1.0 Total collapse

Peter Lynch famously wrote in 1989, that:

“Some companies expand into areas widely different from their core business, ultimately to their detriment. I call this diworseification“

There is hardly a better example for this, then Bayer. Once a high flying stock, one bad acquisition ruined the company for years. With the acquisition of the agricultural giant Monsanto in 2016, the drama began.

Monsanto is the producer of Glyphosate, a herbicide used in the agriculture industry, to kill weeds and grasses. But since 2015 more and more people sued Bayer, with the claim that Glyphosate is causing cancer. In front of the court the company lost many battles, leading to damage payments in the billions of dollars.

This has caused the stock to collapse, by 72% from it’s high. The question is, whether Bayer is a good investment right now, or not.

2.0 The problems

Bayers main problems where/are:

Glyphosate damage payments

The CEO

Debt

The former CEO Werner Baumann totally mismanaged the Company, and created the mess we are dealing with today. He was responsible for the Monsanto acquisition, and with it the massive amounts of debt that had to be taken (to finance the acquisition and to pay the victims).

Further, he created a conglomerate, that consists of very different businesses, that have nothing to do with each other. As a result, there are no synergies created and the stock is trading at a big discount to peers.

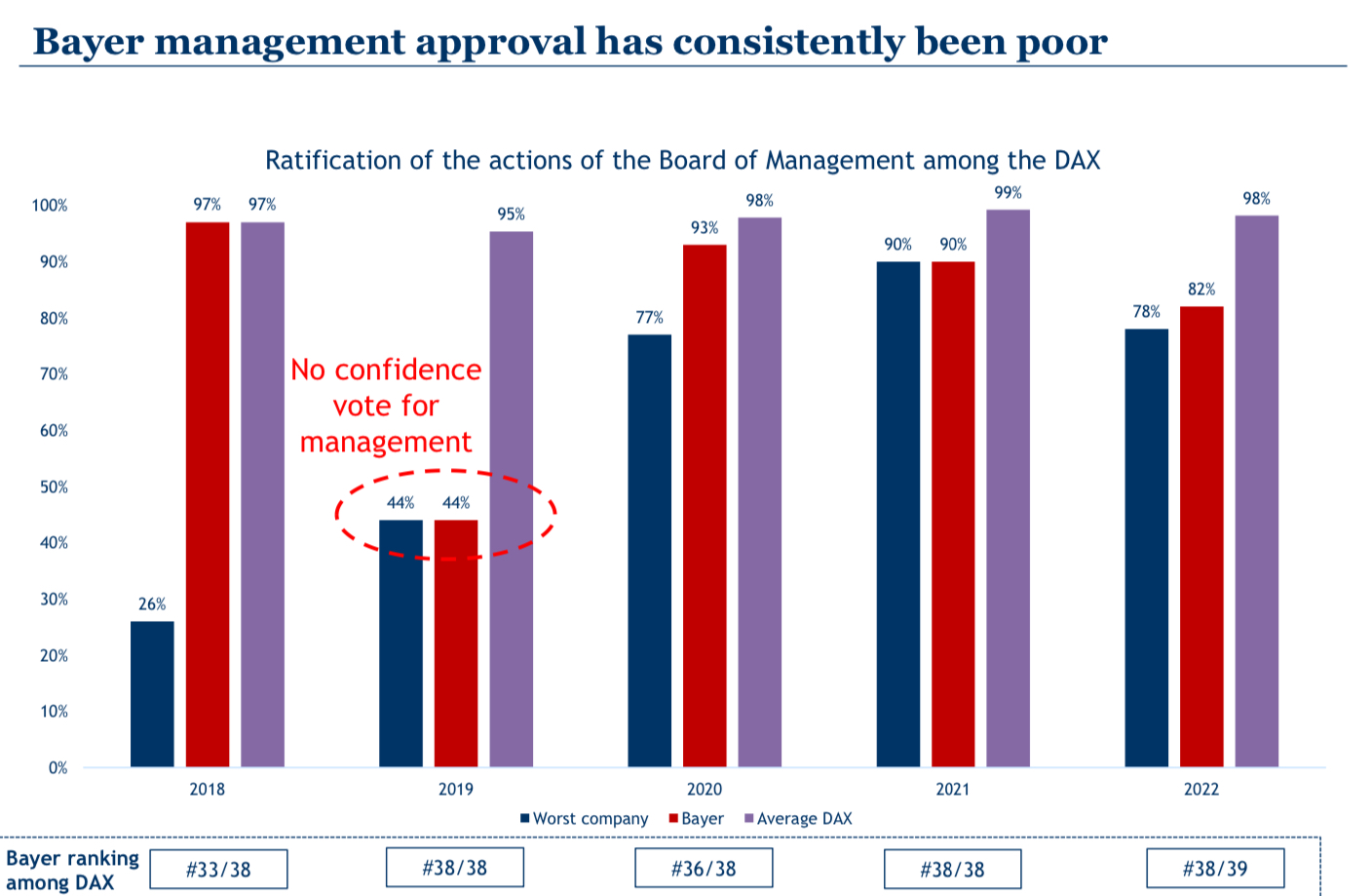

The bad capital alocation and the falling share price (price drives sentiment) resulted in very low management approval compared to the rest of the DAX.1

