It’s All One Big Trade

How global trade shifts are reshaping markets and creating new opportunities…

In light of recent events and the resulting volatility, I have reflected on decisions I made and some of my investment theses. Then it struck me: it’s all one big trade! Most of my long term views lead back to one underlying trend. This trend has been defining the first half of this decade, but few people seem to expect this trend (of massive implications) to continue. Even if one does not agree with the key rationale behind this thesis, it is worth considering it and getting a different perspective on the investment world. In this article, we dive into the underlying drivers and potential impacts of this trend. That is to say, global uncertainty is here to stay. Relations between nations, armed conflicts, increasingly hostile trade relations, new alliances, re-shoring, etc., will impact currencies, capital flows, inflation and forward returns.

1.0 | A shift in global trading patterns & alliances

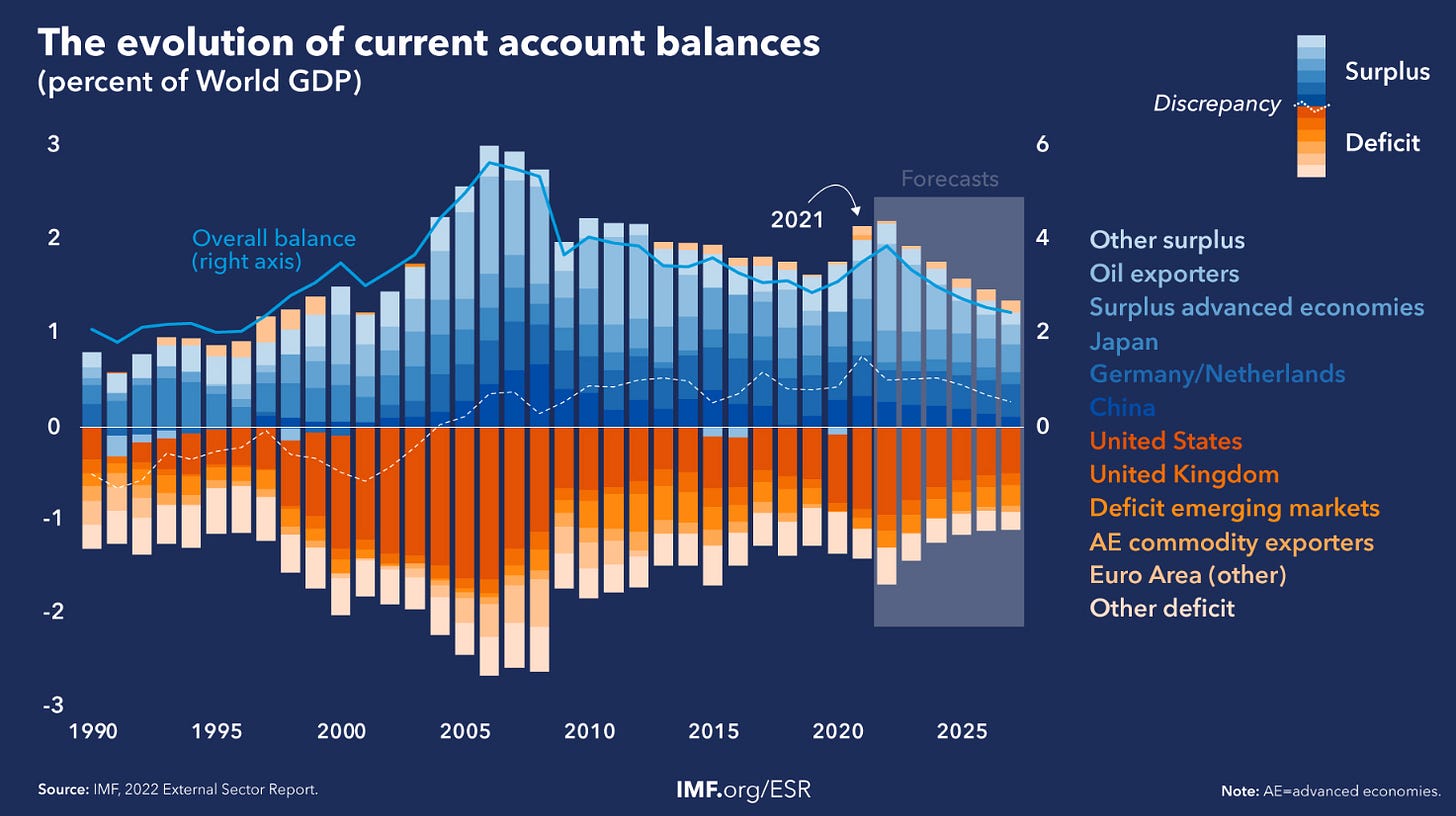

Since the 1980s, our current trading system has been evolving rapidly. The most notable development has arguably been the rise of Asia, especially China. The West outsourced manufacturing and heavy industry to China as the country opened up to the world. The U.S. was able to supply dollars in exchange for goods from East Asia. With the collapse of the Soviet Union and the Iron Curtain, Eastern Europe opened up as a new market. At the same time there was peace in Europe and military expenditures declined for years until the late 2020s. It’s crucial to understand that trade networks have transformed into a complex web of importers and exporters spread all over the globe. Due to the U.S. being the world’s hegemon and issuer of the world’s reserve currency, the country has been able to run a massive current account deficit funded mainly by Asian and European nations.

