Over the past week the sentiment for Chinese equities has gotten even worse. The last time I’ve seen such bad sentiment for an assets class, was oil in 2020. Back then the consensus was that oil would go away and it would trade at 0$. Today the consensus is that the Chinese economy is collapsing. Chinese stocks are uninvestable and shareholders will lose all there money.

Today we will look at 2 things:

What is going on with the Chinese economy ?

Which Chinese stocks are interesting ?

1/ Miracle or collapse ?

China’s GDP grew by 6.3% in the 2nd quarter of 2023. This is mainly the result of the reopening of the Chinese economy, after the lockdowns during COVID.

On the other side, it was reported that China is now struggling with deflation. Further, real estate developers like Evergrande or Country Garden are going bust.

Therefore many people are concerned about the Chinese economy. What if the Chinese economy would enter a recession ? This would of course be horrific for the global economy, because China is the manufacturing powerhouse of the world. So if China’s economy where to collapse, then the stock of Apple would be one of the biggest losers. But as we know the stock market, only Chinese stocks sold off. Not the American ones 🤷♂️

So what’s the bottom line here ?

I think that the Chinese economy is stronger then the market thinks. The Chinese economy is still growing at a fast rate and the country is importing massive amounts of crude oil. So if the countries economy is so weak, why are they importing so much energy ? Further, China is using a lot of it’s petroleum reserves. Why should a country use a lot of energy, when the economy is collapsing ?

The graphic above shows, that global oil inventories are falling rapidly. And based on data from Vortexa: “China has shifted from a stockbuilding to a stockdrawing pattern“.

“China's deflation appears to be coming from […] transportation and food, with pork prices down 26% year over year. Stripping out volatile food and energy prices, China's consumer price index rose 0.8% in July […]. China may be in deflation but that is less likely to persist as the Chinese government is set on hitting the GDP target of 5.5%, which means that China CPI deflation is likely to reverse quickly." — Ben Emons

2/ Longterm bullish on China

Looking at the long term outlook for the Chinese economy, nothing changed, because they’re experiencing disinflation right now (😂). The country has still massive potential and is slowly becoming a superpower, that is threatening the hegemony of the USA.

Looking back, all the way back in the 1990s and early 2000s the US wrote stories about the “Coming collapse of China“.

Xi Jinping described it in a perfect way in 2018 👇

"The Chinese economy is like an ocean […]. The ocean may have its calm days, but big winds and storms are only to be expected. Having experienced numerous winds and storms, the ocean will still be there. It is the same for China." — Xi Jinping

3/ Alibaba, JD, etc.

Let’s get into some interesting names:

Alibaba BABA 0.00%↑ :

Alibaba is one of the stocks that I’m especially bullish on over the long term. The company is profiting from the rise of the (massive) Chinese middle class.

