Over the past 2 weeks I have posted frequently on Twitter/X about the stock of Vale and Iron Ore. In this post, I will try to simply break down my thoughts and idea behind the stock.

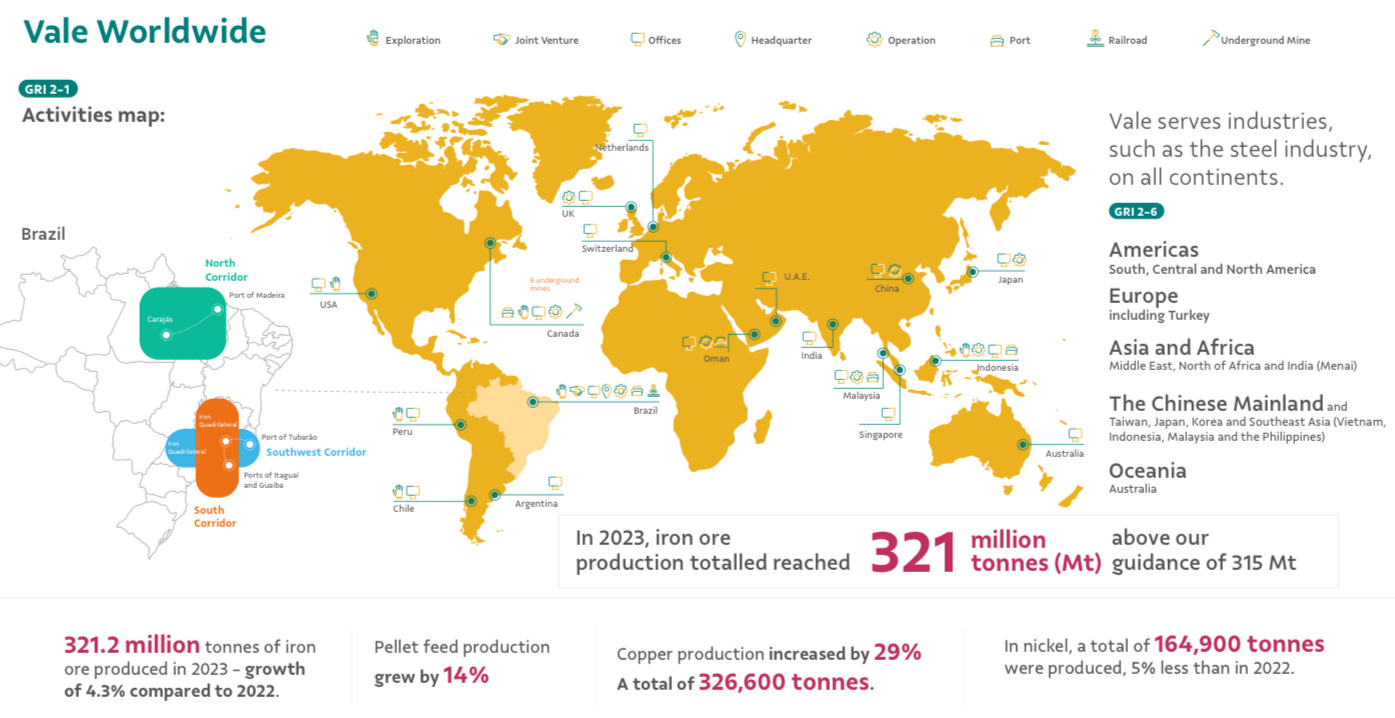

Vale is among the biggest Iron Ore producers globally located primarily in Brazil, Canada, Indonesia, Oman, etc.

Apart from being one of the largest Iron Ore miners globally, the company is among the largest Nickel producers globally and is investing billions of dollars in its base metals division that is focused on copper. We have to keep in mind, that Vale is operating in a cyclical business that is reliant on Iron Ore, Nickel and copper prices.

1| Iron Ore

Iron Ore, which is primarily used to produce steel, has long profited from the Chinese Economic Miracle that we have witnessed sine the early 2000s. This demand growth has very positively influenced the price of Iron Ore but for a few months now, there is a narrative, that the chinese economy would be in free fall. This has resulted in volatile commodity markets, as China is a major importer of all kinds of commodities. Interestingly, this narrative applies for Iron Ore, but not for Oil and Copper. The price of Copper and Oil have seriously diverted from that of Iron Ore, while all these markets are dependent on China (Oil less then the other two).