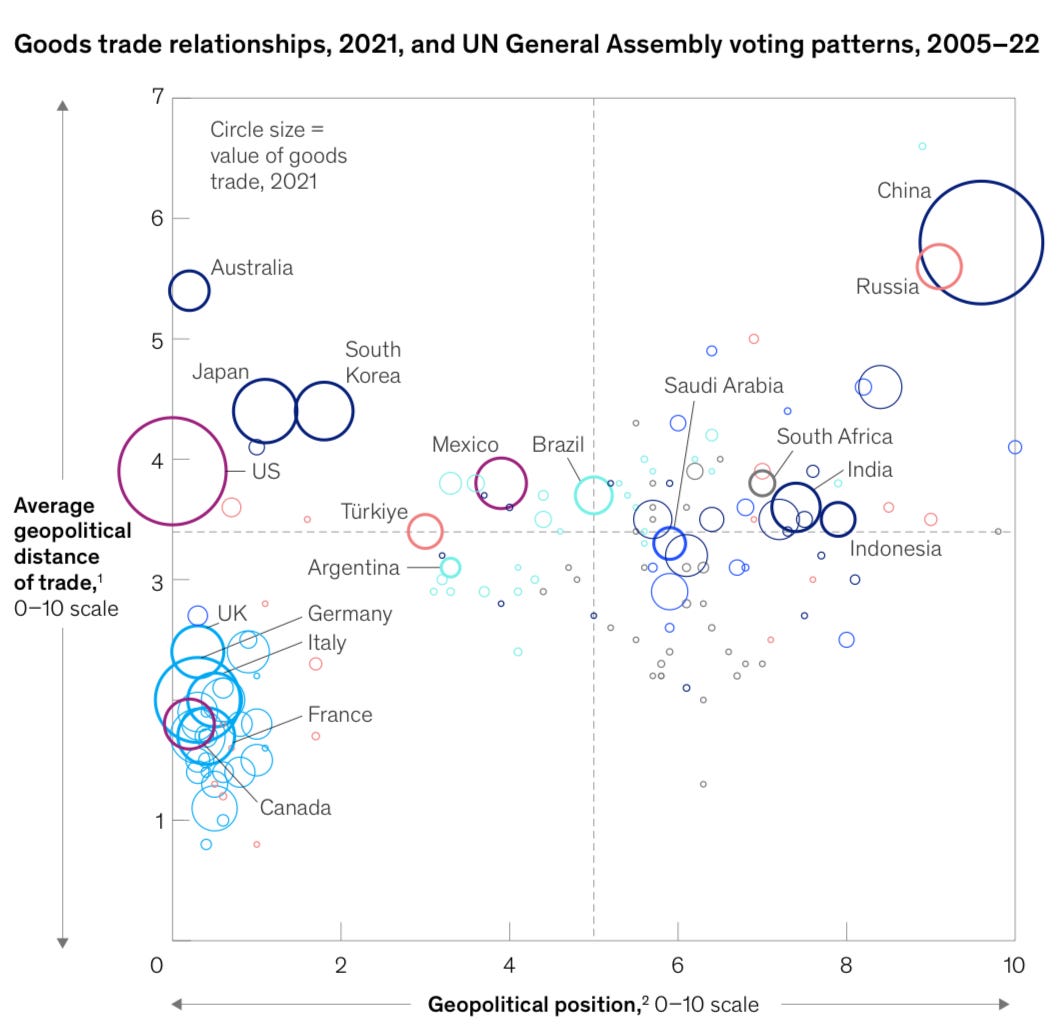

Today however, we have a crucial divide between the two most important countries for global trade. As can be seen in the graphic below, China and the U.S. hold nearly opposite positions in UN General Assembly votes. Europe, Japan and South Korea are allies of the U.S., while Russia, Iran and Indonesia can be considered Chinese allies. Most other countries are somewhere in the middle of this tug of war.

It’s undeniable that this regime shift has already started to have impacts on trade, capital flows, etc. European military spending has skyrocketed following the start of the Russia—Ukraine war. COVID-19, coupled with the first U.S.—China trade war has led to a re-shoring (e.g. the relocation of trading hubs closer to the U.S.) boom. Another major factor has been the withholding of rare earth elements in an act of retaliation against Trump’s tariffs. In general we can clearly see the impacts of these power clashes on consumers, economies and capital markets. It probably would have happened anyways, Trump just sped up the process.

On the topic of trade, it’s crucial to highlight the differences between different trading networks. What is a disaster for some is a golden opportunity for others. In the scenario of more fragmentation, China’s trade with emerging markets would grow even faster, at the expense of trade with the West. Digging deeper into the different trade routes, India is poised to benefit in most scenarios.

