“We have been around for 150 years and want to be around for another 150 years. […] The future is very bright. I like the old song: The future is so bright, I need sunglasses.”

— Jim Johnson

These were the words of Hunting PLC CEO during the capital markets day in September 2023. The stock has been completely forgotten by investors, since it is listed in London and is considered a boring and complex business. The opportunity we are presented with, is tremendous and investors haven’t caught up to the fact, that this is a great business trading at a wonderful price.

1| Summary

Hunting is progressing well in all aspects of the business, which is characterized by growing revenues, profits, capital efficiency and dividends. The order-book is very strong and will support the company’s ability to generate revenues & profits in the future. The management team has a clear path forward, is transparent and is reducing costs by closing less profitable production centers and opening new ones in much better markets and regions.

The stock has close to no net debt and trades at P/NOPAT of 7. FCF conversion is expected to increase meaningfully over the coming years, and revenues will grow, driven by growth in the global OCTG market. OCTG is basically the business of supplying pipes to customers, such as Exxon, Chevron, Equinor and national oil companies (often from the Middle East). It’s important to emphasize that Hunting is not a commodity business, and generates its profits by selling its manufacturing and knowledge to customers (more on that later). As capital efficiency increases over time, the stock is poised for a re-rate. In the meantime, Hunting is building a culture of growth and innovation, while building a company that has sustainable growth for years/decades to come.

2| History

In 1874, Charles Hunting fulfilled his vision of owning and transporting oil, by purchasing two sailing ships. Over the years, the Hunting family expanded their business venturing into oil exploration in Russia, refining in Hungary, and trading across the globe.1

In the early 20th century, they faced a lot of challenges by the 1st and 2nd World War. Hunting always reinvented itself and flourished once again in the mid to late 20th century. The company underwent restructuring and mergers, which resulted in the company we know today. In the early 2000s, the company divested its aviation business and completed the biggest acquisition to date, with the purchase of “Titan”, a company focused on equipment for the North American oil and gas industry. Today, Hunting continues to expand its presence in the global energy sector, with investments into oil, gas, geothermal, carbon capture, etc. Notably, the Hunting family still owns around 27% of the company.

3| Business Model

Hunting has 4 main business units, which is the reason why many people don’t even want to do deep research on them. The complexity and variety of things that have to be considered in the research process, is a hurdle that many don’t want to face. In addition, Hunting has its headquarter in London. The UK stock market is basically trading as if it was an emerging market, with most fund managers ignoring the market.

The main business units are OCTG, Perforating Systems, Manufacturing and Subsea. These divisions account for 42.6%, 26.2%, 20.5% and 10.6% respectively.

OCTG

OCTG is the business of pipes, that are used in the oil & gas industry. While this business might appear like a commodity business, it’s not. Hunting isn’t dependent on the price of pipes, because it is a manufacturing/engineering company that makes money by supplying customers with the products. In the process Hunting uses one of its many locations to deploy its manufacturing knowledge to the product. In the end, the customer gets the OCTG pipes delivered that suit his operations best. Specifically, Hunting provides connections to the pipes that are made for the rough terrain of the oil & gas industry. This includes very high pressure and heat.

“At the end of the day one of the things people will point out when they look at our OCTG business [is] : "oh pipe prices are falling in the U.S.”

I don't care what the pipe price is in the U.S. or globally for that matter. We don't stock for speculation. In the U.S. in Canada, we're working strictly through distribution. We have distributor partners, that they're taking the risk on the inventory. They send it to us, we charge them a fee four our technology and then it goes to the client. Our job is getting our products certified qualified through extensiv physical testing to end users.”

— Jim Johnson2

Internationally, the OCTG business is seeing strong and accelerating growth, driven by South America and Asia. The company has put out a target to grow revenues in the OCTG division by 19% p.a. till 2025.

Considering, that the general market for OCTG is expected to grow between 4-7% p.a. this would imply that Hunting’s market share in the industry grows over the years.

Perforating Systems

Perforating systems are used to create pathways for oil and gas to flow from underground rock formations into oil and gas wells, making it easier to extract the hydrocarbons.

The Perforating Systems division is primarily active in North America with the headquarter being in Texas. In 2011, Hunting acquired “Titan”. Notably, the rig count in the U.S. declined by 20% in 2023. This is a big headwind for “Titan”, but because of fast international growth, revenues in this division declined by just 2.6%.

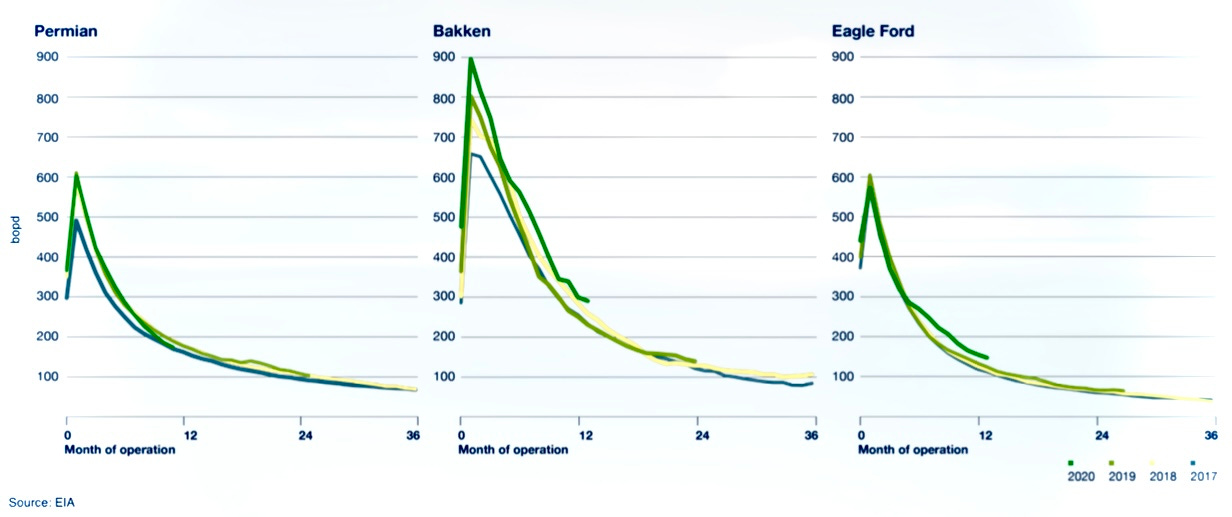

If we take a look at the Shale (majority of U.S. oil production), we can see a trend of declining well productivity. The base decline of production was ~40% in 2023 (!) and the depletion of wells requires much more drilling activity in the coming years just in order to sustain the same production levels.

This is supported by the statement by the CEO Jim Johnson:

“This treadmill isn’t stopping. Even if companies want to have flat production levels, they still have to drill like crazy, just to keep that production flat. Due to the depletion in these unconventional reservoir that are being tapped today.”

— