¡Viva Colombia! A story of political unrest and shareholder returns

Geopark $GPRK and Parex Resources $PXT.TO are tremendously undervalued …

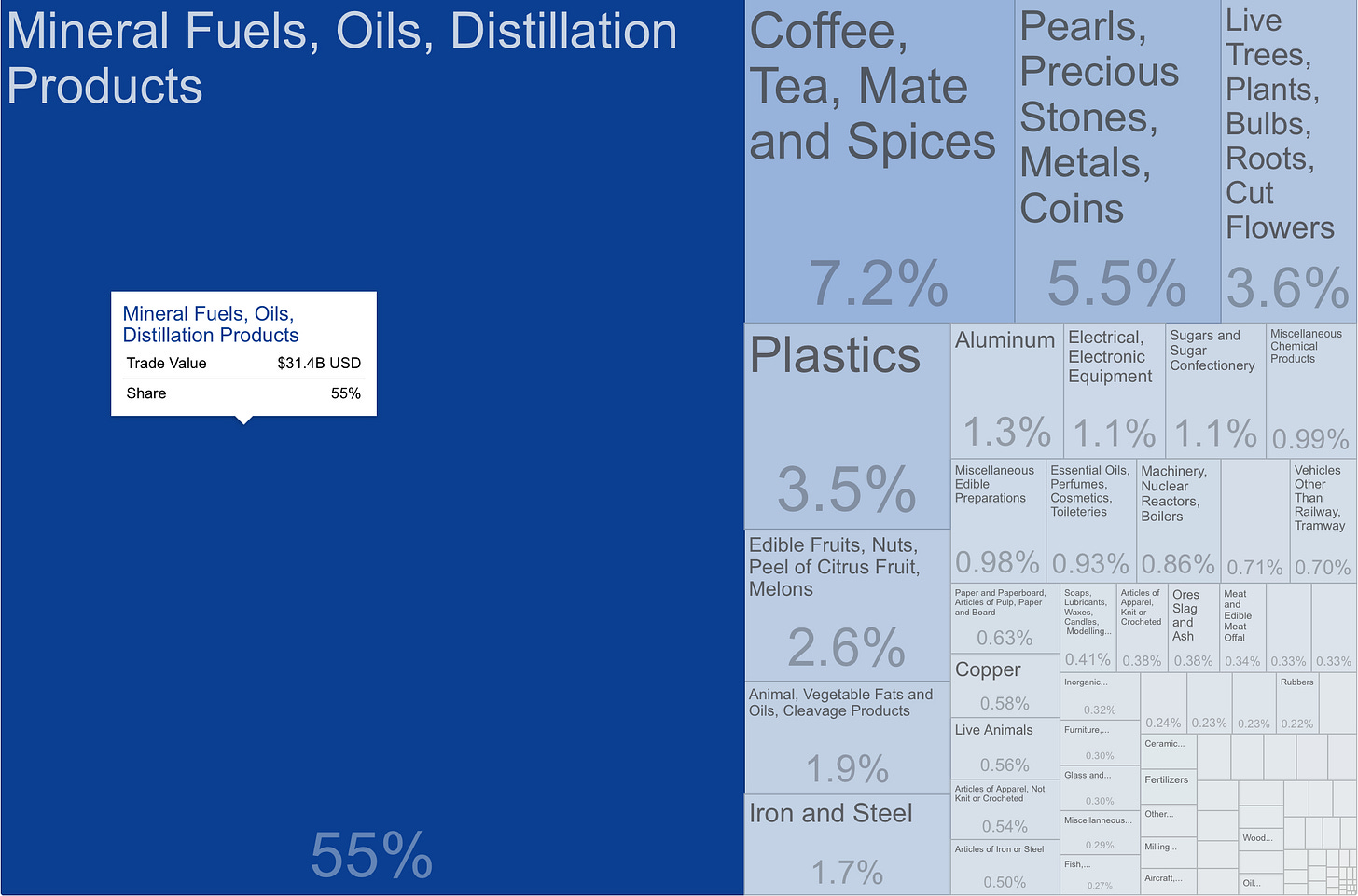

In recent years Colombia has become a destination for expats from the U.S. and Europe, but the stock market in Colombia is still very undervalued and basically ignored by western investors. If you know anything about LATAM, then that there are gigantic oil and gas reserves in the region. Therefore it comes as no surprise, that half of Colombia’s exports are hydrocarbons.

