THE NEXT WALMART

Eastern Europes next multibager ?

The Economic rise of Eastern Europe

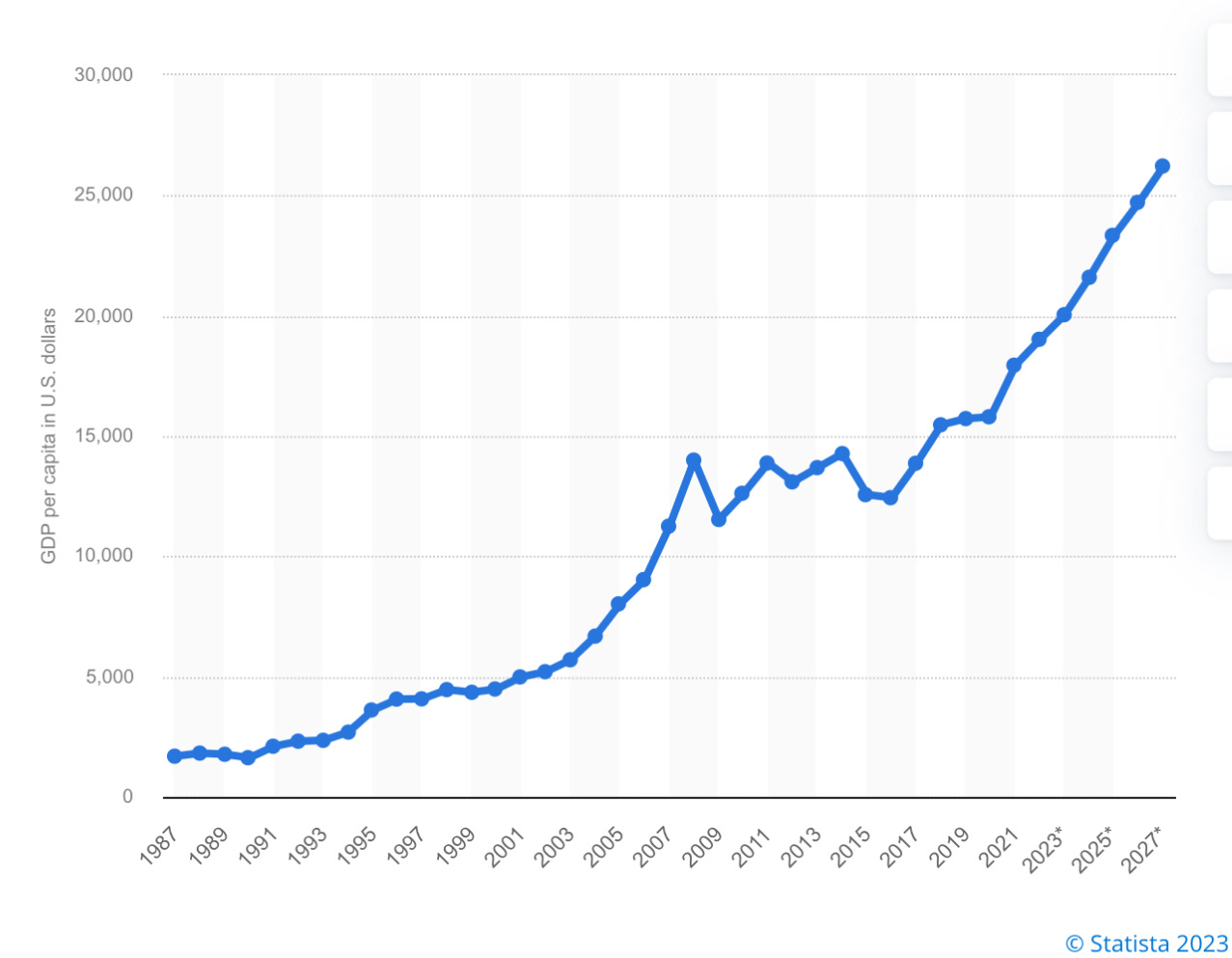

After the collapse of the Soviet Union in 1991 countries like Poland, Georgia, Kazakhstan etc. had to adapt a new system to catch up with the world.

This system is/was called capitalism. Let’s take Poland as an example. In 1991 it had a GDP per capita of around 2000$, which was significantly less than countries like France or Germany (Germany had 23 000$). Well today the situation looks different, Poland is known as the new and better Germany and it is projected that Polands GDP per capita will overtake that of Britain in 2030.