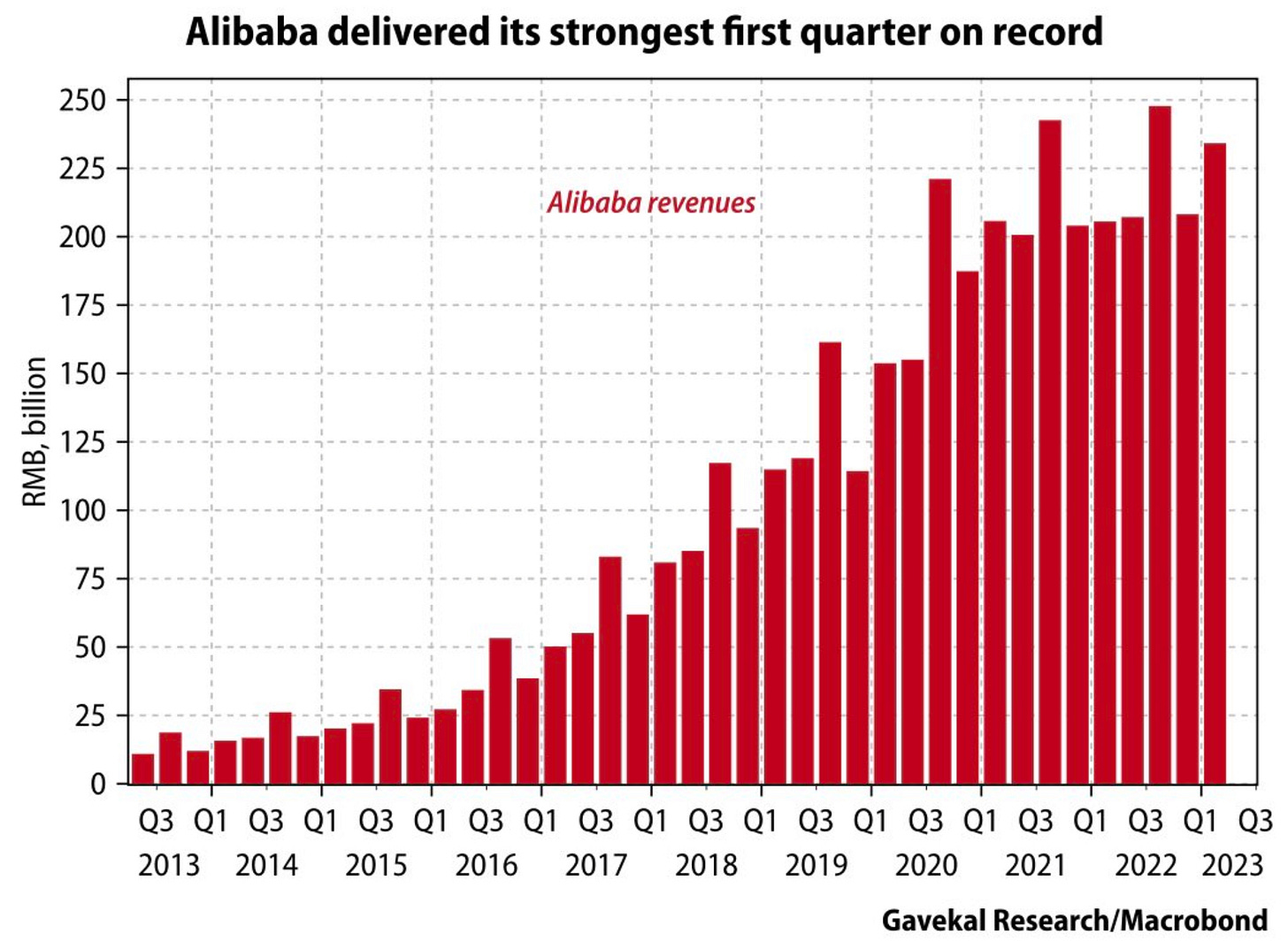

Over the last 10 years, the revenues of the company have grown by around 10x (!), while stock price is still the same !

Further, the company is buying back stock at an aggressive rate. With the focus on Free Cashflow generation, the company will create massive shareholder value over the next years and possibly even decades. Alibaba is also going to split itself into several businesses entities, that will operate on there own behalf. These companies will be listed separately and will/should be valued separately by the market.

JD.com JD 0.00%↑ :

JD.com is one of the main competitors of Alibaba, the company is smaller then it’s larger competitor, but shouldn’t be underestimated. The company has a large logistical network and is more comparable to Amazon then to Alibaba.

