Challenging the EV & ESG narrative, with longs on Platinum & Co

A story of EVs, Hybrids, the comeback of the Diesel and ignorance on WallStreet

1/ ESG & Investing

ESG, the largest money whole since the wars in the Middle East. Pension funds invest in companies that have good ESG ratings. Publicly listed companies talk half of their earnings call about their ESG rating, gender equality and AI. The reason is obvious, CEOs and the management teams have to comply with their largest investors, which are nearly always institutions such as Goldman Sachs, Blackrock, State Street and Co.

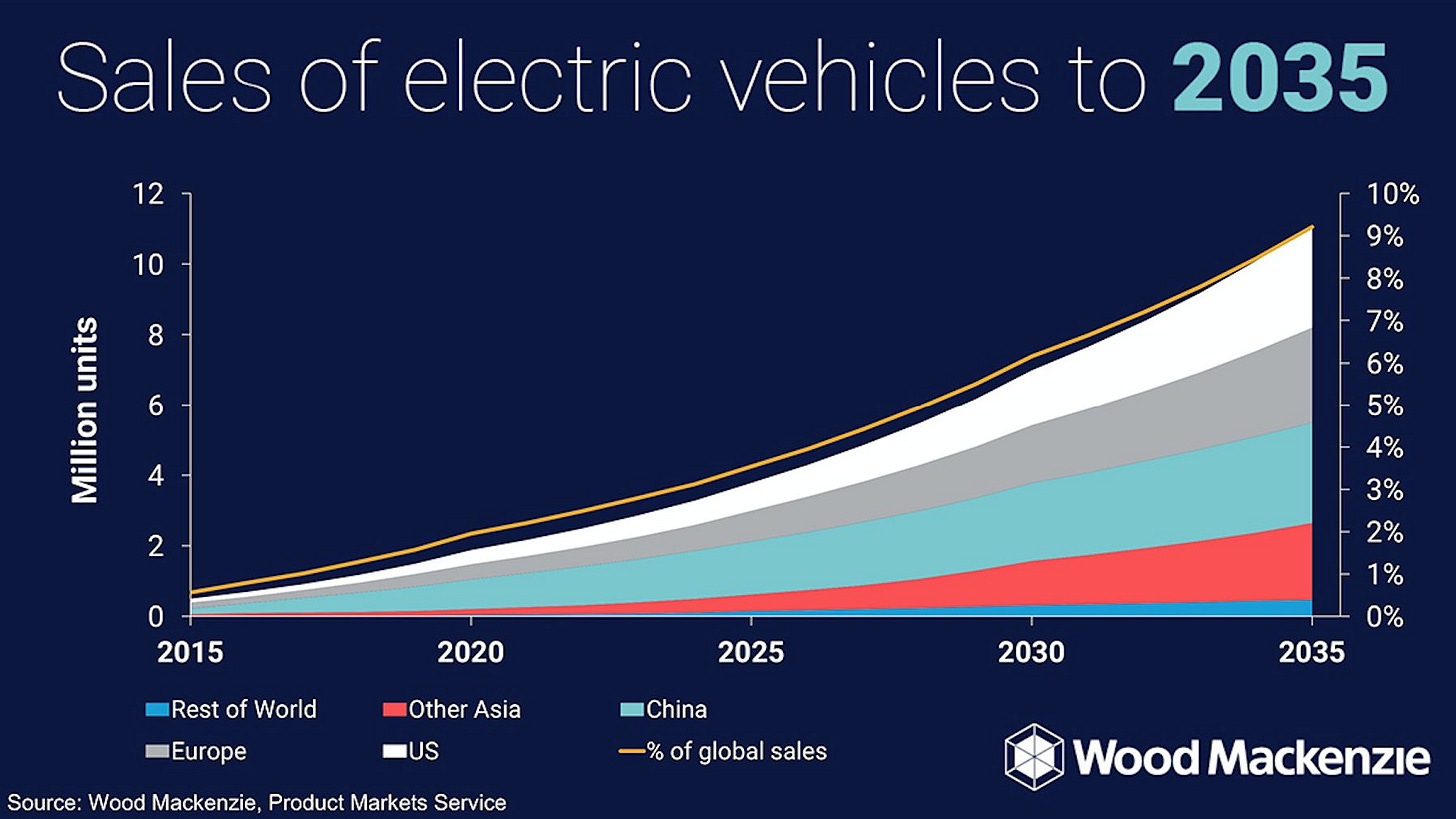

The creation of ESG ratings has resulted in chaos. But as any investor can tell, chaos is great. It creates volatility, which for the patient investor creates opportunities. The irony frankly lies in the ignorance of institutions to read between the lines. Every year hundreds of conferences take place in which companies show the same chart over and over again [like below 👇].

In this fantasy world, everyone will drive an EV and our entire electricity production comes from renewables. Oil will disappear and Internal Combustion Engines (ICEs) will disappear alongside it. These insane statements lead to huge underinvestment in sectors such as Oil, Gas, Platinum, Coal, Tobacco, etc. All sectors that aren’t seen as investable, because of the same old story of “ESG”.

If you remember the core principles of investing, then that you should always do you own research and try to look for sectors that are under appreciated by the markets. This is basically the core reason why people go into small caps, commodities, etc. Commodities are historically an important sector represented in the S&P 500. Since the GFC in 2008/2009 and the following collapse of commodity prices, interest has decreased considerably. This is something that I expect to turn from a headwind to a tailwind. Once investors and especially institutional investors realize that commodities are a hedge against inflation and geopolitical instability, flows into commodities will get back to more normal levels.