“The data shows that GDP per capita in 2021 was $44,979 in Britain and $34,915 in Poland, (…) Poland - should it maintain its 3.6% average annual growth - will overtake Britain by 2030.“

— TVP World

Now this development is not only limited to Poland, other countries in Eastern Europe are also catching up. While countries like Poland have fascinating economic growth, the stock markets in these countries are largely ignored by the west. Even in Germany, the neighbor of Poland few people invest in this market. Which is a big opportunity for us.

1.0 Dino Polska DNP 0.00%↑

Since I have polish ancestors, we are going to start with a polish investment idea.

The growth in GDP per capita in the country led to much higher living standards, which in turn profited companies that are in industries directly or indirectly related to the consumer. Retail is often one of the first things that develop themself as soon as living standards start to take a positive turn.

Dino Polska is a polish grocery chain focused on small villages and rural areas in the country. While this my sound stupid to most Europeans and Americans, we have to keep in mind that the population is Eastern Europe has a different density than in the west. 80% of the population lives in those rural parts of the country.

The founder Tomasz Biernacki is the richest person in all of Poland, and still nobody knows how he looks like.

But his track record speaks for himself. Revenue CAGR (Compounded annual growth rate) stands at 46% over the last 5 years. With ROIC (return on invested capital) of 26% the company is fascinating. There is no dividend or buyback in the foreseeable future. WHY ? Because the management team reinvests all the profits for even more growth. The market realized this and early investors made a lot of money. While this is true, there will be a lot more money to be made over the long term with this stock.

1.1 The next Walmart ?

Walmart doesn’t need any further introduction, it makes 500 billion $ revenue every year and dominates the retail market in the US. My thesis is that Dino Polska will be in 20 years for Eastern Europe that what Walmart is today for the US. Let me explain.

Peter Lynch is a famous investor who made 29% p.a. over 13 years. One of his best investments was Walmart, he said:

Wal-Mart went public in 1970. You could have bought it ten years later and made 30 times your money (…) You still could have made 30 times your money because ten years after Wal-Mart went public they were only in 15 percent of the United States. They hadn't saturated that 15 percent and they were very low cost. They were in small towns.

— Peter Lynch

He points out that the stock of Walmart made 20X in a period of 10 years. Even if you bought at this stage you would have made 30 times your money (interview from 1994). Since this interview the stock made another 1000%. But most importantly he said, that Walmart WMT 0.00%↑ focused on small towns. This is the same story as Dino.

Walmart had 10 years after it’s IPO 15% market share in the US. Dino Polska has 6.8% market share in Poland. Why couldn’t Dino grow to 20% market share ?

An expansion into other parts of Eastern Europe is in my opinion the next BIG step for the company. It will take some years but the similarities are fascinating.

