The last winter was mild, which in turn caused record high oil & gas prices to crash down. Currently the energy sector is again very hated and provides opportunities for contrarian investors.

Let’s look at an interesting opportunity that looks like a very low hanging fruit.

1/ Winter is coming …

While many hedge funds are short oil, there are many catalyst point towards higher prices over the coming months. Funds are shorting because they expect a recession and with it lower demand for oil. Arguably this is one of the most crowded trades apart from going long MEG7 and maybe shorting Chinese Tech stocks.

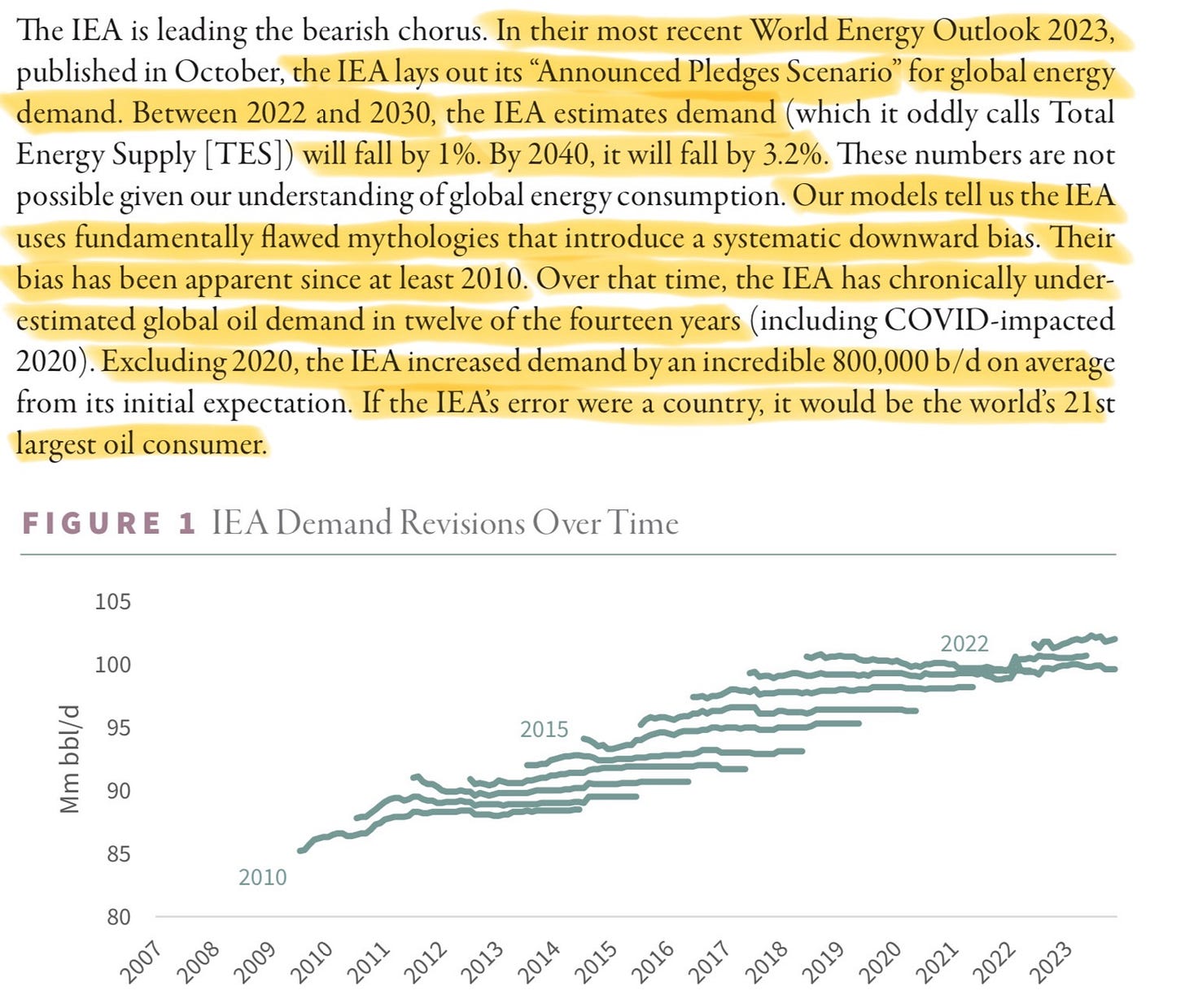

But if we look at demand, we can clearly see that demand is very robust. Chinese imports are up 12% in October and the IEA (International Energy Agency) is reviving their demand outlook higher, as they have underestimated demand for 12 out of the last 14 years !

