EdiliziAcrobatica: Italy’s compounding machine

Fast growth + Multiple expansion = Exceptional Return

The investing world is divided, between growth and value investors. Both sides try to (ideally) buy a stock bellow it’s underlying value. Most value investors look for low P/E or P/B ratios. While growth investors typically look for fast growing companies and care less about the multiples payed.

Both sides are wrong ! While low multiples are important, growth has to be considered in the valuation process. Today we want to dive deep into Edilizi Acrobatica, a stock that is described best by this little formula:

Fast growth + Multiple expansion = Exceptional returns

1.0 Investment Thesis Summary

EdiliziAcrobatica is a fast growing company with a dominant market position in the industry of facades.

Founder led business with high insider ownership.

Expansion into Spain, France, UAE, Nepal, etc. should be a massive boost for revenues.

Base case +250% upside over the next 3.5 years !

2.0 Business Modell and CEO

EdiliziAcrobatica was founded in 2004 by the current CEO Riccardo Iovino. He build the company from the ground up to what it is today. Further, he is actively engaged in the company and owns 74 % of the company !

Today the company is the leader in rope based services. Now many people will say: “What is so special about ropes ?“, well Edilizi uses the double safety rope technique. This technique increases safety and helps them operate in areas, that are else very difficult to get to.

The rope based services include:

Renovation & Mainteinance

Building Cleaning

Interventions

Italy is the main market for the company, with all of the profits and around 90% of the revenues coming from this market. Arguably the market for cleaning, renovation & maintenance is huge. Especially if we consider that the company is based in Southern Europe, which is a location with many old buildings, that need to get renovated over the next decade.

The founder of Edilizi Acrobatica; Riccardo Iovino (Owns 74% of the company)