Greater global tensions will have considerable implications for investment portfolios, as investment funds tend to see 25% lower cross-border allocations for a one standard deviation increase in geopolitical distance between two nations. China and the U.S. are a very good example of this phenomenon.

1.1 | Global trade concentration

In a report by McKinsey from 2024, titled: Geopolitics and the geometry of global trade, the authors break down global trade corridors with a focus on the risks of changing trade patterns, namely fragmentation. Based on their research, 20% of global trade volume is settled between geopolitically distant countries. More importantly, 40% of global trade in concentrated products is settled between these nations. Key areas include Electronics, Iron Ore, Soybeans and Rare Earth Metals.

The simple fact that China is an export based economy is why global fragmentation is a risk that can’t be ignored. As I stated repeatedly, the U.S. is the consumption powerhouse of the world. Nobody comes close to the American consumer. Meanwhile, China is the manufacturing powerhouse of the world which exports 40% of products which are classified as “concentrated” — i.e., three or less countries are responsible for at least 90% of global supply.

I, however, am not a perma-bear who will tell you that the sky is falling. It’s just a waste of time. Still, we need to consider potential risks and ask ourselves which assets would perform well in such an environment. The trend of trade fragmentation seems undeniable at this point. I don’t think it poses a big threat to the global economy, as both China and the U.S. have started diversifying away from each other in a gradual manner since 2017.

