VOLUE ASA - Profiting from European Energy Problems

High growth stock with large tailwinds at a compelling valuation

At this point it’s no secret that the European economy is going into a recession. Further the most important industry of Europe, the automotive one is becoming uncompetitive against Asian & American competitors. The reason for this is Energy. Europe was importing cheap gas from Russia and used it to build & engineer new products. These products were exported around the world and Europe was strong. Now the situation has changed. Europe is importing expensive LNG gas from the US, Qatar, etc. As a result, many companies in Europe (especially Germany) move to the US or China.

But instead of criticizing everything and spreading fear, I want to present to you a stock, that I think is perfectly positioned to profit from volatility in the European energy markets.

Grab yourself a cup of coffee and a notebook, because this write up will hopefully be valuable to you.

Special thanks to Alexander Eliasson

for bring up this idea.1/ The Flywheel

A like to have a portfolio, that is organized in an flywheel. This gives unique advantages and helps compounding your money over the long run.

The graphic below showcases a large part of my portfolio:

As you can see, the heart of it is the basic idea is, that we are in an Energy Crisis. I have write several times why I think that oil, gas, and energy in total, will likely be more expensive for years to come. This is based on the idea, that in the developed world oil consumption is about to go down, but in the rest of the world (6.8 Billion People !) consumption will reach levels close to the ones in the “west“.

Companies like Petrobras, Vår & Orlen are profiting from this massively, because they are large oil & gas producers. As a result of higher energy prices, these companies invest more into growth of production & CAPEX increases.

The main profitiert of this is Odfjell Technology, which is one of the leading companies in the market for equipment, maintenance & engineering for oil & gas companies.

And because the landscape for energy/electricity distribution is becoming increasingly difficult and complex, companies turn to Volue. The company has software solutions, that enable clients to make better & more precise decisions in the energy markets.