2.1 Growth

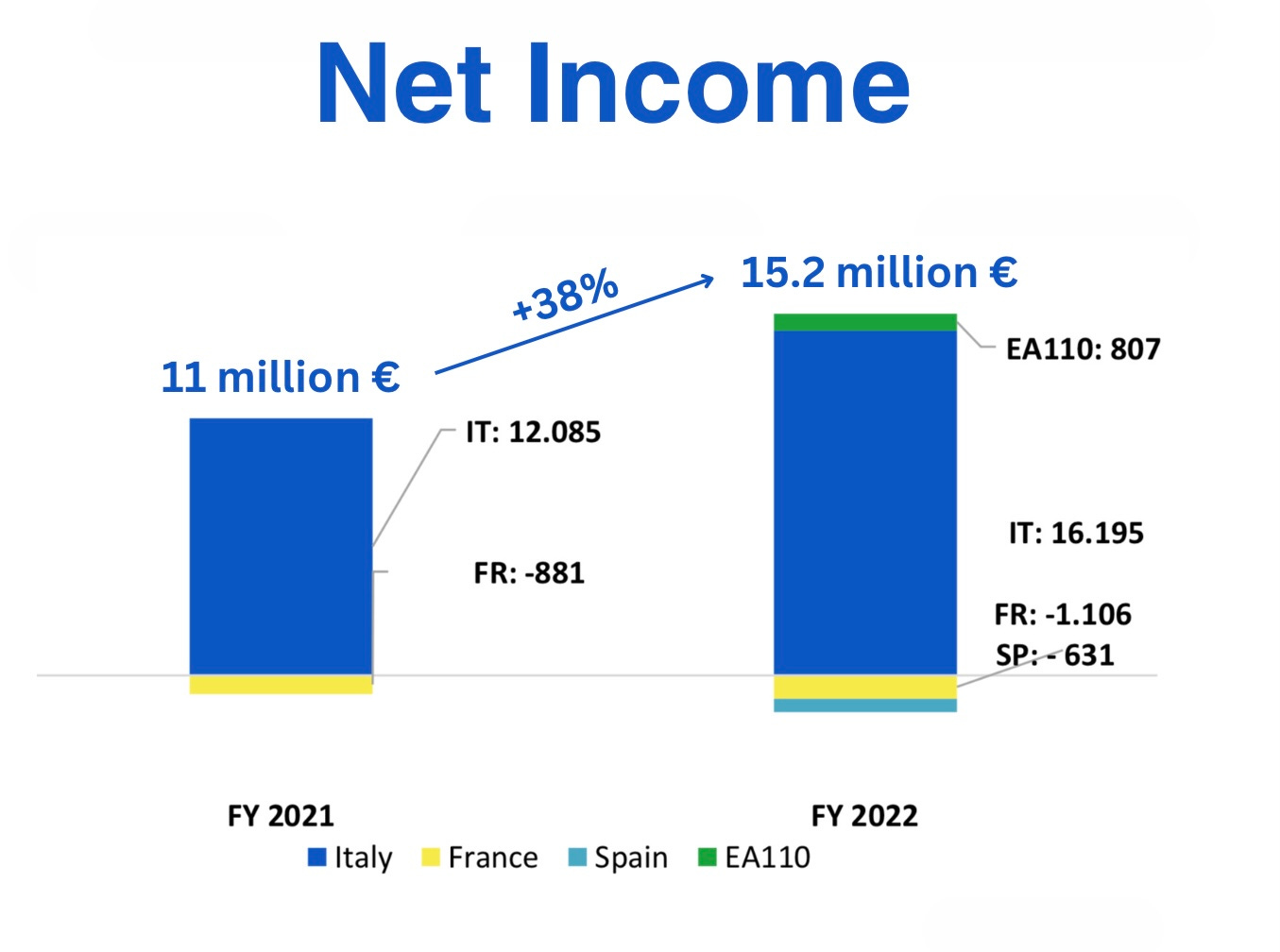

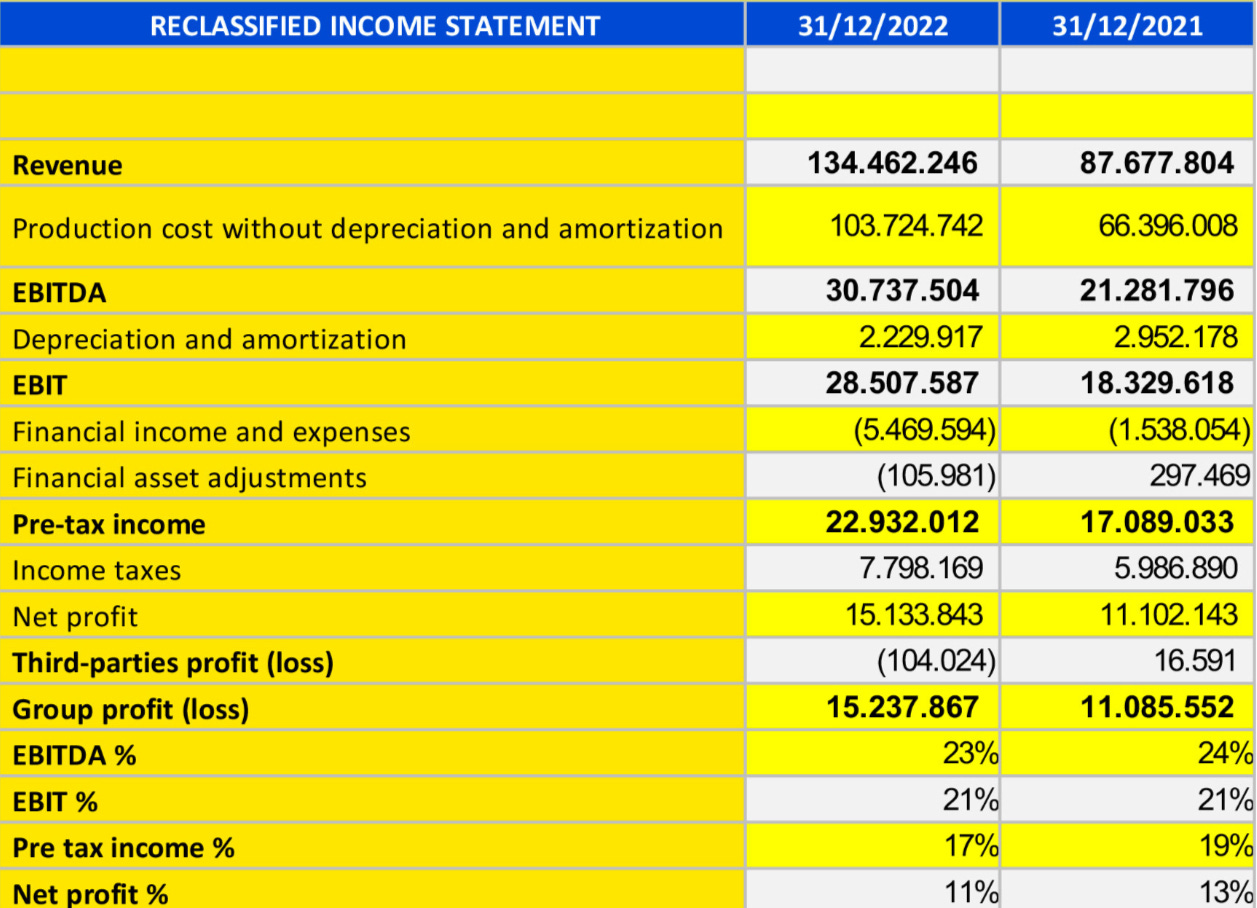

In the period from 31st December 2016 — 31st December 2022, revenues have grown from 11.4 million € to 134.4 million €. While Net Income has grown from 1.7 million € to 15.2 million €. This is a CAGR (Compounded annual growth rate) of 51 % and 44 % respectively !

