Jerome Powell signaled rate cuts in 2024 and the stock market rallied as if there was no tomorrow. If things are continuing the way they do right now, we are going to have a situation similar to the one Argentina is facing right now.

Remember:

“Throughout history there have been only four kinds of economies in the world: advanced, developing, Japan, and Argentina”

The reason people laugh about the Argentinian Economy, is the the following. The country moves from one crisis to another. From Inflation, to default and social unrest. Lately the win of Javier Milei to become president has sparked hope for better policies, that benefit the country. The U.S. is sadly on the same path as Argentina has been for decades now. 👇

1.0/ Point of No Return

Federal spending is increasing, while income is not keeping pace with spending, resulting in a deficit. The U.S. deficit is projected to reach 1.5 Trillion $ by in 2023. And with 34 Trillion $ in debt, the interest expense alone is more then 1 Trillion $ year to date !

If the U.S. would be a person, it’s financials would look like this:

44k $ Income (yearly)

61.3k $ Spending (yearly)

340k $ debt (yearly)

Interest on debt alone >10k $ (yearly)

Would you as a creditor lend this person money ? I wouldn’t ! But creditors are willing to take on more risk in exchange for a higher possible reward. Therefore the U.S. treasury has to sell bonds at a higher interest rate, in order to fund themselves. These are the same problems Argentina had/has. In order to solve this problem you can either earn more or spend less, earning more would be the result of higher taxes, while spending less is self explanatory.

Raising taxes will likely not help, since the ultra rich always find a way around them. Further, there are a bunch of lobbyists that would cancel such a plan before it would go trough. The effects would be lower corporate margins and with it lower profits. As a result companies would invest less in the U.S. and over time, other countries would get a larger share of the R&D spending.

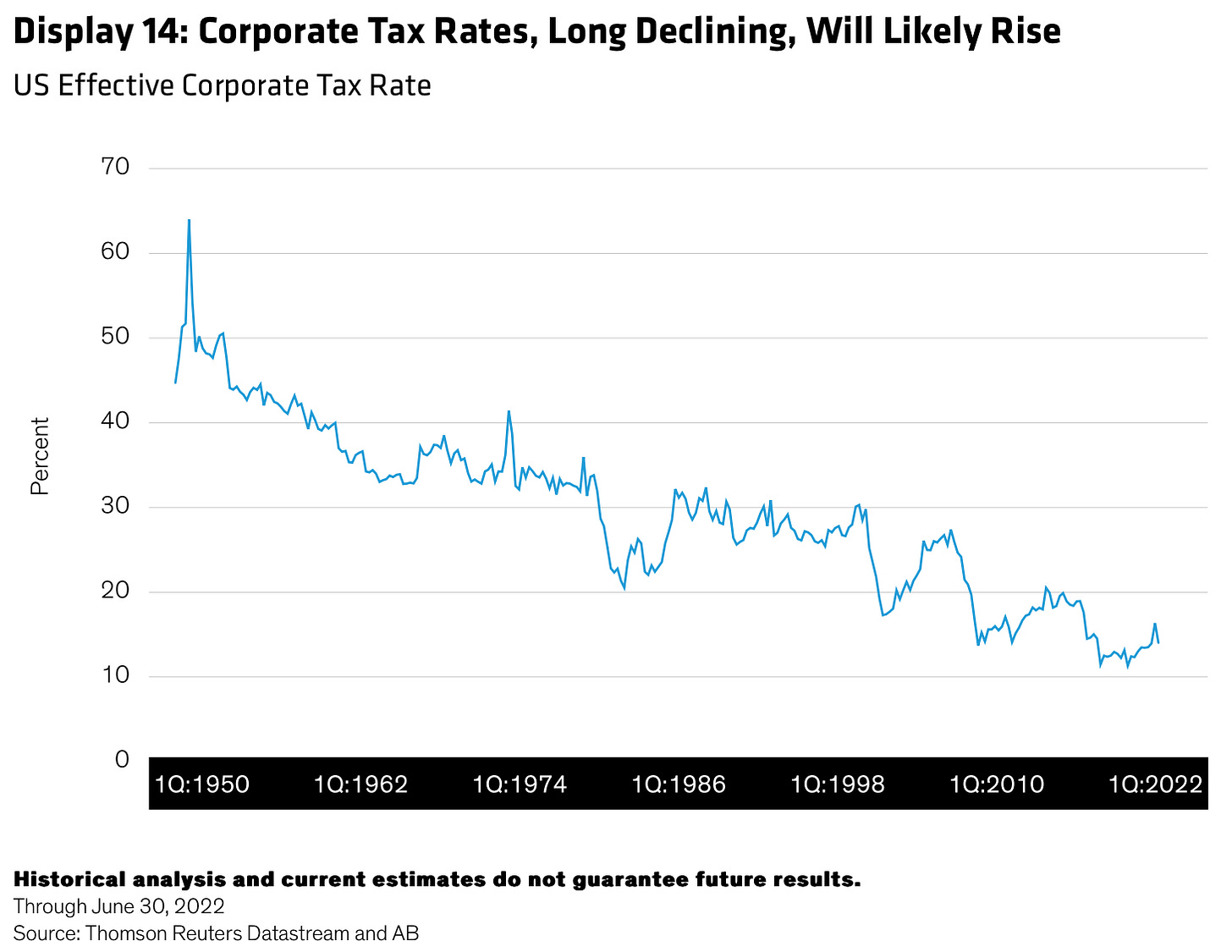

Since tax rates have dropped a lot the last decades, it wouldn’t come as a surprise, if they would be moving up again.