2/ PGMs at the bottom of the cycle

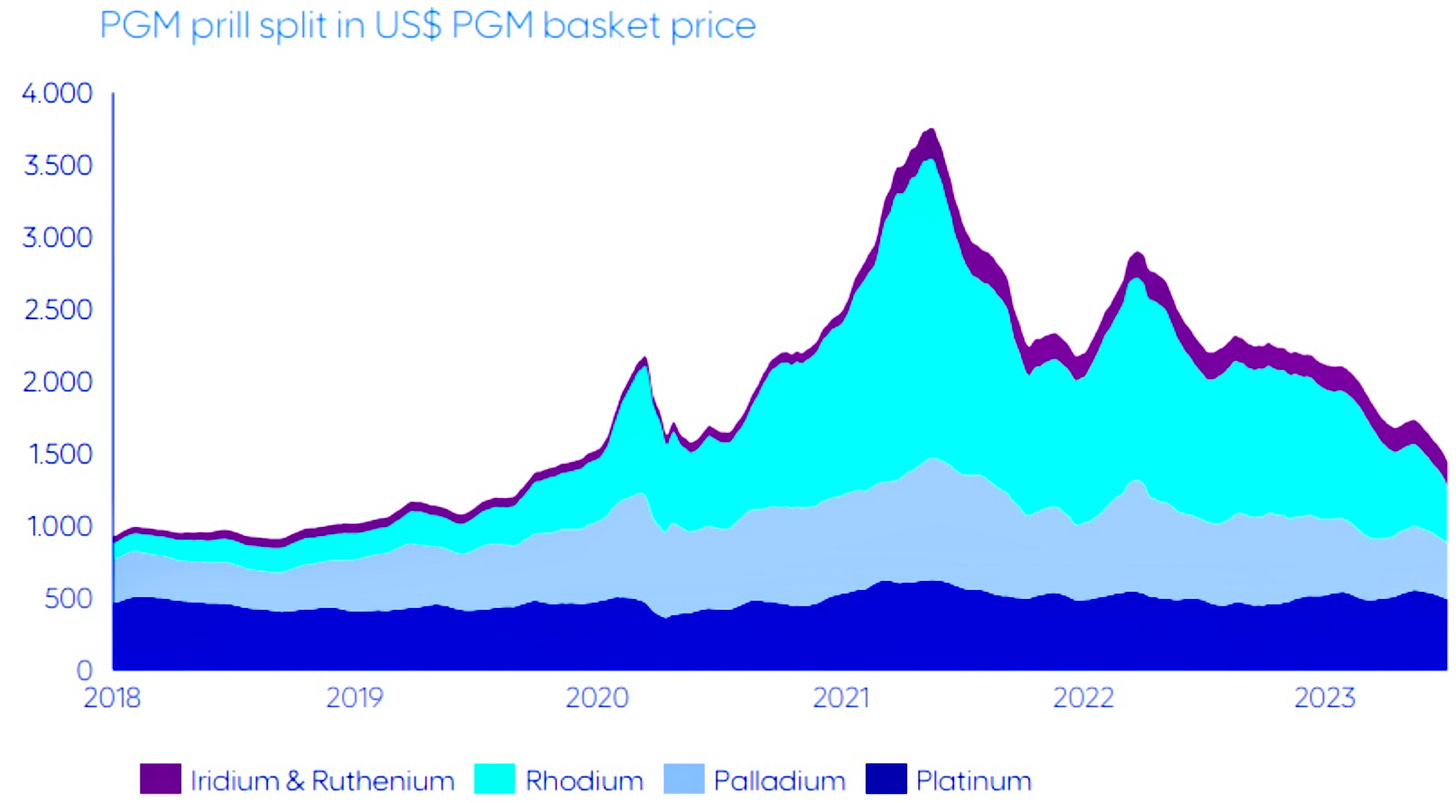

Platinum Group Metals (PGMs) are likely the most under appreciated commodities in the world. Prices have dropped considerably over the last years, politically instability has risen and net (!) short positions have reached a record high. Meanwhile the major PGM producers are down 75-80% from the highs.

The consensus is, that because of political pressure regarding climate policies, ICEs will become a technology of the past. EVs will become the new normal and because of it the demand for PGMs decreases consistently. A similar view as Jim Cramer had in 2020 in regards to oil.