2/ The transformation of the Energy markets

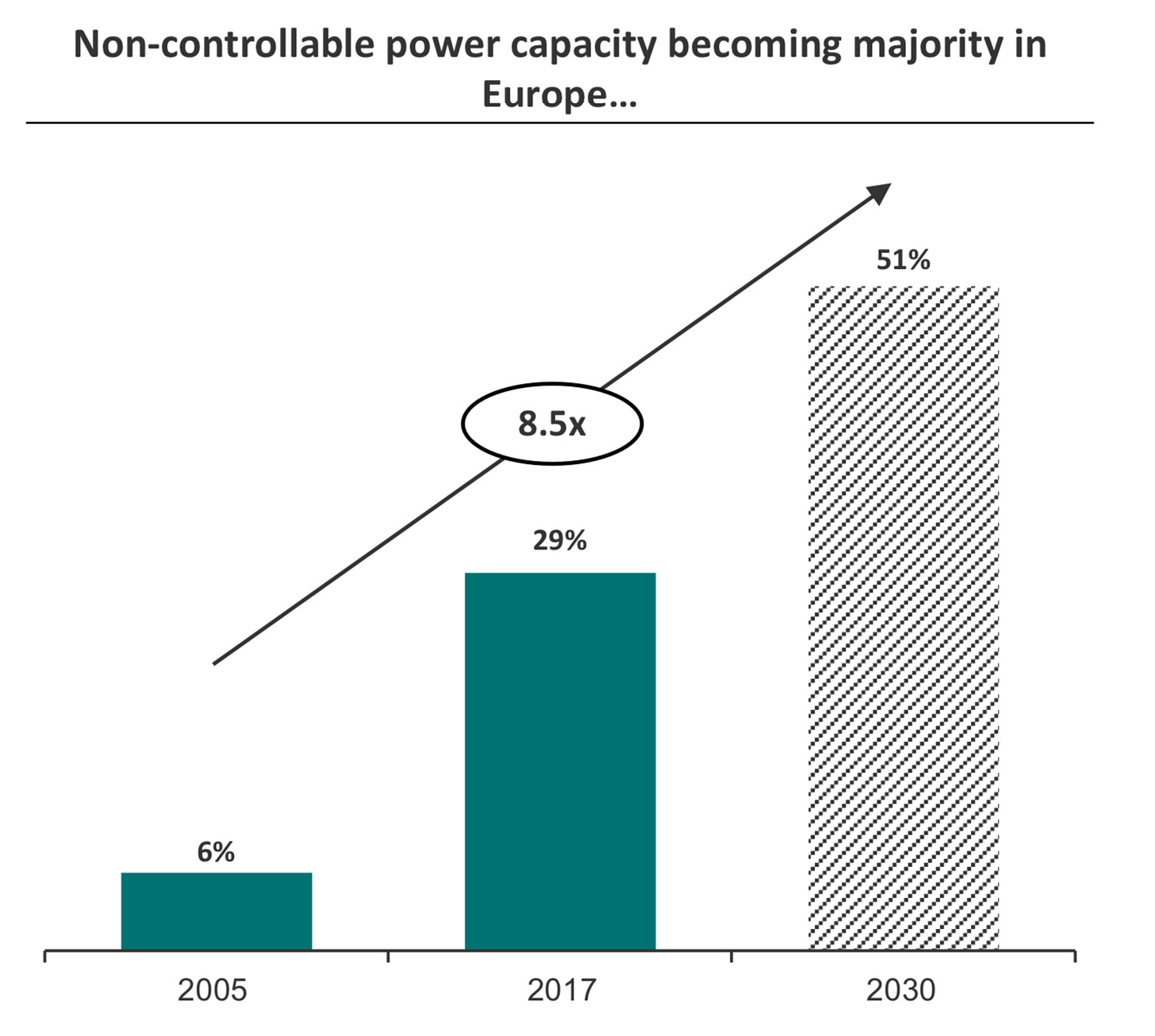

The existing power grid was simply not build for the huge transformation that is taking place right now. As a result of the massive investments into renewables, Europe is becoming more dependent on an energy source, that hardly predictable.1

As seen from the chart above, it is expected that this energy sources will make up 51% of the energy capacity in Europe by 2030. But with less predictability comes more volatility. And we all have experienced a volatile energy market of the last 2 years. Therefore it is highly likely that this will become the new normal in Europe and the World. 2

Conventional power production was build where the power was needed. The distribution system was build from there to where the power was consumed. Renewables on the other hand are build where conditions are meet. […] Additionaly households, that used to be consumers become producers. […] Solar Energy and EVs are putting enormous pressure on the power grids.

— Jacob Krøvel (Volue ASA - Head of Investor Relations)

The video below gives a good representation of what the challenges are and what Volue is doing to create value to customers. 3

Looking closer at the situation in Europe, from 2035 onwards only EVs are allowed to be sold in the EU. In Norway this is even from 2025 onwards !

Although I personally think that many of these policies will miserably fail, I will look at this as an opportunity. Further, politicians are not knows for moving back on there goals. Even if this means, that they destroy there own economy.