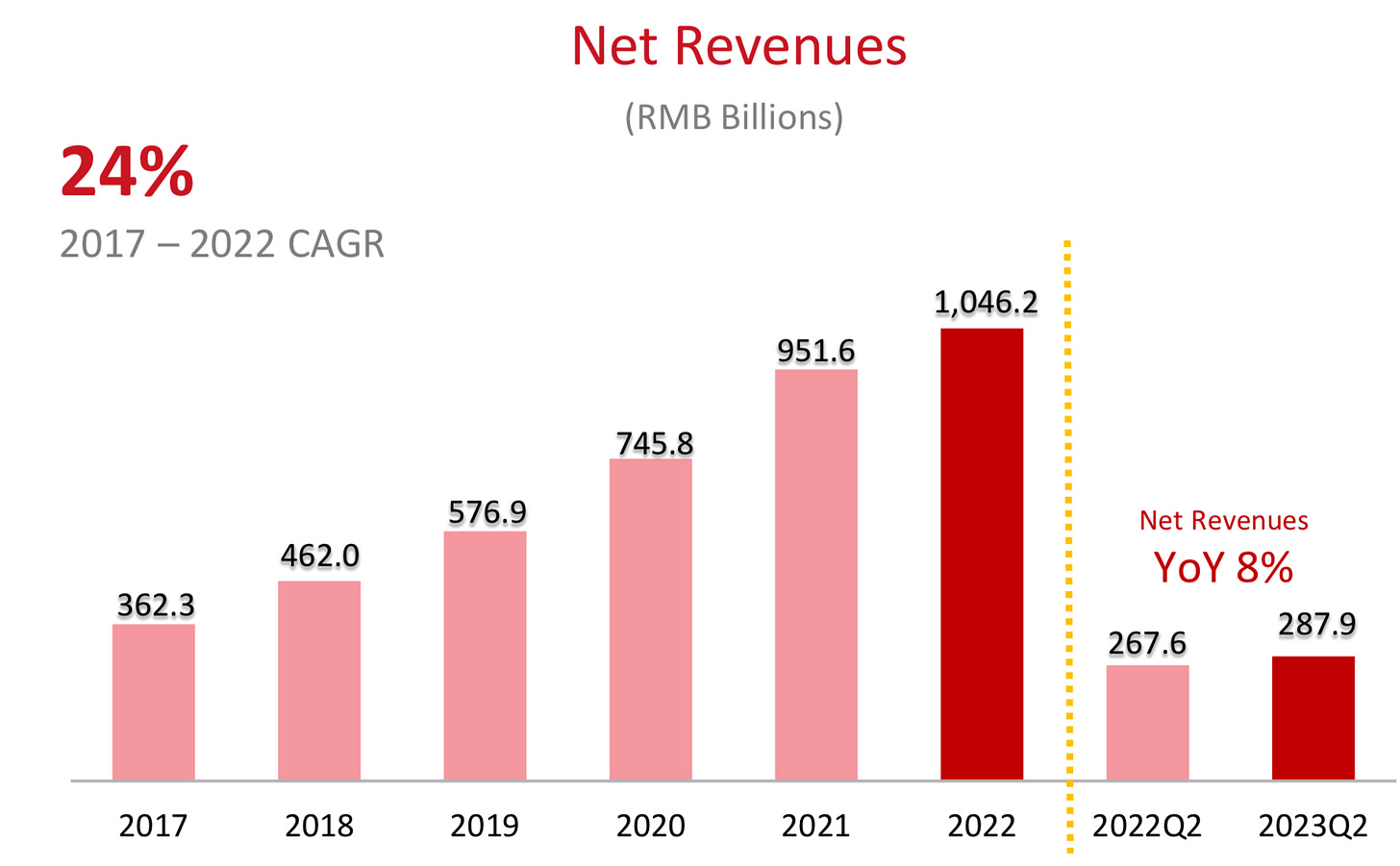

The stock is currently trading at a 11% Free Cashflow yield. While the company has been able to grow revenues at 24% p.a. Over the past 5 years.

4/ Conclusion

All in all the Chinese economy is still fine. Chinese stocks are incredibly undervalued, especially compared too American stocks. There is political risk, but I’m willing to invest a few percent of my portfolio into the Chinese dragons.

I’ll end this episode of Weekly Investing Focus with a quote of Jack Ma:

“Never give up. Today is hard, tomorrow will be worse, but the day after tomorrow will be sunshine.“ — Jack Ma

Yours sincerely,

MODERN INVESTING

Tons of commercial activities are done as undeclared payment (no taxes-under govt radar). That's why construction have this strength relating the GDP. Also everybody is paid with the minimum wage( the difference has no government take)

Youth unemployment is among people that have college titullations with aspirations of very good jobs. Savings in china are huge, so they can afford it.

Just see oil consumption in china, up YoY. And this is white one of biggest EV fleets on the world.

Long china

Youth unemployment is heading over 20% and China stopped disclosing the figure. If you look at the GDP contribution of China, you will find that majority comes from real estate and infrastructure construction. Quoting the GDP number is easy but you need to take everything into the context. The hiring freeze is real in China. I am saying this as a Chinese national.