Odfjell Technology - High quality at a discount

20% Free Cash Flow Yield, 5% dividend, P/E of 7 and a strong business …

Over the last 2 years we have realized that energy independence and energy security are very important parts of the global economy. But these problems date back all the way to the global financial crisis and to the global ESG movement. The consequences of the drastic underinvestment in fossile fuels are now coming in large waves that will result in several crises and grey/black swans.

While I have invested heavily into oil & gas stocks, many people are concerned about the fact, that investing into commodities is cyclical. Therefore they are completely ignoring this market, which is full of opportunities. But today we will dive deeper into a company that is a much safer and resilient way to play the commodity cycle. The stock is deeply undervalued and has great momentum.

Without any further introduction, let’s dive into Odfjell Technology.

1/ Years of preparation

While energy is essential for every society to flourish, it is sad to see that we even have to debate things like energy security, innovation, etc. As a result of the increasingly leftist and green movements in the political spectrum, we have come to a point at which Europe is dependent on Energy imports from other parts of the world. Germany is the perfect example for this. They turned off nuclear energy, build renewable energy and stopped importing gas from Russia. What a coincidence, it didn’t turn out well for them and now their industry is in ruins.

We need fossile fuels for modern live, there is currently no other solution that is as easily accessible and cheap. And while many nations in Europe may be in favor of a ban of fossile fuels and cars with combustion engines, the world is much bigger then just Western Europe. Population growth in Southeast Asia, Africa, India, etc will more then offset the slowing demand in Europe.

We can see form the graphic above1, that the oil consumption per capita is in Africa 8x lower then in the EU. And with the population of Africa forecasted to double by 2050, the demand for oil will definitely increase. And this is where the problems begin ! As a result of a very capital tight energy market (meaning that the accessibility of capital is low), we will likely see a disconnect between supply and demand for years to come. Further, CAPEX has gone down dramatically since the last cycle, leading to an even less balanced market outlook.