3/ Volueˋs Business Modell

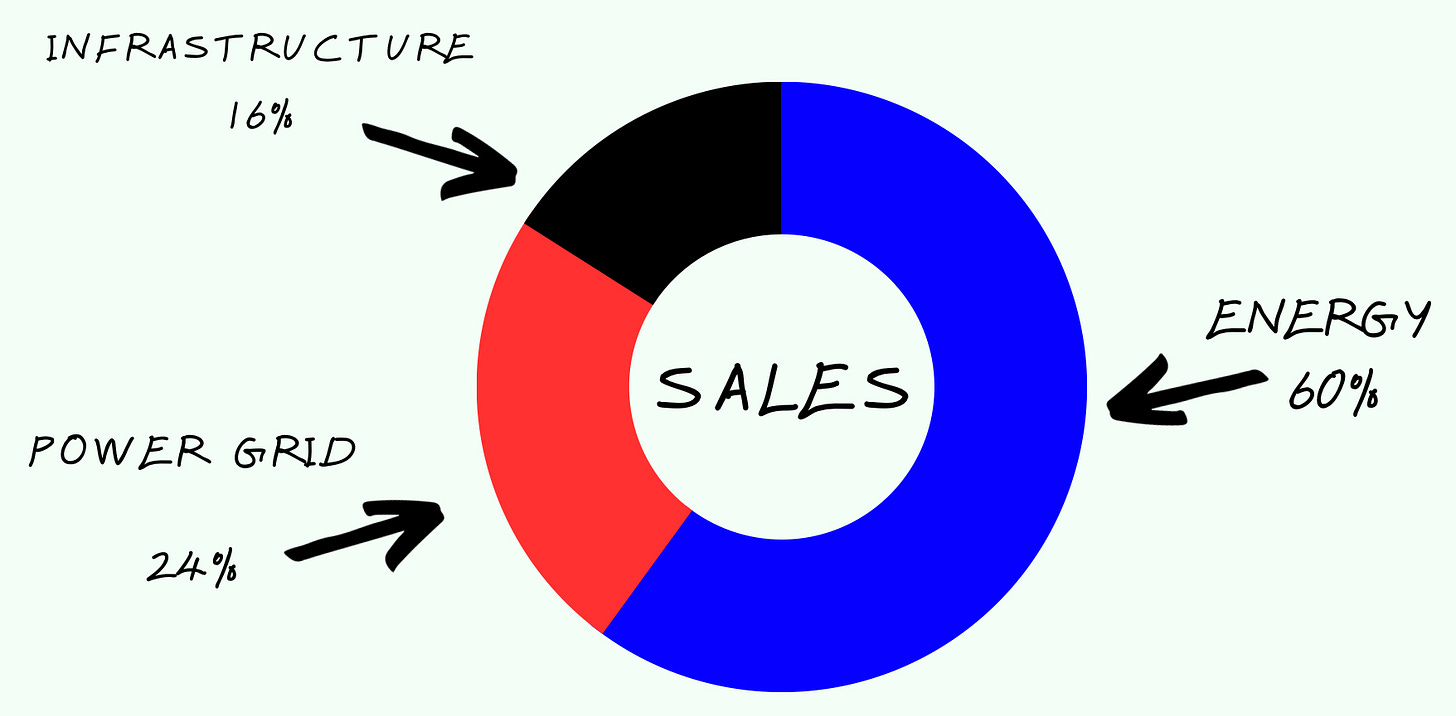

Volue has 3 main divisions, which are namely Energy, Power Grid & Infrastructure. The company has 2700 customers, +820 employees and 36 offices in 8 countries.4

Let’s have a look at each division on it’s own:

Energy:

The Energy segment offers clients a trading platform too better navigate the volatile Energy markets. Big clients are Enel (Italyˋs largest utility company) and EnBW (Large german utility focused on the area of Baden Württemberg).

This devision is growing rapidly in Europe and is also expanding internationally. In countries like Japan, the company has been able to attract many large cooperations and clients, thanks due to there strong position in Europe.

The software can pretty well forecast the price of energy, based on the data they have. Further, the program has access to real time data of energy consumption, production & demand.

Power Grid:

The power grid of Europe is, as noted earlier not designed for the immense changes that are happing right now. Therefore clients need to find ways, too react quickly if a problem accures. With the products of Volue, they can pretty well predict how the consumption and supply of electricity will impact the power grid. I assume that this segment is well integrated with the Energy division, because it has very similar use cases.

