The most valuable resource in the 21st century

Taking a look at the software developer market

The 21st century is an exiting time to live in. From innovation, to large scale problems, humanity is at a point of hugh development. And as my idol Miron Mironiuk put it:

The most valuable resource of the 21st century are not diamonds, gold or oil. No, the most valuable thing is the human intellect. […] 200 years ago only 10% of the adult population could read or write. Today every 8 year old can do this. And the same is going to happen with programming. It’s going to become an essential and natural thing for humans. — Miron Mironiuk (Founder of Cosomose AI)

I agree 100% with the statement of Miron and logically asked myself, how I can profit from this mega trend. Since the world is digitalizing quickly and we’re going to consume much more data, there are 2 main beneficiaries of this:

The software development market

And Cybersecurity

In this part of Weekly Investing Focus we are going to cover the software development market.

1/ Overview

The software developer market has become very big as a result of the global expansion of companies. The globalization has enabled companies to have developers all around world. This resulted in to incredible advantages :

Firstly, a company can have employees in all major time zones, which is a crucial factor in the IT sector. If there a errors or problems that occure at night, a team from for example Asia can fix it.

Secondly, an american company can have developers in Pakistan, Romania, Hungary, Argentina or Indonesia that will to the same job for half or even one third of the money.

These advantages created a highly fragmented industry with a lot of small players that are competing for market share. This in turn is great for companies focused on M&A (Mergers and Acquisitions), that want to become a bit like Constellation Software.

