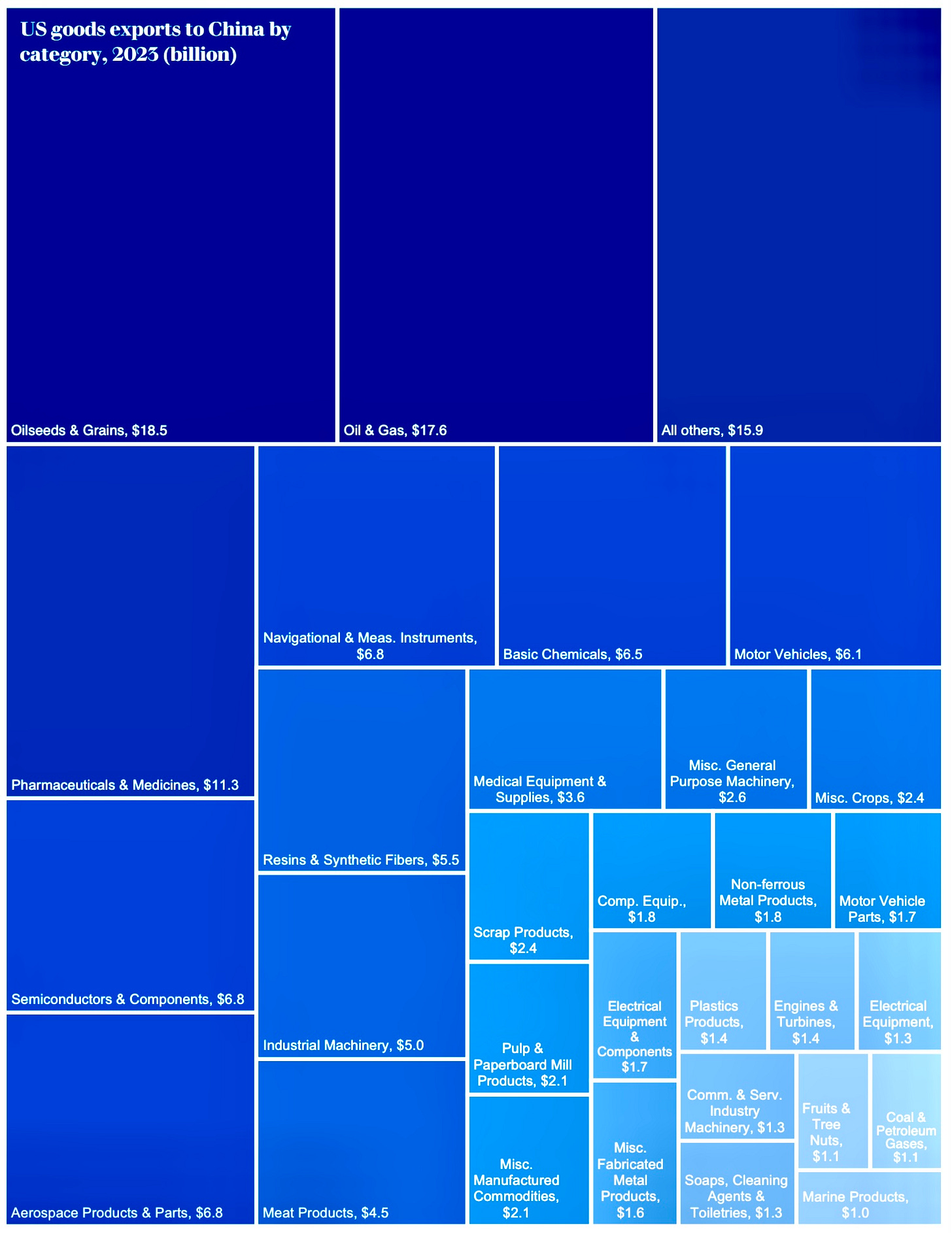

On the other side of the spectrum, China imports mostly agricultural commodities and energy from the U.S. These are fairly easy to source from other trading partners. So to summarize the trade balance between China and the United States, China imports goods from the U.S. that are fairly easy to source from other trading partners, while the U.S. imports goods from China that can’t be sourced from other trading partners at this scale. This situation favors China, which might be the reason why the White House has announced the exemption of tariffs on electronic products and semiconductors. It’s uncertain wehether Trump and Xi will strike a deal, but in case they don’t, China will have to source their commodities from somewhere else. The prime candidate to supply them would be Brazil commodity-focused economy. At the center of all this? Two Brazilian states which have quietly risen through the ranks of global relevance.

2 | The rise of Mato Grosso as the agricultural hub of Brazil & the World

Today Mato Grosso is responsible for 16% of the global grain trade while Goiás adds another 5%. The sheer size of these two states is mind-boggling. Together, both states have a size of roughly 1.2 million square kilometers, or roughly the size of South Africa.