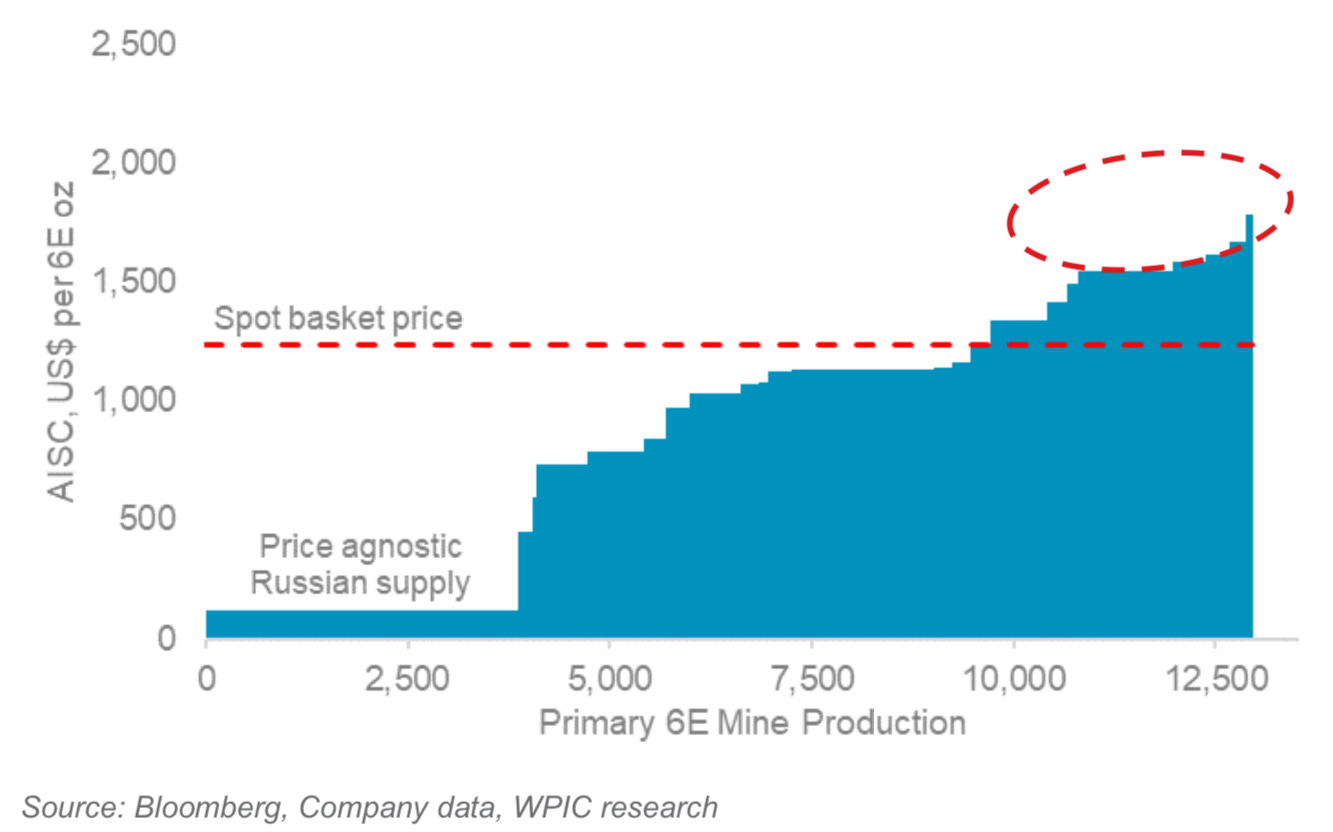

It is often much better to look at the supply side rather then the demand side, because fears of worsening demand are nearly always exaggerated. If we look at the supply side of PGMs we can draw a clear picture in which supply is in a secular downturn. For this secular downturn to change, we