If we look at real data, we can see that the Chinese economy is not anywhere close to a “collapse” as we would expect if we would rely on FinTwit for economic news.

“China’s Gross Domestic Product (GDP) grew by 5.3 percent year on year in the first quarter. Growth of investment in fixed assets is 1.5 percentage points higher than that of 2023. The total retail sales of consumer goods and services went up by 4.7 percent and 10 percent year on year respectively. The growth of imports and exports hit a six-quarter high. The per capita disposable income of residents jumped by 6.2 percent.

We also noted that there has recently been growing optimism about China and increasing confidence in China’s development in the international community. Asian Development Bank, Goldman Sachs, Morgan Stanley and other international financial institutions raised their forecast for China’s economic growth this year. Asian Development Outlook April 2024 released by ADB predicts that from 2024 to 2025, China will account for 46 percent of the economic growth of Asian developing countries and remain the largest contributor to the global economic growth.”

— Foreign Ministry Spokesperson Lin Jian

While the real estate sector has been weak and obviously faces headwinds, the situation is not as dramatic for Iron Ore demand as people suggested on Twitter. While there is all this talk about demand, many people seem to have forgotten to look at supply. What we see in Q1 of this year is, that miners such as Rio Tinto, BHP and LKAB (Sweden) have lower production volumes as a result of weather conditions, lower prices and issues with the capacity of volumes handled in Sweden.

This was the chart of Iron Ore I posted on the 2nd of April.

I highlighted, that Iron Ore is severely oversold, while fears surrounding China are overblown. In addition the price had entered my consolidation/buy zone (yellow). Since the low on April 1st, prices of Iron Ore have moved up around 15%.

2| Market Inefficiencies

The performance of Vale has been significantly lagging its global peers which is in my opinion not justified. Therefore I have a position in the stock and advise anyone interested in the stock to do his own research. If we take a look at the graphic below, we can see that Vale has had a near perfect correlation with the shares of its peers until January 2024. From this point on, shares significantly underperformed its peers.

I have identified 2 main reasons for this:

Brazilian equities have seen significant outflows of foreign funds, driven by companies such as Goldman Sachs, J.P. Morgan, etc. This was fueled by the decision of Petrobras to not pay a special dividend. I have written about this decision here. Importantly, this decision has been taken back and the company announced on the 19th of April, that they will pay out the special dividend in full over the coming months. Petrobras is the largest company in Brazil and therefore moves the entire stock market.

The Brazilian Real has fallen massively since the start of the year, driven by worse investor sentiment, higher U.S. yields and funds shorting the currency.

The strong performance of the USD, driven by interest rates staying higher for longer, has severely impacted the BRL.

Both these factors are in my opinion not from huge significance for the long term thesis of holding one of the largest mining companies globally, in the age in which commodity demand will rise driven by human prosperity in emerging markets.

There are many theories on why sentiment towards Brazilian equities has changed since the beginning of this year. I try to look below the surface and while I a see a nation that has some issues, Brazil remains among the largest beneficiaries of the global commodity boom. Brazil’s exports of oil, agricultural goods, etc, have massively helped the country and will continue to do so in the coming years.

An example of Brazil’s export capacity is Brazil’s huge share of the global corn market. 👇

