Over the past years I invested into several energy stocks. From Shell, Petrobras to Orlen. But currently there is one stock that I am especially bullish on. From an risk/reward perspective, Vår Energi is my absolute top pick.

This article was done in an cooperation with

, We hope that you all find value from it.1.0 The European Gas market

Since the war in Ukraine, Europe has become a difficult place to do business. Especially if you have exposure to energy. While a lot of companies go bust, or move away from Europe, some companies are seeing the opportunity. And two of these are Vår Energi (Norway) and Kistos (Great Britain). Both offer excellent investment opportunities over the mid/long term.

The biggest problem in Europe are the insane and in my opinion criminal windfall taxes on oil & gas producers. If you think about it, the company and it’s shareholders are taking risks, by investing into a cyclical industry. And the government takes 80-90% of the profits as a windfall tax. But when there are bankruptcies, no government is giving money to these companies. On top of this, oil & gas is trading below pre war levels ! This makes the need for windfall taxes even more absurd.

As a result of the increasingly worse economic situation in Europe, more an more worker strikes take place in countries like Norway, the Netherlands, Germany or France. This also effects the production of oil & gas. Therefore a lot of companies have turned there eyes on production in North America, Brazil or Mexico.

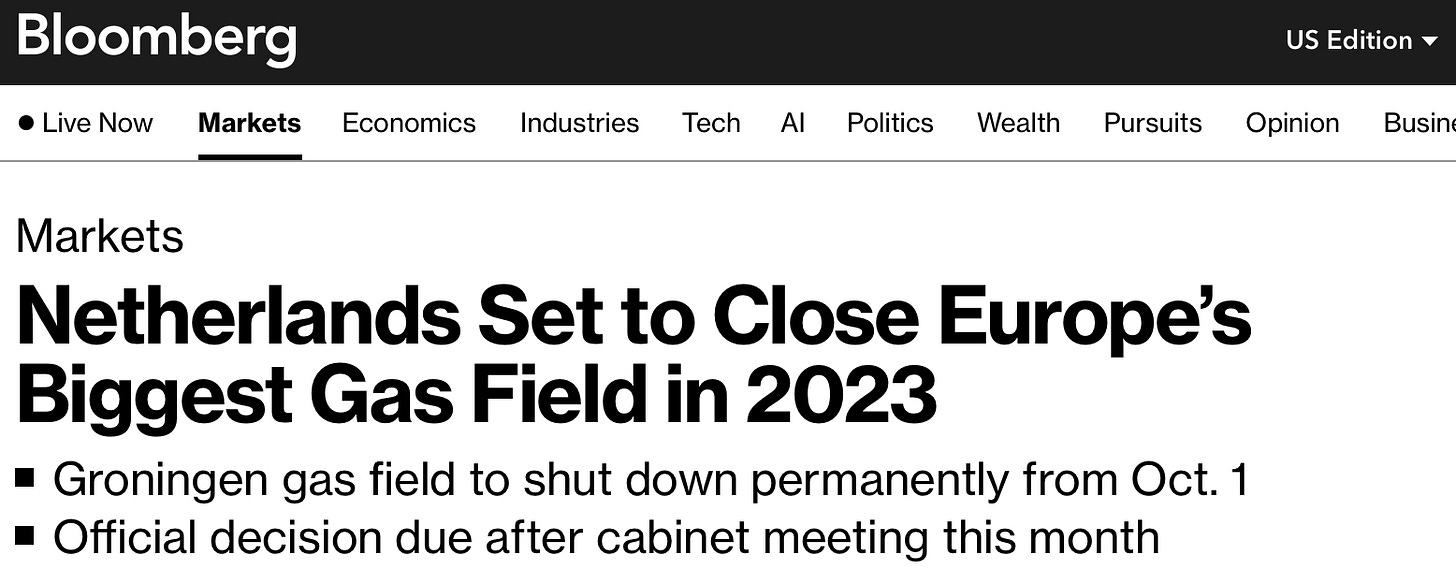

The political pressure against oil & gas in Europe is very high, therefore it is no surprise to read things like this bellow1.

But as we all know, in every crisis there is an opportunity to make a lot of money. Specifically in this case, you can become very wealthy by buying up oil & gas fields for cents on the dollar.

The CEO of Kistos, Andrew Austin is know for buying high quality assets for a fraction of it’s true value. Now Vår Energi is also buying up assets at ridiculously low prices.

Without any further introduction, let’s start to look at Vår Energi in more detail.

2.0 Vår Energi Overview

Vår Energi is a Norwegian oil and gas producer that went public in September 2022. It was a spin-off from the Italian energy giant Eni, that still owns 63% of the company. Currently Var Energi operates or owns stakes in 36 production fields, that are all located in Norway.

