Petrobras reported FY 2023 numbers yesterday, and trading volume was massive. The share price was down 13% and I could smell the fear all the way here in Europe. FinTwit (X) is escalating and people that missed the entire run up are now in the “I told you so mode”.

Over the past 24h I spoke and debated with people I highly trust (THE PETROBROS) about this topic. In this article I will share my thoughts and conclusions.

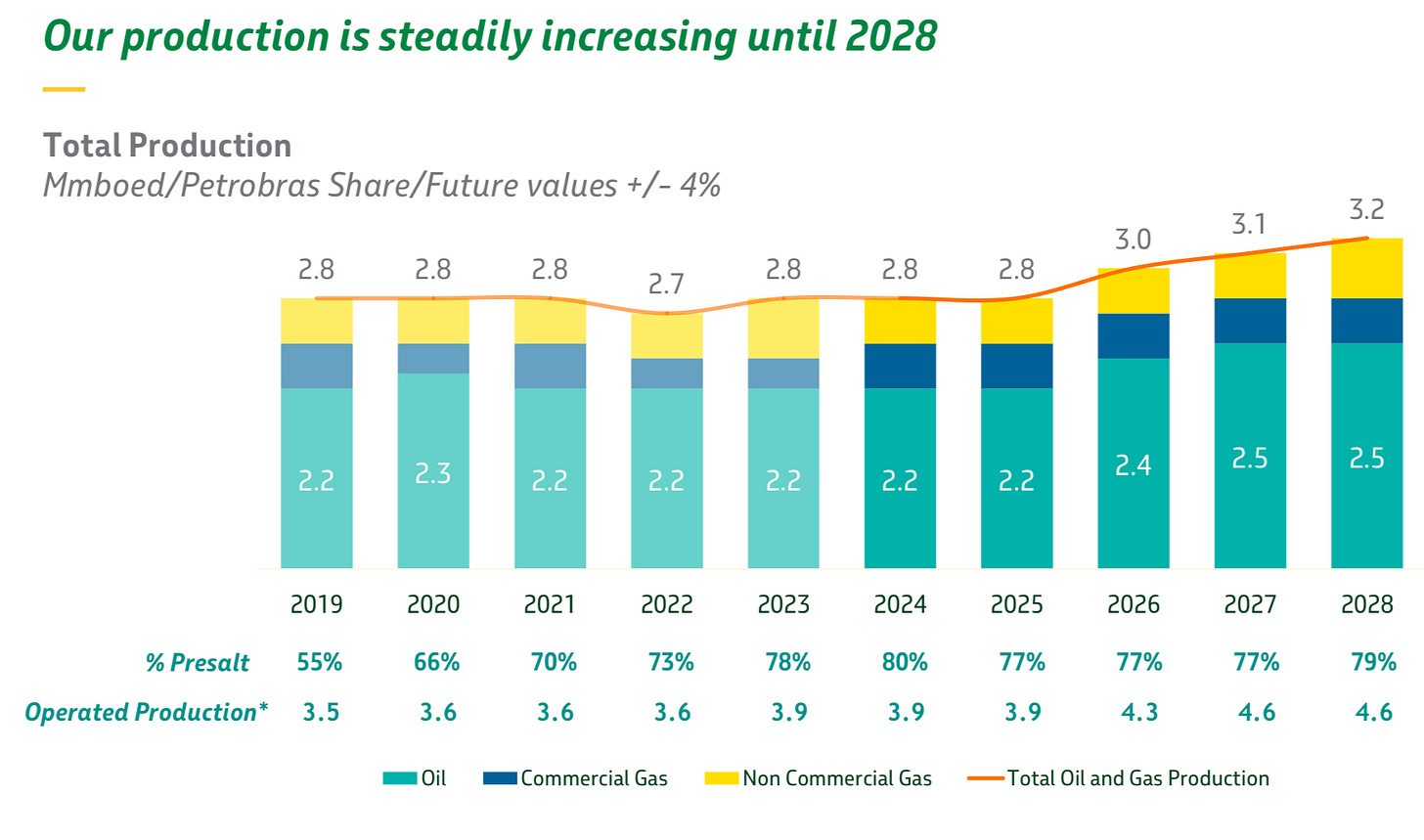

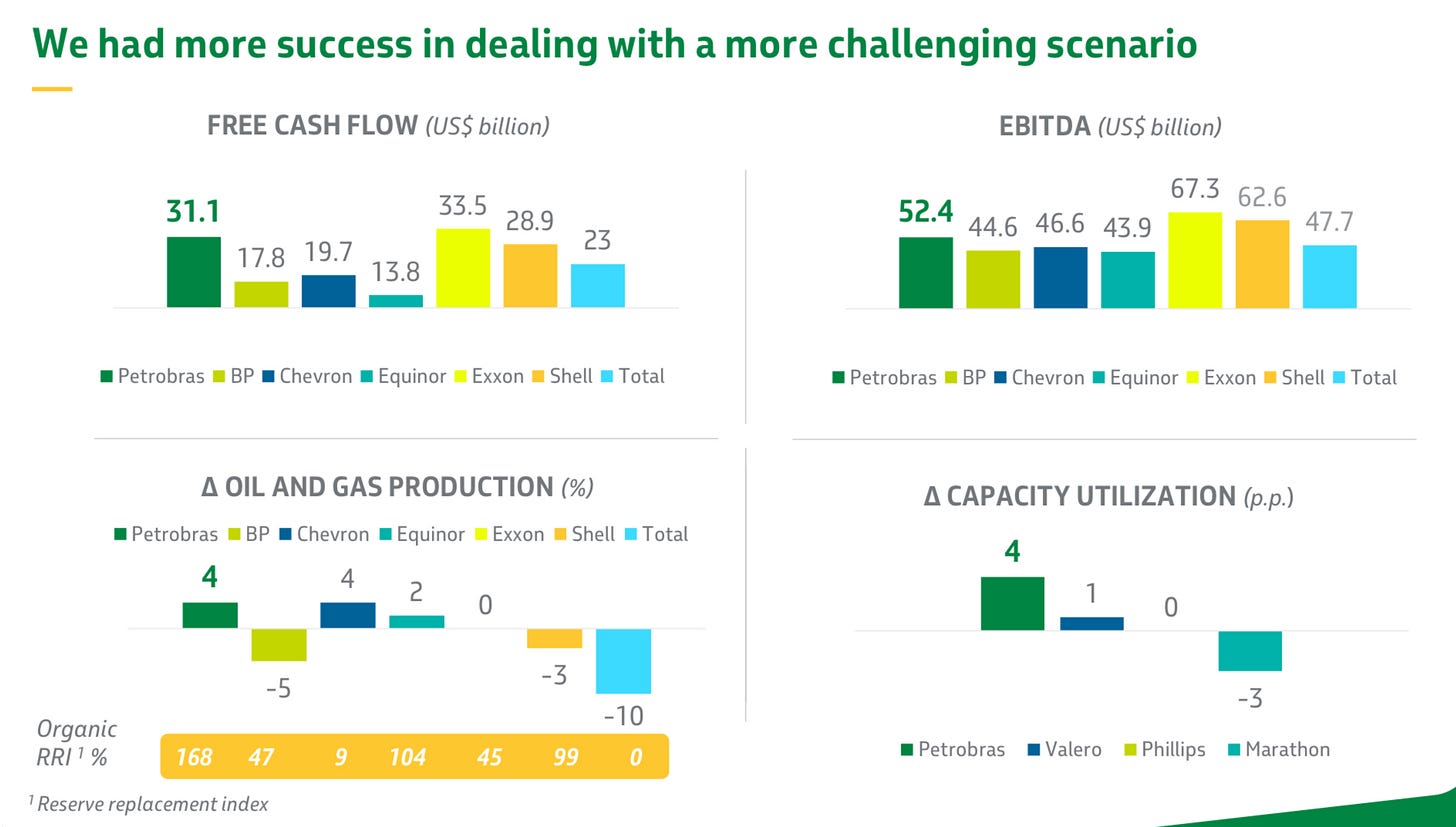

The earnings report was fantastic if you consider that realized oil & gas prices went down globally in 2023. PBR 0.00%↑ generated the 2nd highest profit in the company’s history and generated an impressive $31 Billion in FCF. Production hit 2.78m boe/d and operating costs per barrel went down. Net debt stood at $28.8 Billion, which equates to a Net Debt/FCF ratio of just 0.9x. The year was negatively impacted by lower prices for oil and an impairment. This is common with nearly all energy stocks that I own and follow, as FY 2022 was so impressive, that the performance of 2023 (although very god) looks worse than it is.