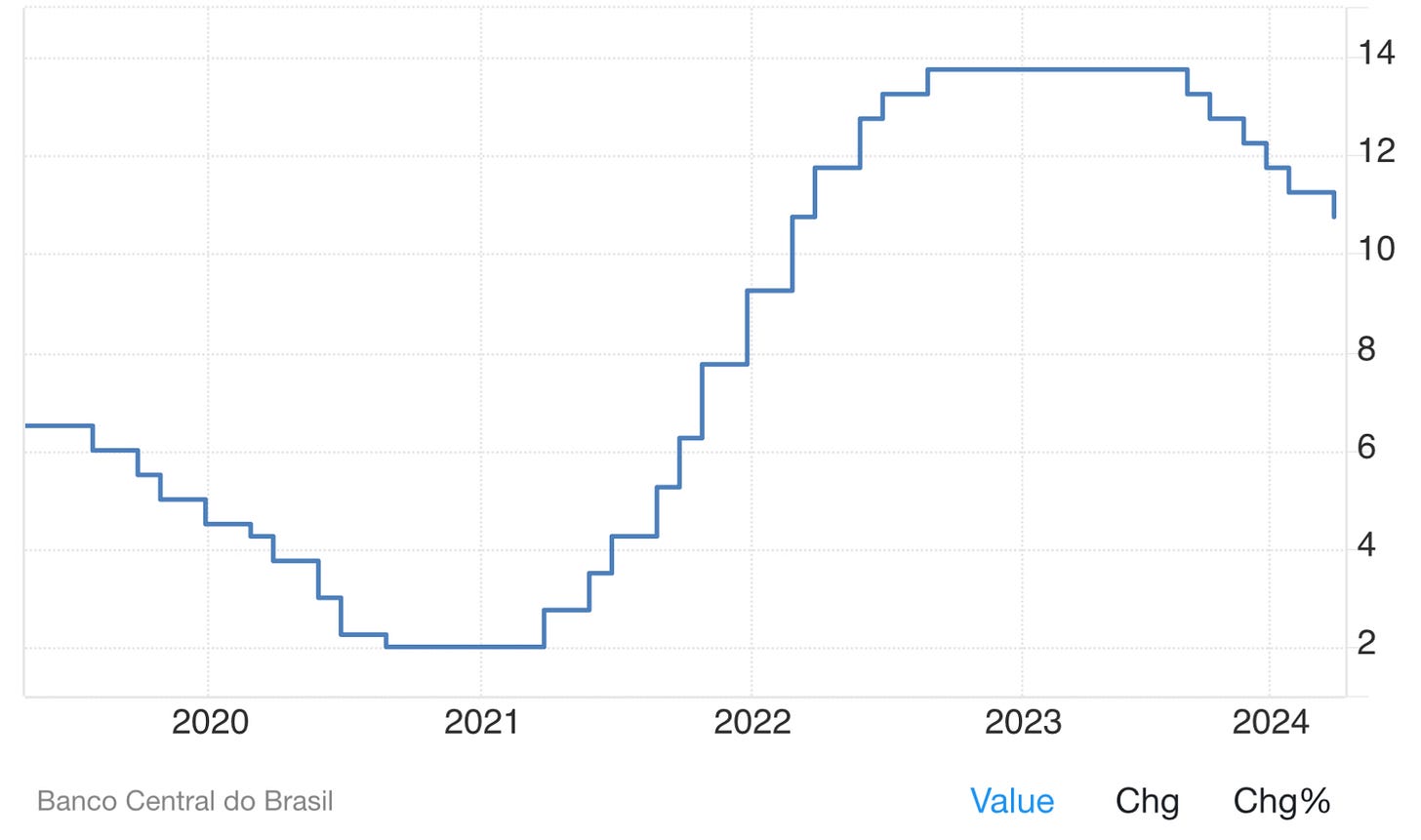

When the dust settles and Petrobras payed the special dividend, while Brazilian exports continued to boom, Wall Street will once again pull in with billion of dollars in Petrobras, Vale, etc. In addition, the Brazilian central bank has been cutting interest rates alongside its South American counterparts.

This was made possible, by the rapidly falling inflation rate and strong economy. Without a doubt, Brazil has one of the best Central banks in the region, that has acted quickly when it had too. Following the global tsunami of liquidity following COVID, the central bank raised interest rates above 13% in an effort to defeat inflation. They were successful, which allowed them to be one of the first countries to cut interest rates. In March the CPI in Brazil stood at 0.15%, confirming the trend of lower inflation.

3| Risks & Valuation

Politics is obviously a risk that can’t be underestimated, although the situation looks similar to that of Petrobras, where the government is trying to change the executives of the company for their own interests. Recently there has been news stating that the license for the Sossego Mine in Brazil will be suspended. A few weeks later this was reversed and later again suspended. It’s a similar situation with the special dividend payments of Petrobras. In the end this is probably more noise than any real impact.