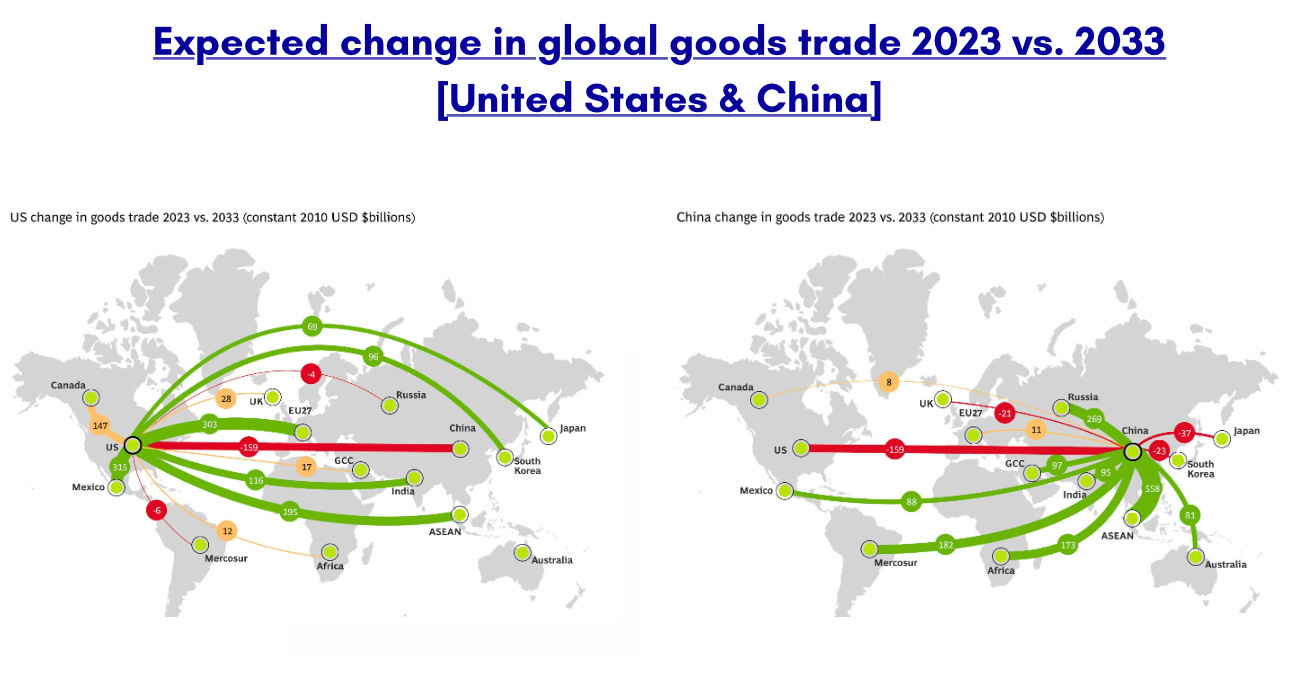

Below we can see the expected change in trade for both China and the U.S. over a 10 year period until 2033. Green lines represent above average growth, red lines represent shrinking trade and yellow lines represent below average growth. The thickness of the lines represents the size of the expected change in trade.

While direct trade between the two is expected to decline significantly, their trade with ASEAN and India is projected to grow considerably. Mercosur is a South American trading bloc composed of Argentina, Brazil, Uruguay, Bolivia and Paraguay. While the trade between South America and the West is expected to remain stable, China, India and ASEAN should be major driving forces behind South American exports.

On the other side of the spectrum, the UK’s trade outlook looks more grim, with projected trade growth of just 9% in a 10-year period.

2.0 | Historical parallels

While it might look like we live in unprecedented times, nothing could be further from the truth. In fact, I would argue that the past 80 years were unprecedented in human history. What we are seeing right now are just similar patterns that we can compare well to the events in the late 19th century. In 1871, Otto von Bismarck united Germany after the Franco—Prussian war. What followed was the unprecedented rise of Germany as an economic powerhouse.

“The speed of Germany’s advance to industrial maturity after 1890 was breathtaking. […] Earlier British fears of German competition were now fully justified. While Britain produced about twice as much steel as Germany during the early 1870s, Germany’s steel production exceeded Britain’s in 1893, and by 1914 Germany was producing more than twice as much steel as Britain. Moreover, only one-third of German exports in 1873 were finished goods; the portion rose to 63 percent by 1913. Germany came to dominate all the major Continental markets except France. The focus of national wealth as well as population shifted to the urban industrial sector by 1900. Only 40 percent of Germans lived in rural areas by 1910, a drop from 67 percent at the birth of the empire.”