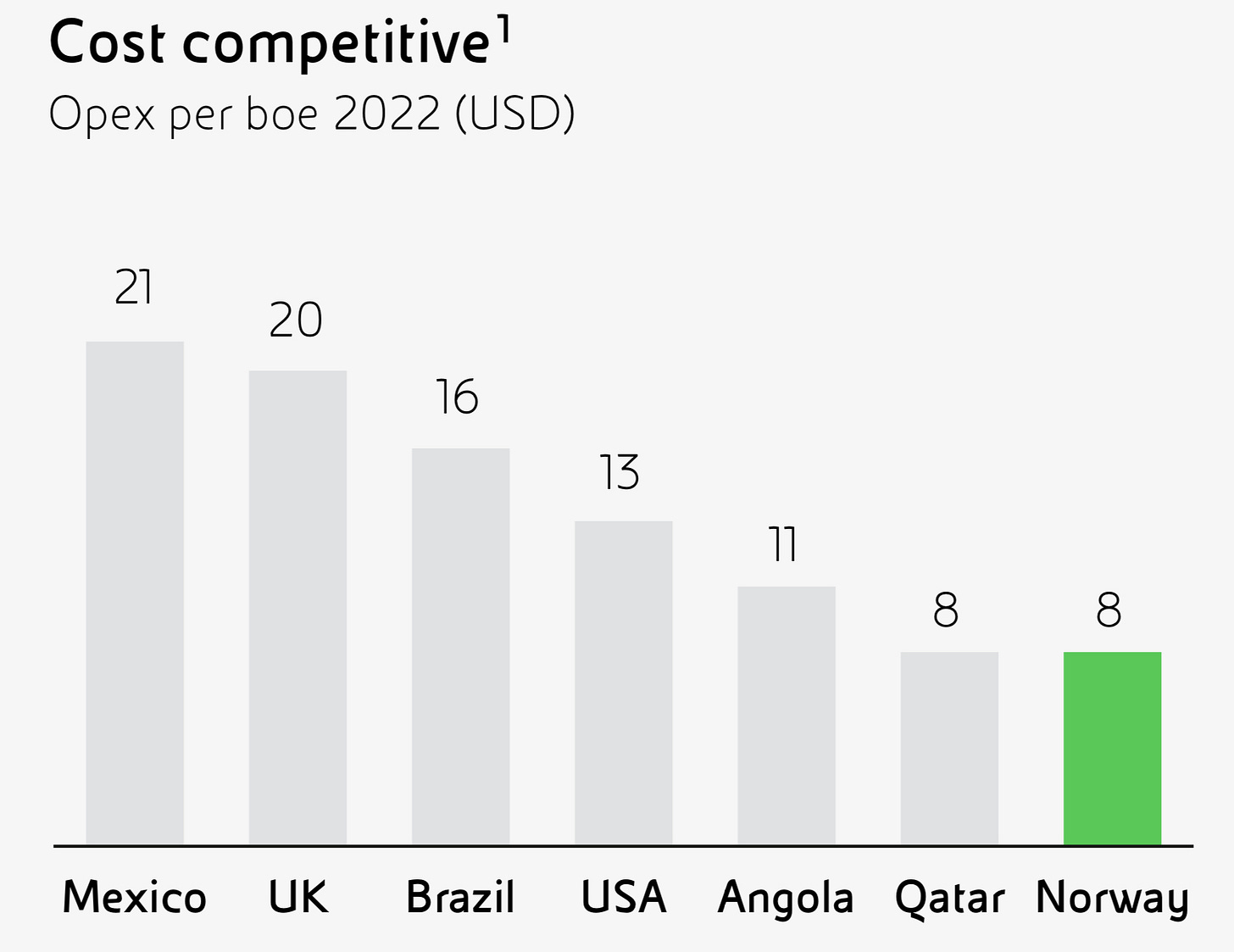

Norwegian oil & gas producers have several advantages over competitors from the rest of the world. First is, that they have very low production costs2. With huge oil & gas reserves, there is a lot of room to grow for a company like Vår Energi. The current production costs per BOE (Barrel of oil equivalent) is 13.1$. But managment is guiding for production costs of 8$/boe in 2025.