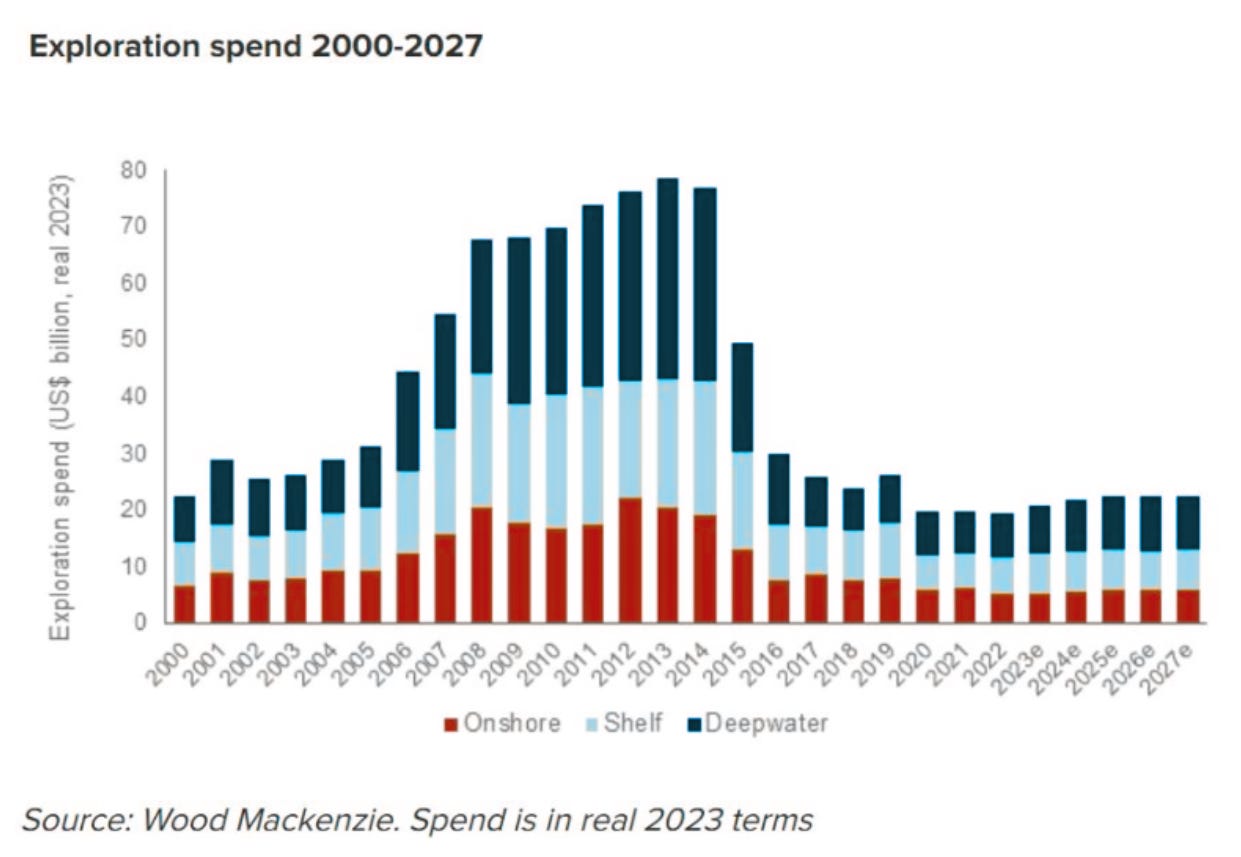

Looking at global CAPEX adjusted for inflation2, we are far off the highs of the last cycle. But with increasing energy problems and a new focus on energy security we will see global spending on oil & gas increase again over the coming years.

Rystad Energy wrote about the downturn the following3:

The oilfield service industry has had a rocky ride since 2014. An oversupply of oil volumes driven by the US shale revolution, a volume war led by OPEC, Russia flooding the market, and a two-year long pandemic all contributed to depress oil prices and upstream spending […]. From its peak in 2014 to the trough in 2021, revenue fell almost 60% for the biggest contractors.

Now Rystad expects that global oil & gas spending will hit 1 Trillion $ by 2025 and will remain high thereafter:

“Global oil and gas suppliers look set to echo the biblical story about the Egyptian pharaoh’s dream of seven years of feast and seven years of famine – only in the opposite order,” says Audun Martinsen, partner and head of energy service research at Rystad Energy. “All signs point towards 2022 being the start of another super cycle for the energy services sector”.

The investment thesis for oil and gas service companies is simply that the years of underinvestment will provide market beating returns over the coming years, while theses stocks will have less volatility then E&Ps, since they have more resilient earnings.

2/ Norway, the New Saudi Arabia ?

Odfjell is primarily active in Norway, which is something that goes back all the way to the foundation of the company in 1973. Norway is uniquely positioned to supply Europe with gas and profit that way from this crisis. Apart from this, Norwegian energy companies face benefits thanks to their location.

The operating expenses per barrel are extremely low and one of the lowest in the world at just 8$ per boe (barrel of oil equivalent). Further, they have the lowest CO2 footprint, which in the case of potential global CO2 taxes looks quite good. With very low corruption rating of 85 there is also more transparency. And lastly there are still a lot of undiscovered resources in the Norwegian Continental Shelf.4

I got to say thank you to Alexander Eliasson (Twitter profile here) for sharing the idea of Odfjell Technology and making me interested in the stock.

3.0/ Business Model

Odfjell Technology is a spin off from Odfjell SE, which is on of the leading shipping, energy and transportation companies in Norway. The Odfjell family still owns 60% of the shares of Odfjell Technology, which highlights their interest that this company succeeds.

The company operates in three core segments:

Well Services

Drilling Operations and

Engineering.