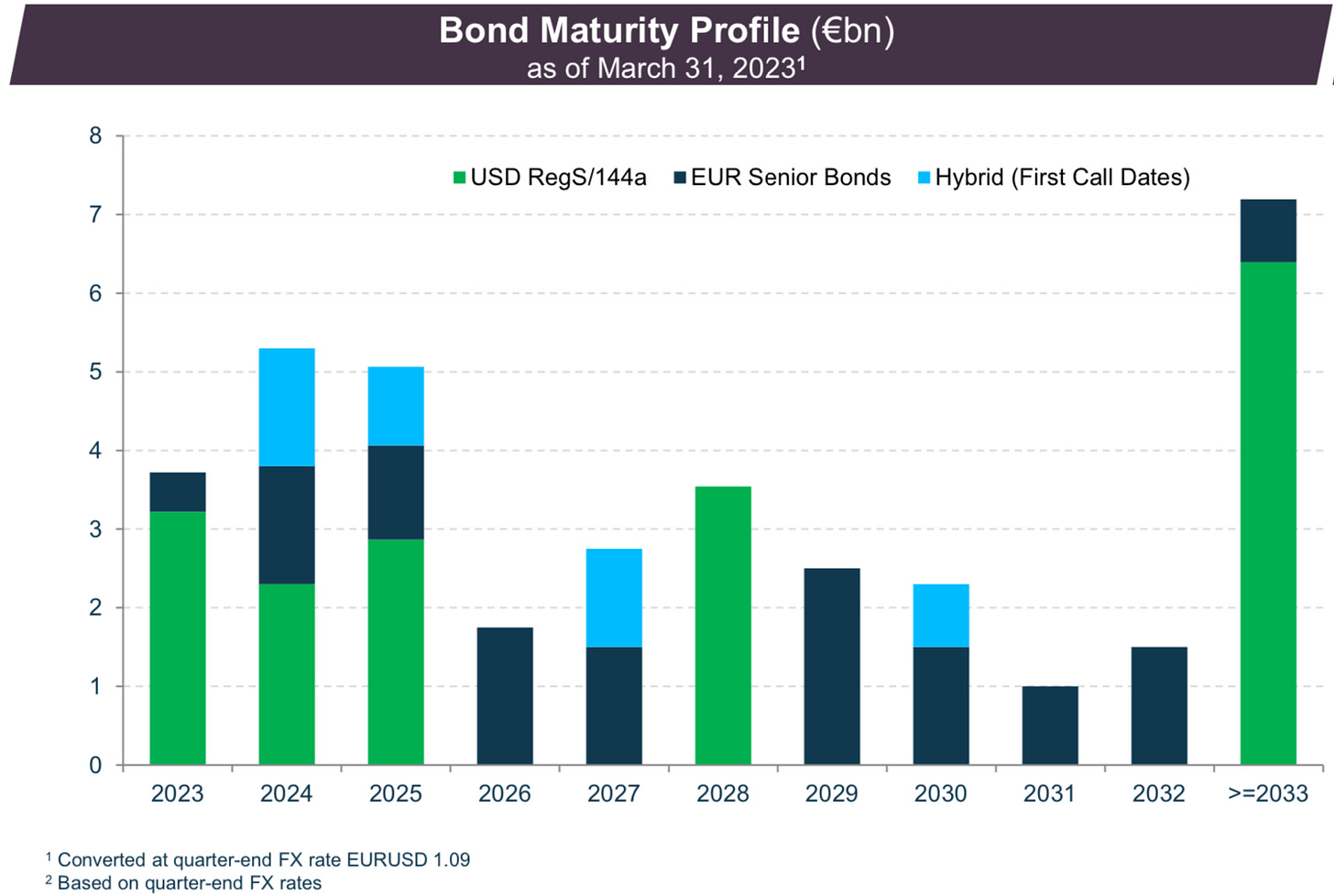

With Net Debt of 36 Billion €, and EBITDA of around 13 Billion (2023 outlook), the company has a lot of work to do, if it wants to reach a strong financial position.

3.0 A possible turnaround

Bayer definitely has it’s fair amount of problems. But over the last year the company has shown signs of a possible turnaround. First of all, there are activists interested in the company. Namely Bluebell has made a great presentation about there ambitious and plans for the company. This resulted in a new CEO.

Since June 2023 Bill Anderson, who was the CEO of Roche, is the new CEO of Bayer. This is a step in the right direction, because the old CEO completely mismanaged the company.

Further, there is a clear trend, of Bayer winning more and more lawsuits related to Glyphosate. As the german newspaper HANDELSBLATT put it:

“Why Bayer suddenly wins all glyphosate lawsuits“2

The EU commission also made public, that Glyphosate is not responsible for cancer. Even tough I personally have my own opinion on this, it is very positive for the company. Now there are only the lawsuits in the US left, which Bayer also wins most of the time.

So currently the company is behind it’s worst days. With the new CEO and hopefully better lawyers, the company has changed quite a bit over the last 2 years.

4.0 Catalysts

Apart from the possible turnaround, as a result from the end of lawsuits, there is a much more promising catalyst for the stock of Bayer. The spin-off, of the Crop Science devision (actually the Monsanto business).

Bayer is the market leader in Crop Science and has with it a lot of influence over the worlds food supply chain. A spin-off would create 2 separate businesses, that would be both valued independently from each other.

A spin-off would make sense, because there are no synergies at all, between Crop Science and Pharma.