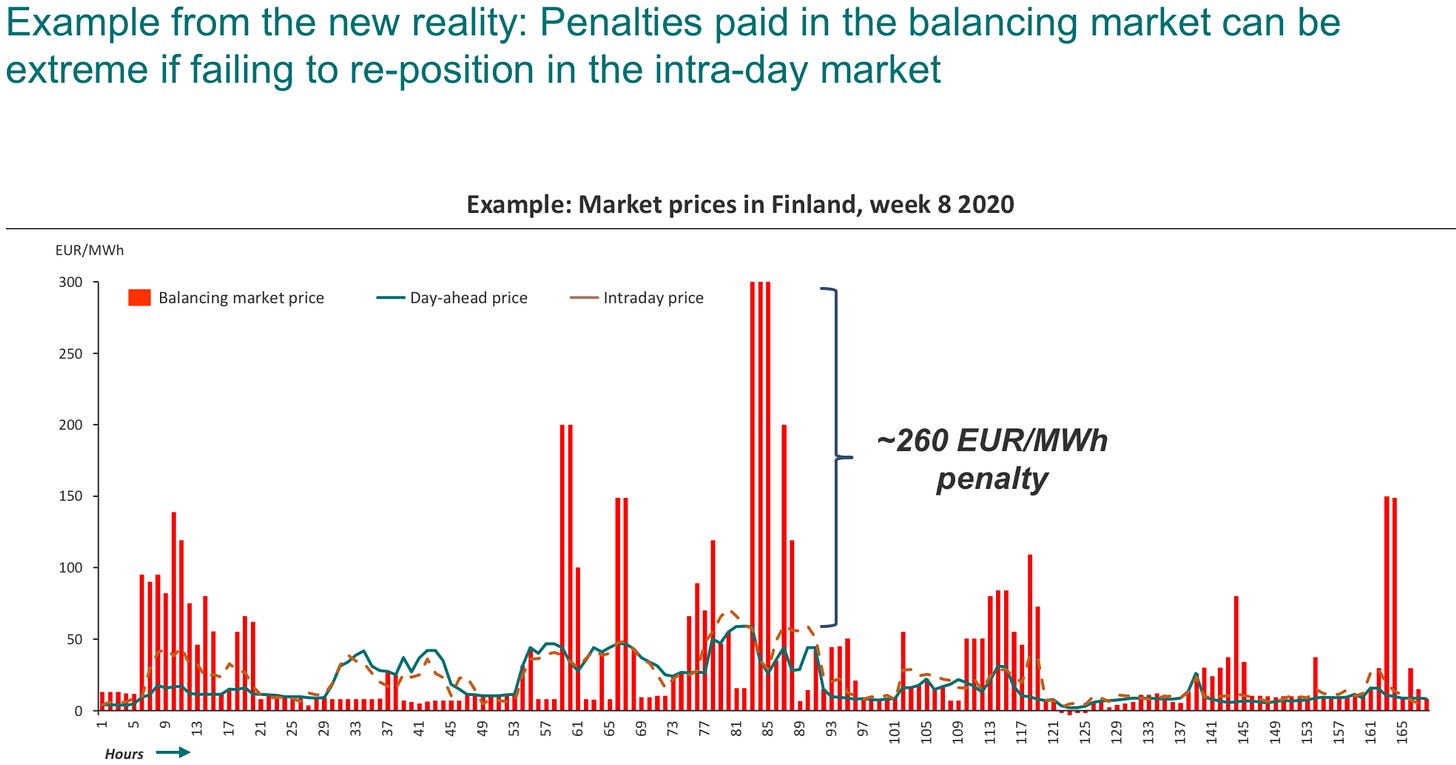

In the below graphic we can see that, there are large fluctuations between the intraday, day ahead and market prices. The difference is the time frame. There can be massive discounts or premiums for the balancing market price compared to the day ahead & intraday price.

Therefore it’s important to navigate the markets smoothly, since one mistake can cost these companies 100s of millions if not Billions of Euros !

Infrastructure:

This segment focuses on key and systemic relevant infrastructure mostly in Norway but also in the rets of Europe. With 90% of Norwayˋs water network being managed by Volue, the company has become very successful in it’s home country.

For the water infrastructure business, Volue offers a SaaS (Software as a Service) platform that is integrated into the cloud. This gives them low operating expenses and makes it easier to scale. By 2021 the Gemini SaaS Software had already ~ 12k users. With all the water services accessible in the cloud and the growth the company has experienced since then, I think that this number is now much higher. But I wasn’t able to find information for 2022 and beyond.

Further, the infrastructure devision has 75% of it’s revenues on a recurring bases. This gives more stability and predictability for the company.

Revenue mix:

All in all, the company has 62% of it’s revenues on a recurring bases. Energy accounts for 60% of revenues, Power Grid for 24% and Infrastructure for 16%.5

3.1/ The Data machine of Europe

By having large clients with a lot of end customers, Volue has access to a lot of data. In fact, the company is collection 120 Trillion data points every singe year. This will make the models of Volue over time more accurate and better. Volue has the vision of becoming the market leader for power software, in Europe, by 2030. In order to achieve this goal Volue has to use it’s first mover advantage and collect as much data as possible. I think that by executing on it’s goals, and by expending the company, Volue will become the company with the most valuable data in weather and energy. From this point on Volue will be able to make a lot of money just by opening branches in other geographic locations.