But apart from all that, the winter has started. Somehow nobody is really paying attention to this, but the potential for a cold winter in Europe is increasing and shouldn’t be underestimated. As of right now, around 60% of Europe is covered in snow. This is the highest number since 2010.

Forecast project that this winter which will be impacted by El Niño (Jet Stream), will be colder then prior projections expected.

2/ “When two quarrel, the third rejoices”

With a structural supply deficit and a potential for a cold winter, the question becomes, where will Europe get it’s s gas from ? Especially, since OPEC+ is cutting production by a further 1 million boe/d (barrel of oil equivalent per day). OPEC+ is at war with the U.S. which is trying to keep the price low, by dumping reserves and exporting as if there was no tomorrow.

But as the saying goes: “When two quarrel, the third rejoices”. In this case Norway and Brazil are the profiteers from this battle. While Brazil will be part of OPEC+ from 2024 onwards, they will not cut production. Therefore Brazil and Norway will make a lot of money by filling the gap.

There are several advantages that are helping Norwayˋs energy industry. Firstly, there are very low operating expenses per barrel. Secondly, there are gigantic resources in the Norwegian Continental Shelf. Thirdly, the CO2 emissions per barrel are the lowest in the world. And lastly, there is very low corruption and the industry is much more transparent then their counterparts in other countries.

3/ OKEA ASA

After building a position in Vår Energi in July: 👇

Var Energi: Norways dividend monster

Over the past years I invested into several energy stocks. From Shell, Petrobras to Orlen. But currently there is one stock that I am especially bullish on. From an risk/reward perspective, Vår Energi is my absolute top pick.

I’m now building a position in OKEA, which I consider even cheaper then Vår at the moment. It’s a smallcap with a 12.5% dividend yield and a valuation that is extremely low. Nonetheless, the stock hasn’t attracted many people on FinTwit, which I see as a positive sign.

3.1/ OKEA Introduction

OKEA is a small E&P in Norway that has a strategy of M&A, that has worked out positively for other companies in the industry.

“OKEA is a leading mid-to-late-life operator on the Norwegian continental shelf, finding value where others divest. The company has an ambitious growth strategy built on accretive M&A activities, value creation and capital discipline. OKEA is listed on the Oslo Stock Exchange.“

— OKEA

With a production of currently around 23 kboepd, and a market cap of 310m $, the company is deeply undervalued. The company has 6 assets, that are all located in Norway and with the Hasselmus production well coming online on October 1st, the production of the company increased by 4.4 kboepd.

3.2/ Flashcrash

The stock of OKEA was down 12% yesterday (Friday the 1st of October), which was the result of firstly the ex-dividend for the December dividend (~3%) and the news that OKEA had postponed the acquisition of the Statfjord Field from Equinor. In my opinion this is a clear overreaction by the markets and is a great buying opportunity. To make a long story short, the Statfjord deal would have been fantastic.

“OKEA ASA (“OKEA” or the “Company”) announced that it had entered into an agreement (the “SPA”) with Equinor Energy AS (“Equinor”) to acquire 28% working interest in PL037 (Statfjord Area) with effective date 1 January 2023 for an initial fixed consideration of USD 220 million (the “Acquisition”).

Completion of the Acquisition was contemplated to take place on 30 November 2023. OKEA has notified Equinor that completion will be postponed.

In connection with Equinor’s (as operator) obligation to provide RNB 2024 figures for the Statfjord Area, OKEA received updated information which indicates a reduction in 2P and 2C volumes of 10-15% over the lifetime of the acquired assets compared to RNB 2023, combined with increase in cost.“

— OKEA

As a result of lower reserves, the fair value of the area is lower then expected. Therefore OKEA has postponed the deal for now. The problem is, that OKEA had clearly expected that this deal would go trough and stated that with the acquisition, their production would hit 40 kboepd by 2024. Further, this acquisition would have a payback time of around 1 year.

“The majority of the purchasing price, based on current forward prices, will be covered by cash flows generated by the assets prior to completion.“

— OKEA

In my opinion OKEA will try to negotiate a lower buying price, while Equinor will try to maintain the previously agreed buy price of 220m USD.

3.3/ Valuation

I’m now excluding the Statfjord deal in the valuation process, since there is to much uncertainty regarding this for now.