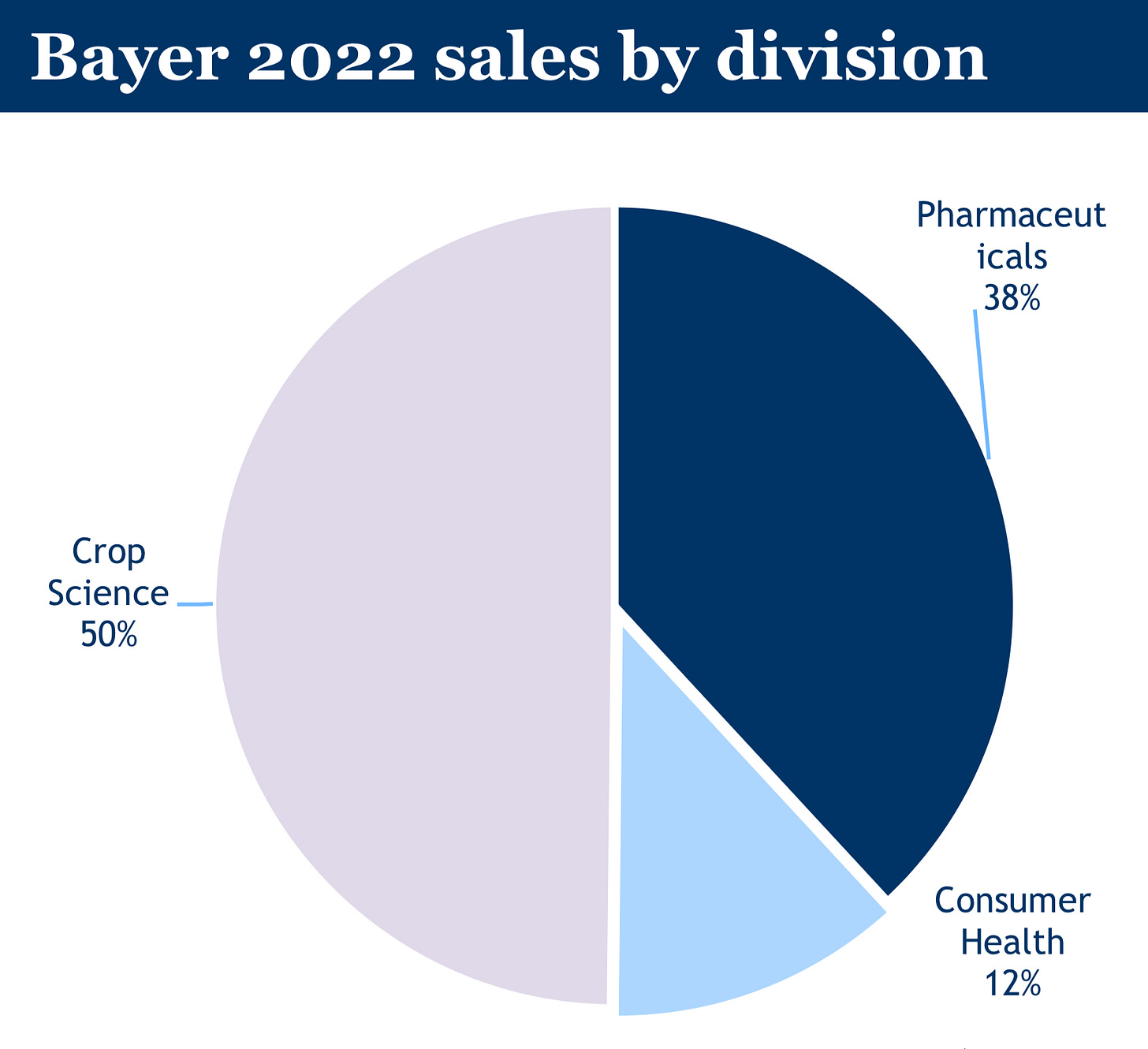

As of 2022 half of Bayers revenues come from Crop Science, 12% from Consumer Health and 38% from Pharma. Apart from the Glyphosate lawsuits, Monsanto is a market leading company, profiting from a growing population and more gen editing.