The vision for the future is, a portfolio management service that will manage the large portfolios of utility and trading firms. With the the experience and data, the company has, they’re becoming increasingly more important for cooperations.

Many large clients are choosing Volue because it’s the biggest player in the market6. And because the software is not only providing predictability, but is also reducing costs.

"Volue offers a complete portfolio of solutions for trading with battery storage devices. The team's phenomenal trading expertise quickly convinced us that to choose Volue was to choose the market leader."

— Ingo Müller (Elli; battery storage division of Volkswagen)

Doing some simple math, we can find out that Volue has a 15% market share of power software spending in Europe. The global power software market generates currently around 4 Billion $ in revenues. Europe accounts for 25% of that. Currently Volue makes 1.5 Billion NOK or 150m $ in revenue. With a market in Europe that generates 1 Billion, the company has around 15% market share.

4/ Financials & Growth ambitions

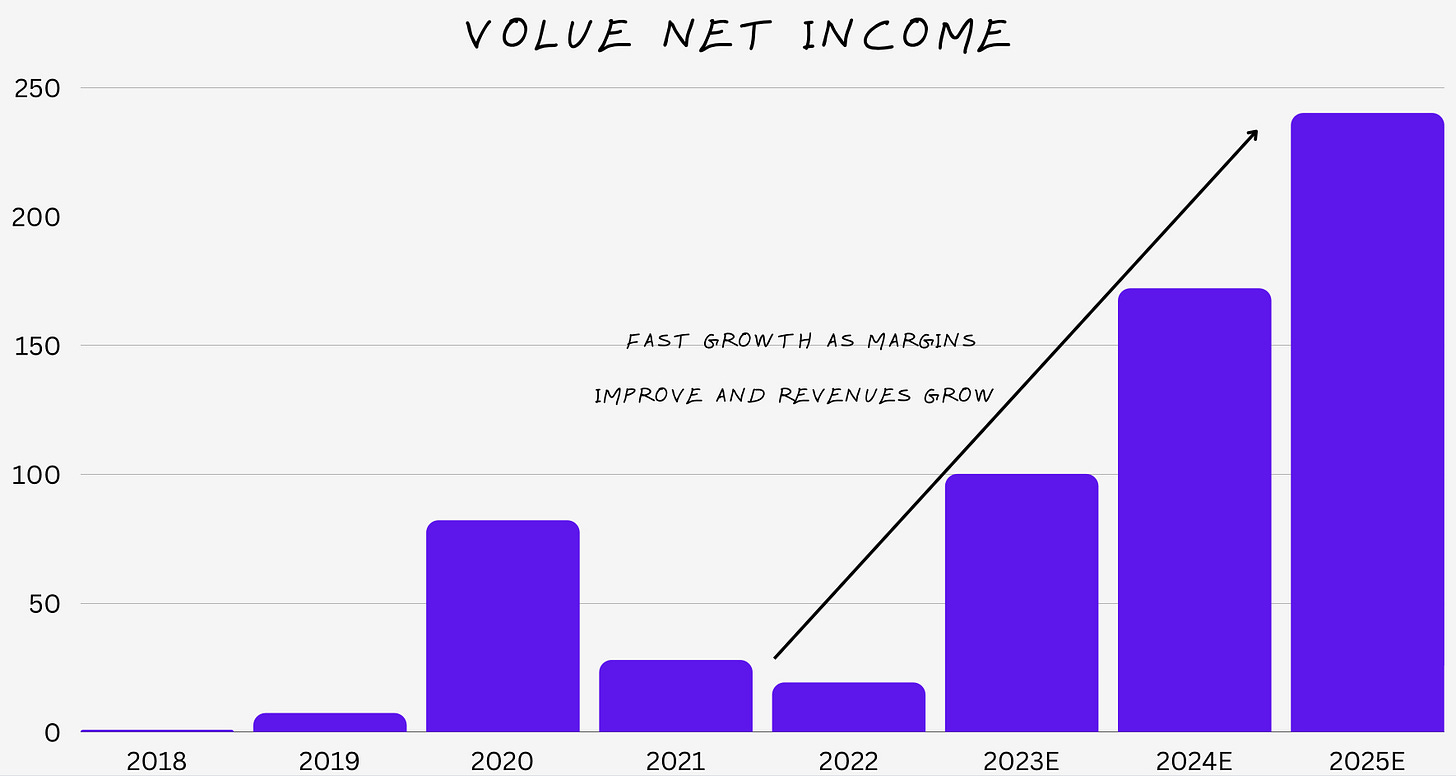

In Q2 2023 the company made 375m NOK in Revenues, 80m in EBITDA and ~ 35m in Net Income. Year over Year (YoY) revenues + 25.8%; EBITDA + 105% and Net Income +240% !