To make a long story short, headlines like these caused the crash. 👇

While the company crushed it operationally, the company didn’t announce a special dividend. This caused weak shareholders to dump there shares. While I would have very much liked a special dividend, we should remember that the dividend of $0.55 per ADR per quarter (!) is a dividend yield of 14.6%. PBR 0.00%↑ has a fund called remuneration reserve that is used to pay special dividends to shareholders. This fund is build with capital that is left after the company has paid out the regular dividend. At the moment this fund has around R$44 Billion, which equals around $8.8 Billion. The CEO of Petrobras, Prates, said in the conference call that the money in the reserve will be paid out via special dividends at a later point in time. This was contrary to media reports claiming that Petrobras would use the cash for further investments (CAPEX).

The question is, why didn’t they just paid out the special dividend instead of paying it later? Firstly, Petrobras has a policy of distributing 45% of FCF via dividends. FCF is metric that is impacted by the operational results and capital expenditure (CAPEX). Operationally Petrobras is doing terrific, but if the company wants to spend more on investments, then FCF would drop. This would in turn result in dividends falling, since it’s at a fixed 45% of FCF. To offset this, Petrobras is likely building the reserve. In times of large investments, the company would be able to pay a dividend, although FCF would be weaker.

Now the question that remains is, what the money would be spend on. Petrobras was really trying to please western ESG investors in the conference call, if you consider that they talked quite long about the climate, woman, and all the other things large western companies have to talk about. Is this a sign, that PBR 0.00%↑ will go all in on renewable BS? I don’t think so. While they have talked about the energy transition and renewables in detail, all of this will make up around 11% of CAPEX going forward. And we should expect that large parts of this CAPEX will flow into biofuels. I don’t consider Biofuels as bad as the ESG-Money-Whole that has resulted in billions of dollars in losses globally. Biofuels have a large advantage in Brazil, since Brazil is an agricultural powerhouse that can produce the feedstock for those fuels independently.

In addition to that, Petrobras is a Brazilian company that is focused on oil. The company doesn’t have the same pressure as oil companies from the west, in regards to renewables. Furthermore Prates said, that Petrobras is ready to be the “World’s last oil producer”.

I think that we can expect that most of the additional investments will be made into chemicals, refining and in the traditional oil business. Nonetheless a small part will likely be invested into renewables.

