1.0 PetroChina ?

In 2003 Warren Buffet started buying positions in PetroChina, a company that is controlled by the Chinese government. It is as the name says an oil producer that still exists today. Here is what he had to say about his position.

At the time, … it produced about 3 percent of the world’s oil, which is a lot of oil. It produces, probably, 80 percent or so as much as ExxonMobil will produce. And it’s a huge company.Last year it earned $12 billion… At the time we bought it, the total market value was $35 billion. So we bought it at about three times what it earned last year. It does not have unusual amounts of leverage. They say they will pay out about 45 percent of the amount they earn. So, if you can buy it at three-times earnings, what turned out to be three times earnings, and you get 45 percent of 33 percent, you know, you’re getting a 15 percent yield on your investment.

— Warren Buffet

He sold his position in 2007 after oil rallied and his investment in increased by 720 %.

Today there are many similar opportunities, with state controlled oil producers. They often trade at absurd valuations and pay nice dividends. Petrobras and ORLEN are my top pics in this area. But today I will write up my thoughts about ORLEN.

1.0 ORLEN

The company is an oil and gas producer in Poland. In the last few months I have written fairly often about the polish economy and it’s stock market, which is one of the cheapest in the world. In fact it is the fastest growing economy in all of Europe, and has outperformed even South Korea in GDP growth since 1980 ! This puts Poland even above Great Britain, by 2030.

“The data shows that GDP per capita in 2021 was $44,979 in Britain and $34,915 in Poland, (…) Poland - should it maintain its 3.6% average annual growth - will overtake Britain by 2030.“ — TVP World

A country that has a lot of economic growth, needs more energy, to keep up with the increasing demand for gods. A clear profiteer from this trend, that will continue for decades, is PKN ORLEN.

The company owns a huge network of gas stations all across Poland, and has a market share of 37 % in the country ! All tough the firm also has a network in countries such as Lithuania, Germany, Hungary, Slovakia and the Czech Republic, this is not significant compared to Poland.

2.0 Monopoly and the polish government

As of 2020 the polish government held ~ 27% ownership in the company. But this year, the ownership went up to 49.9 %. This is the result of two major mergers with LOTOS and PGNiG. LOTOS was the largest competitor of Orlen, and PGNiG has major production fields in Norway. The polish government held majority stakes in both companies, which increased the ownership in ORLEN after the mergers. After these Mergers, ORLEN also sold 30 % of it’s stake in a refinery in Gdańsk to Saudi Aramco, at an valuation of 1.15 Billion USD. This shows the close relationship, the firm has with other multinational corporations such as Saudi Aramco. This is in my opinion a beneficial partnership for both sides.

PKN ORLEN is used by the polish government as a toll of international politics. The firm will for example build the small nuclear power plants (SMRs), trough which Poland aims to reduce it’s dependence from coal. I link the live stream with the announcement here.

Further ORLEN is also the company that started talks with other nations, such as the US for importing LNG, after the beging of the war in Ukraine and the embargo on oil from Russia. Sure the company is used by the polish state to represent it’s energy policies all over the world, but this is also helpful, since support from the government is very helpful and has created a strong moat, that is hard for competitors to compete with.

In an article by money.pl (here), they said that small owners of gas stations in Poland struggle to compete with PKN ORLEN, because they can’t sell gas at an price as low as ORLEN can. When I was last time in Poland, I heard from family members, that they can use an app, that reduces the price they have to pay per liter at ORLEN.This is of course a government incentive, because the polish state wants to have as much control as possible over the gas stations.

But ORLEN also has an interest in gas & electricity distribution across all of Central Europe. With a 70 % coverage of all polish households, ORLEN (and the government !) is de facto close to monopoly status in gas distribution across Poland.