On 12th of July, the company announced, that they had grown the number of contracts by 50 % in the 1st half of the year. This is a strong indication, that revenues will increase massively this year. From an Net Income point of view, the situation is a bit different, but well get into this later on.

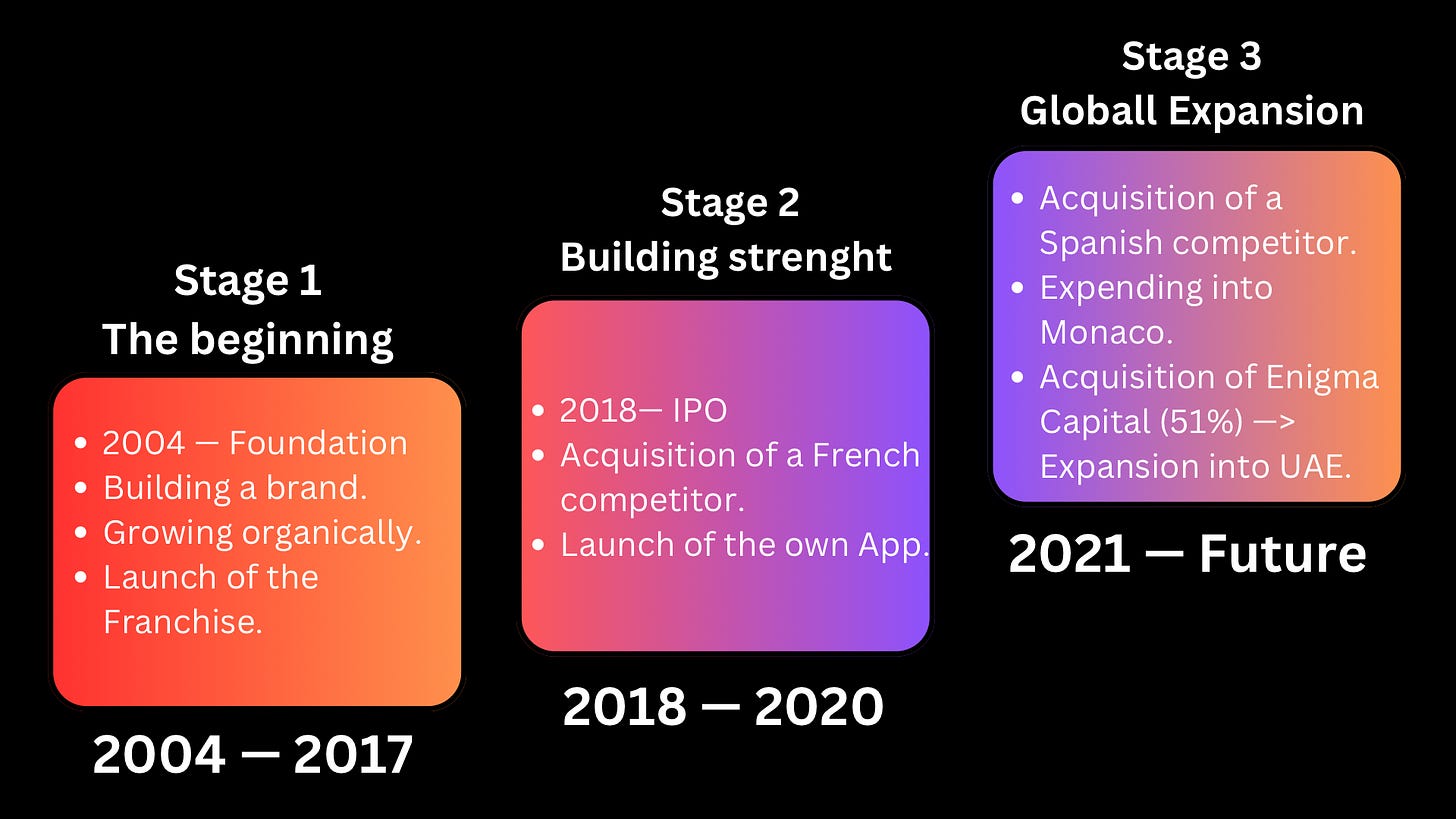

2.2 The next growth stage

Edilizi Acrobatica sees a huge opportunity for even more growth over the next years & probably also decades. This growth will be realized trough the standardization of many process. This will enable them to scale and realize scale effects. 1

By closing deals with well know firms and institutions, the company builds trust. Over the long run, this will help the company expand into other geographic areas as well.

I like to call the company the McDonalds of facades. If we look at McDonalds, the design of their stores are in every location pretty much the same. The “kitchen“ is build everywhere the same, and every franchise partner is using the same systems.