Well Services, contributing to 34% of revenues, involves agreements for rental equipment and exclusive service agreements. Drilling Operations, contributing to 47% of revenues, focuses on high-end drilling services. Engineering handles smaller to medium-sized projects for offshore drilling and oil/gas companies and accounts for 10% of revenues.

Odfjell Technology, which is a spin-off from Odfjell SE and showcases fast growth since the beginning of this energy cycle.

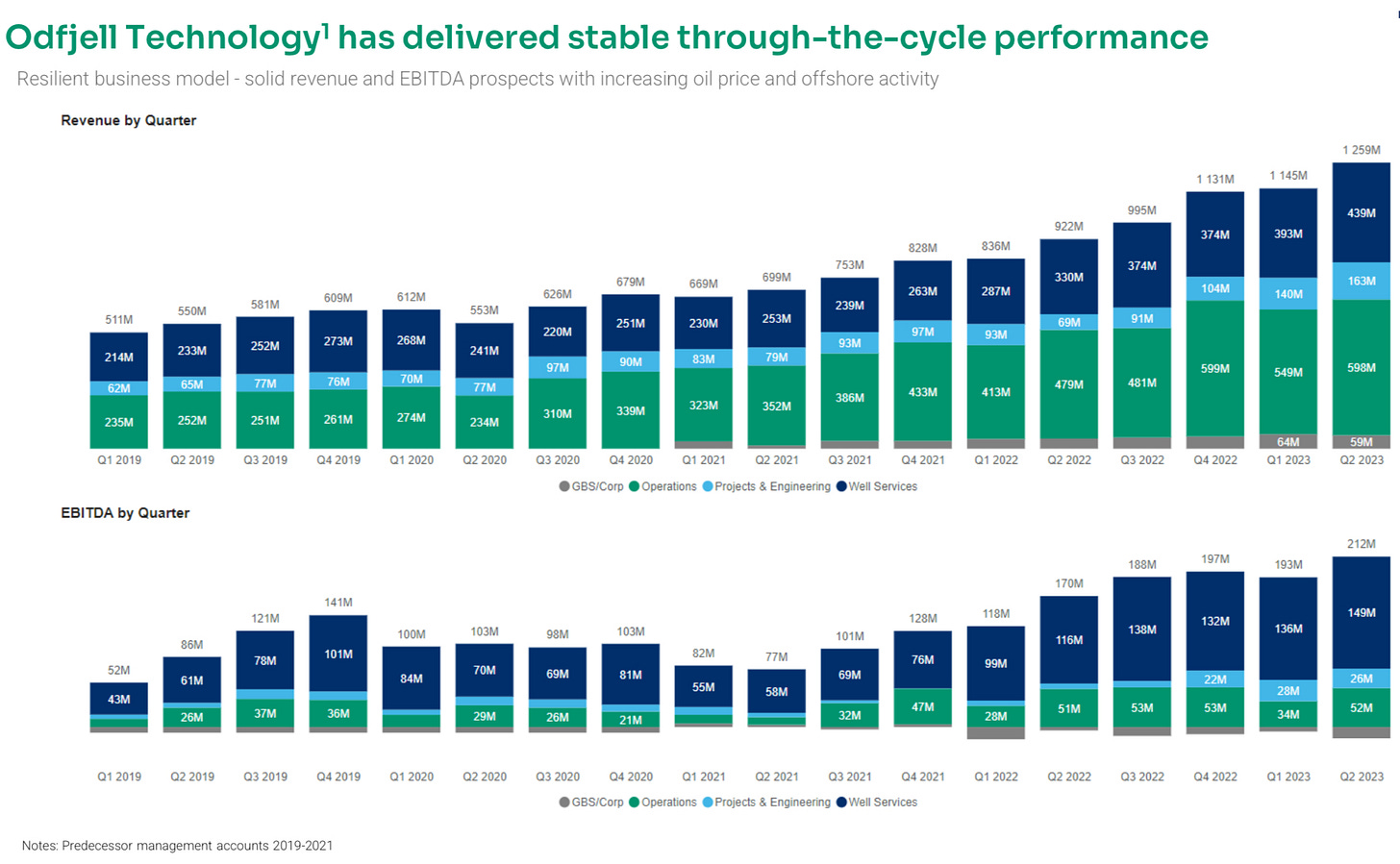

Above5 we can see, that since the low of the cycle (somewhere around 2019/2020), Odfjell Technology has grown it’s revenues and EBITDA from 500m to 1.26 Billion and from 52m to 212m respectively. While Operations account for nearly half of revenues, they account for just 25% of EBITDA. Well Services are a cash cow for Odfjell and are contributing greatly to the bottom line of the income statement.

The great thing about oil services is, that they are not directly exposed to the risk of volatility in the underlying commodity. This resulted in incredible resilience for Odfjell Technology. They even remained profitable during the COVID pandemic.

Below we can see a selection of their customers.6 👇

3.1/ Backlog

The strong environment for oil service companies was highlighted in the recent earnings call7:

The upcycle is driven by high demand and oil prices. [We are] well positioned to profit from increased drilling activity. By integrating Well Services into drilling operations, we will create competitive advantages. 2023 is some sort of a transition year. 2024 will be a year of higher growth. We expect much more aggressive growth going into 2025 - 2026.

— Q3 2023 Earnings Call

So with 2024 being even better then 2023 and valuations for Odfjell pricing in no growth, Odfjell appears very undervalued. The most important thing to this thesis however is how good cash flows will get and whether they can sustain these conditions. Therefore we should look at backlog to get a sense of the coming quarters of financial performance.