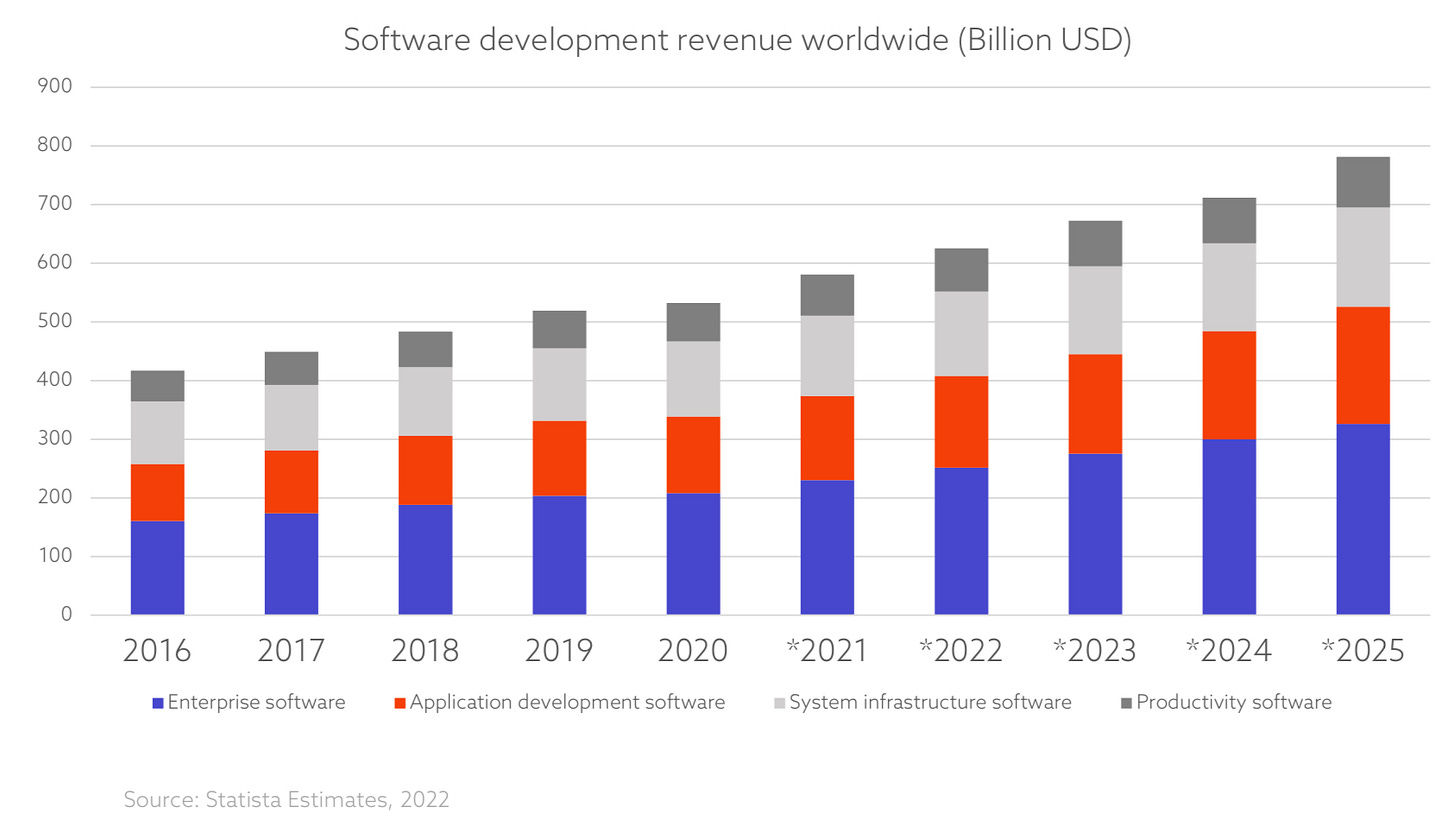

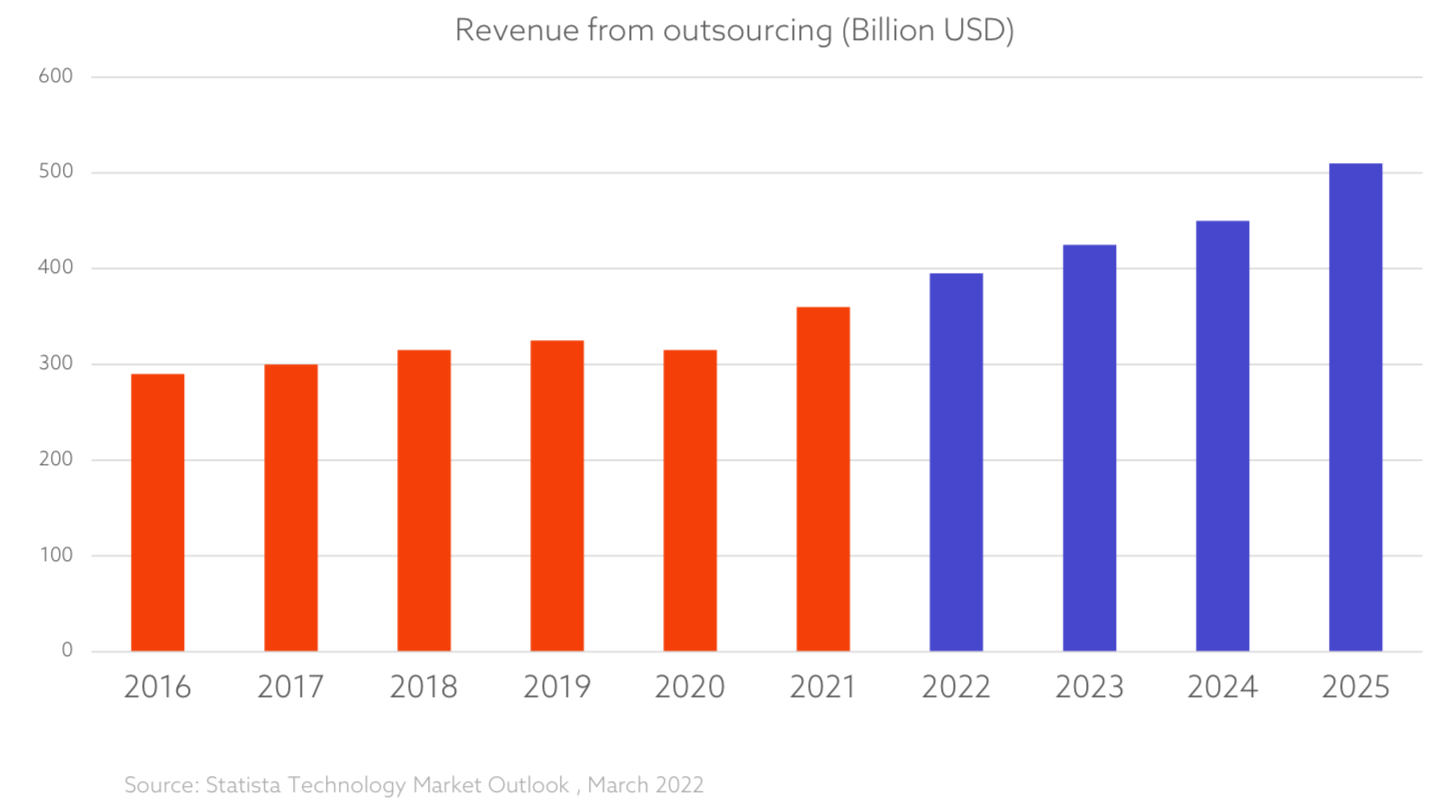

If we just look at the numbers, the market is gigantic. The next charts should paint a pretty clear picture:

2/ Challenges

But the software market is not without difficulties. As a result of large price increases, employees have become more expensive, while the tough economic environment has reduced revenue growth. And because of higher interest rates expenses have gone up further. This together reduced profitability and has hurt many smaller players in the industry.