Ecopetrol is the flagship energy company in Colombia, and the majority shareholder is the Colombian state. I mentioned that Colombia’s stock market is left for dead, if we compare different sources, we arrive at a P/E of 5-6 ! The reason for this low valuation, is obviously the high concentration of sectors such as oil, gas and banking. Another reason is political uncertainty. A few months back JP Morgan said, that Colombia is at risk of losing the emerging market status.

The reason behind this statement was political instability, low trading volume and of course the bad track record of the Colombian stock market. The question is, from which perspective you look at things. Do you see an opportunity with a stock market down 80% from the highs 14 years ago? Or do you see a country that’s collapsing? I don’t think it’s collapsing, so you can guess my position on this topic.

2/ Politics

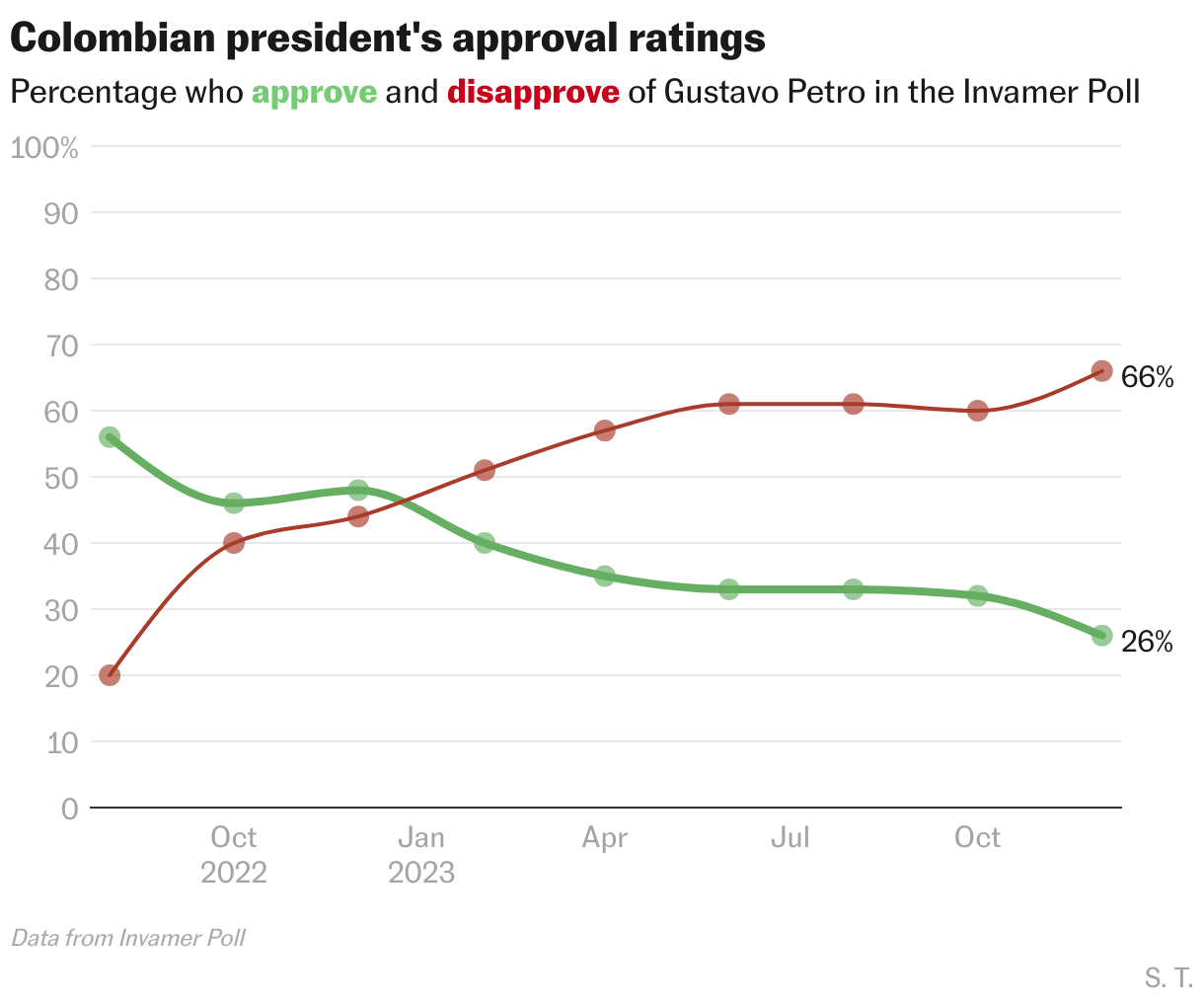

Petro is the 1st leftist president in Colombia’s history, and as you can see below, the people aren’t to supportive of his policies anymore. With an approval rating of just 26%, and conflict between him and the congress, he has hit what some would describe as rock bottom.