Backlog currently stands at 11 Billion NOK, which is 5.5x the current market cap and around 2x revenues. Backlog is flat over the last few quarters, which is the result of the division “Operations“, which makes up 65% of total Backlog. The results of the very strong environment for Well Services is therefore not well represented. But generally the backlog is expected to rise over the coming quarters, which should make the company more resistent during volatile times. The CEO Simen Lieungh put it like this:

We expect to grow our operations backlog going forward, since there are a lot of tenders right now and we expect to take our share of that. We are focused on growing [the] Well Services Backlog and expanding into other geographical areas.

— Q3 2023 Earnings Call

3.2/ Expansion

The expansion into other geographical areas was mentioned by the CEO, regarding the growth of the industry. Right now the world is thirsty for oil, which means that we have to put our focus on the Middle East and Latin America.

Recently the management emphasized that the hub in Dubai serves as a gateway into the Middle East, which is arguably one of the most strategic locations in the world regarding energy. Apart from the Middle East, Odfjell is also expanding into South America, which will become one of the most important energy suppliers once Guyana, Suriname and Brazil have increased production.

4/ Competitive advantages

Commodity stocks are driven by the performance of the underlying commodity. Odfjellˋs performance is also dependent on the state of the market, but the company is much more resilient during downturns, which bags the question, whether they have an competitive advantage, or not ?

To answer this question, we should try to look at this from a different perspective. How easy would it be to compete with them in their markets ? It would be incredibly difficult to do so. Firstly, Odfjell Technology has more then 50 years experience and is well integrated with the other companies under the Odfjell umbrella. Another hurdle is trust.

After decades of collaborating between them and their clients, it’s impossible to compete with them trough quality or culture. The only way to do so, would be by being a lot cheaper then them. But since the Oil & Gas Services sector in Norway is predominantly dominated by a few players, the characteristics of the market are similar to an oligopoly.