3.0 The Vision

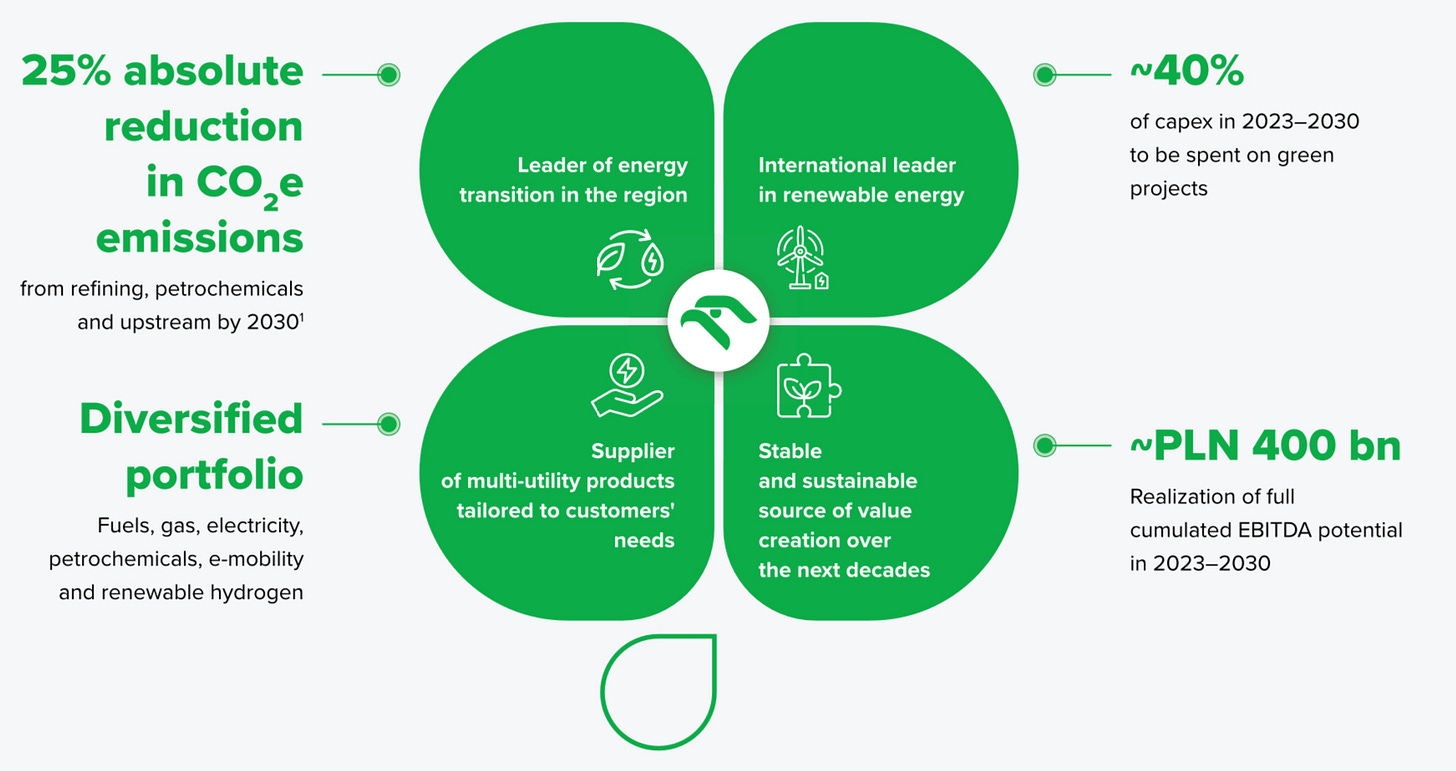

The vision of ORLEN is to become the most important energy cooperation in Central Europe. With a focus on gas stations, and in the future renewable energy, charging stations for EVs, etc. Under the plan 2030 (here) the company shows investors what there plans are for the period till 2030.

ORLEN aims to reduce CO2 emissions by 25 %, and wants to invest 40 % of it’s CAPEX into renewable energy sources. This is a staggering 128 Billion PLN ! (40 % * 320 Billion PLN). The company also wants to generate 400 Billion PLN in EBITDA by 2030, which is ~ 5.5x the current market cap of the company ! EBITDA should also double in the main time. Further the company wants to diversify into hydrogen, EVs, electricity, etc.

In the graphic above, you can see how much money will be invested in each category, and what the goals from these investments are. The number of charging points for example will grow to more then 10.000, which is an increase of 1500 %. Most money will be invested into renewable energy, which should also reduce the dependence on volatile commodities in the long run.

4.0 Financial Results

Companies in the energy sector had a mixed year of 2022, the year started with champagne and an surge in oil prices. At the end of the year oil was at pre war levels. Still ORLENs Net Income went up by 217 % ! This is mainly the result of the mergers, I wrote about earlier.