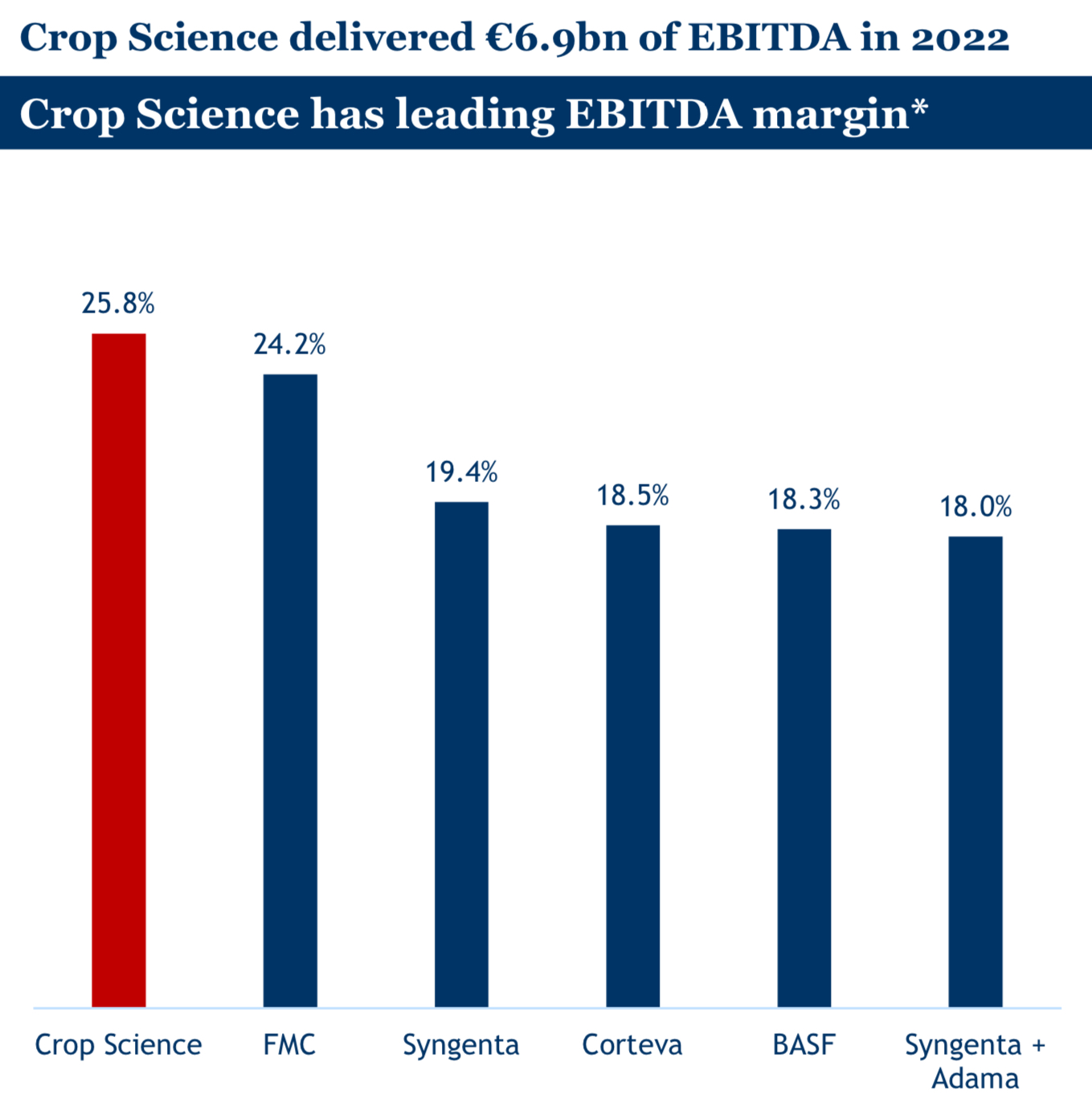

Monsantos EBITDA margin stands at 25.8% as of 2022. This is better then all of it’s competitors. At 6.9 Billion € EBITDA this devision could be valued at 7X EBITDA, or 49 Billion €.

4.1 After the spin-off

After the spin-off, Bayer would only consist of it’s Pharma and Consumer Health division. In this market, Bayer is well positioned and has high market share.

With a lot of new drugs in the pipeline, Bayer will be able to offset the loss of it’s two most profitable drugs. Namely the Blockbusters Xarelto and Eylea will go off patent in the next years. While this will take several years, these are around 7.7 Billion € in revenues that will melt away like ice cubes.