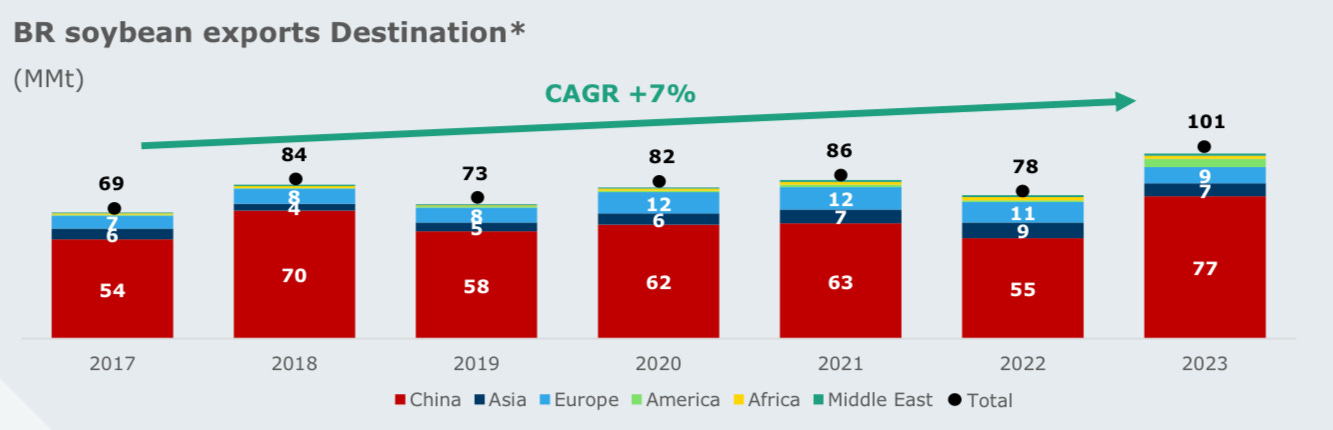

But let’s just build upon the idea that American exports to China are mostly commodities, while Chinese exports to the U.S. are mainly electronics. In fact, the U.S., Brazil and China are the most crucial countries to the global trade of soybeans.

“The United States and Brazil are major competitors and together supply over 80% of soybean global exports, while China accounts for about 60% of total soybean imports“

— The United States, Brazil, and China Soybean Triangle: A 20-Year Analysis

Together, these nations form the triangle of global soybean trade. Over the past 20 years most of the demand growth in commodities has come from Asia and especially China. The U.S. and Brazil are competitors in this regard. Recent turbulences in global trade due to Trump’s announced tariffs are opening up a window of opportunity for Brazil that could turn out to define global trade flows for years to come. It’s pretty clear that China will have to find a new source for many agricultural products they currently buy from the U.S. The key question is who will be able to fill the gap first? Who has to capacity to produce these goods competitively at scale? Brazil seems like an obvious winner here in case Trump’s tariffs stay in effect longer than currently expected.

Today, Mato Grosso is one of the fastest growing states in Brazil, driven mainly by the unprecedented growth of the agricultural sector. The agricultural sector accounts for more than 20% of the states GDP and is the key driver behind the fast growth of the local economy. In 2023 for example, the GDP of Mato Gross gew more than 3 times as fast as the national average.

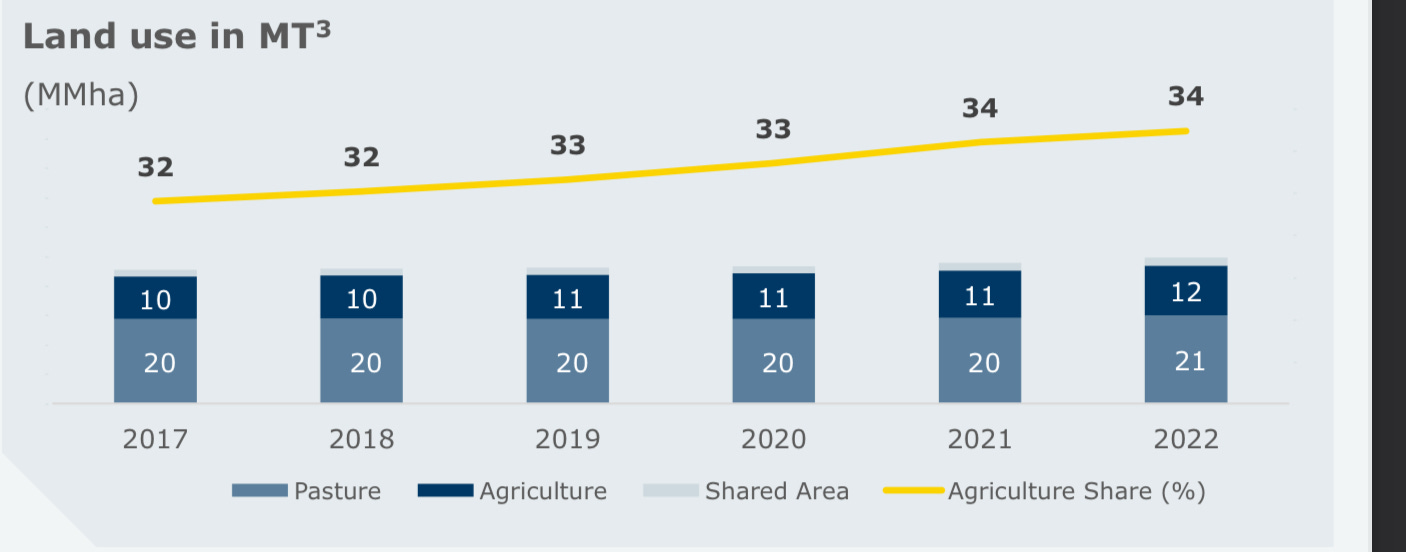

Another thing to consider is that in the state of Mato Grosso 34% of the arable land is used for agricultural purposes. The trend is for gradual growth and there is a lot of room left for growth.