China today is in the position that the German Empire was in during the late 19th century/early 20th century. Following Germany‘s unification, the country began an unstoppable rise driven by its economic engine. Germany started not with high-quality goods that we connect with the label “Made in Germany,” but rather with low-quality and cheap goods. Over time they stole British technology and used their cost advantage to dominate trade on the European continent. Sounds familiar, doesn’t it?

Over time, Germany started focusing on newly emerging technologies. In an act of fear over the sudden rise of Germany as a competitor to the UK and France, both countries passed laws that prescribed that all goods sold in their respective markets should be labeled with the origin of the product. At first “Made in Germany” was mocked, later it became a symbol of quality, engineering talent and innovation. And this is were our story end for now. WW1 started in 1914 and makes it impossible for us to predict what would have happened to the economic landscape of Europe had there been peace instead.

However, there is one key insight we can draw from this analogy. China’s rise is following the exact same pattern that the German Empire did in the late 19th century. Obviously this will lead to tensions. One way or another! Including tariffs makes the situation look even more similar. In response to the quick rise of the German industry, France and many other European nations imposed tariffs on Germany. It’s clear that we are currently standing between two tectonic plates which are drifting towards each other, impacting global trade, capital flows and thereby the financial markets.

3.0 | Impacts

Since we have a situation in which underlying principles, that drove our entire economic system for the past few decades are changing, there are ripple effects that should effect everything. Firstly, higher tensions lead to more hostile relations and a fragmentation of trade that shifts to more politically aligned countries. This leads to the development of new trade hubs and in some cases longer shipping routes. With the formation of new trade blocs and the diversification away from rivals, capital will flow to other markets. Since this process will be complex, usually things don’t go swiftly and countries are forced into corners while others make significant decisions in response to market environments. Trump’s desire for a weaker dollar, for example, would be one such thing. Potential taxes on foreign investors in U.S. equity markets and tariffs are other examples.

In a highly fragmented world, inflation and interest rates move higher, marking a turning point in the decade-long decline of real assets compared to financial assets. Do I expected such a catastrophic scenario? No, but it’s important to prepare for multiple scenarios. Even a gradual and partial fragmentation of trade—given the scale of the trend—could have significant implications for financial markets.

4.0 | Winners & Opportunities

Previously, we saw the political divide between countries at the UN General Assembly. Apart from China and the United States, one country stood out — Brazil.

Brazil is positioned between China and the U.S., creating a unique opportunity to trade with both, while much of the world finds itself caught between two rival superpowers. Countries that stay neutral in all this mess can benefit greatly from a fragmentation of trade. Brazil also offers another thing — natural resources. From Iron Ore to Soybeans and Crude Oil, Brazil has a lot to offer. The Iron Ore market is one of the most concentrated in global trade, dominated by just a few major players. Australia, Brazil and China are the majority of the market. If the trend of fragmentation continues, Brazil’s geopolitical neutrality coupled with the existing infrastructure for natural resources will benefit the nation in a significant way.

Brazilian equity markets are also trading at valuations that are very cheap, in contrast to the near-record-high valuations seen in the American stock market.

There are justified reasons for a discount of Brazilian equities, but if we believe that real assets will have their time to shine again, we have to take Brazilian equity markets very seriously. High interest rates and a market that is full of commodity exposed companies has frustrated foreign investors, who in turn threw in the towel. A shift in global trade balances, higher commodity prices and a lower dollar could create an environment in which the Brazilian financial markets perform extremely well.

“Over the past 22 years, the U.S. dollar has historically carried a strong inverse relationship with Brazilian equities, with the MSCI Brazil Index (Net) climbing over 4.5% for every 1% decline in the U.S. Dollar Index (DXY)“

One company that is very attractive in such an scenario is the largest global Iron Ore miner, Vale. I have shared my thesis on the company in autumn of 2024 and nothing material has changed since. In addition, the logistics behind Brazil‘s exports are tied to Rumo, a stock I pitched earlier this year.