would require much higher price levels. And in addition to that, it seems like demand for ICEs is picking up again.

3/ ICEs are making a comeback

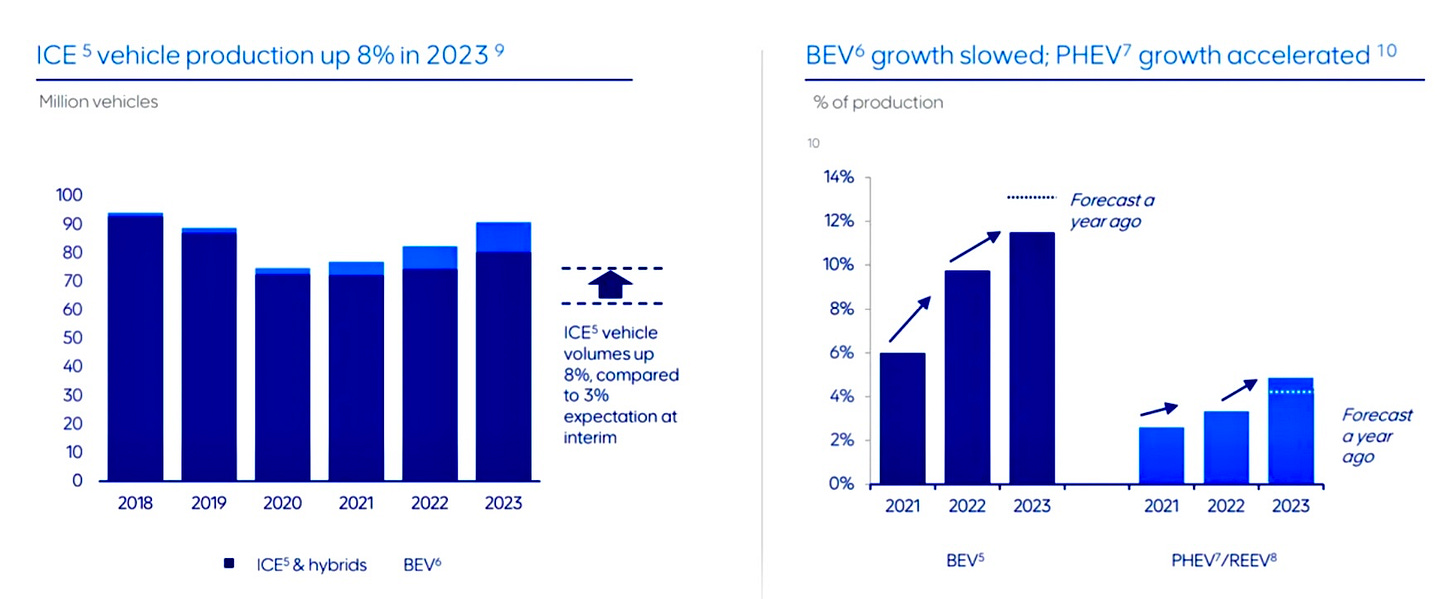

While the media always brags about the massive success of EVs, the reality is that the sales of ICEs are moving up again [left chart].