3.1 | Rumo Logistica - Overview

Rumo Logistica is Brazil’s largest independent company focused on railways with a network that stretches currently roughly 14.000km or 8,700 miles. The company has 8000 employees and owns key assets essential for the transportation of goods from Mato Grosso, Goiás, etc. to the ports of Brazil. Rumo was founded in 2008 as the logistics arm of the Brazilian conglomerate Cosan. The company still holds 30% of Rumo.

Below is a map of the company’s operations in Brazil, with the company’s railways highlighted in different colors:

Red — Malha Central

Blue — Malha Paulista

Yellow — Malha Oeste

Purple — Malha Norte

Green — Malha Sul

The company transports roughly 75 million tons of freight a year, with 80% of the volume being attributable to agricultural commodities such as corn, soybeans, fertilizers, sugar, etc. The two main business operations of Rumo Logistica are the Northern and Southern Operations. These are made up of:

Northern Operation: Malha Norte, Malha Paulista & Malha Central

Southern Operation: Malha Oeste, Malha Sul

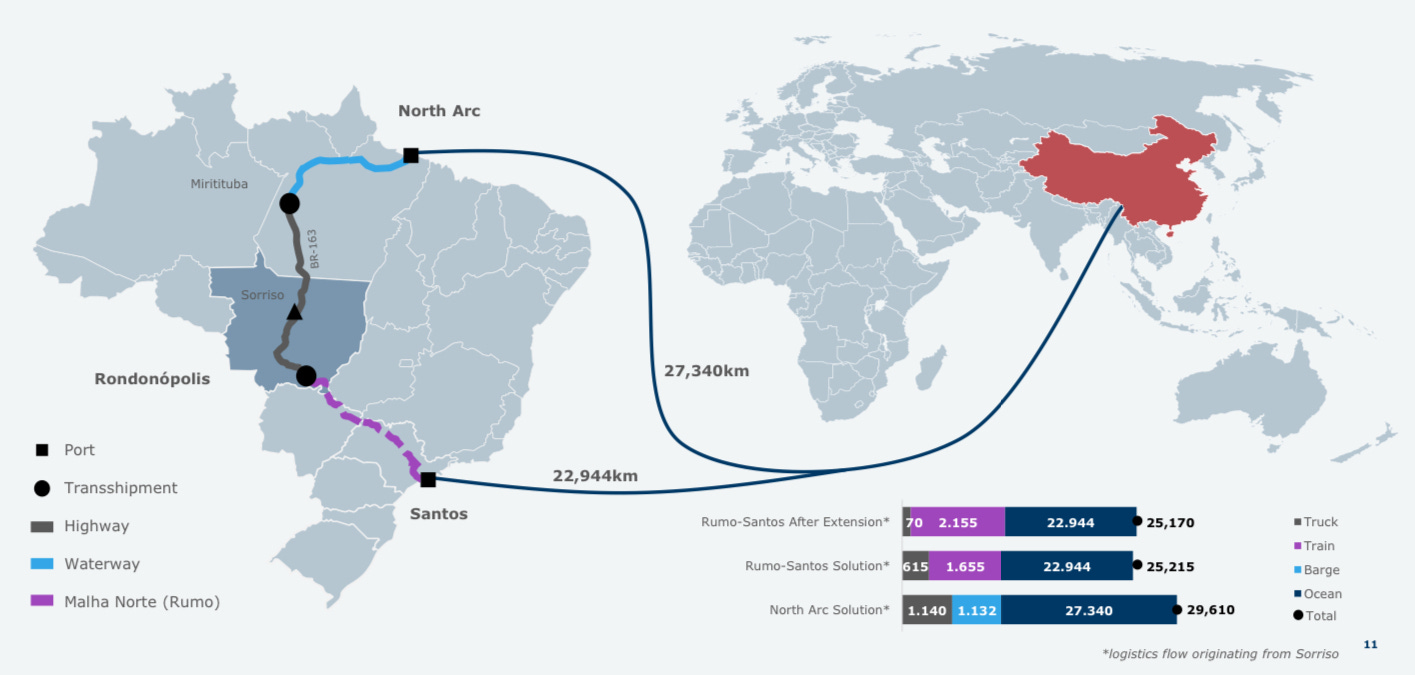

It’s crucial to understand how important Rumo‘s network of railways is to the agricultural industry of Mato Grosso and Goiás. There is no cheaper option if one wants to export goods from these states to the rest of the world. Rumo positions itself as a key corridor between the highly productive state of Mato Grosso and the Port of Santos.