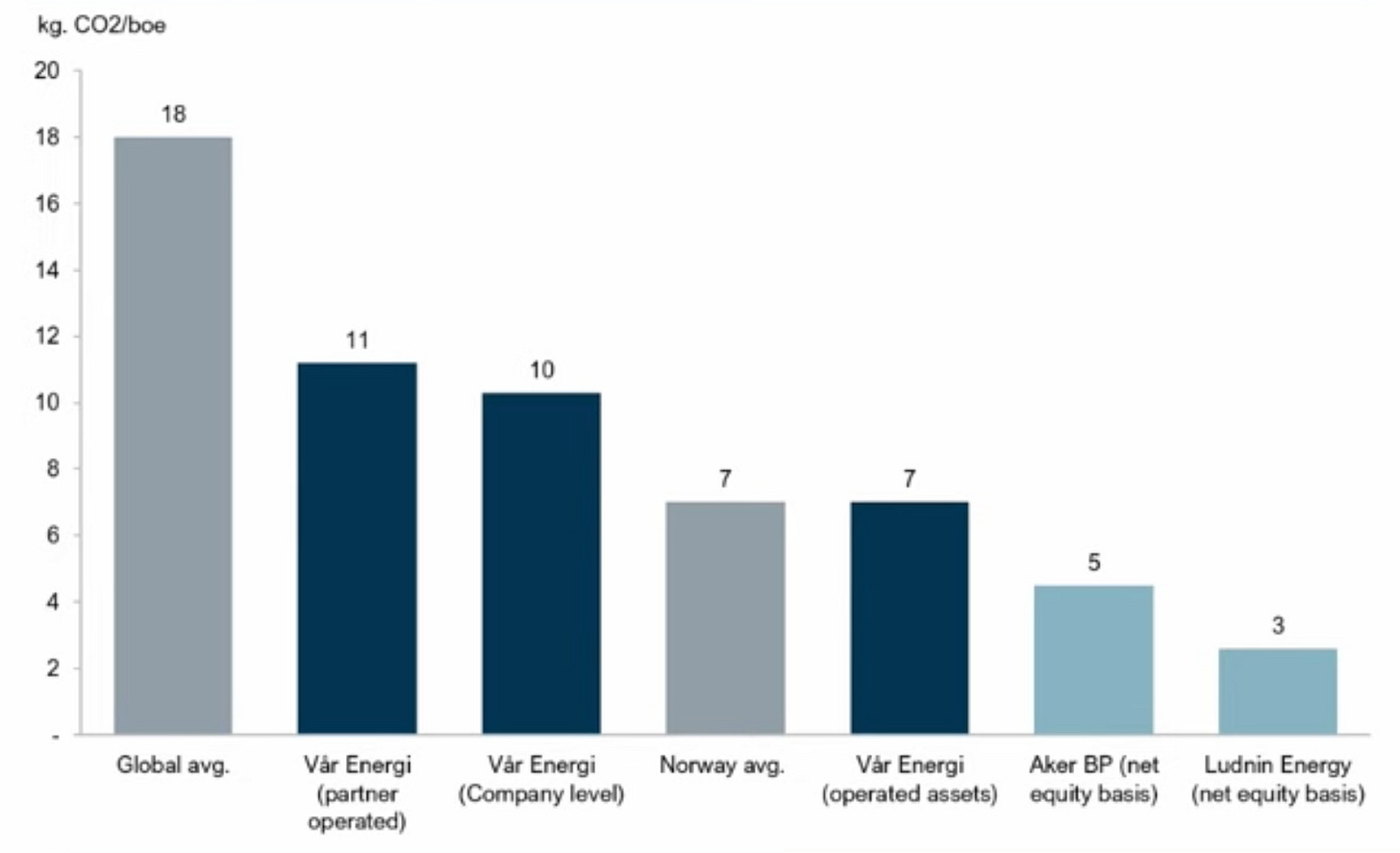

Secondly, they have very low CO2 emissions compared to the rest of world. I personally have my own opinion on ESG. But importantly, there will probably be a worldwide CO2 tax in the future. This will make companies like Vår more attractive and competitive, because Vår emits 45% less CO2 per barrel, then the global average3.

Currently Vår has 2P reserves of around 1.1 Billion BOE. From these reserves 23% are gas 77% is oil. The company produced 214k boe/d in the 1st quarter of 2023 and wants to grow this (excluding acquisitions) to 350k boe/d by 2025.

3.0 Growth till 2025 and beyond

As a diversified producer Vår has been able to perform very well over the last few years. With most of the growth coming in the next few years, trough the expansion of existing fields and acquisitions (more on this later), shareholder returns should really start going up in the next years.

In the period from 2019 — 2021 the owner of Vår (Eni) has paid out 3.1 Billion € in dividends. This was in an period, in which oil prices have been 24% lower then currently. In the same period the price of WTI (West Texas Intermediate or Crude Oil) even went negative ! Therefore we can assume that dividend payments will be at least 1 Billion € per year going forward. This would be a dividend yield of currently 15%.

