#1 Fertilizer market

“Buy when there is blood in the streets“ — Baron Rothschild

For global live, Fertilizers are close to as important as water. Over the last 75 years the human population has tripled. While the output of for example corn has grown by 450%, the land area used for farming corn hasn’t gone up at all ! This is the result of more efficient farming and importantly fertilizers.

In this part of Weekly Industry Focus, we are going to have a closer look at the fertilizer industry. Who are the biggest players ? What are problems these companies are dealing with ? And when will the industry turn around ?

Let’s get into it:

1/ Market overview

The fertilizer market has several companies that are competing for more market share. But the most important factor for profitability is notably the price of Nitrogen, Urea and Ammonia. These are the most widely used commodities in the fertilizer industry.

Emerging nations will require much more fertilizers over the next decades, in order to support the growing populations of these countries. Further, a warmer climate and the need for food security will increase the demand for fertilizer products over the coming decades.

But as a result of much higher supply and lower demand, the prices have crashed over the last year.

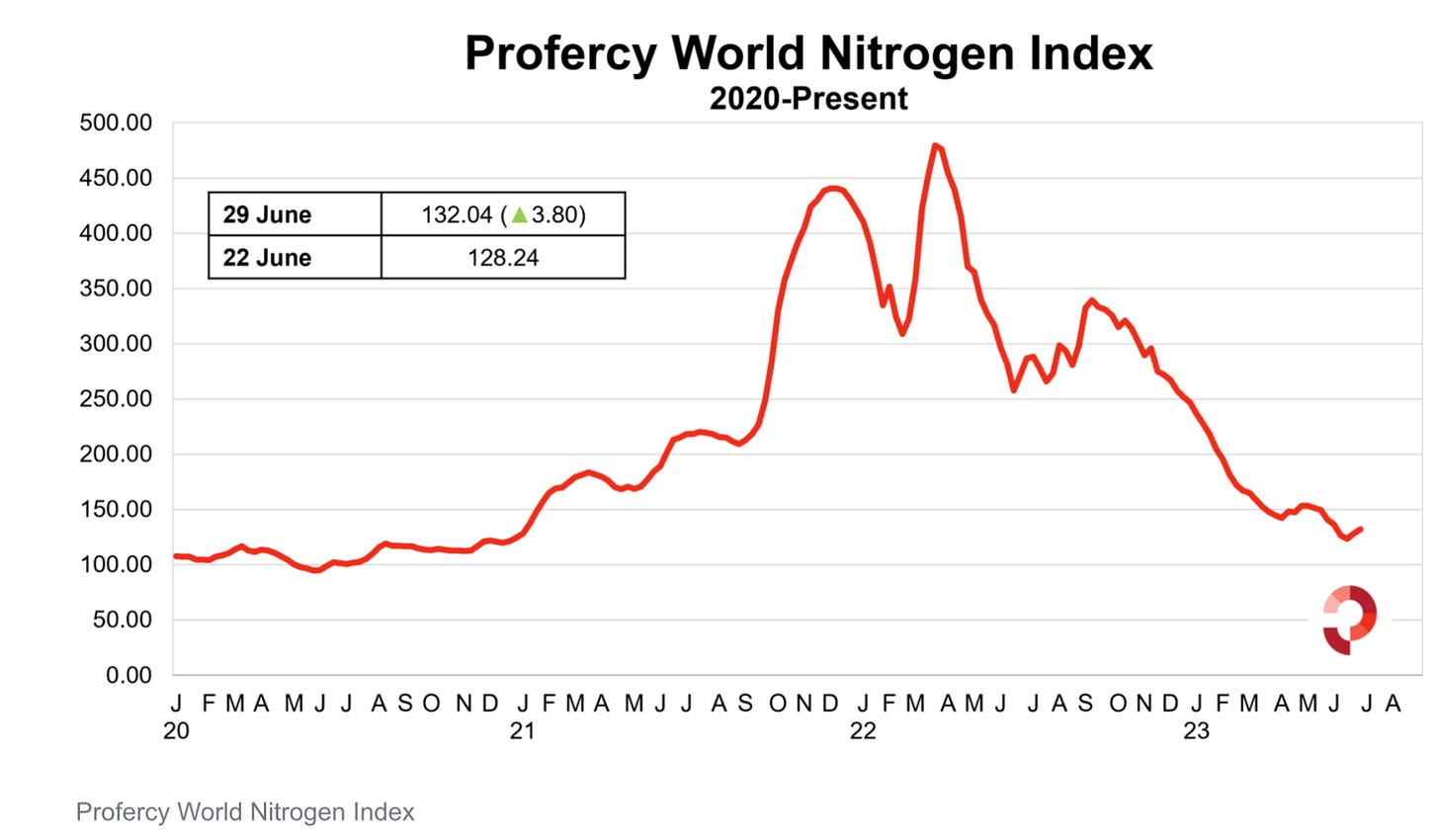

The world Nitrogen Index for example has fallen by close to 75% (!) from it’s high in 2022.1

The main reasons for this are lower demand for the products, higher supply and lower production costs. The price of gas has fallen 50% below per war levels and has created a “death spiral“ for producers.

Further, Russia & Belarus have exported record amounts of Nitrogen to the rest of the world. That’s the case, because the western nations haven’t sanctioned these kind of exports from Russia & Belarus.

2/ At rock bottom

I highly doubt that the prince of fertilizers will fall even further, because many producers from South East Asia, Nigeria, Russia, etc. are cutting supply.

Further Nutrien (one of the largest producers) declared that they will stop the construction of a new plant, because the prices for Ammonia have fallen so low.2

This gives a good representation of the entire market, that has been in a brutal bear market over the last 1.5 years. The market is so oversold that many producers are selling for a loss. This combined with the fact that Natural Gas prices are about skyrocket this winter. The prices of Nitrogen are about to go much higher in my opinion.

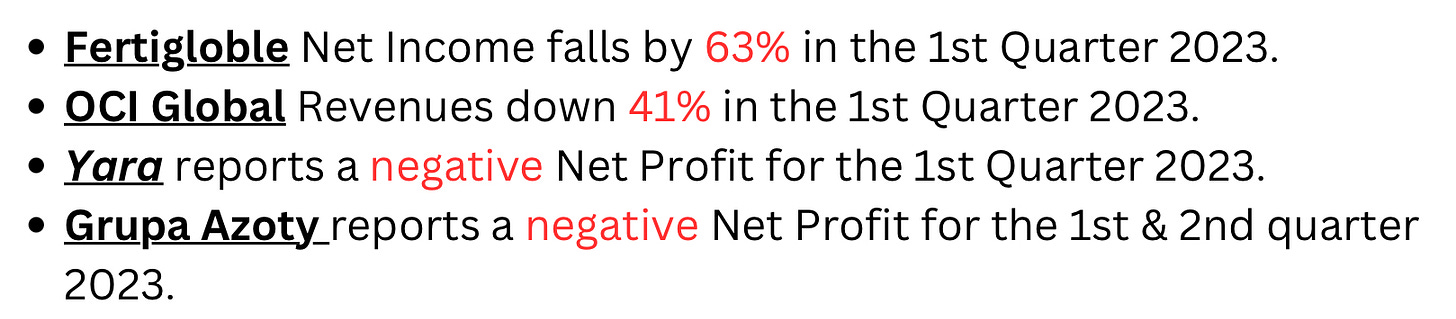

Here is a list of news for a few companies in the sector:

3/ The turnaround

While the situation is very bad for all producers, the sentiment is so bearish, that the stocks of fertilizer producers are near multi year lows. Further, several companies such as Yara or Grupa Azoty noted that they expect better conditions as early as Q3 2023.

The price of Urea has already formed a bottom, and rose by around 50% from it’s low. 3

While the prices start to recover, the supply is getting cut dramatically as a result of the increasingly hard environment for producers especially in Europe.

Below are comments from earnings calls by leading companies in the industry.

“[Yara has] more than half (58%) of its ammonia capacity curtailed and almost a quarter (23%) of the Norwegian major’s finished fertilizer capacity offline at present.“ — Profery

“[This] should result in closures of European marginal production if pricing remains below cost for a sustained period of time,” — Adnoc and OCI Global.

Trough the closure of many production plants in Europe, the supply of finished fertilizers will take a big hit. It’s s also important to note, that as a result of low prices, many plants that are under construction are getting canceled. Therefore very low new capacity will come into the market over the next few years.

The chart above shows new capacity additions ex china over the next years for Urea. 4

4/ Top picks

Now lets have a look at the best ways to play the recovery of the fertilizer industry. In order to compare the different players in the industry I will use the Q1 2023 revenues and annualize them. This is by no means a perfect way to compare these companies but, since in Q1 2023 the industry was at rock bottom, these numbers should provide a rough comparisons of the different companies.

We can see, that the by far cheapest stock is Grupa Azoty. The most expensive one being Nutrien. I expect all of the above companies to perform well over the next 18-24 months. With rising prices and low stock prices, this is an opportunity with a relatively low downside and an high upside.

The North-American producers Mosaic & Nutrien have higher valuations then the rest, but are more resilient and are buying back shares. The European producers Yara, Grupa Azoty and OCI are less resilient then there North-American counterparts. The valuations and dividends are therefore however more attractive.

4.1/ Grupa Azoty

Grupa Azoty is a small polish chemicals producers, with 50% of it’s revenues coming from it’s fertilizer products. The company is owned 33% by the polish state and is considered strategically important for the country.5 Further, the national pension fund of the Netherlands has a stake of 10% in the company.

Polimery Police is a key investment for the entire economy — Mateusz Morawiecki (PM Poland)

As a result of the difficult macro situation, the companies profits have fallen to negative levels. Further, the company has high debt.

But with a market cap of 2.6 billion PLN, the company can be considered deep value. If we take the first 9 months of 2022 for a period that can be considered more normal, we can calculate yearly profits of 2.1 Billion PLN. This implies a normalized P/E of around 1.2 !

Recently the Polimery Police project was finished, that is 100% owned by the company. The construction costs for this project alone totaled 7.2 Billion PLN !

Although the stock is riskier then the other fertilizer stocks, the upside potential is much bigger. The current assets are about the size of the current liabilities, which gives the company at least over the short term some kind of security.

Should the company face any financial issues, the polish energy giant Orlen or the polish state, would probably provide funding in exchange for bigger company ownership, or some of their assets.

4.2/ The asymmetric basket

By creating a basket of Grupa Azoty, Yara, Mosaic, OCI and Nutrien, we can invest into the fertilizer industry with a low risk/high reward ratio. The basket has few of the worlds biggest producers in it. Is diversified between Europe & North America. In a better price environment, the valuations of these companies will significantly rerate. And over the next 18-24 months, I expect that 4 out of the 5 companies will return cash to shareholders. Either trough dividends, buybacks or both.

The current price (August 11th 2023) of the fertilizer basket is 36.23 $.

5/ Conclusion

The investment thesis in the fertilizer market is a classic “buy cyclicals when they are unprofitable“. We can see early signs of a turnaround and I’m bullish on the entire market. Trough the fertilizer basket, we can see how the thesis evolves and if things turn out as expected.

Yours sincerely,

Weekly Industry Focus

Do you have any fertilizer stock?