By using the Port of Santos instead of other ports in the north of the country, the route to China is 16% shorter saving crucial time and money. As most of the growth in the agricultural demand comes from Asia, the Port of Santos and by definition Rumo are well positioned to provide China and generally Asia with the commodities they need. In the long run, price and efficiency win, which is why the company has been investing heavily into their infrastructure connecting the Port of Santos with the Brazilian Midwest.

3.2 | Floods in Rio Grade do Sul

The Northern business operation currently transports roughly 6 times as much volume as the Southern business operation, which is up from 5 times as much from the prior year. The Southern business operation has been underperforming in 2024 due to extreme weather events in Rio Grande do Sul, which led to the indefinite shutdown of some of the infrastructure at Malha Sul. The resulting non-cash impairment negatively impacted headline Net Income & EBITDA by R$ 3.149 billion.

“According to the latest official report issued on 20 August, the floods affected nearly 2.4 million people, resulting in 183 deaths, 27 missing persons, and widespread damage across 478 municipalities in the state.

The peak of the emergency, nearly 600,000 people were displaced, with over 80,000 sheltering in official facilities across the state, increasing the protection needs of vulnerable groups, including women, girls, young children, and the elderly.“

— UNITED NATIONS BRAZIL

3.3 | Track record of growth

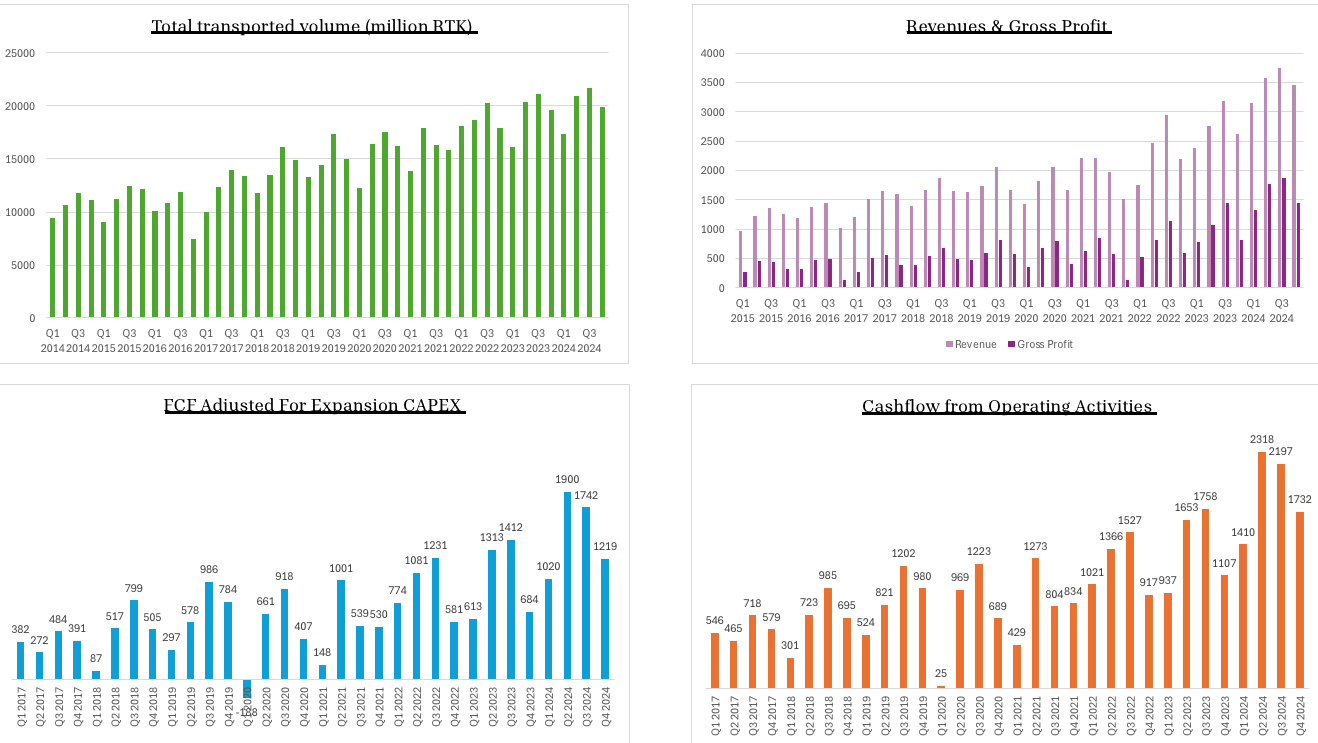

Rumo has a track record of growth in terms of transported volumes, revenues, cash flows, etc. (Due to the merger with América Latina Logística in 2016 my data is limited to the time period from 2015-2017 onwards).

We can see a clear cyclicality in the underlying earnings of the company with Q4 and Q1 being seasonally weaker than the rest of the year, while Q2 and Q3 are usually pretty strong. Over time Rumo has managed to grow volumes, revenues, gross profit and FCF substantially. The only 2 times in which the company performed badly was in 2016 and 2020, which were both attributable to severe economic pressures.