4.1 | Between Japanese trading companies and the UAE

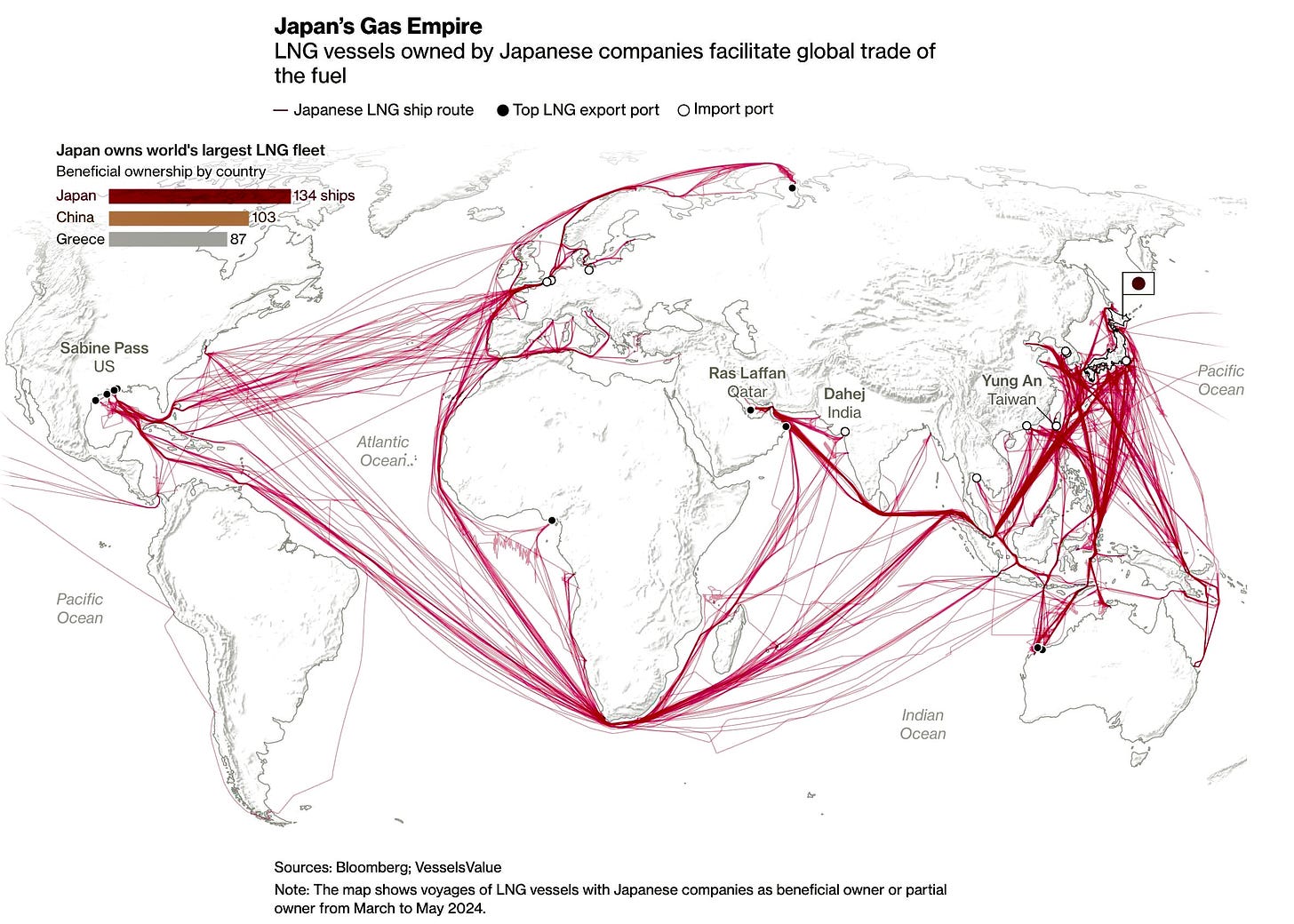

When Warren Buffett bought Japanese trading companies such as Sumitomo, Mitsui, etc., the investing world started focusing increasingly on Japan. While many have looked into the large trading companies, few have taken a look at the smaller companies like Sojitz, Hanwa and Kanematsu. In an increasingly fragmented world, Japanese trading companies face two paths: either position themselves in industries poised for growth—focusing on trade with the Global South and geopolitically aligned nations—or risk falling behind.