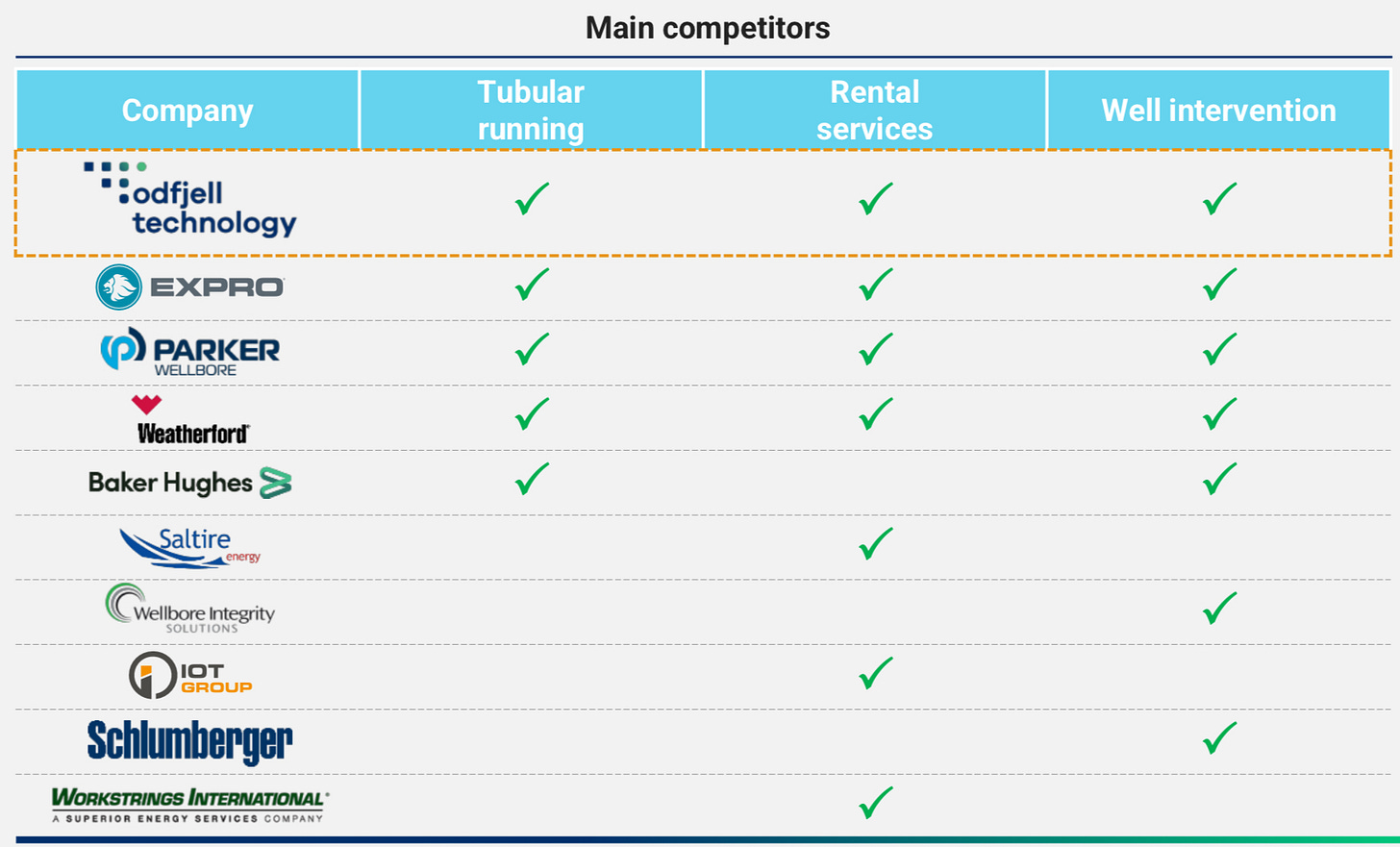

In the Well Service Market, there are just 3 other companies that offer the same services as Odfjell. In general the market is concentrated, which makes it difficult for new competitors take market share away from the leading companies.