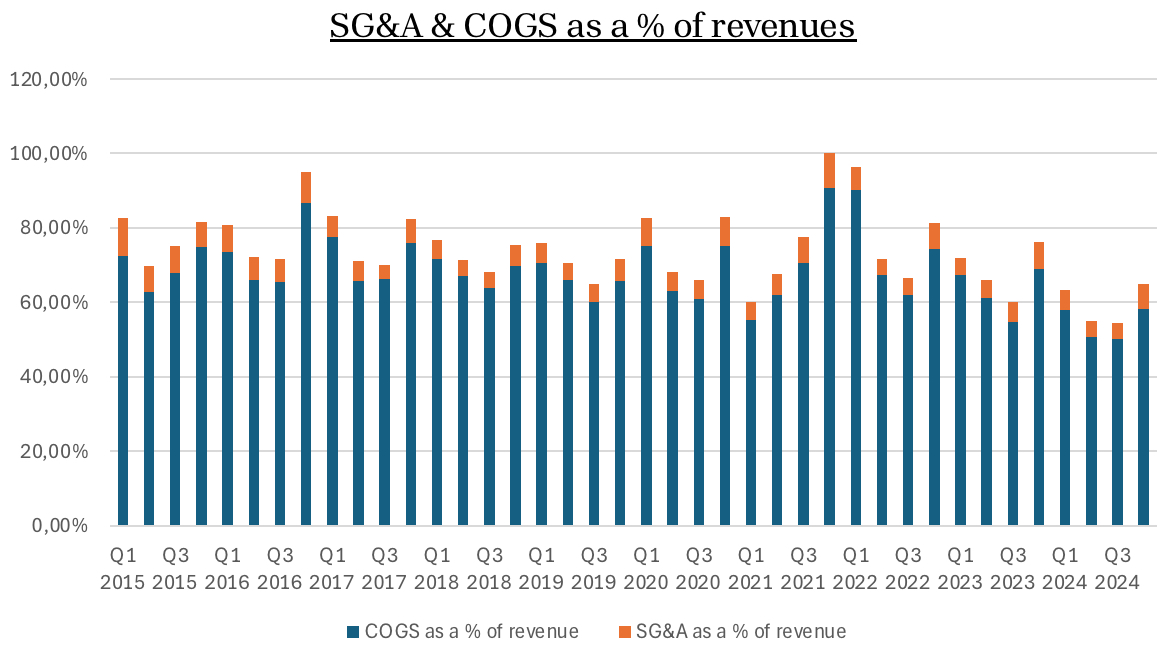

When I say that the company has a good track record I not only refer to growing revenues, but also costs being under control. Clearly, there is a trend for higher expenses in Q4, but as a percentage of revenues, SG&A (Selling, General and Administrative Expenses) as well as COGS (Cost of Goods Sold) is declining over the past few years.

If we look at non financial metrics, energy efficiency has seen significant improvement over the past couple of years while personal accidents have declined a lot.

3.4 | Future growth and expansion

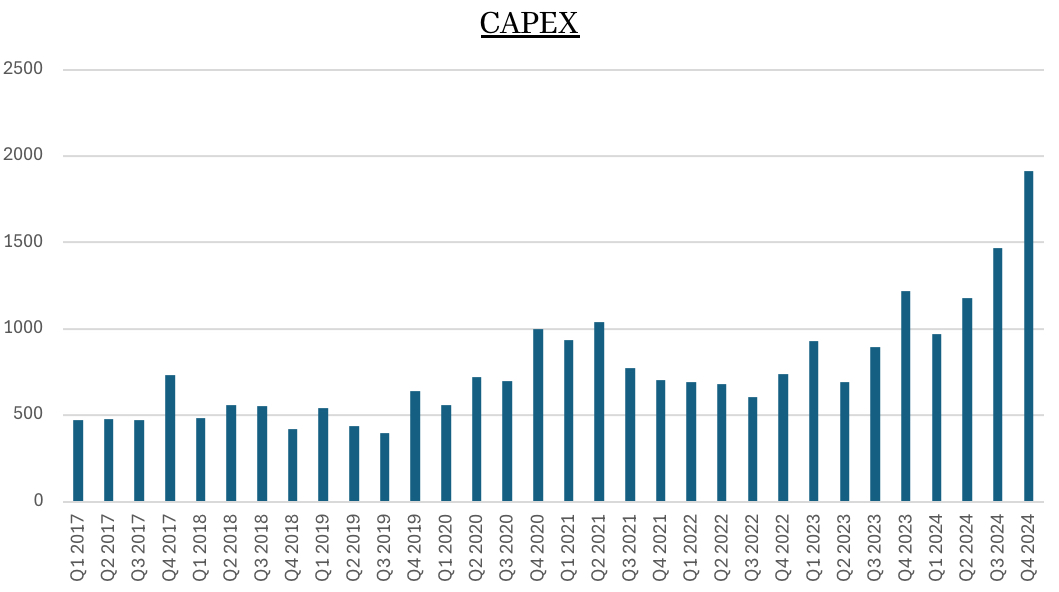

With significant growth in revenues and cash flows, CAPEX has also gone through the roof in recent years.