The company is well run from a financial standpoint. The dividend payout ratio is not dramatically high (as with a lot of companies with state ownership !) and debt is under control. The position of current assets (cash, receivables, etc.) is around the size of the total debt the firm has. Further there are assets such es property, equipment etc. that are worth 100s of Billions of Zloty. All in all ORLEN has Equity of 138 Billion Zloty, which is 2X the current market cap !

Lets dig deeper into the most important number, PROFIT ! In the period from 3Q 2022 - 4Q 2022 , the oil price fell 12 % (Brent). But Net Income went up by 33 % from 12 Billion PLN to 16 Billion PLN. If we annualize these number, we get to 64 Billion PLN (4*16), which is much higher then the 35 Billion PLN profit ORLEN made in all of 2022. This means, that profit only went up in the last 2 quarters of 2022.

The reason for this, is that the mergers with PGNiG and Lotos happened only after the first half of the year. And the increase in profits from the third to the fourth quarter happened in my opinion trough synergies associated with companies. ORLEN claims in the 2030 plan to realize synergies worth 20 Billion PLN per year, trough the mergers, which would be a huge number for a company of this size.

5.0 Dividends and Valuation

The dividend from ORLEN is a major income stream for the polish government, therefore the company announced a new dividend policy, under which 40% of Free Cash Flow will get paid out in dividends. In bad years (low oil price), there is a base dividend which is guaranteed and rising. This base dividend is currently at 4.00 PLN per share, and will grow 0.15 PLN per year until 2030. The dividend is likely to be higher, because of operational growth, but this base dividend alone is 6.5 %. The actual yield for 2022 was on current share prices around 9 %.

The valuation for ORLEN is very low, with a P/E ratio of 2 on last years earnings. But because the mergers were only complete in the second quarter of the year, I’m going to annualize theses numbers. Net Income was 16 Billion PLN in the 4th quarter 2022. This is on an annualized basis 64 Billion PLN (16*4). It is worth noting that oil was at an average of 89 $ over that time period. Now we trade at around 73 $ after a brutal sell of in the last few days (without any good reason). I reamain bullish on oil, but will for valuation purposes reduce our Net Income of 64 Billion to 50 Billion PLN.

For a company with the moat and dominance ORLEN has I will have to give a high multiple, bat because it is polish and the government is involved with it I give it a conservative P/E ratio of 4. This implies an upside of 175 %, plus dividends in an conservative scenario with a P/E of just 4 !

6.0 Summary

In my opinion ORLEN has the potential the be an investment comparable to PetroChina. I am bullish on oil prices and ORLEN gives me trough the ridiculously low valuation a good downside protection. Here is another quote from Buffet regarding PetroChina.

In 2002 and 2003, Berkshire bought 1.3% of PetroChina for $488 million, a price that valued the entire business at about $37 billion. Charlie and I then felt that the company was worth about $100 billion. By 2007, two factors had materially increased its value: the price of oil had climbed significantly, and PetroChina's management had done a great job in building oil and gas reserves. In the second half of last year, the market value of the company rose to $275 billion, about what we thought it was worth compared to other giant oil companies. So we sold our holdings for $4 billion

— Warren Buffet

And just like this, an investment that many wouldn’t want to touch turned out the be a massive winner. PetroChina was a great investment and I believe, that ORLEN has the potential to be the same. With a lot of upside trough the underlying commodity and a very low valuation.

Yours sincerely,

THE MODERN INVESTING NEWSLETTER

Nice write up. Agree, number of Polish stocks far too cheap to resist at present, in particular Orlen and JSW.

Though Orlen is a somewhat different beast with less upstream and more downstream operations than say other SOE's like PBR or CNOOC, the current value multiple is severely below what it should be. SOE's are often a good place to find value when the market gets overly pessimistic on them.

Thanks for sharing your idea! Interesting view from you see this as a quasi monopoly while common sense will tell stay away from goverment companies. Now they bought Polska press 😳 capital allocation? To get the downside rigth with those cyclicals is quite hard. They always look cheap before thinks get ugly. It´s hard landings versus oil supply deficit. Wouldn´t it be a more conservative approach to anker to 2019 numbers?