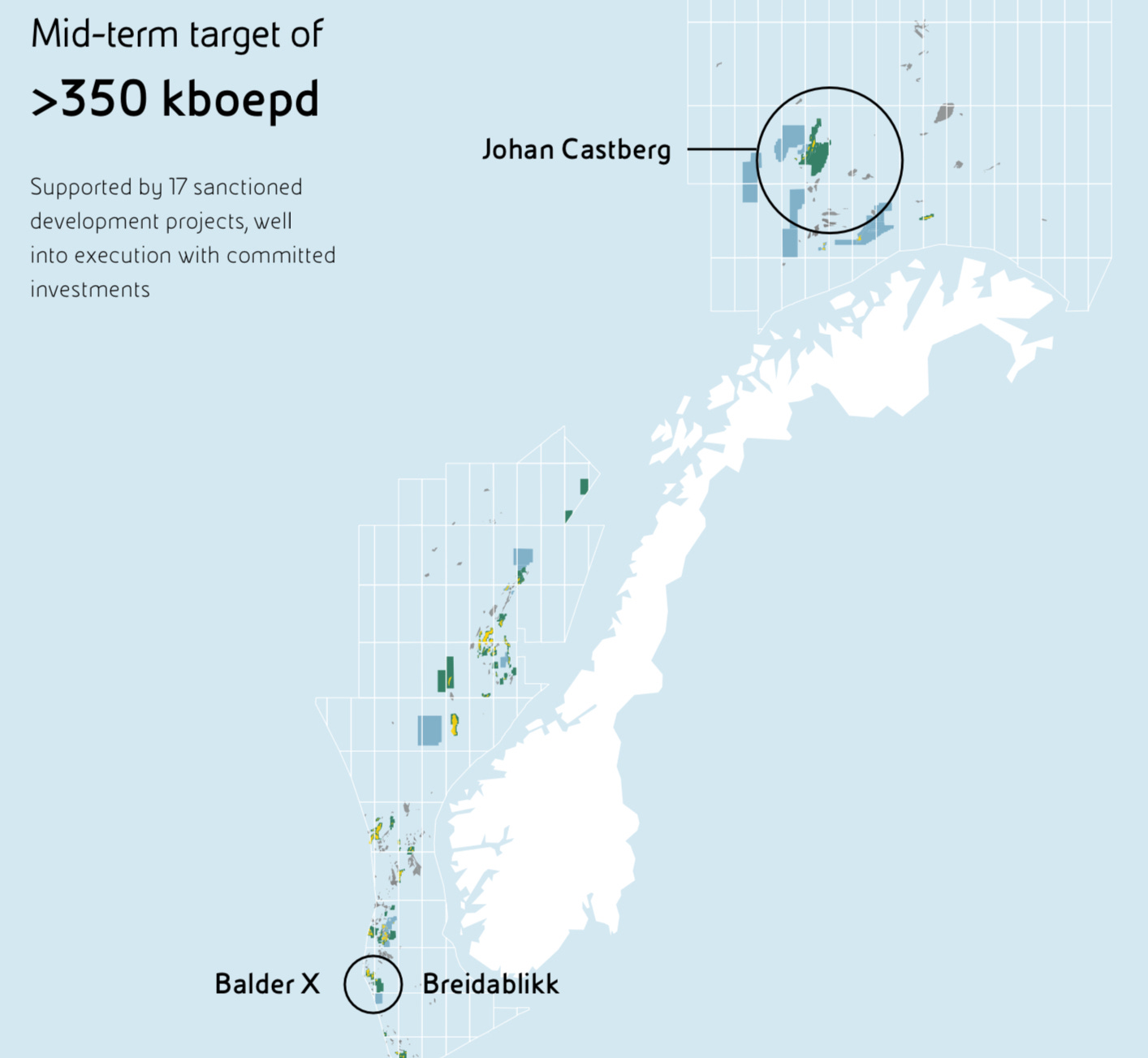

Vår Energi is expecting a production of ~350k boe/d in 2025. This is a substantial increase compared to the 214k boe/d right now. There are 3 main projects, that will result in the growth of production.

The new projects are:

Balder X — Completion Q3 2024

Breidablikk — Completion Q1 2024

And Johan Castberg — Completion Q4 2024

All this projects will have break even prices of around 30$ per barrel. Which will give shareholders stability and predictability, because it is highly unlikely that oil will drop below 30$ per barrel.

4.0 Neptune Energy Acquisition

On June 23th Vår announced the acquisition of the Norwegian Assets from Neptune Energy. In cooperation with Eni (the mother company of Vår) they bought out nearly everything from Neptune Energy. Only some german assets weren’t bought, which tells you a lot about the how unattractive Germany has become for companies.

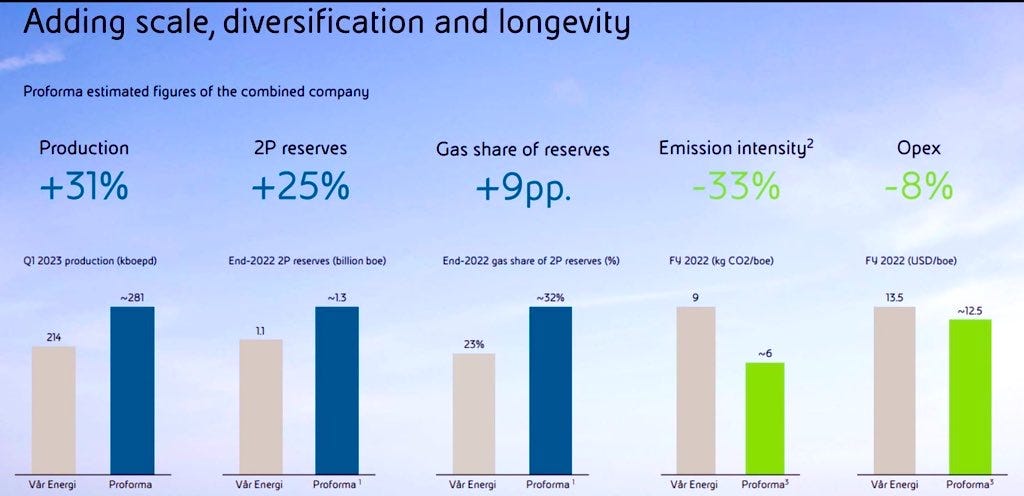

At an price tag of 2.275 Billion $, Vår acquired 264 Million BOE in 2P reserves. We can see below that the acquisition will increase production by 31%, will further reduce the CO2 emissions of the company (potential CO2 tax) by 33% and will reduce operating expenses by 8% to 12.5 $ per BOE. 4

Looking at the price tag Vår paid for the acquisition, it was a very low price. They paid 8.60 $ per BOE in 2P reserves, which I consider low, for Norwegian assets.