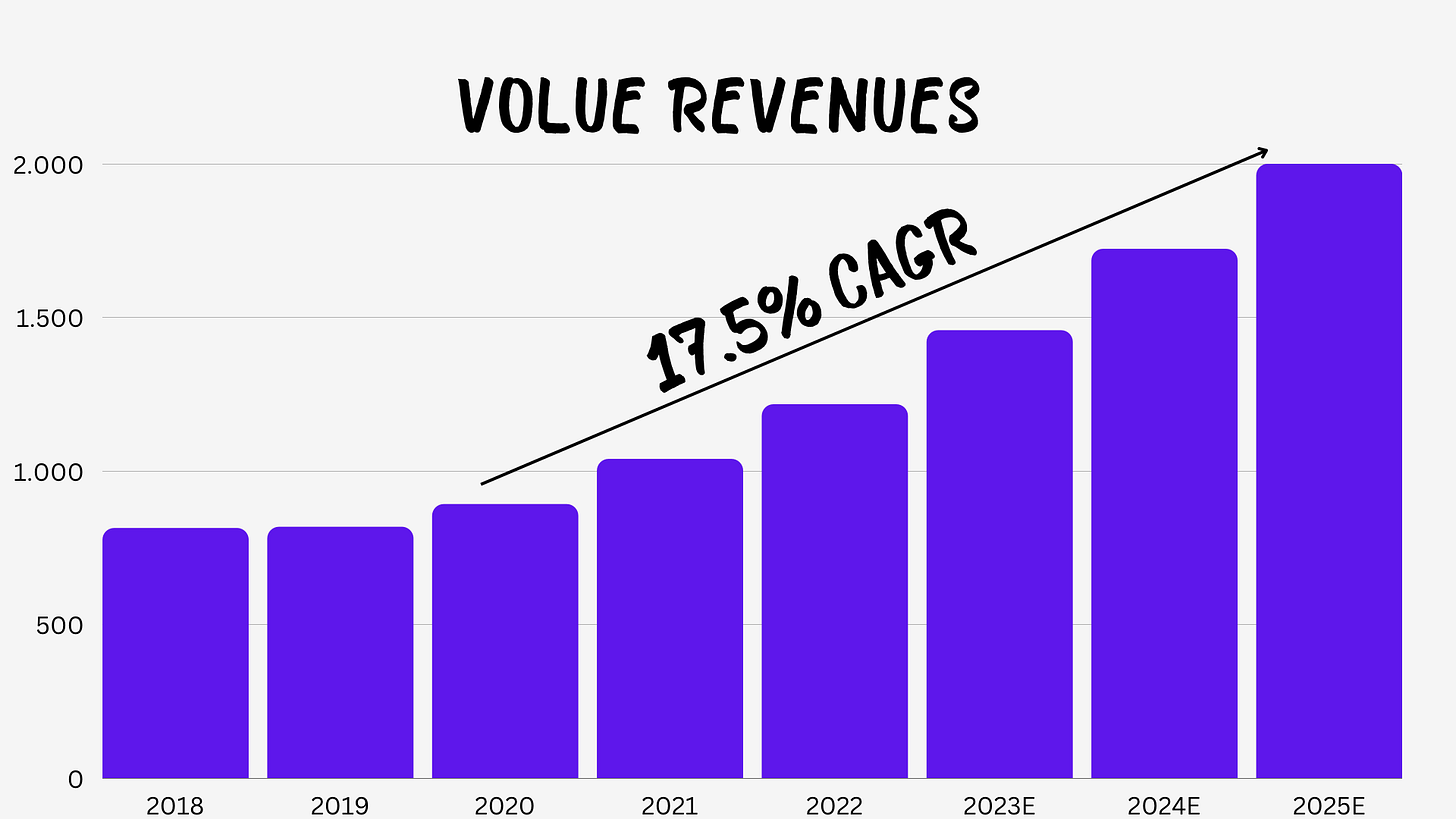

The 2 charts below showcase Revenue and Net Income of Volue:

The company maintains the goal of achieving 2 Billion NOK in revenue by 2025. In 2022 Volue made 1.3 Billion NOK in revenues. Further, the company expects that adjusted EBITDA margins will increase significantly from now to 27-30%.