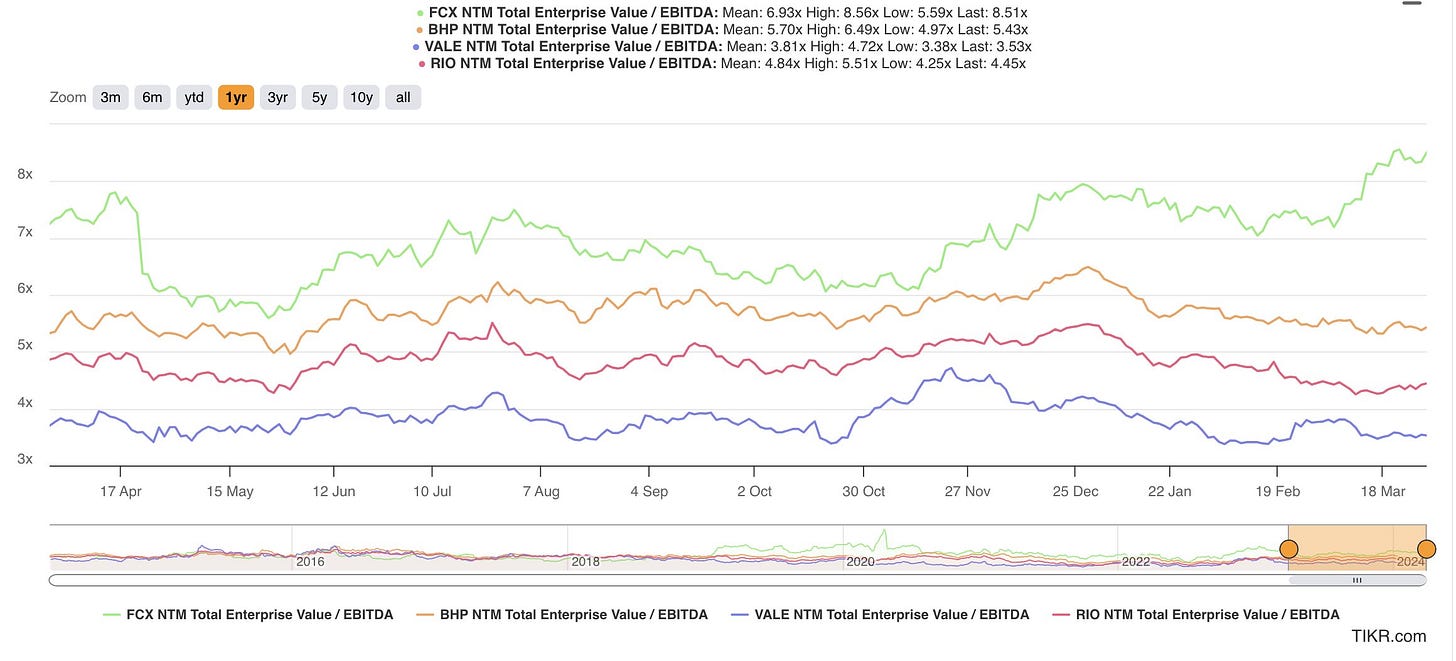

The valuation of Vale is lower than any out of its major peers, which is contrary to the fundamental developments within the company. Vale has low breakeven costs at ~55$, while recently announcing that the production for Q1 was up by 15%. The situation is quite straight forward with Iron Ore prices having likely bottomed, while Copper continues to perform well. When sentiment towards Brazil recovers and the BRL strengthens again, Vale should profit.

One important part that I left out for now is the Base Metals Division (VBM). The Saudi National Fund recently invested $3.4 Billion for a 13% stake, valuing VBM at $26.15 Billion. VBM has the goal of growing copper production from 350k tons to 900k tons. In addition, Nickel production should grow from 175k tones to 300k tones. With the ramp up of VBM, the valuation of Vale should increase and come closer to that of peers focused on Copper.

The graphic below shows Vale’s EV/EBITDA in comparison to Rio Tinto, BHP and Freeport McMoran. The source for this is here.

Furthermore, the stock pays dividends that at current valuation could total 10%, even though Iron Ore is lower then in Q4 2023.

4| Conclusion

In the end, cyclicals are a game of buying when others are fearful, while not using leverage. For some people this is a to simple concept and they try to make things complicated. Vale is currently sitting near 52 week lows, while Iron Ore has seen positive momentum.

While political risks and the obvious risks related to fluctuations in the price of Iron Ore remain, the risk/reward ratio looks very compelling at this point. I am long Vale stock and continue to closely monitor the company and sector.

Yours sincerely,

MODERN INVESTING

I think there is continued litigation involving some tailings disasters https://en.wikipedia.org/wiki/Vale_S.A.#Disasters_and_incidents which to be honest, I have not followed too closely even though I think I have owned the stock for 2 decades and just reinvest the dividends... If I am not mistaken, some of the court cases have been in foreign jurisdictions b/c BHP etc are involved or it was a JV...

Anyway, I included this piece in my Emerging Market Links + The Week Ahead (April 29, 2024) for today: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-april-29-2024

Interesting analysis. I assume this is a short term investment? You are not planning on holding Vale for a decade?