Further Roy Kroc, the man who really build McDonalds to the empire it is today, had a vision of his company. The goal was to use the franchise model to grow McDonalds to an empire.

Edilizi Acrobatica is similar in many ways. The CEO and founder Riccardo Iovino had the vision to make complicated maintenance services easily accessible. All while doing it in an profitable way.

“(…) EdiliziAcrobatica has revolutionized the way of building in Italy and it is preparing for revolutionaries in the world. Because the limits are not the borders between countries, but only the borders that our mind decides not to cross.“ — Riccardo Iovino

Further, the company is right now entering it’s next stage of growth. Trough more standardisation and the franchise model, Edilizi Acrobatica is following the growth model of McDonals.

The graphic above illustrates the different stages Edilizi Acrobatica has gone trough in the past.

There is a long run way for growth, in the Italian market for renovations. If we just look at buildings that are higher then 3 floors (EdiliziAcrobaticaˋs target customers), the market has the size of 50 billion $ p.a. And these are numbers just for Italy !

2.3 Domination

If we look at the construction industry in Italy & worldwide, there are no real direct competitors for Edilizi Acrobatica. These competitors are either way smaller (I’m talking about 10x smaller !) or have no synergy effects like Edilizi.

As a result of the size the company has in it’s industry, they are very trusted from big institutions. The Burj Khalifa for example has a contract withe Edilizi, for cleaning the windows.

With a lot of smaller players in the industry, Edilizi Acrobatica could become a compounder for decades to come, if managment decides to invest a lot in acquisitions. The fragmentation in this industry is amazing, and can be one of the greatest opportunities over the next decade.

As it is common for Edilzi, the company acquires a competitor in another country and enters the market trough this company. With operations in Saudi Arabia, France, Spain, Italy, Moanaco, Nepal and the UAE, they have a huge market opportunity also outside of Southern Europe.

3.0 Margins and tax subsidies

To understand the company, we have to understand what the tax subsidies in Italy mean for the company, and how it impacts there margins. In Italy there have been subsidies for businesses that renovated the facades of buildings. This subsidy was called “Bonus Facciate“. Under this tax benefit companies & residents could deduct 90% for works carried out in 2020 and 2021, and 60% for works done in 2022, on expenses related to the renovation of the building’s facade.

The margin of EdiliziAcrobatica was positively affected by this tax subsidies. But in 2023 these tax subsidies are non existent. As a result of this, many people sold of the stock and caused it to drop.

I expect that the company will be able to compensate for lower margins trough the massive growth in revenues over the next years.

4.0 Financials

With total current assets of 106.5 million € and total debt 75.4 million € (as of 2022), the company has a strong financial position. Further, revenues grew in 2022 by 54 %.2

Net Income increased *only* by 38% over the same period, which is the result of lower margins.

5.0 Valuation

Edilizi Acrobatica is a very undervalued stock right now. In the valuation process, we have to adjust for the lower tax subsidies in Italy, since this effects there margin. In FY 2022 the Net Income Margin stood at 11 %, down from 13 % the year prior. This was mainly the result of lower tax subsidies.

After many reports, that the contracts signed climbed by +50% year to date, I assume that the revenue of the company increases to 180 million € for 2023. This is an increase of around +33%.

Further I expect margins to go down further. I assume margins to go down to 8.5% for 2023. In this scenario Net Income would stay flat year over year, which is a strong performance, if you consider that the tax subsidies fell away.

Since the company is realizing scale effects, operates in an huge market and is domination the industry, I expect that Edilizi Acrobatica will be able to grow revenues & profits at an rate of ~24% p.a. over the next 3 years. From then on I assume that the growth rate will slow down to ~20% p.a.

Based on these assumptions and the assumption, that the stock would trade at 15x earnings in the future, the stock has a upside of 250% over the next 3.5 years. And 300% over the next 5.5 years !

Currently Intesa Sanpaolo has a price target of 25.5 € per share, which is 42% above the current share price. I consider this a low price target, since EdiliziAcrobatica has been able to massively beat the estimates of analysts in the past. The revenues of 2022 for example where equal to the 2023 estimates !

6.0 Conclusion

While the removal of tax subsidies in Italy will impact the margins, the substantial revenue growth is expected to compensate for this decrease. With a solid financial position and strong revenue growth potential, the stock is very undervalued.

In my base case EdiliziAcrobatica has an estimated upside of 250% over the next 3.5 years and 300% over the next 5.5 years. While we wait we also get a nice dividend, that I expect to grow substantially from the current level of 4.5%.

EdiliziAcrobatica is part of the Modern Investing portfolio and I personally want to add to the position if there is weakness.

Yours Sincerely,

The Modern Investing Newsletter

Congratulations for the thesis! Here you have another investor in the company, in my case, since April 2022 :)