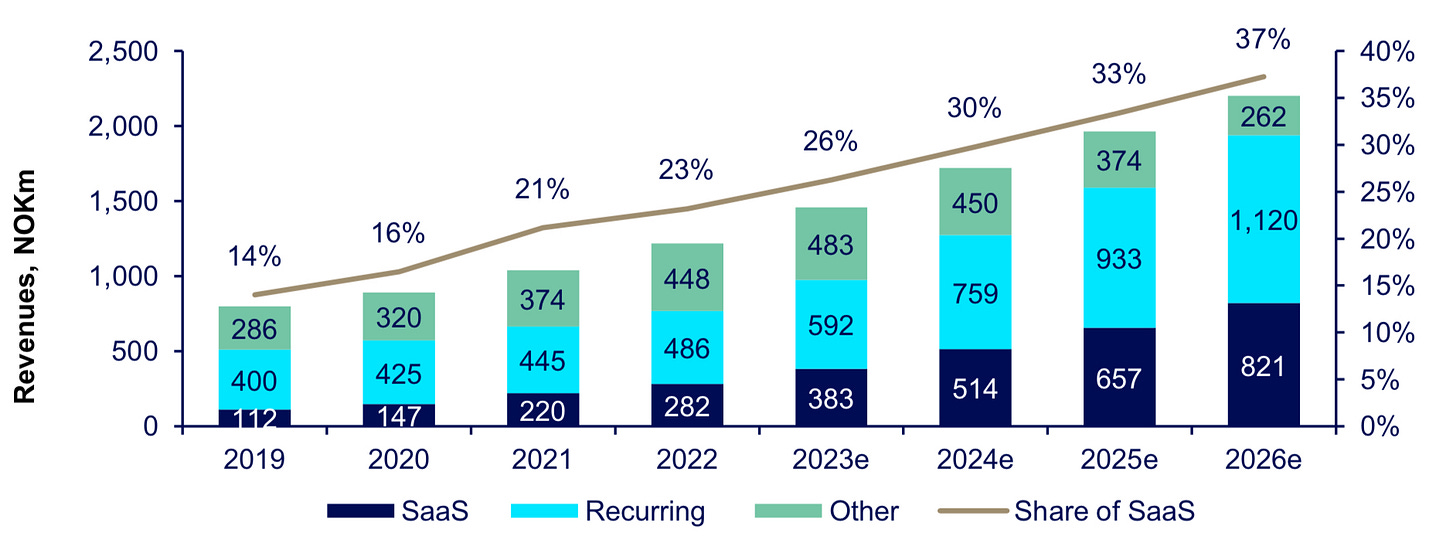

If we take a look on the projections of Arctic Securities, we get to the conclusion that the 2 Billion NOK goal is highly likely to be reached. Although Arctic expects margins to go up, they’re not as bullish as the company itself. Arctic expects that Adjusted EBITDA margins will reach 24.5% by 2025.

It’s worth noting that the higher margins will be the result of the role out of SaaS in all business devisions. We can see that SaaS is growing faster then the “traditional“ business of Volue.

While in Q2 2023 the total revenues grew by 25.8%, SaaS revenues grew by 43% YoY.

