SIBANYE STILLWATER - Most hated commodity producer !

Cycle Lows provide great opportunities !

Most people who are regularly on FinTwit have experienced the massive sell off, that Sibanye Stillwater SBSW 0.00%↑ has experienced over the last week. But while many throw the towel, there are interesting activities below the surface. I am highly interested in SBSW 0.00%↑, and at the time you read this, I might already be long with a small amount of the portfolio !

This is going to be a short overview of what has happened and why the stock is so interesting.

Let’s get into it:

1/ When do you jump ?

We all have heard that when others are fearful we should be greedy (Warren Buffett). When there is blood in the streets we should buy (Nathan Rotschild). But this quote by Oscar Isaac is not that well know in the financial industry, although it might be the best one regarding this topic. 👇

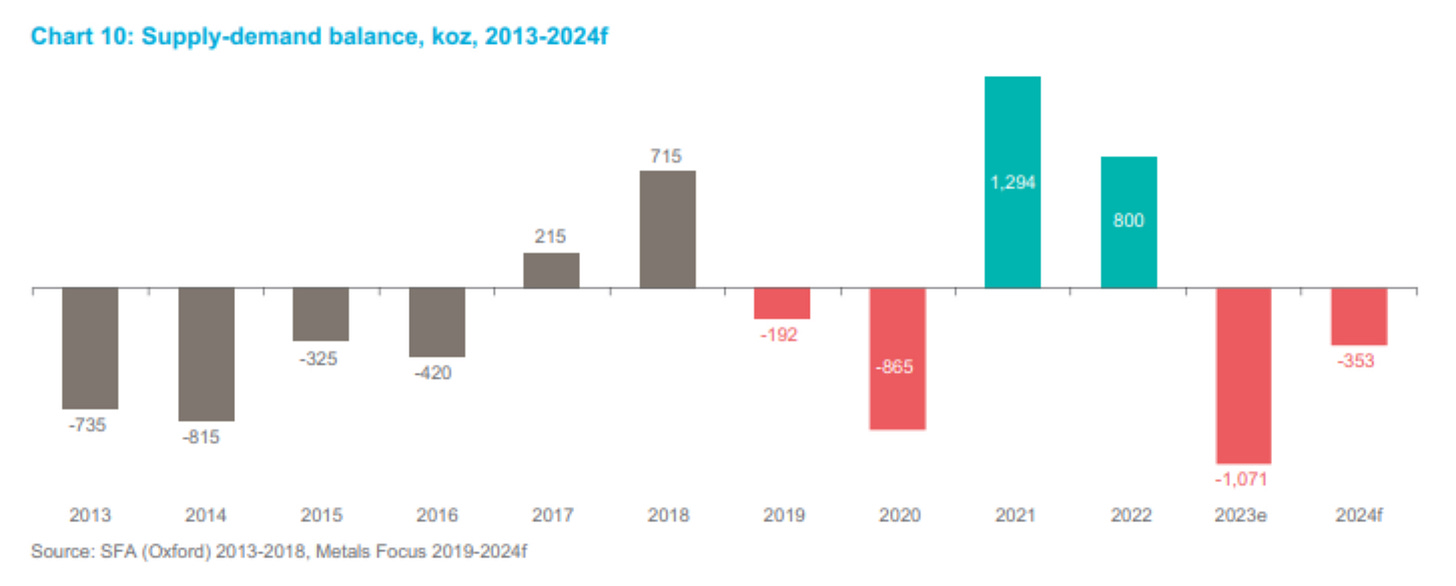

Platinum producers such as Sibanye or Impala are both down 80% from their highs in 2021, while we have a supply deficit that is projected to reach 1m ounces by the end of 2023 !

Many producers are closing mines that are below the current price in the market, and I haven’t even started to discuss the political situation producers are facing.

2/ South Africa - A failed state

In Germany I like to call the economic trend we are experiencing as a failed state. But this doesn’t even come close to the situation in South Africa. While the economy is in the trash, there are frequently power outages, that affect nearly all of the country.

Then there are the rolling blackouts implemented by Eskom Holdings SOC Ltd.

The state-owned power utility, which has become a byword in recent years for South Africa’s troubles, has a fleet of coal-fired power stations that are old, poorly maintained and badly designed. The shutdowns are known locally as “loadshedding” and last for up to four and a half hours at a time

— Bloomberg

There is nothing much to say that is positive. But what we have to admit is, that 80% of all Platinum Group Metals (PGMs) are located in South Africa. PGMs are critical for the global economy and especially for the automotive industry very important. Apart from that PGMs are also used in the chemicals industry, renewable energy industry, etc.

"The forecast deficit for 2023 has increased by 66 koz to 1,071 koz since the Q2'23 Platinum Quarterly in September 2023, and reflects a 3% decline in total supply and a 26% increase in demand versus 2022,"

— World Platinum Investment Council (WPIC)