1/ Missing the Forrest for the trees

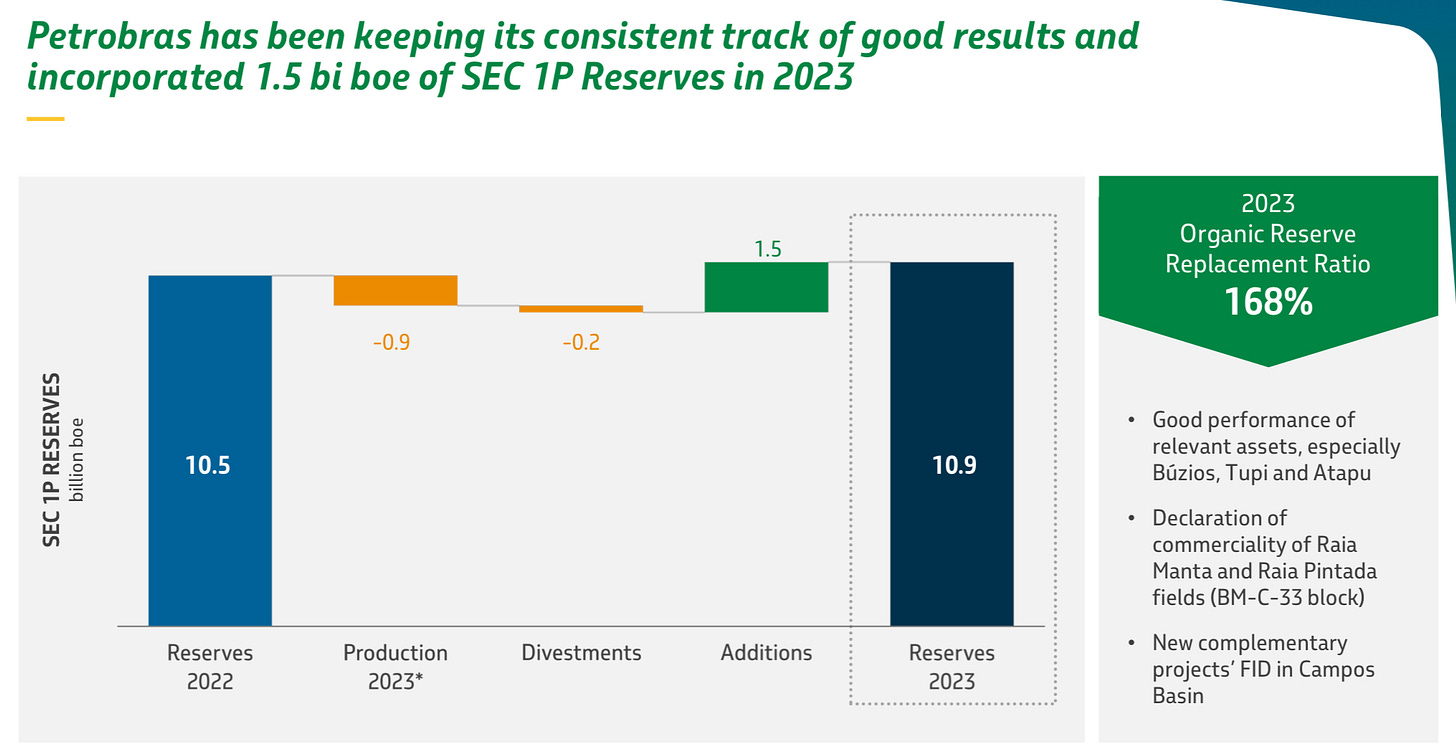

The price action has shown that WallStreet is very uncertain about the future of Petrobras. In my opinion, Petrobras is the best major oil producer in the world, if we look at operations. The company has huge reserves of ~11 Billion boe (1P), which at current production rates equates to >10 years reserve live. The reserve replacement ratio stood at 168% in 2023, which basically means that although the company produced 900m boe during the year, new production coming online, resulted in reserves growing by 400m boe.

On top of this, there are many projects that will be started and explored, that will contain billions of barrels in reserves.

Studies by Brazilian state-run oil company Petrobras show that a single oil block of Amapa's equatorial margin could total more than 5.6 billion barrels of oil, the country's mines and energy minister said on Friday.

— Offshore Engineer

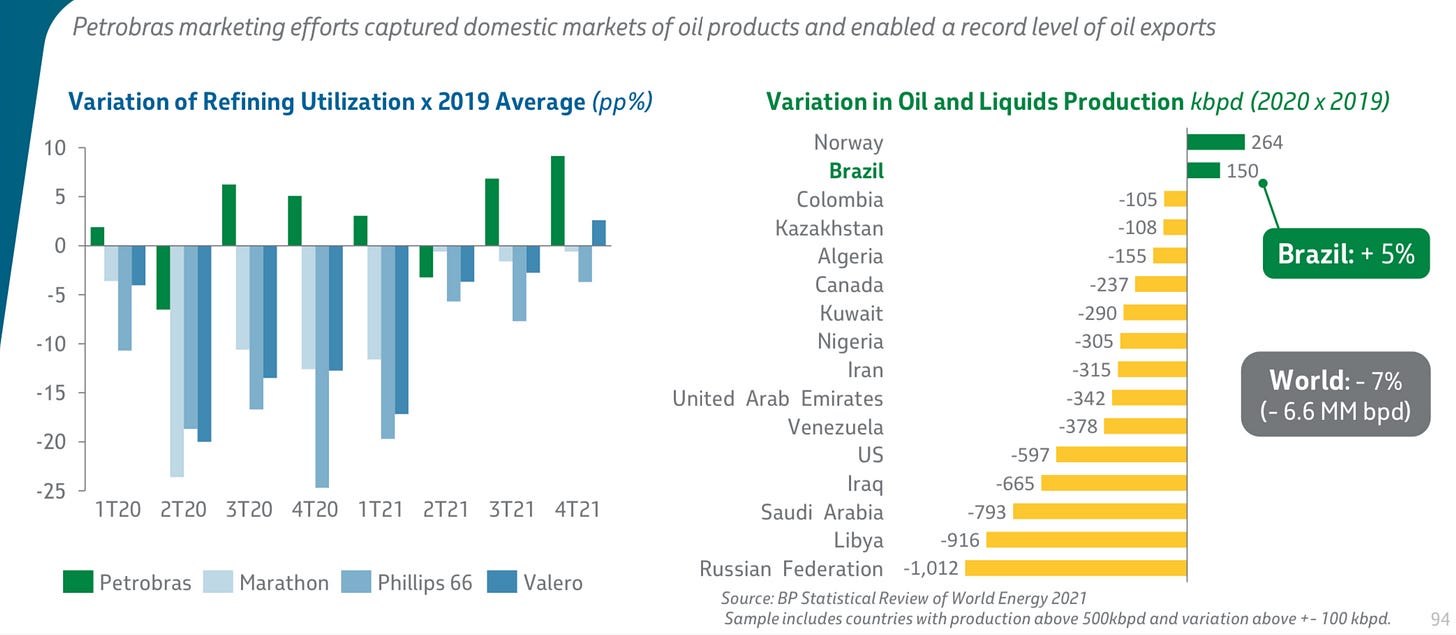

The Assets of the company are great with breakevens at 35$ a barrel, while new production (pre salt) is coming online, that has breakevens at 25$ a barrel! The refining business is doing very well too, as utilization has been in the high 90s for the past months. In terms of utilization, Petrobras has outperformed its peers a lot since 2019 (left chart).

Not only does Brazil has huge amounts of natural resources, but it also is uniquely positioned to supply the world with energy and food. Both Norway and Brazil have been able to gain market share in the global energy markets in times of crises. While OPEC+ is keeping production artificially low, to support the oil price from american production, Brazil and Norway are increasing production levels. This is also the reason, why I have large parts of my net worth invested in Norwegian oil & gas companies.

Brazil is becoming an energy hub in the souther hemisphere. This will be driven by production growth from Petrobras, which will boost production by 14%.

In addition, Petrobras is mostly immune to geopolitical instability. Think about the latest geopolitical events, has petrobras been effected? Global trade disruption by attacks in the Red Sea, a war in Ukraine. Actually the contrary is the case. Petrobras is able to profit from these events, as they aren’t affected by them.

3/ Valuation, Risks and my Conclusion

While the stock has had a terrific run in 2023, the valuation is still insanely low compared to the quality of the company (discussed above☝️). The company is valued at $100 Billion, while generation $31 Billion in FCF last year. This means, that PBR 0.00%↑ generated nearly as much FCF as Exxon Mobile, while Exxon is valued at 4x the market cap of Petrobras!

Regarding debt, I have stated earlier that it stands at just 0.9x FCF. The interesting part is, that the a averge maturity is around 11 years, with an average interest rate of 6.5%. While the interest is quite high, the time till maturity is very long, and the company is producing huge amounts of FCF.

Now, there are risks. We shouldn’t underestimate the fact, that dividends could be cut to finance some projects or wild ideas of the energy minister. Apart from these risks we need to understand that the “risk free rate” in Brazil stands at 10.25% (in real). The reaction by Brazilian fund managers over the coming trading days will be very interesting, since at a “risk free rate” of 10.25% the interest for dividend stocks changes a lot. A Brazilian member of the “PETROBROS” said the following. 👇

It's Brazil. Here we say even the past isn't certain.

My conclusion is, that Petrobras is obviously still a fantastic company. Operationally, the company is like Arnold Schwarzenegger in his prime. But the risks shouldn’t be underestimated. I have decided to not sell a single share (yet …), and wait for the further reaction by the markets and whether there will be any comments from the company (I doubt it). The next important day is the annual shareholder meeting on April 25th. Going forward I remain bullish on the company, but it remains to be seen what the shareholder meeting will bring.

I also expect times of much higher volatility with frequent cycles of “we’re so back” and “it’s so over”. If you can’t handle volatility you should find a hobby as fast as possible, since you won’t survive this market otherwise. If you have anything to add, feel free to comment below and join the community.

Yours sincerely,

MODERN INVESTING

This was your best writing yet mate. Well Done 🤙🏼

I linked to this piece and a couple of others on Petrobras in my links post for today: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-march-18-2024

I know the Latam Substack guy recently did a podcast w/ a Brazilian oil expert who noted the private sector Brazilian oil stocks that deal with the smaller and depleted fields that a bureaucratic behemoth like Petrobras does not want to deal with can take oil out for as low as a few dollars a barrel - and you don't have all the political noise that comes with Petrobras...