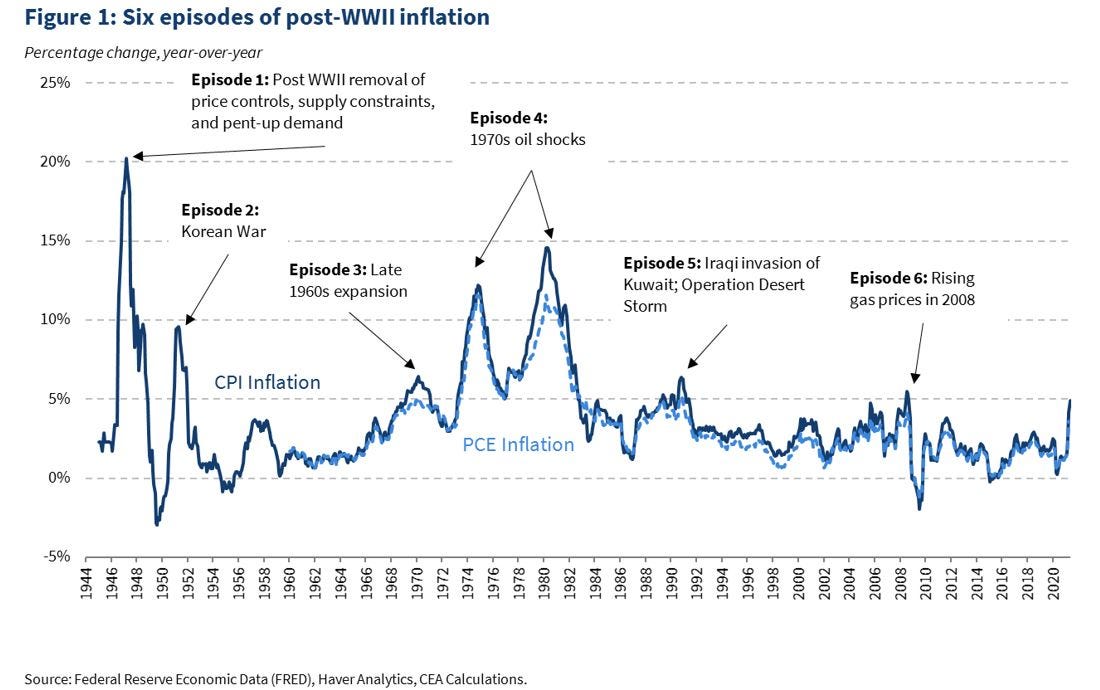

Now to the 2nd way of solving the problem. Cut spending ! The problem is, that cutting spending is very difficult. Let’s say that the U.S. could cut spending by 30% ! This is nearly impossible and would also assume that interest expense went down. But let’s say this would be possible as a result of great leadership by U.S. politicians (the opposite of the current path). Then the U.S. would be earning as much, as they are spending. But they still have huge amounts of debt. So the only solution is, to reduce debt. How could this be achieved ? Either you pay it down (not possible at this point) or you inflate it away. This is the path we’re on and if people assume that inflation is dead, you should keep in mind, that there were 3 inflation waves in the 70s.

In the post WW2 period, we went from inflation to deflation and to massive inflation again. 👇

The Suez Canal is going to have problems as a result of the tensions in the Middle East. The Panama Canal is operating at lower capacity, as a result of a severe drought. And central bankers are indicating rate cuts ? In my opinion a fatal mistake. But we will see …

2.0/ Impacts on Investments

The path the U.S. is on, is unsustainable, inflation, interest rates and taxes will push down corporate margins. With inventories expected to rise again, margins should drop from historically elevated levels.