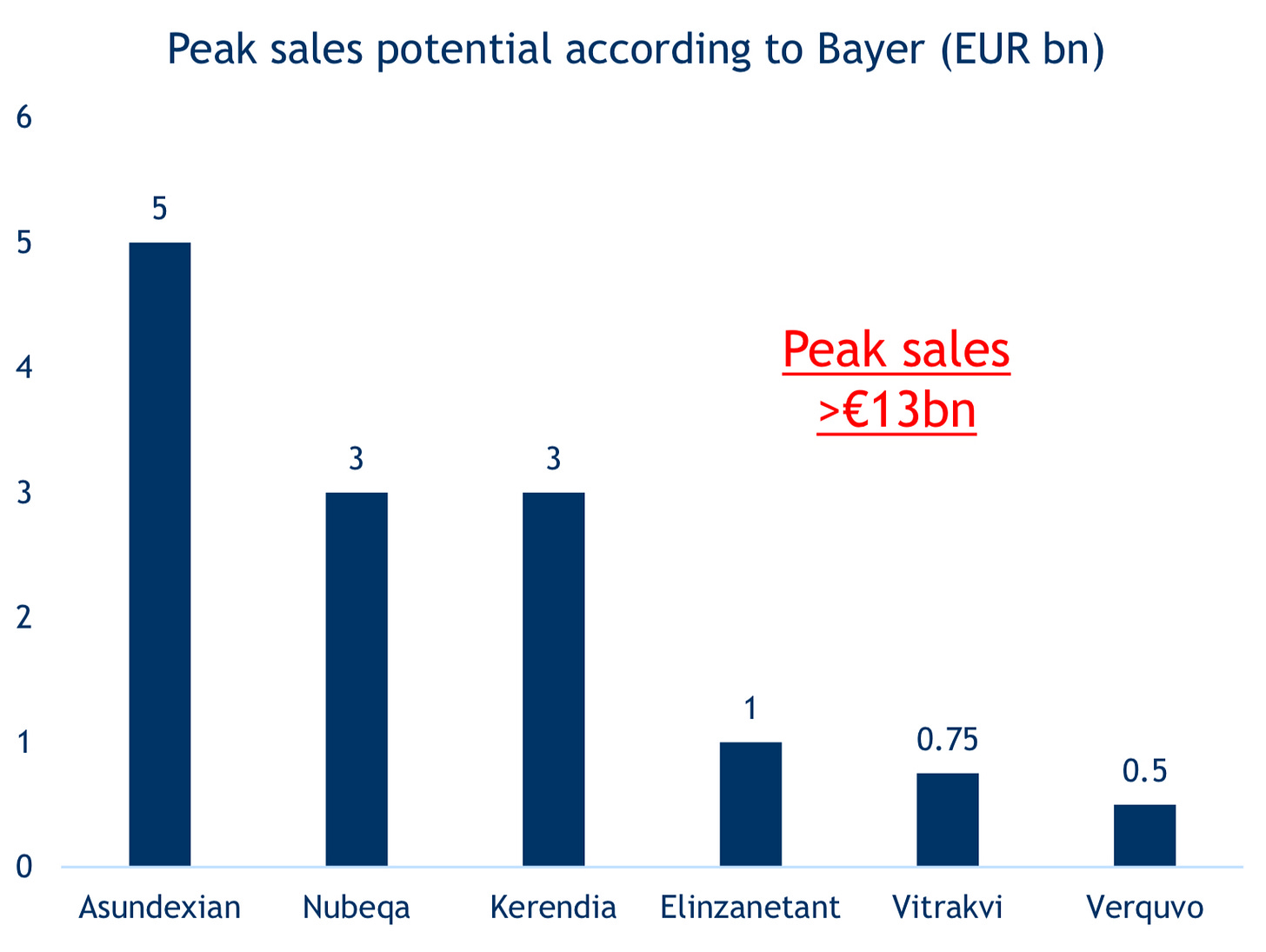

Therefore new drugs will have to compensate for that. These drugs are estimated to have peak revenue potential of around 13 Billion €.

All in all the Pharma and Consumer Health division have leading market positions and will be worth alone more, then in combination with the Crop Science business.

5.0 Valuation and Conclusion

Bayer is valued at 49 Billion € and has Net debt of around 36 Billion €. Therefore the EV is 85 Billion €.

The Crop Science business is worth around 49 Billion. In the case of an IPO Bayer could probably also dumb some debt on Monsanto, but let’s say 50 Billion in value for Monsanto.

With firms like Roche, Novartis, etc trading above 10X EV/EBITDA and competitors in the consumer health division trading above 12X EV/EBITDA, it is reasonable to value the pharma business at 9X EBITDA. And the Consumer Health business at 10X EBITDA.

All in all the company is worth around 80 Billion €, which is 60% (!) over the current price.

Bayer is NOT a position in the Modern Investing Portfolio, which is the result of the following reasons:

The portfolio is nearly fully invested (more on this in the next portfolio update).

The debt is a bit to high for me.

I want to see that the new CEO is taking incentives to create shareholder value. For now I haven’t seen this clearly !

I will add Bayer to the watchlist and will follow the stock closely. Let me know your opinion on the stock in the comments.

Handelsblatt — Warum Bayer auf einmal alle Glyphosat Prozesse gewinnt (here)

This is not financial advise and shouldn’t be threaded like it. Everyone has a different risk tolerance, which is why we don’t want and can’t give anyone financial or investing advise. Everyone has to make his on mistakes :)

Nice write up. Interesting situation. Read Abt it several times and that might say sth...

SOTPs are tricky, as are multiples.

What about HQ costs in SOTP?

With blockbusters expiring soon, (much) lower mult warranted vs peers?

Due to high debt, FV derived by SOTP might be very sensitive to inputs

What's your opinion?

Even tough I personally have my own opinion on this, it is very positive for the company.