5/ Valuation

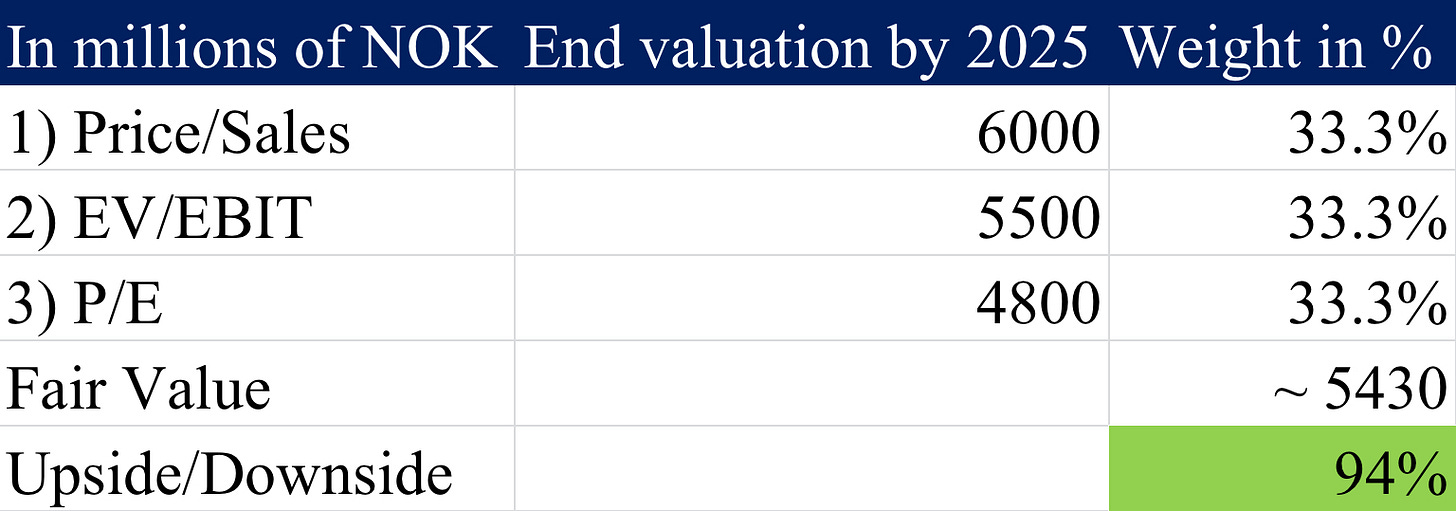

There are several ways to value Volue, I will therefore use 3 different models and provide you with what I think is the most accurate one.

Volue is valued at 2.8 Billion NOK and has an annualized revenue of 1.5 Billion NOK. So the stock is valued at 1.86x sales. In 2022 they bough out Enerimˋs Energy Service division for 3x sales. In 2021 the company sold it’s chemicals and fire devision for 5.2x sales.

If we assume that Volue will reach 2 Billion in revenue by 2025 then we have 33% upside if it would be valued at the same multiple as right now. Using 3x sales, which I think is fair, we would reach a 6 Billion NOK market cap by 2025 (+114%). And if it where to trade at 5.2x sales (expensive) we would reach ~10.4 Billion NOK (+271% !).

If we look at the estimates of Arctic Securities, then the average competitor of Volue is trading at EV/EBIT for 2024 of 21. Further, they estimate that they will make around 305m NOK in EBIT by 2025. At this point they should have in my opinion a net cash position. At 18x EBIT this would be a market cap of 5.5 Billion NOK. Arctic Securities has a price target of 34 NOK a share (+72%).

Lastly by 2025 I estimate that Volue will make 240m NOK Net Income. This estimate is in line with estimates from Arctic. The question becomes how much would market participants pay for a fast growing Software company from the Nordics, that has high recurring revenues and a strong market position ? I think that a P/E of 20 is fair. So we would end up at a market cap of 4.8 Billion NOK.

The average of the 3 valuation models implies an upside of 94% over the next 2.5 years !

6/ Risks & Conclusion

The main risks of an investment in Volue are:

Growth rate lower then expected

Margin lower then expected

And too high valuation

Everyone can make his own estimates and can decide how much of the risk they see as justified or not.

In my opinion Volue gives us the opportunity to profit fron the energy transmission not only in Europe but in the entire world. The company has a strong market position, which is proven by there large clients. With high recurring revenues and strong growth, I think that the stock will generate positive shareholder returns over the next years & decades. I allocated a small portion of my portfolio into the stock.

Lastly I want to end this write up with a quote of Alber Einstein:

“In the middle of difficulty lies opportunity.” — Albert Einstein

Yours sincerely,

MODERN INVESTING

Congrats

Thank you. Nice write-up!