The article below is for Israel, but it illustrates how bad the software market looks right now.

While the situation is bad and there will never be a clear uptrend without and pullbacks, the long term view is stronger then ever. With AI, Machine Learning, Quantum Computers, Electricity problems, etc. the demand for software is only going to increase.

Further, a bad economic environment for the short term means more concentration and market share for the strong players in the industry.

Now with that out of the way, let’s have a look at one very interesting company:

3/ Polandˋs growth champion

So if we look at software companies, the process is not different from other stocks. We just want to buy a company that is currently undervalued by the market and hold the stock for some time. Over time the company will become worth more and the market catches up to reality and values the stock correctly.

Since the environment for software developers is not the best, I want to look at high quality companies that will survive the storm easily. Further, I want a company that has a track record of growing quickly. By applying this mindest during my research, the stock of Spyrosoft stood out.

Spyrosoft SA:

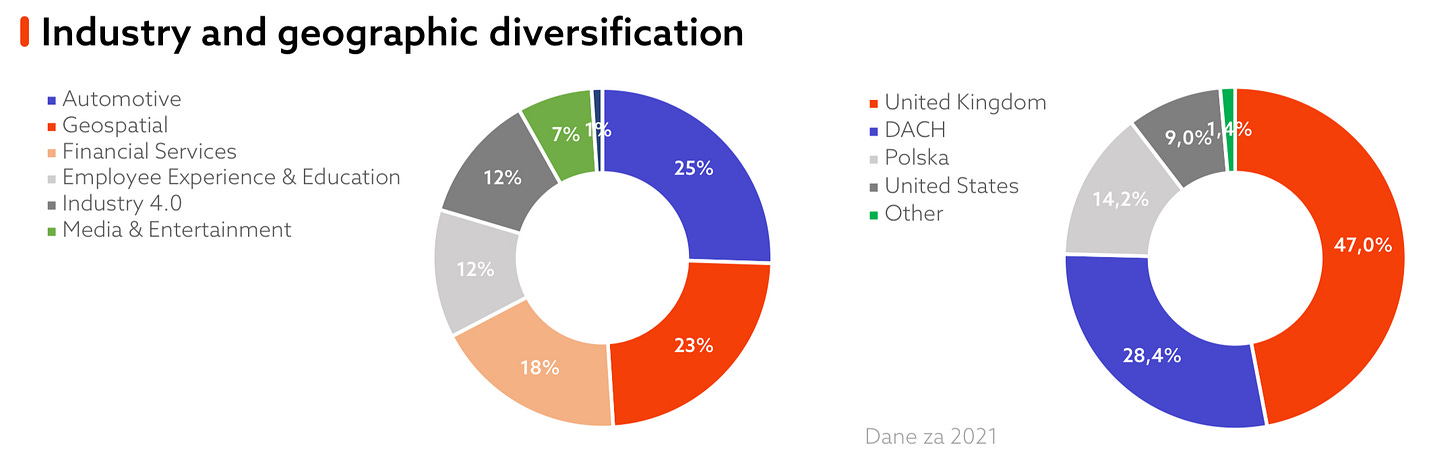

Spyrosoft is a polish software developer located in the city of Wrocław. The company has around 1000 employees and has customers from a wide variety of sectors.

As you can see below, The company is diversified in 6 main business areas and the company generates 47% of it’s revenues from the UK.

The company has achieved tremendous success over the past decade, which was mainly the result of cheap polish software developers working for them. The company would then sell their services to “Western“ companies that paid them (for polish circumstances) very well. Now the company has a new focus for growth, CULTURE !

Insiders owns 85.1 % (!) of the company, it’s founder led and has subsidiaries in a lot of countries. These subsidiaries are run by the best employees of the company and are also partly owned by the employees. This motivates the employees to work hard and create value for their families and the shareholders.

The five-year motivational share option programme will cover the key Spyrosoft Group employees. […] The programme will result in the issue of shares (approx. 5% of the shares). The programme will start in 2022 and will cover current and future employees.

The consolidation will be conducted based on share exchange parities based on the EBITDA of the subsidiaries for 2026 and market multipliers. The exchange is planned for 2027

— Spyrosoft 2022-2026 strategy report

Financials & Valuation:

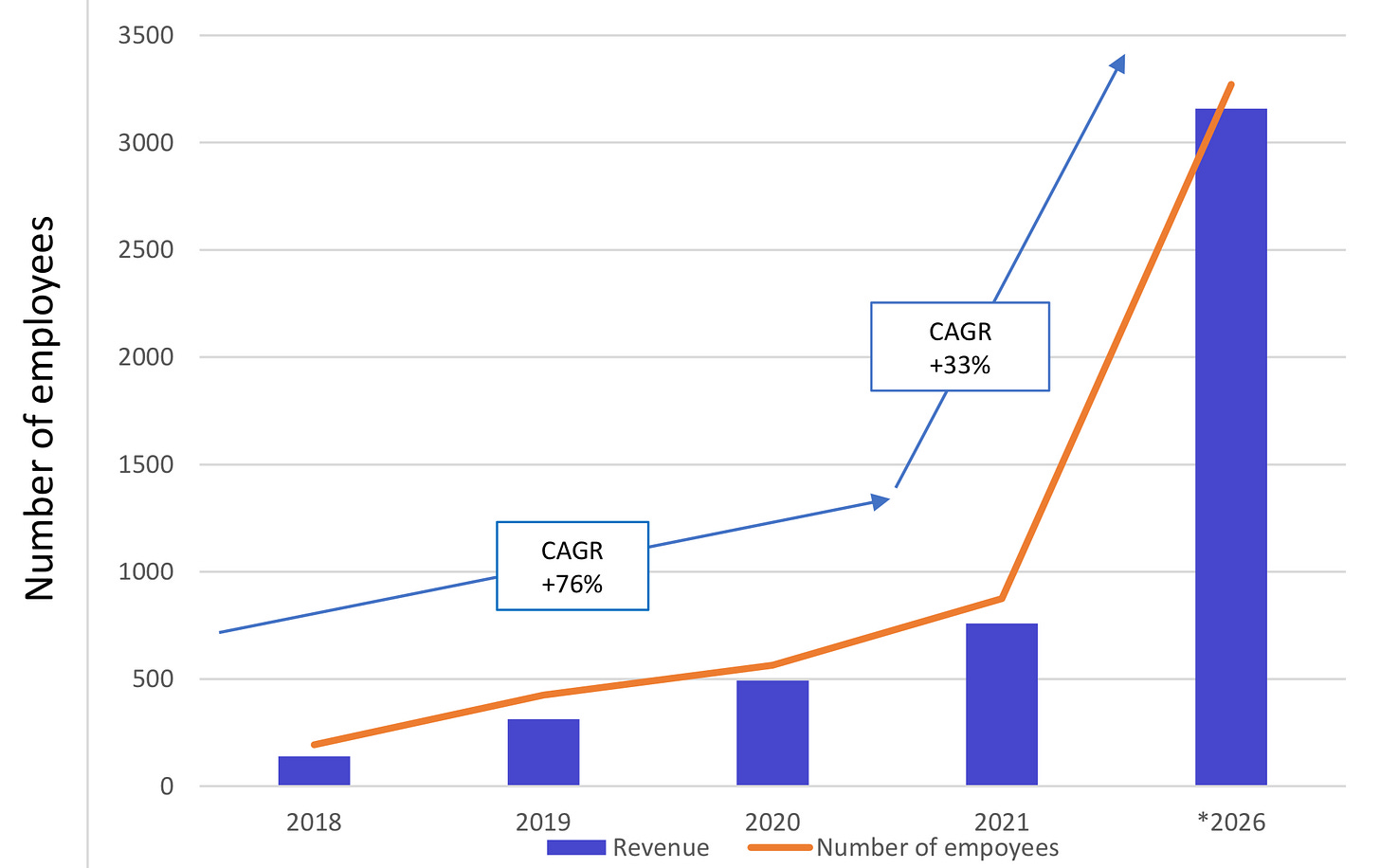

So looking at the long term plan, they will simply execute and grow further. The goal is to grow revenues between 25-35% until 2026, while EBITDA margins will vary between 11-14%.

Looking at the valuation, I will assume:

27% revenues growth

10% EBITDA margins

Exit multiple of 11x EBITDA (current multiple)

Total dilution of 7%

By doing this, the future share price in 2026 would be 792 PLN, which is +93% above the current share price.

Risks:

But Spyrosoft is also not without problems, in their last earnings report (H1 2023), we saw revenues rise 47%, but EBITDA margins dropped to 8% as a result of higher investments and higher salaries. So the most important factor to consider in our assumption is the margin. If I do the above calculation with 14% margins it will look out of this world. But if I do them with 7% it will look pretty bad.

Another risk is that the dilation is getting out of hand and that shareholders basically throw money down a black hole.

3/ Conclusion

All in all, the software developer market is currently under fire from several fronts. But the long term outlook is still great. There will be clear winners that will emerge stronger out of this crisis, and Spyrosoft looks like it’s positioned to do just that. There are some risks, but the risk reward ratio looks very tempting.

I want to end this article with a great and inspiring quote by John F. Kennedy:

“Those who look only to the past or present, are certain to miss the future."

- John F. Kennedy

Yours sincerely,

MODERN INVESTING

What are the reasons?

The article below is for Israel, but it illustrates how bad the software market looks right now.

Good article, Spyrosoft looks interesting.