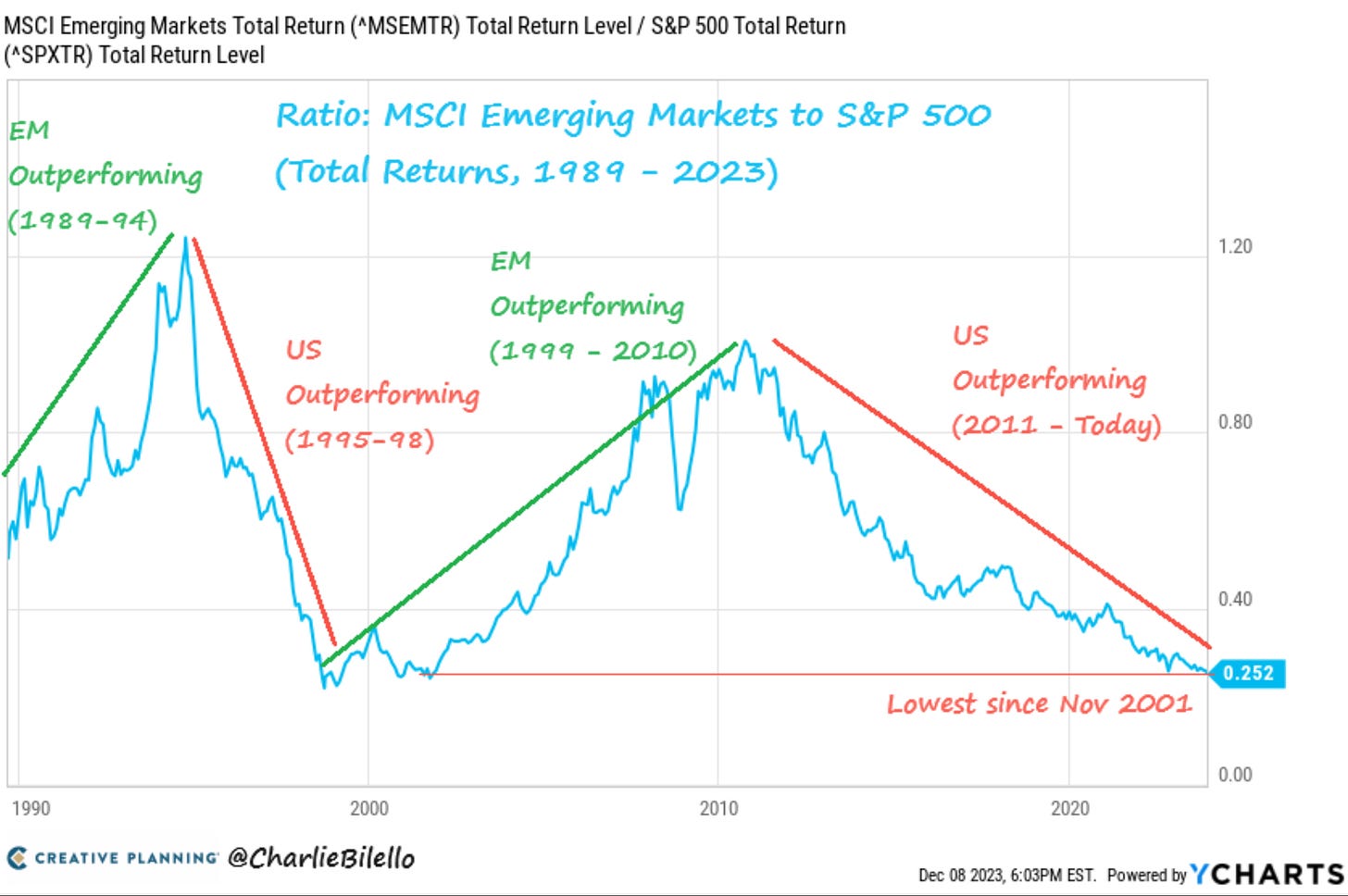

In the meantime the S&P 500 and NASDAQ 100 are trading at historically near all time high valuations. I try to stay away as far as possible from these indices. The American indices will underperform their historical average over the coming years.

Emerging Markets are trading near all time lows compared to the S&P 500 and have a great risk/reward ratio in comparison to the U.S.

Further, defense spending will increases meaningfully over the coming years, as global tensions rise. If we get just closer to the levels during the Cold War (5x current spending), weapon manufacturers would outperform the market by a lot. 👇

After World War II, the US reduced defense spending to 7.2 percent of GDP by 1948, boosting it to nearly 15 percent during the Korean War. During the height of the Cold War with the Soviet Union US defense spending fluctuated at around 10 percent of GDP.

— U.S. Government Spending

Oil, Gas and Precious Metal stocks should perform also quite well, as they are seen as an inflation hedge. The fact that they have a limited supply and that breakeven costs will increases with rising inflation, supports this argument. Lastly, companies that own assets, which are rare or hardly replaceable should perform well, because the value of assets increases over time (especially in times of elevated inflation).

3.0/ Conclusion

All in all, the U.S. is playing a risky game that is similar to the path Argentina went on, which ultimately resulted in a catastrophic decline of this nation. There are many reasons why inflation could rise again and with rate cuts, it will be even harder to combat this problem. In uncertain times it’s smarter to avoid these problems and search for value in other sectors and locations. Among them are commodities, emerging markets and “defense“ stocks.

Always remember that:

A clever person solves a problem. A wise person avoids it.

— Albert Einstein

Yours sincerely,

MODERN INVESTING