1.2 Competitors and Biedronka

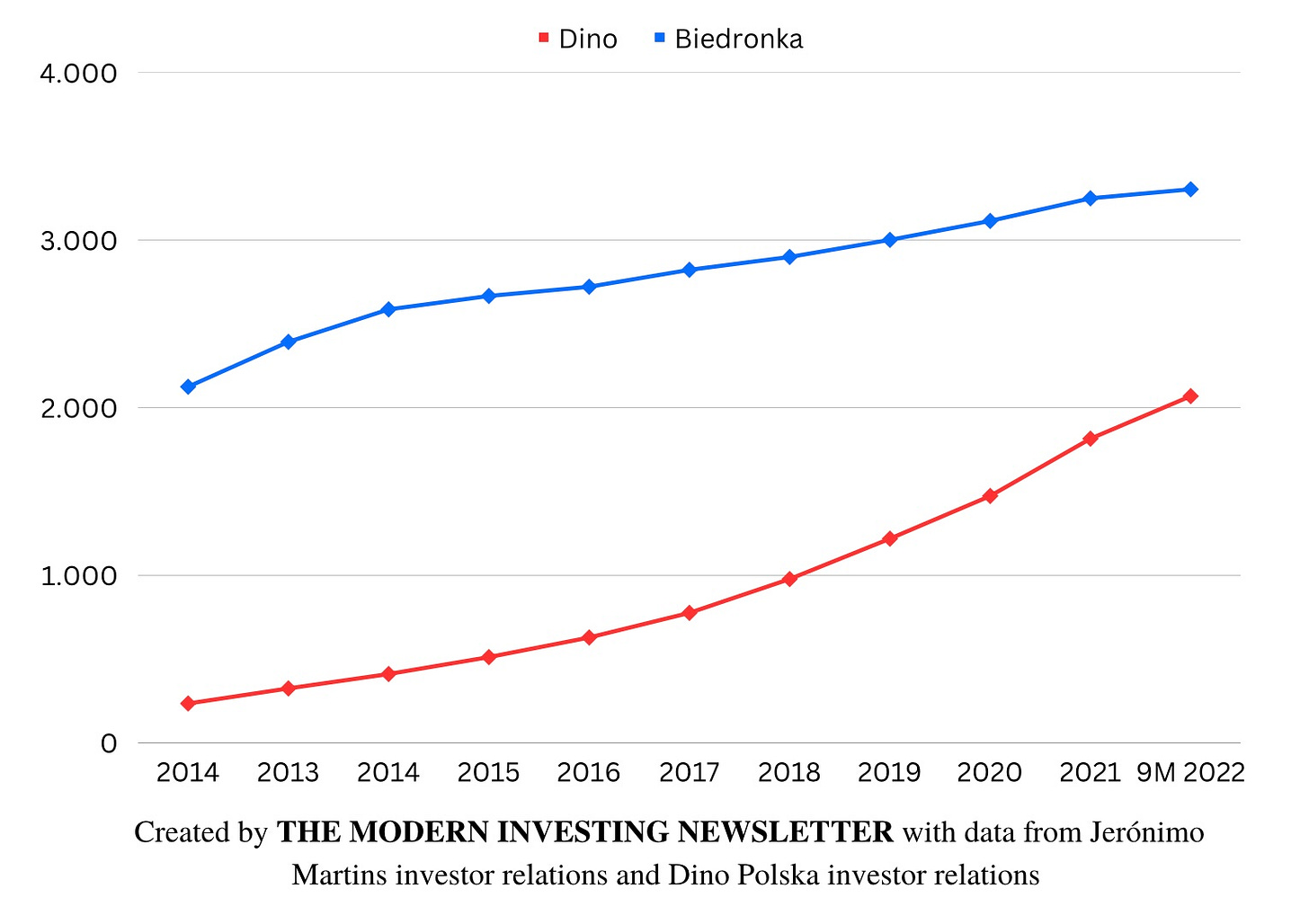

The largest competitor of Dino is Biedronka (translation ladybug), Biedronka has a total of 3304 stores, while Dino “only“ has 2069 stores. But the growth rate at which Dino is growing is significantly higher than that of Biedronka.

While there are other grocery chains that are trying to compete with Dino or Biedronka (which is 100% owned by Jeronimo Martins), they don’t have a chance to grow much. Dino and Biedronka are taking market share of the small grocery stores, run normally by only a few people. These stores can’t compete with them and often they dominate the market in this areas.

In the foreseeable future Biedronka and Dino won’t compete directly. Since the market has still a lot of room to grow and there is a lot of market share that can go to them simply by continuing operations.

If they would compete directly at some point the future, Dino would in my opinion win this battle. Because Biedronka is owned by Jerónimo Martins, and Dino is a company totally focused on the polish market, Dino could use it’s experience to gain an advantage.

Ebay may be a shark in the ocean, but We’re a crocodile in the Yangtze River. If we fight in the ocean, we lose, but if we fight in the river, we win.

— Jack Ma Founder of Alibaba

It is also worth noting, that Dino Polska owns all stores themselves. While Biedronka and other competitors often just rent the buildings. While this a less cost intensive business model, in times of inflation, and over the long term it is significantly cheaper than renting the stores.

1.2 Valuation and Price Target

While Dino is a great business, the price you pay for this beautiful business is what matters in the long run. If we annualized the Q3 22 earnings, we get to a P/E of 29. Which is very high. Now we are in a difficult environment for the stock market. Rising interest rates, inflation, banking crisis etc. I hope that the stock drops to a more reasonable valuation of 20-18 times earnings.

Until we see that, the stock remains on my watchlist and will definitely be bought if it drops.

1.3 Conclusion

Dino Polska is an amazing business, which even during times of 17% inflation in Poland can grow at rates between 30-40%. The company is run by an exceptional CEO, who is also founder and owns 51% of the company. For me the price is still to high to pull the trigger. But over the long term the stock will likely be a success story comparable to Walmart.

Nice overview!

When I visited my grandparents, we had a netto there (I think it has a Norwegian owner). For me, it has by far the best cottage cheese (twaróg). :-)

What about it in this group?

All the best,

Alan from financial-engineering.net

I think it would be very ambitious to overtake the UK that fast.

As for Dino, I like the simple business model. All the shops look the same. In my town (25 000 inhabitants) two shops are located in developing parts of the town where new blocks and single-family housing estates are being built. One Dino is under construction outside the town. Until a few years ago, there were no Dino in the area. As for the reception of the store from the consumer, Dino shops are cleaner than Biedronka shops. I personally prefer Lidl than Dino and Biedronka, but maybe it's because I have it closest.