Thanks to the strong brand name and the global expansion, Odfjell is a well know name in the industry that stands for continuous innovation and high quality services.8

5/ Financials and Debt

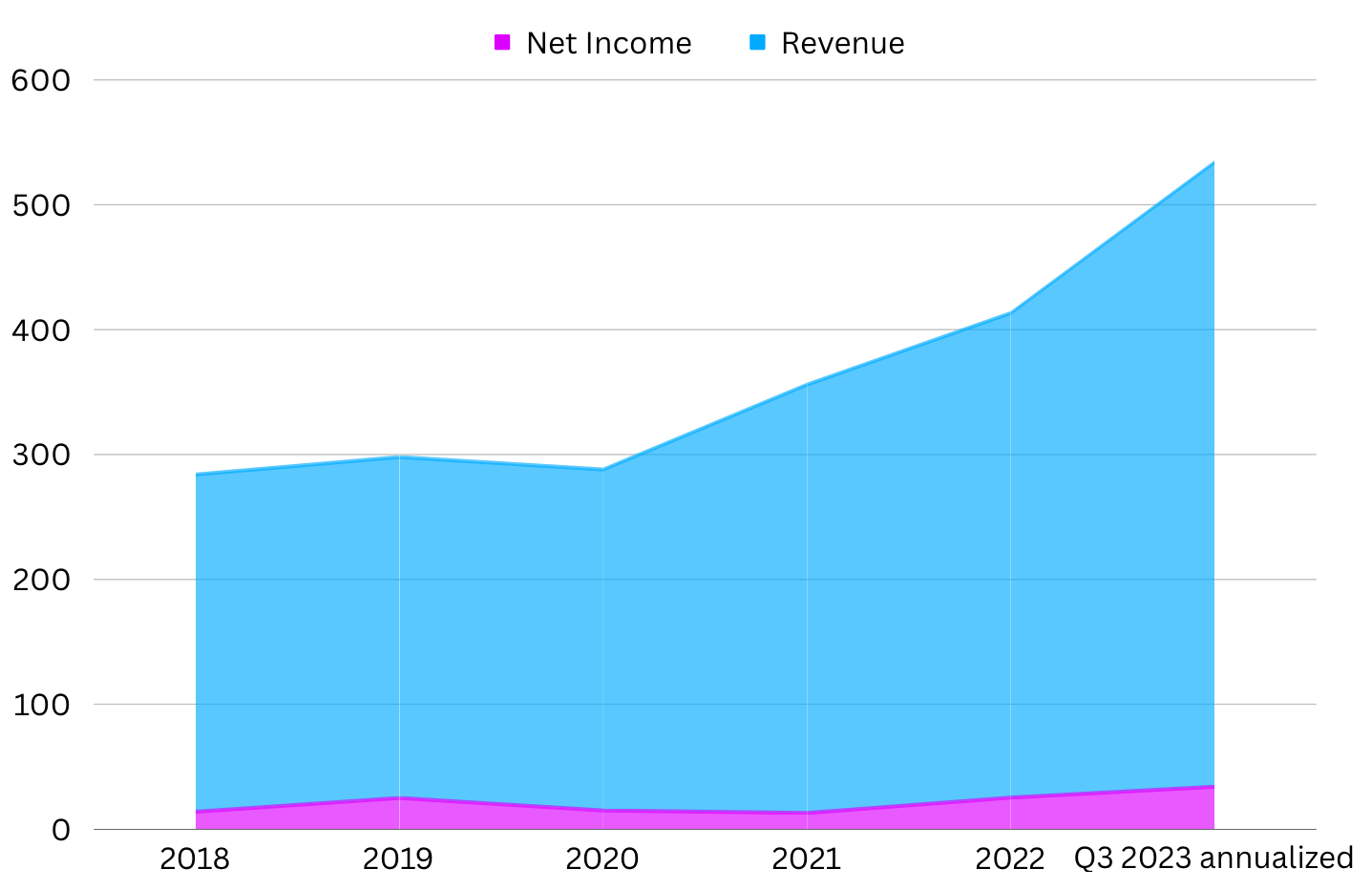

Both revenues and profits have grown nicely since 2020, which is mainly the result of higher drilling activity and a better market environment. With projections of 2024, being a year of fast growth, revenues above 600m USD wouldn’t come as a surprise.