The global population is growing, especially in low to middle income countries. The middle class in China, India, Indonesia and large part of Asia is growing fast. This will on one hand lead to higher global oil demand, but also to more demand for luxury products. ICEs are in most countries still the most competitive solution, as even in large parts of Western Europe the infrastructure isn’t build out yet. In other parts of the world, the situation is even worse (for EVs). In addition to that, the power grid isn’t build for the huge amount of electricity required to power the EVs, in a hypothetical wet dream scenario of EVs overtaking ICEs.

Demand for PGMs is highly correlated with sales of ICEs and Hybrids. Hybrids require even more PGMs than ICEs, while EVs require basically none. So the question is how does the industry currently reacts to higher sales in ICEs and lower demand growth then expected for EVs? Well, producers such as Volkswagen, Mercedes, Ford, etc, are scaling back their ambitions in regards to the EV space.

In Germany, the number of new licensed vehicles shows a trend that is great for PGM producers. EVs (yellow), see less demand and have declined, while Diesel and generally ICEs are holding up well.

Nemak is an important supplier to the automotive industry and is based in Mexico. The company supplies products for 1/4th of the cars sold globally and said the following in regards to EV demand in the Q4 earnings call:

What we are experiencing on the EV side in both regions, North America and Europe, is that the expectation from customers or OEMs related to EV sales are growing in comparison to previous years, but at a much lower pace than originally anticipated. That has to do a lot with the infrastructure on the charging stations, also prices of electric vehicles, range, and others.

[…] Most of the OEMs, with a few exceptions, are not making money on the electric side.

— Nemak Q4 Earnings Call

4/ PGMs Supply vs. Demand

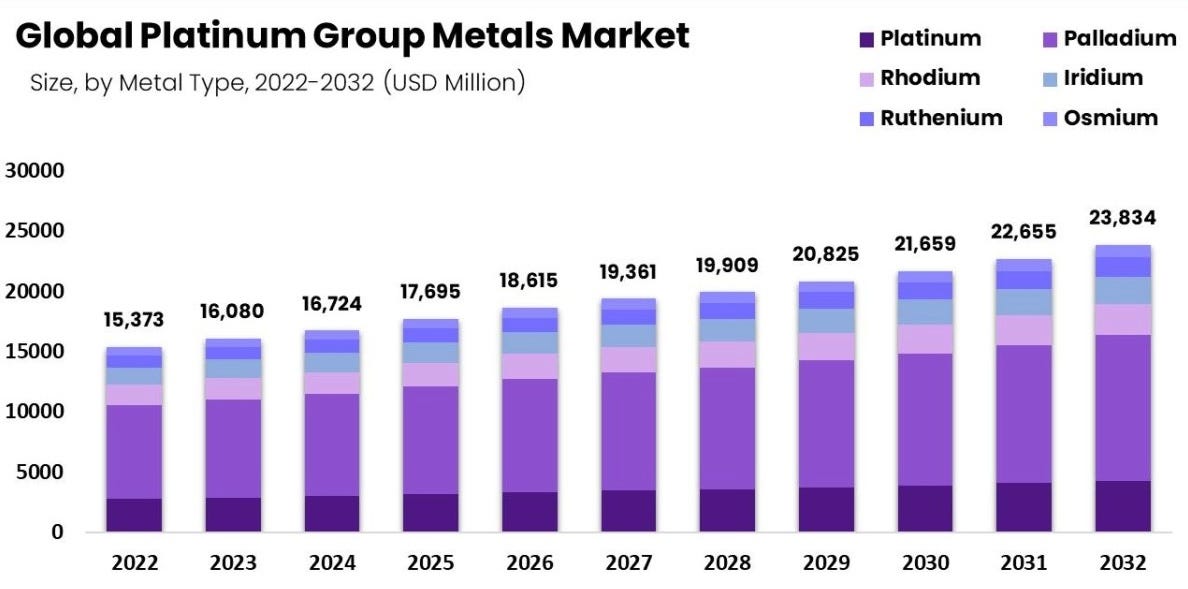

Demand worries for PGMs are largely just a fear with no data to back up. The market for PGMs is expected to grow at a CAGR of 4% and the market has been in a major deficit for quite some time now.