From what I have read (please point out any flaws if there are ones), Colombia is currently in phase of war between the elites and the leftist government. The situation was describe as a “soft coup” by a media outlet, that claimed that Attorney General Francisco Barbosa led this coup in the name of the elites in Colombia. The previous Attorney General openly declared his contempt for Petro’s government, but as the Suprem court has to elect a new Attorney General, there is political uncertainty regarding his stance on the current government.

Unionized teachers plan to hold protests in multiple locations throughout Colombia on Feb. 8 to denounce alleged attacks and persecution from the country's Attorney General's Office. They are also calling for the selection of a new Attorney General. Additionally, supporters of President Gustavo Petro plan to have another rally at Plaza de Bolivar in Bogota, starting at 12:00.

Protests in other cities are likely, including Cartagena, Barranquilla, and Cucuta. Thousands are likely to participate in most demonstrations, especially in Bogota. Transport and business disruptions are likely, as is heightened security near government buildings. Clashes are unlikely, but cannot be entirely ruled out.

— CRISIS 24

Parex Resources, which is one of the largest independent oil and gas producers in Colombia, reported that oil production would be down 4-10k boe/d as a result of the protests.

All in all, the situation in Colombia appears to be not as dramatic as portrayed by the media. Several times in Colombia’s history, there have been protests and riots as a result of politics, and the country still exists. With one of the cheapest stock markets in the world, there are several interesting stocks. These are namely Geopark GPRK 0.00%↑, Parex Resources $PXT.TO, Ecopetrol EC 0.00%↑ and Bancolombia CIB 0.00%↑. My personal favorite is Geopark, as the independent oil & gas producer is deeply undervalued and has great capital allocation.