Neptune Energy generated 2.3 Billion $ in Operating Cash Flow (after taxes) in FY 2022. Norway accounted for 43% of the production, which is why I estimate that the Norwegian assets generated ~ 1 Billion $ in OCF.5 This means that at an price of 100$ per Barrel, Vår would have it’s entire investment back in just over 2 years !

I view the acquisition as a very good decision by the management of Vår, because it will increase production and reduce operating expenses. This will create a lot of shareholder value over the next few years, if you consider the low price they paid for the acquisition.

5.0 Kistos and Var

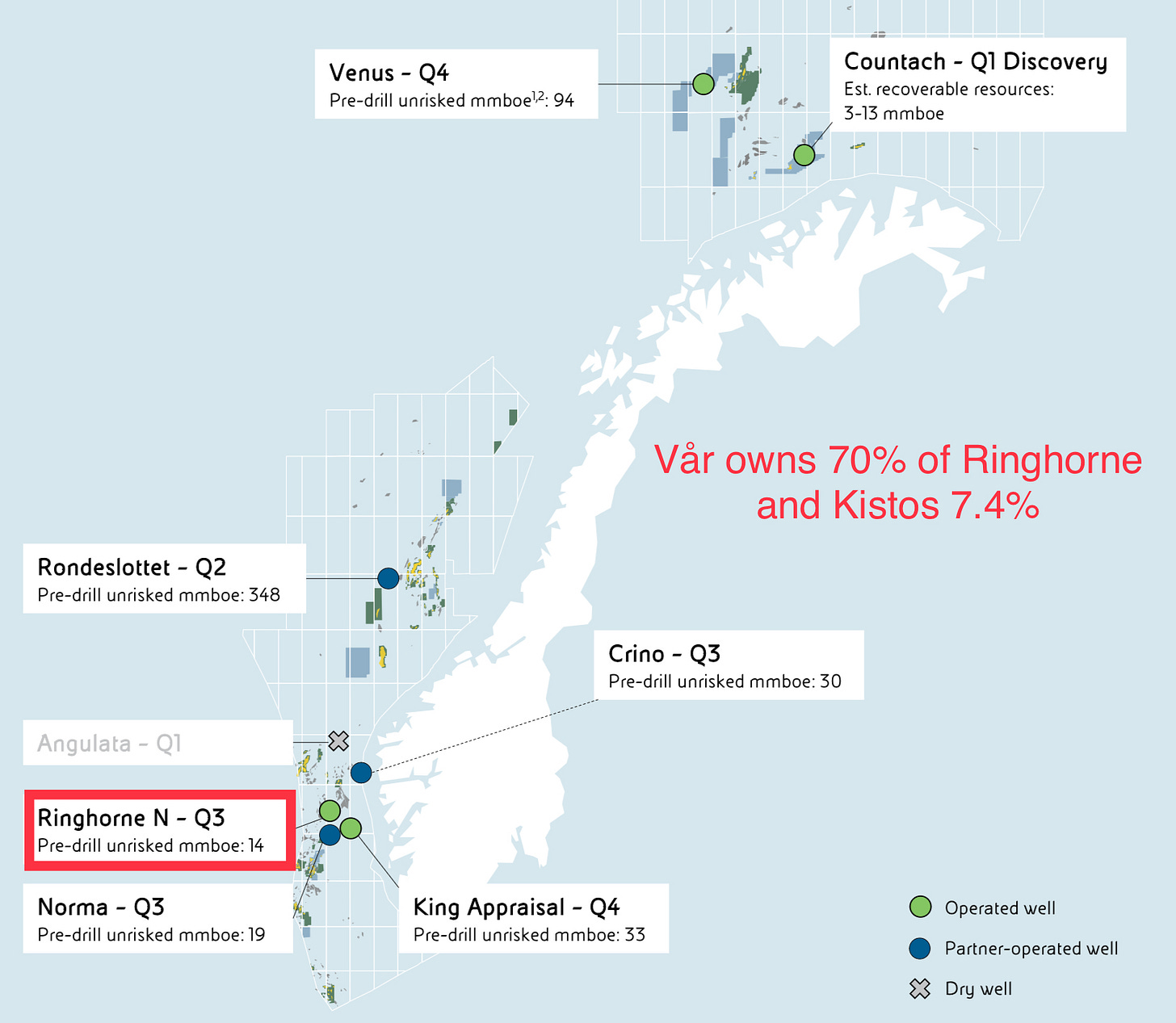

On the 24th of May 2023, Kistos completed the acquisition of Mime Petroleum, the junior partner in the Balder and Ringhorne fields operated and 90% owned by Vår. Mime didn't sell out of these projects because they didn't believe in the project or because Vår was a bad operator, but because they were forced to do so.