Total supply of Platinum has dropped by 2% over the year, as supply issues in South Africa have resulted in lower production levels. In the same period, demand has gone up by 25%, which is mainly driven by a rebound in automotive and industrial demand. The overall deficit stands at 878k Oz, while inventory has declined by exactly this amount to 4m Oz.

The critical part regarding PGMs are Russia and South Africa (SA). SA is responsible for ~80% of global PGM supply, while the country has been a political mess. Blackouts, shortages and economic chaos have had its impact on PGM supply. If the country were to fall into massive political unrest, PGM supply would collapse, wich would likely trigger a massive rally in PGM prices. On the other hand, most producers such as Anglo American, Sibanye & Impala have the majority of there mines in SA. In this case, the price of PGMs would skyrocket, while the stocks of producers would have a very hard time.

Russia has since the invasion of Ukraine been dumping large amounts of Platinum. Nornickel in particular produces PGMs as a byproduct, which means that they can sell it at any price and still make a profit. This is likely part of the reason, why PGM prices have fallen so much over the past 2 years.

Going forward the deficit is expected to decrease in size. But any reduction in Russian supplies would destroy this idea, and Nornickel guides for a 5 year low in PGM production for 2024.

If we exclude the Russian supply, which is simply a byproduct of Nickel production, then 35% of the current mines aren’t profitable anymore. We should keep in mind, that commodities are cyclical and that the point of maximum pain is often a great entry point.

5/ Shorting & Ignorance by WallStreet

WallStreet, which still believes in its fantasy world in which ICEs go away, is massively short PGMs. The net positions of managed money are for both Platinum and Palladium negative and this to a huge extend.

Over the last few days/weeks, PGMs have risen in price again and while the situation for most producers is still a shit show, the potential of a short squeeze shouldn’t be underestimated.

6/ Conclusion

In conclusion, prices for PGMs are very low and sentiment is bombed out. Most producers are making a loss with there operations and shares are down 70%+ from the highs. With the huge misconception of EVs destroying the business, WallStreet has gigantic short positions. Once these short positions get covered, the short squeeze can begin. The major risk with an investment in Sibanye Stillwater, Anglo American, Impala, etc, is the political situation in South Africa. If one wishes to position himself in this sector, a basket of the major producers in combination with an ETF on PGMs should work out fine over the coming months.

Yours sincerely,

MODERN INVESTING

I agree 100% the PGM prices will make a record spike in value within the next 12-24months .. I avoid the likes of South Africa as they are becoming a basket case having to now import fresh water .. POD on the ASX is a great PGM investment location WA Australia large PGM Reef like SA miners have been mining for decades.. present resource 6Moz PGM5 to 250m deep but they are hit the same high grade PGM reef 500m deep and studies show it should well run to 2km deep so potentially 24Moz PGM5 + Cu +Au … worth less than $10mill USD !!!!!!

Nice, I was halfway through PGPs.

1) I thought platinum is used for diesel, palladium for gasoline, though that can be changed if you retool.

2) I haven't been able to find a recent cost curve for platinum/palladium. Where do you get that the current platinum price of $900+ is below production cost?

3) Newer ICE cars automatically stop/start their engines at traffic lights, but I don't know if this uses PGPs as a catalyst. https://www.autoevolution.com/news/the-engine-start-stop-systems-conspiracy-108734.html

4) Theres a big "South Africa" risk when buying producers. An ETF holding the metal is a much safer way to invest (and it'll go up if SA cant keep the lights on....google for SA's electricity probems).