3/ The Flash Crash

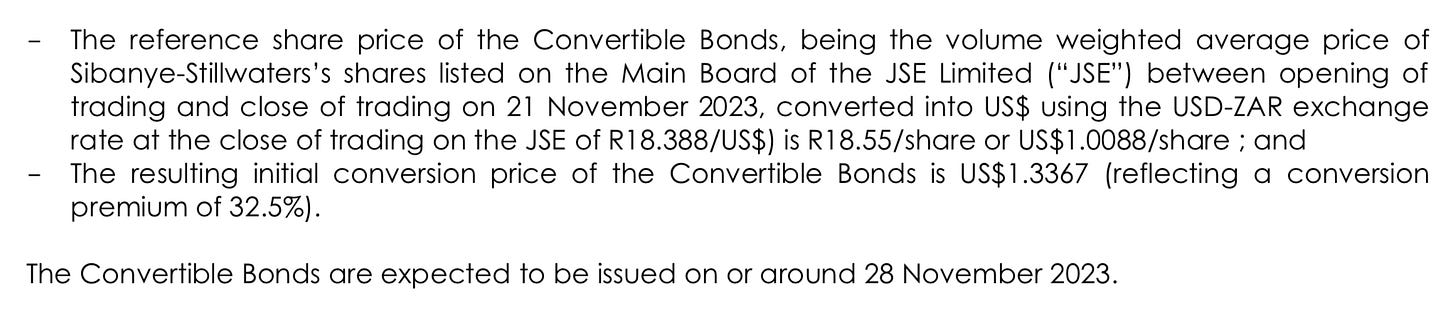

On November 21st the share price of SBSW 0.00%↑ collapsed by a stunning 20% ! The company announced that it would sell convertible bonds to raise cash. The bond is going to pay a coupon between 4 and 4.5% p.a. and the conversion price is going to be 1.33 $ per ordinary share or 5.32 per ADR.

But before the selloff, the stock was at 5.15 $ per ADR. Meaning that the conversion price is just cents higher then the price the stock had traded before the announcement. Obviously the banks that are involved in the offering had some conflict of interest in this transaction and wanted the conversion price to be as low as possible.

This is the only logical reason I can find why the stock would crash that much on news like this. Is it bad when SBSW 0.00%↑ raises cash, just to be sure to have no liquidity problems, while we are at the low of the cycle ? If a company that has assets in a geographical location as bad as South Africa, can raise cash at 4 to 4.5% p.a., then this shows strength.

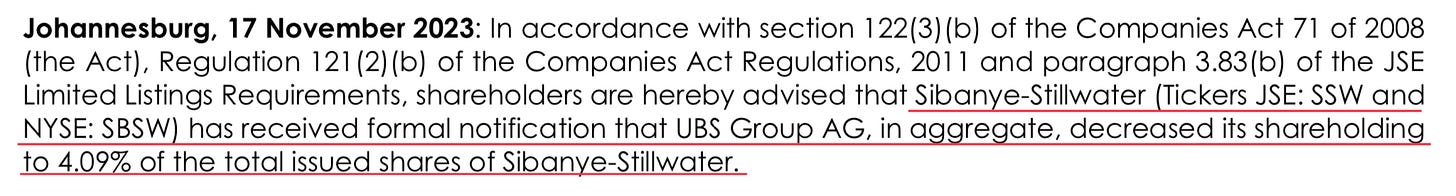

Further UBS has decreased it’s position in SBSW 0.00%↑ on November 17th, while they increased the position on November 21st.

If this isn’t conflict of interest, I don’t know what is !

4/ Elevator Pitch

Sibanye Stillwater holds 80% of the worlds PGM Reserves and holds gigantic Uranium, Gold, Silver and Lithium reserves. The CEO owns personally 10m shares and has decades of experience in the industry. PGMs are currently at a very low price level and we are at the low of the cycle, which we can see, because demand is growing, while supply is going down.

SBSW 0.00%↑ is trading at 4x Earnings and a 7% Dividend Yield, while they have a balance sheet where there is basically no Net Debt. The market cap is 3 Billion $, while they made a Net profit of 2 Billion $ in 2021 !

The potential risk is the total collapse of South Africa and huge protests that could be the consequence of this. This is a serious risk, although I think that this is more then priced in.

5/ Conclusion

Sibanye Stillwater is a perfect example of how the financial industry uses volatility to build positions and profit from the selling of retail investors. The stock is extremely cheap and could easily double, and still be hated. But as Rick Rule said:

You can make a lot of money when something goes from extremely hated to just hated.

— Rick Rule

If you have something to add or a comment, feel free to comment below and join our community.

Yours sincerely,

MODERN INVESTING

Thanks for an informative column on $SBSW. One thing I would like to add is that the PGM price has been depressed by the liquidation of inventories by Russian, who, because of the war, are desperate for money. The price of diamond is brought down also by the liquidation by Russian. While the liquidation is short term negative, it is the positive for both medium and long term for SA producers in general.

The PGM price is below the full cycle cost plus the cost of the capital of the PGM miners. Since you are quoting the legendary natural resource investor Rick Rule, I would add two important points that I learned from Rick. The first is on the countercyclical investment of commodity producers. "ln natural resource investing, you are either a contrarian or a victim. The second is why to buy majors of a commodity sector when the commodity, essential for the society, is in self-liquidation mode. What Rick said in the following short segment about a year ago applies to PGM (eg. SBSW and IMPUY) today. https://youtu.be/ZNJCLXBSZhE?t=1460

Interesting company. You have to kind of normalise earnings that are cyclical and maybe take an average. Looking at the price to book of 0.6, it is also screaming undervaluation.

As for South Africa, this is a country that will send the army before stopping mining production, and there is a precedent (police) with the Marikana massacre. I do not glorify the death of strikers nor do I know the ins and out of the story, if it was legitimate fear on the part of the police or not.

But this is the lifeline of the economy and they will not abandon it, and they have some extremely efficient army and police special units. Not too much to worry about that.