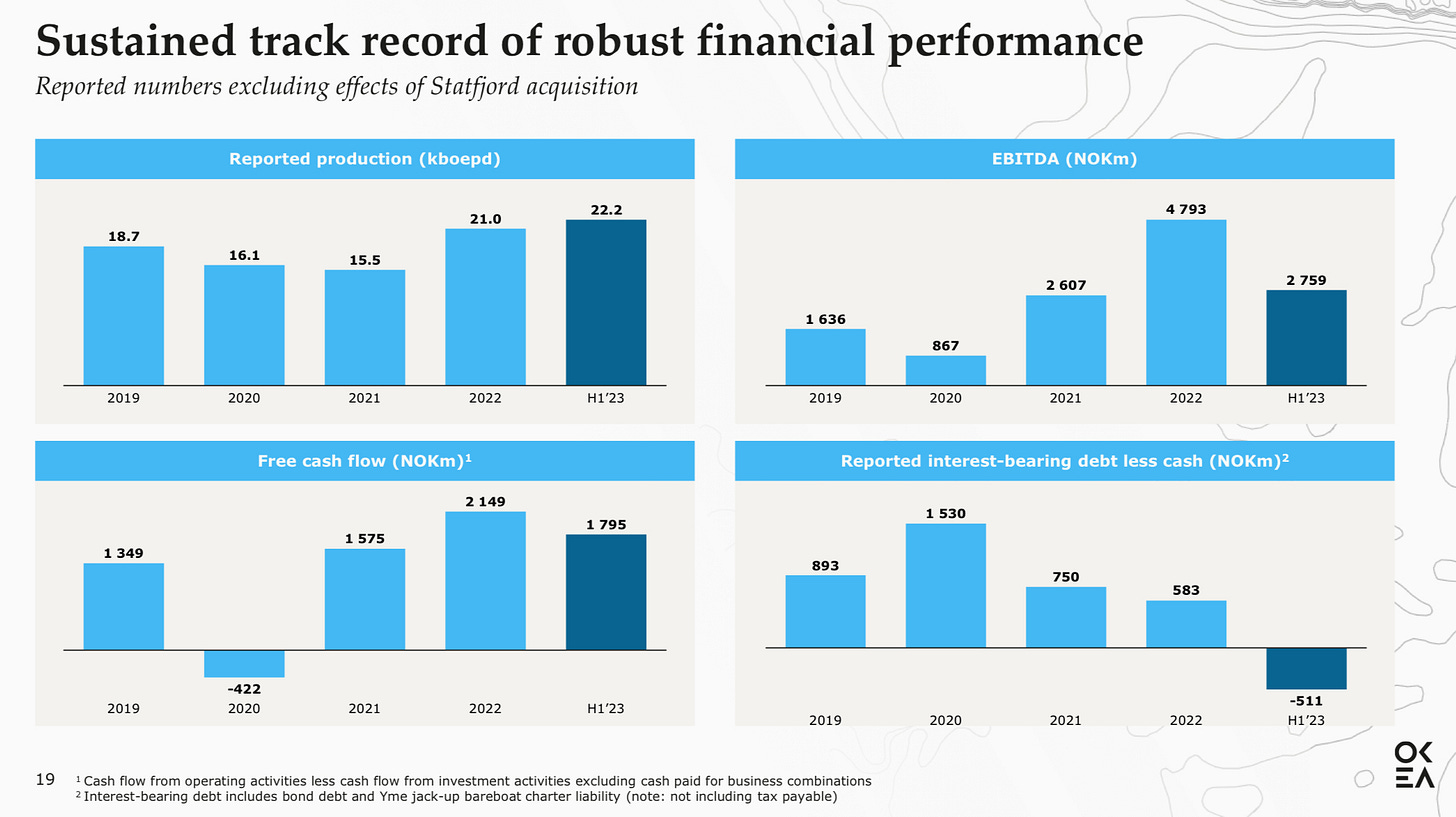

The company has Net Interest Bearing debt (minus cash) of negative 511m NOK and Free Cashflow of 1.8 Billion in the 1st half of 2023. Being realistic, I expect cash flow after taxes of around 2 Billion for a 12 month period at constant Brent prices and production.

This would imply a Price to FCF of 1.65 and a price per flowing barrel (market cap divided by kboepd) of 13-11k $ per flowing barrel. In contrast, Petrobras PBR 0.00%↑ trades at 25k $ per flowing barrel.

4/ Conclusion

The aftermath of the mild winter of 2022 presents contrarian investors with an interesting opportunity. While hedge funds are shorting oil amid recession fears, demand is stronger then ever and the likely hood of a cold winter is increasing by the day. OKEA is deeply undervalued and I hold shares in the company.

Yours sincerely,

MODERN INVESTING

Good read. Especially the valuation part. Maybe a comparison with other pure oil/gas play would be meaningful. I agree that OKEA is very cheap at a FCF yield of around 60%. , which is the highest I have seen. Petrobras, the most undervalued big company in the world, has a FCF yield of around 30 %.

Excellent piece. Intriguing idea.