Mime was owned by a private equity firm called BlueWater Energy. After cost overruns, the PE decided to finance the rest of the projects with bonds, overleveraging the company. With additional delays due to COVID and supply chain issues, Mime faced liquidity problems. BlueWater decided against funding the liquidity issue, and the bondholders took effective control of the company. The bondholders forced BlueWater to sell to Kistos for a nominal amount, with Kistos assuming the debt and offering some minor warrants to the equity holders.

Normally, a large owner like Vår, who owned 90%, might like to take advantage of a situation like this and swoop in to take out the last 10% of a project. However, this is not allowed in Norway. Hence, this deal ended up with Kistos.

Although the cost overruns that forced Mime to sell to Kistos are not great for Vår, the now complete sale to Kistos is great for Vår. Kistos has the capital required to ensure the project is finished, even if there are some overruns. This eliminates the need for the junior partner to seek new financing, avoiding additional delays and costs.

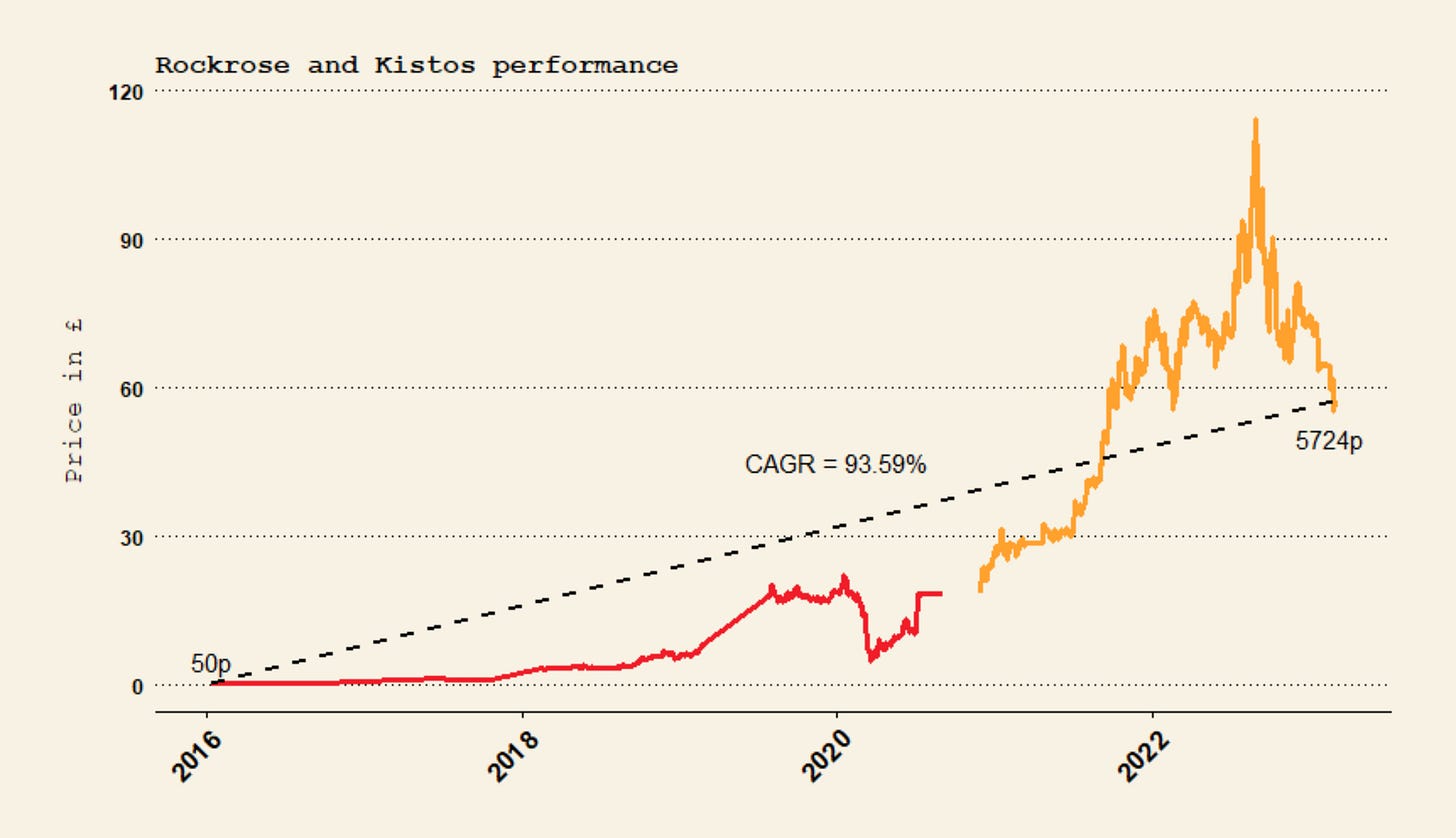

Additionally, Kistos is led by an excellent team, with Chairman Andrew Austin renowned for his accretive M&A activities in the North Sea Oil and Gas sector. He achieved a remarkable 42x return with his previous entity, Rockrose, in around 6 years. Andrew's entities have a history of acquiring minority interests in fields operated by excellent operators, which serves as a strong endorsement for Vår.