Fortunately, most Japanese trading houses have been around for over a century and are actively investing in their future. One example is Japan’s dominance over the LNG trade.

Most trading houses are diversified in a broad number of industries and have shares in hundreds of companies employing tens of thousands of people. Through their immense trade network they have been able to spot trends relatively early on and have been investing heavily overseas. Southeast Asia, India, Australia and the U.S. are just some of the places where Japanese companies have been betting on. Toyota Tsusho, a lesser-known trading house with 70,000 employees, is investing billions in the African market.

Apart from Japan, the UAE are poised to benefit from the sea change we are witnessing right now. From a geopolitical perspective, the UAE are positioned roughly in the middle between China and the United States. The country has received the highest FDI (Foreign Direct Investment) from China out of all countries in the Middle East.

At the same time, the Emirates have also been a close partner of the West. Especially from a migration standpoint, the UAE is one of the magnets for millionaires leaving Europe.

The UAE’s access to a cheap supply of energy coupled with its central location along one of the major shipping routes from Asia to Europe has been a driving force behind the success of the country. Gigantic capital inflows from all over the world have elevated the country to the top of the globe. The strategic location of the UAE can be best expressed when we look at the Jebel Ali port in Dubai. The port is a logistical hub and the 4th largest port globally outside of China. Furthermore, the Dubai International Airport is the second busiest airport globally. With a gradual move towards more trading with geopolitically aligned countries, the UAE is set to become the neutral trading partner in the region.

“The UAE placed second on the Commodity Trade Index, equalling its performance from 2022. In particular, the UAE has the top score for commodity endowment factors, driven by its large natural supply of oil. The UAE has scored top for this pillar of the index in every iteration of the Commodity Trade Index. The UAE also scores relatively well in institutional factors, which is driven by its attractive tax rates and strong performance in trade logistics.”

One thing that has been evident in all graphics and data on the global trading system has been the rise of India. While it’s hard to get access to Indian equity markets, the UAE will benefit greatly from the Indian economic boom. Low taxes coupled with enough available capital and an already established logistics hub, the logical next step is the development of a commodity trading hub.

5.0 | Conclusion

In conclusion, the global order is shifting gradually. The fragmentation of trade coupled with geopolitical tensions, and capital reallocation are the reality we live in. Historically, this is nothing unusual. Actually the contrary, the past few decades were unusually stable from a perspective of global trade. As investors, we need to consider the risk that derive from more fragmentation. The rise of neutral players like Brazil, the strategic positioning of Japanese trading houses and the growing relevance of the UAE as a commodity hub create opportunities in this challenging environment. Volatility is here to stay and potentially increase due to tensions all over the globe. It’s not about predicting the future perfectly, but about understanding the longer term trend. Because in the end, it really is all one big trade. And political decisions in Washington, Brussels, Moscow, Beijing, Tel Aviv, Tehran, etc., have only sped up the process of more fragmentation.

Over the next month, I will attempt to go trough the entire UAE stock exchange on the hunt for companies that will benefit from this megatrend. Vale is in a great position to benefit from this situation, because Brazil is a neutral trading partner of both the U.S. and China. At the same time, the Iron Ore trade is very concentrated, which leaves Vale in a dominant market position. The valuation is low and nothing much has changed since I published my thesis last year. In case Japanese trading houses sell off, I will be ready to buy in, as these companies have been expanding internationally and are stable long term investment you want to buy at the right price and hold forever.

Yours sincerely,

MODERN INVESTING