Regarding their margin, we know that the strong environment for oil and gas services and the high demand for their services is helping them a lot. Inflation pressures are there, but in the recent Earnings Call also this topic was discussed:

We already invested in some equipment in advance, since we expect an “escalation“. But we are pricing contracts with the expectation of an escalation [in the equipment market]. We are aware of cost increases.

— Simen Lieungh CEO of Odfjell Technology

It’s clear that Odfjell is/will continue to generate a lot of cash flow. So we have to look at the balance sheet to indentify potential risks. The company has a current ratio of 1.77 which means that current assets are 1.77x the size of their current liabilities, which is a positive sign regarding the financial strength of the company. Further Odfjell Technology has an interest coverage ratio of 4. This is another aspect that highlits the srenght of the company.9

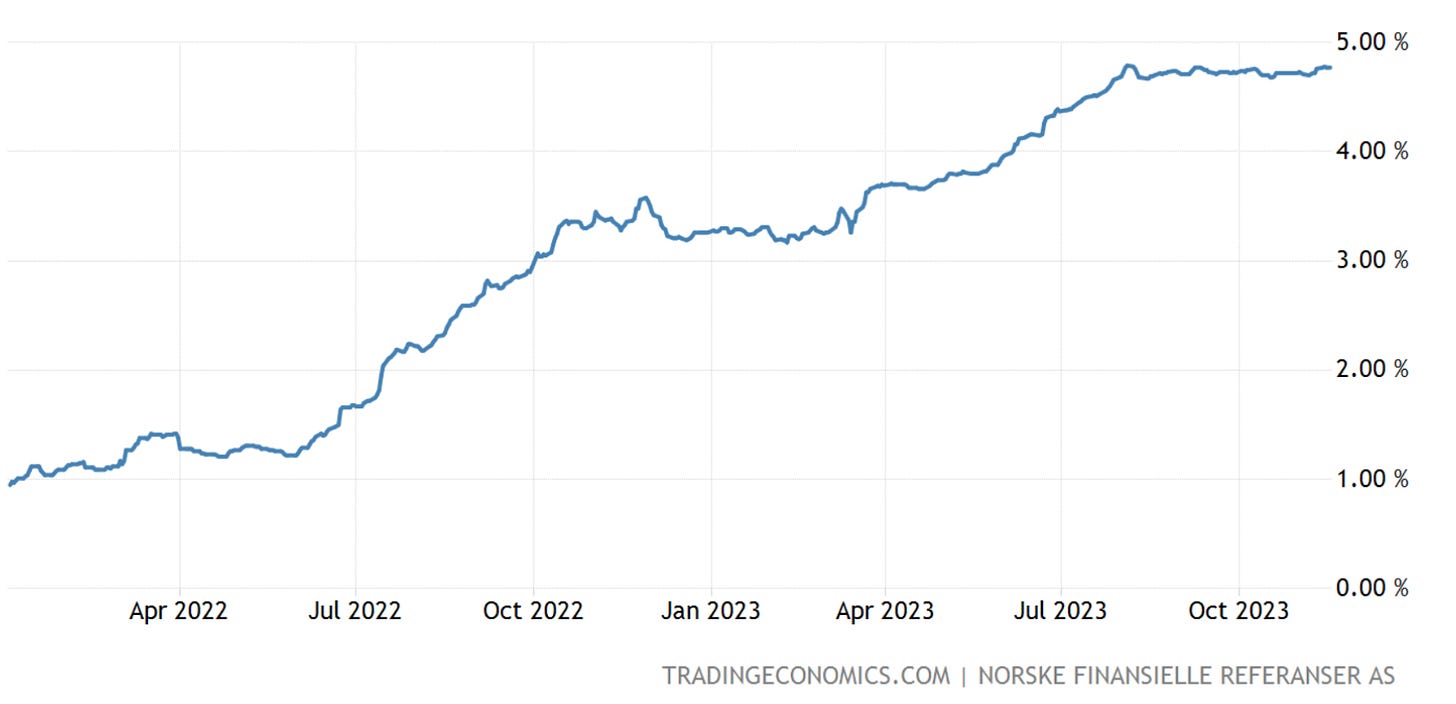

Net Interest Bearing Debt is equal to 866m NOK, which is 2.6x the annualized Net Income from Q3 2023. The interest they are paying on the bond they issued is very high. It’s the 3 month interest rate in Norway plus 7%. Therefore interest expenses are very high for the business. I don’t expect liquidity problems, since they have to pay back the bond in February 2026. Also 80% of the shares are owned by insinuations and the Odfjell family (60%).

I would prefer buying back bonds and paying back loans over dividends, since this would increase cash flow and would make the company financially more flexible.

6/ Valuation & Dividends

The important part is always which price we are paying for a business. Odfjell Technology is cheaply valued at a P/E of slightly below 7 for 2023. 2024 is going to be even greater so then the valuation will drop further. DNB recently compared the valuations of several energy focused companies.

Among the small caps, certain names have covenants restrictions, but we highlight Odfjell Technology and Odfjell Drilling as the best dividend candidates, in our view.

— DNB

We can clearly see, that OTL is trading at the valuation of tanker or small oil producers. The difference between them and OTL is, that OTL is much more resistent during downturns and corrections. At a Free Cashflow Yield to EV of 21% for 2024 and 27% for 2025, the stock is tremendously undervalued. 10