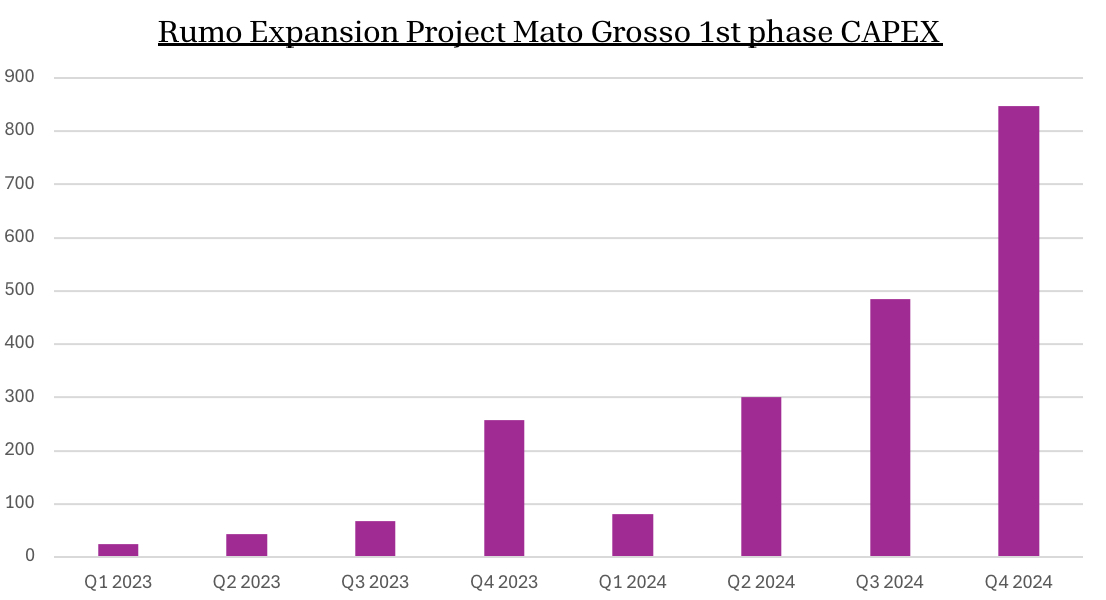

This is mainly due to growth CAPEX, as the company has committed to a large project in Mato Grosso which aims to grow the transported volumes of grains from 32 million tons p.a. to 60 million tons p.a. by 2032. We are currently in the construction process of phase 1.

The expansion project employs more then 4,000 people and the first part is scheduled to be completed sometime in 2026. Overall the project will strengthen Rumo‘s position in Mato Grosso and will help them thrive for decades to come. The cost of this project however is estimated to be about R$ 15 billion.

3.5 | Guidance and trends for 2025

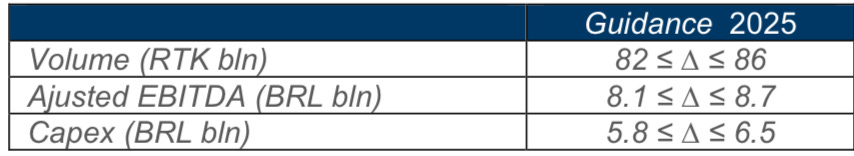

For 2025, management is guiding for 3-8% growth in transported volumes compared to 2024. Adjusted EBITDA is expected to grow 5-13% while CAPEX is projected to rise by 5-17%.

Last year, Rumo‘s actual results were largely aligned with prior guidance. Transported volumes however did fall short of expectations with 79.8 billion RTK (revenue ton kilometer) compared to the guidance of 80-82 billion RTK. This is largely due to the floods in Rio Grande do Sul and extreme weather conditions, contributing to a severe crop failure in Mato Grosso.