In an interview with Malcolm Graham-Wood at Core Finance (here), Andrew expressed his satisfaction with the deal, stating that he believed he completed it at a 50% discount on a 2P basis compared to Vår's trading value (!) . He also highlighted that he considers Vår to be undervalued. Furthermore, Kistos is a great partner as their team has a long track record of maximizing asset value for shareholders.

Interested in Kistos ? Check out the article from Iggy on them 👇

6.0 The oil & gas market

The last 3 years have been a roller coaster for the oil & gas industry. From negative prices to record highs of 120$ per Barrel of oil. And now gas is 50% bellow pre war levels. But I remain highly bullish on the oil & gas market.

There are many reasons for that, but the main reason is that the market is completely lost from reality. The price of oil is going sideways for 6 months now. With an all time high demand for oil at 102 million Barrels/day the demand side is very strong. And this 102 million Barrels/day is achieved even tough jet-fuel demand is lower then pre COVID. Further, the Chinese economy is reopening, which should add even more demand over the coming months.

World oil demand is forecast to rise by 2.2 mb/d year-on-year in 2023 to an average 102 mb/d, 200 kb/d above last month’s Report. China’s demand recovery continues to surpass expectations, with the country setting an all-time record in March at 16 mb/d (…) with global oil supply down by 230 kb/d to 101.1 mb/d in April. Steeper losses are in store (…)as extra cuts from some OPEC+ producers take effect. — International Energy Agency

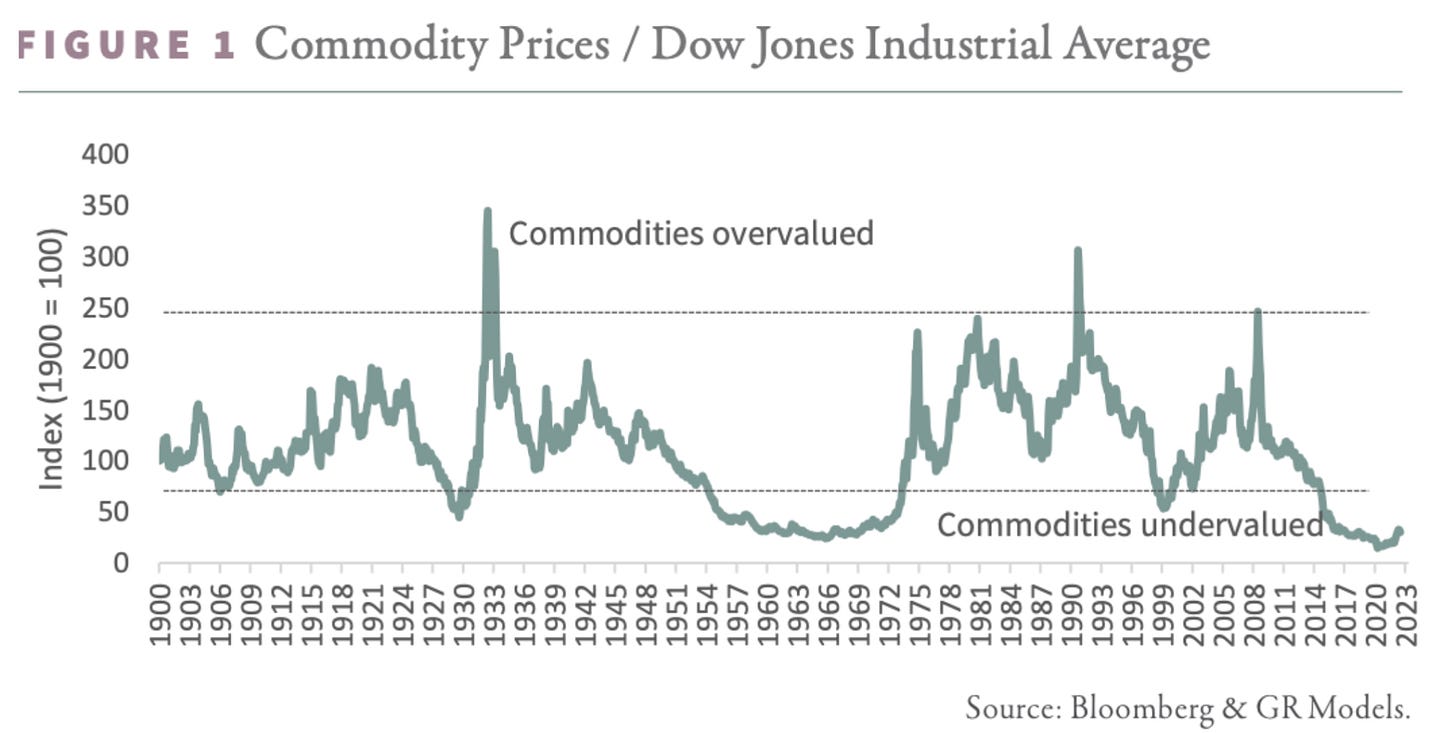

The question remains, why are hedge funds short oil ? In fact, they have on of the largest short positions ever ! My best answer is, that these funds expect an recession, and with it lower energy prices, like in 2008/2009. I disagree with this thesis, because historically oil/commodities have performed very well during times of crisis. The only major exception was the GFC in 2008/2009.