3/ Geopark

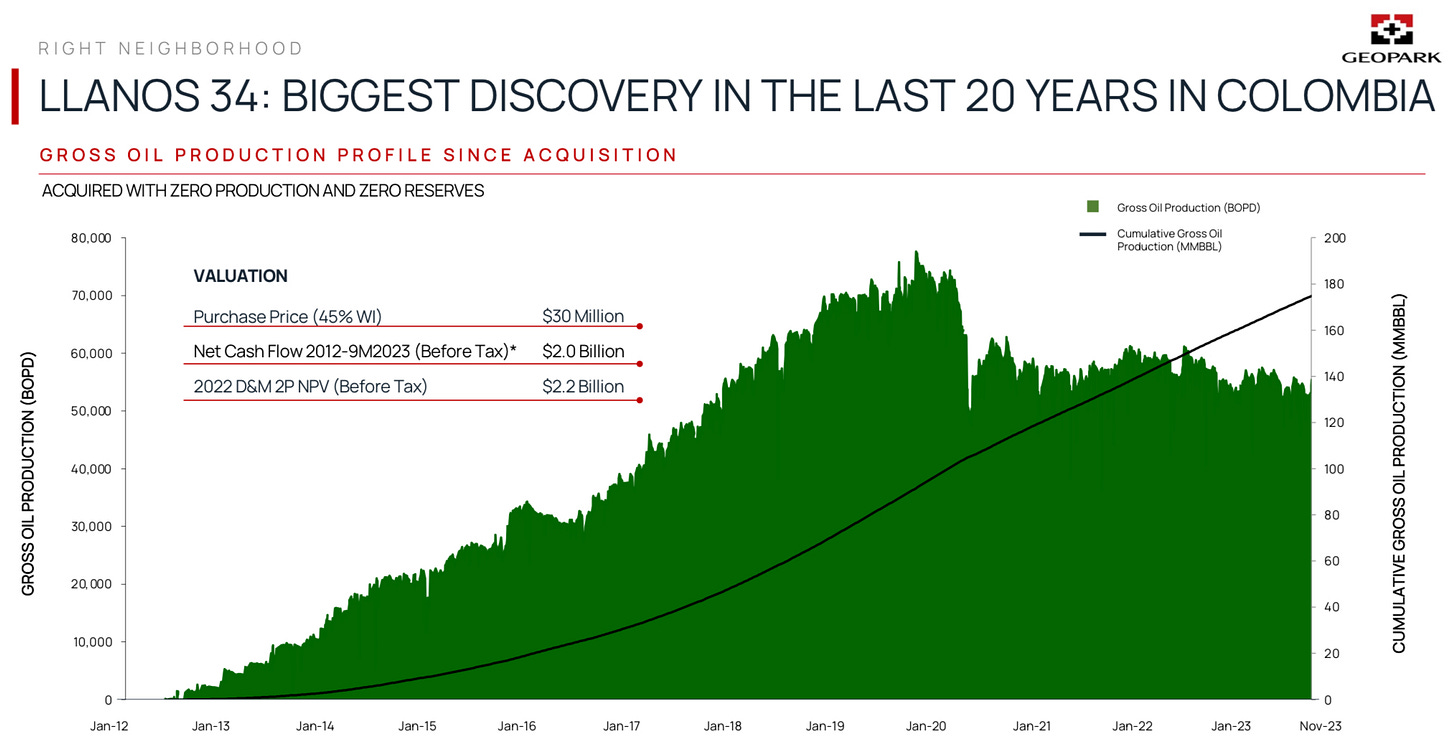

Geopark produces around 37k boe/d and produces the absolute majority of it’s hydrocarbons in Colombia. The company has a market cap of around 500m USD and is to ~60% in control of institutional investors and insiders. This limits the float and in combination with the fact, that the company is from Colombia, limits the amount of investors even considering the stock as part of their portfolio. The Llanos 34 block is the major block for both Geopark (45% ownership/operator) and Parex Resources (55% ownership). 👇

The breakevens for the company are around 25-30$ a barrel of Brent. This gives much more predictable cashflows in uncertain and volatile times. Llanos 34 has created massive value for the company, as it was bought for just 30 million $ and has generated cash flow of around 2 Billion $ over a period of 12 years.

In addition to the 45% stake in Llanos 34, Geopark also has a 30% stake in COP-5, which is considered the fastest growing block in Colombia.

The founder of Geopark is James Park, who co-founded the company in 2002 and was CEO till 2022. After his retirement, he still owns 15% of the company and has placed Jaime Uribe as the new CFO of the company. Jaime Uriabe was the former CFO of Ecopetrol, and is the perfect choice for this position. One of the strengths of Geopark lies In it’s capital allocation. Operating Netback is 3x it’s CAPEX, which indicates, that for every dollar invested into the company, they generate 3$ in netback.

Furthermore, the company announced a share buyback program of up to 10% of it’s shares outstanding till the end of 2024 ! This is on top of the already nice dividend yield of approximately 7%. Geopark has repurchased 20% of it’s shares since 2019 (excluding the new buy back program) and has hedged around 1/4th of it’s production going into 2024. The company has a reserve life of 9 years (2P reserves), and has Net debt of 387 million $, compromised of a 550m $ bond that matures in 2027 and has a fixed interest rate of 5.5%.

Based on my calculations (multiplying production with reserves life), I get to around 120-130m boe in 2P reserves. The company itself states, that it trades at a 39% discount to 1P NAV per share (14$) and 56% discount to 2P NAV per share (25$). If we were to value Geopark at 9$ per boe in 2P reserves, we would get to ~1.2 Billion in value. If we subtract the 387 million in Net debt, we get to around 813 million $ fair value at the moment. This would imply an upside of 40%. Over time the company will produce cash flow, which will pay down debt and be distributed to shareholders via dividends and buybacks. Geopark estimates 90-160m $ in FCF for 2024 at 80-90$ per barrel of Brent. This is a simple model to illustrate the risk reward with Geopark.

In my opinion the company is even at fair value not a bad investment, as the shareholder yield alone is a nice return. On the technical side, there is a long term trendline that was slightly undercut recently. But the stock got momentum as soon as it entered the traget zone (green box) and has had pretty high volume on the days following the (probably) bottom in December.

Long term Geopark share holders would lose money, if the price of oil falls significantly and/or there would be massive political violence and unrest in Colombia. Both look at the moment in time very unlikely, which made me buy my first position in the stock. If you have any questions or informations, please comment them down below.

Yours sincerely,

MODERN INVESTING

Why own this over $PXT.TO ?

I have all 4 of the Colombian stocks you mentioned, I believe once Petro is gone Colombia will be quite ripe for Argentina/Milei type of repricing. Another company I own there is grupo Aval.