3.6 | Balance Sheet

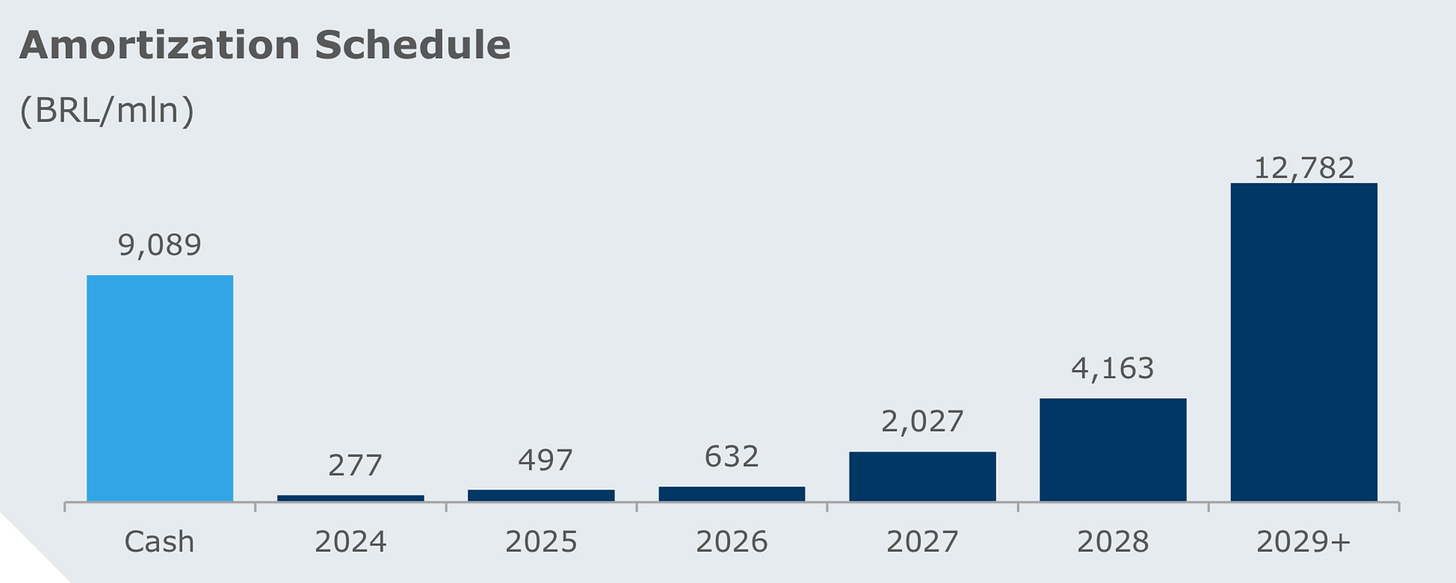

If we take a look at the balance sheet, Rumo is well capitalized and has enough liquidity to invest in projects like the Mato Grosso railway expansion project phase 1. Current cash and cash equivalents are more than enough to cover all debt maturities till 2029.

The company has current assets worth R$ 10.873 billion with current liabilities totaling R$ 6.669 billion, translating to a current ratio (current assets divided by current liabilities) of 163%. The average duration of their debt stands at 5.2 years and net debt/EBITDA ratio is 1.4x.

3.7 | Risks

Rumo has seen steady growth in recent years but as with any stock there are risks. Some are more severe than others but I have to mention political risks. We are still talking about Brazil here. While much of South America appears to be shifting from left to right politically, chaos can erupt anytime. Another risk is the company’s exposure to the global commodity markets. If we were about to see a decline in demand for commodities in general and especially agricultural commodities, Rumo could be hit as the transport of commodities is their primary revenue source. Another risk is obviously the uncertainty the Trump administration has caused in recent weeks related to tariffs. As of now Brazil is a relative winner in this entire tit for tat game, but the tide can always turn.

With the floods in Rio Grande do Sul and the impacts of El Niño in Mato Grosso we have to consider the risk of mother nature. Potential weather events could damage infrastructure and result in lower supply of agricultural goods.

Lastly a risk that is less macro related. The company’s concessions for Malha Oeste and Malha Sul could not be renewed, as their current contracts will expire in 2026 and 2027 respectively.

“The potential non-renewal of Rumo Malha Sul and Rumo Malha Oeste in 2027 is expected to have a limited impact on credit metrics. These businesses contribute approximately 10% of consolidated EBITDA and have lower operating margins (around 35%) compared to the consolidated margins of 45% to 50%.“

— Fitch Ratings

The impact would likely be small but it’s something to keep in mind. Luckily all other assets have concessions ranging from 2049 to 2079.

3.8 | Valuation

Railways tend to be seen as defensive and stable investments due to their irreplaceable nature and long history. In the Americas only a handful of railways are publicly traded. Since Brazil is amongst the cheapest equity markets globally, it comes as no surprise that Rumo is trading far below the multiples of Union Pacific, CSX and Norfolk Southern. The fact that Cosan owns 30% of the shares is probably also weighing on the stock.