Apart from that we can also look at the P/E ratio, which is equal to around 7. EV/EBITDA stands at 2.5 for 2025 and Free Cashflow is expected to grow quickly over the coming years. With a quickly improving balance sheet and a strong market environment, Net Interest Bearing Debt (NIBD) will drop considerably till 2025. From then on even to negative levels !

In 2023 the company paid dividends of 100m NOK, which is equal to a 5% yield. But if we believe several analyst houses, then we are going to see payout ratios of 50% from 2025 onwards. This would be driven by an improvement of the balance sheet, which would allow larger distributions to shareholders. If we have a Free Cashflow Yield of around 20% and a payout ratio of 50%, then the dividend yield would equal 10% on our cost basis.

As a a result of this, several analysts have price targets above 80 NOK a share (+60% from current levels).

I like stocks that’s are so cheap, that no mater which valuation method you use, the stock is still cheap. And with more predictability Odfjell Technology is one of my favorite stocks right now.

7/ Conclusion

In conclusion, Odfjell Technology appears to be a great investment opportunity in the energy sector. The company benefits from long term tailwinds. With a resilient business model that was profitable even during challenging times such as the recent pandemic. Its strategic position in Norway, coupled with an expansion into the Middle East and South America, makes the investment case even stronger..

While the debt is for now a bit high, thanks to their FCF generation, the financial position is going to strengthen significantly over time. This will result in large dividend payments and a healthy financial position, allowing for mergers and acquisitions. The valuation is very compelling at a Free Cashflow Yield above 20% right now.

I hold shares in Odfjell Technology and plan to add to the position over time.

Yours sincerely,

MODERN INVESTING

This is not financial advise and shouldn’t be threaded like it. Everyone has a different risk tolerance, which is why I don’t want and can’t give anyone financial or investing advise. Everyone has to make his on mistakes :)

DNB Markets — Oil Services

What's the difference between Odfjell Technology and Odfjell Drilling? Seem to do same thing. Not explained in their presentation well at all.

Excellent write-up. I've put in on my watchlist