The thing most people forget, is that in 2008 the capital spending cycle peaked, meaning that a lot of new supply was coming from projects recently finished. This combined with an demand destruction, led to the crash of the oil/commodity market.

Today the situation is very different, with lower supply in the future from existing projects (mostly because of ESG). A lot of companies are afraid of investing into more production, leading to lower supply and in the long term higher prices. 6

7.0 Financials and Valuation

In the FY 2022 Cashflow from operations (CFFO after tax) amounted to around 5.7 Billion $. In the 1st quarter 2023 CFFO after tax was 1.35 Billion $, which was down 39% compared to the 1st quarter of 2022 (2.2 Billion $). This is mainly the result of lower energy prices and higher taxes.

I’m bullish on energy prices, but will take the 1st quarter 2023 numbers as a baseline for the valuation of the company later on.

Vår has a policy, under wich the firm will pay out 20-30% of CFFO after taxes in dividends. This year the goal is to pay out 30%, which translates into ~1.6 Billion $ in dividends. The dividend is well covered by cash flows and the company has enought liquidity, so that they will not face any problems from this side (e.g. BlueWater Energy).

The debt of Vår is a bit high, but with high CFFO, after taxes and dividends of around 4 Billion $ annually and most of the debt having to be paid back only in several years, I see no big problems ahead.

Currently Vår is valued at 6.6 Billion USD. With CFFO after taxes of 5-6 Billion $, the stock is trading at at Price to CFFO after tax of 1.1 - 1.3 !

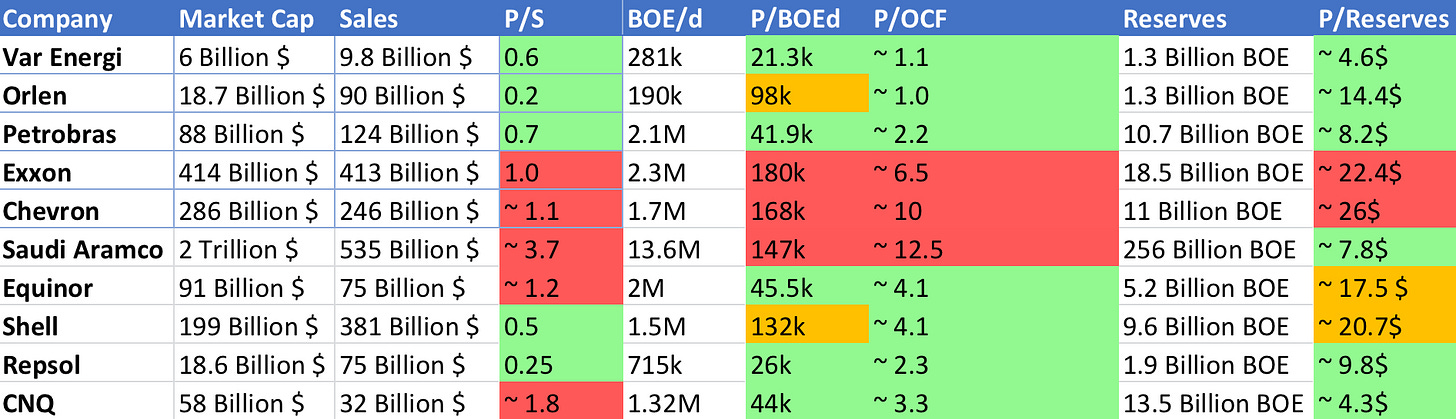

In an valuation table I uploaded around 2 weeks ago on Twitter, Vår Energi turned out to be one of the cheapest energy stocks out there. Now the stock is 10% higher, but the stock is still insanely cheap, both on an absolute and relative basis.

The P/OCF numbers are after taxes, but are not 100% correct, because it’s difficult to go trough the numbers in some cases.

8.0 Conclusion

All in all, Vår is a very attractive investment opportunity right now. With a dividend of 15-20% this year, that I expect to grow over the next years. With the acquisition of Neptune Energy and multiple projects that will be finished over the next years, I expect very good shareholder returns over the long run. Notably the sentiment for European oil & gas producers is bad, but even with all the headwinds the stock will still perform well. Now imagine, that some of these headwinds could go away.

Vår is a position in the Modern Investing portfolio, and I will use price drops to add to the position.

What about share repurshases? Has the company said something abut that?. It would be interesting at these prices. Thanks for sharing

As of 3Q 2023:

- TTM CFO is 3004m

- TTM CFI is -2810m

- TTM dividends paid are -1130m

They should cut back on the dividends for a while, especially if they have upcoming capex to increase production by 2025.