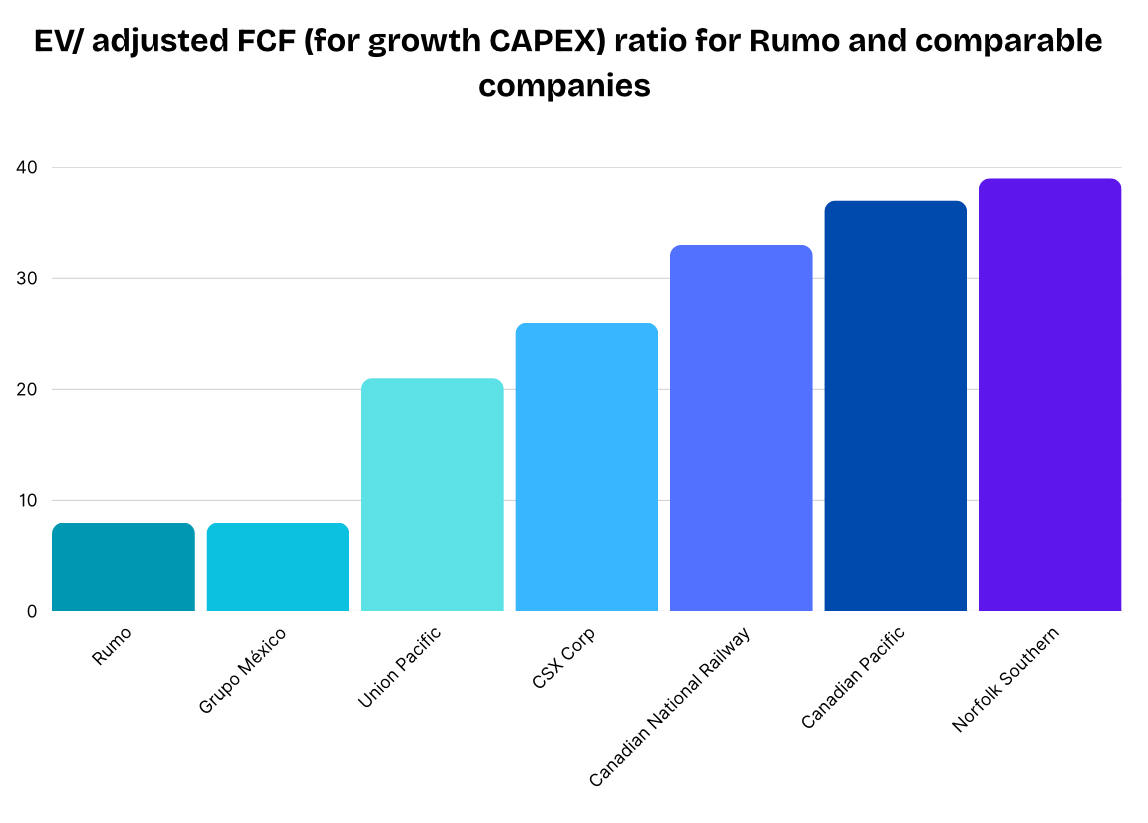

At a market cap of R$ 34 billion and net debt of R$ 11 billion, the EV for Rumo stands at R$ 45 billion. In 2024 adjusted FCF (adjusted for expansion CAPEX) amounted to R$ 5.88 billion, putting the EV/adjusted FCF ratio at 7.65.

It’s probably not fair to compare Rumo with Union Pacific or CSX, but in the graphic below we can see the EV/adjusted FCF ratio for all publicly listed railroad in the Americas that are comparable or to Rumo.

The only company that trades at the same multiple as Rumo is Grupo México. This company however makes just 20% of its revenue and 13.5% of EBIT from the railway business. The rest is mainly derived from the mining business. Apart from them, Rumo is by far the cheapest stock in this group. Growth in many of the other railroads has been disappointing at best with years of near flat revenues. I wouldn’t go as far as saying that Rumo deserves to trade at the same multiple as American based railways, but considering the assets base and growth prospects, around 7.5-8x EV/adjusted FCF seems too low.

4 | Conclusion

In conclusion, Rumo has irreplaceable assets that are a crucial part of the global supply chain. Recent turbulences in financial markets and politics, driven by concerns over tariffs and global growth expectations are an opportunity for the company. As the global trade of soybeans is mainly concentrated between China, the U.S. and Brazil, the South American nation is in a great position to fill the gap with more exports to China. Rumo has a great track record of revenue and free cash flow growth. Costs have been managed in a prudent manner while the company has been investing billions in new projects supporting the firm’s long-term growth prospects. Rumo has relatively low net debt with long maturities on its debt while having current assets far exceeding current liabilities.

Considering all the points above, it’s difficult to imagine how Rumo can trade at 62-78% discount to U.S. and Canadian peers (EV/adjusted FCF ratio). Grupo México trades at the same valuation multiple while generating the absolute majority of revenues and profits from the mining business. So why does this opportunity exist? Well there are a few points. First and foremost, Rumo is listed in Brazil. This alone is making it hard for foreign investors to invest in the stock. Then there is a discount that has to be applied due to Brazil’s political risk. To be honest, political risk in Europe and the U.S. has also risen sharply in the past few years, but we all get why Brazil deserves a discount. Lastly there is the risk that Rumo’s concession for Malha Oeste and Malha Sul railway won’t be renewed in 2026 and 2027 respectively. The effect on earnings would be small, but it’s a risk that has to be considered.

So putting all of this together, I view Rumo as a very attractive opportunity at the current point and would like to build a starter position in the stock. My issue is that my broker doesn’t have direct access to the Brazilian stock exchange and that I have used most of my available capital to invest during in the recent drawdown. For these reasons I don’t have a position yet but will continue to watch from the sidelines. Maybe the opportunity will arise one day.

Yours sincerely,

Modern Investing

Thanks for the analysis!

A note, as I have done an analysis of Grupo Mexico myself: Grupo Mexico is not a good peer, but its transportation business is listed independently on the stock exchange under "GMéxico Transportes", which would probably be the best peer overall for Rumo

I would consider buying cosan at current prices a good alternative for those who have no access to brazilian stock market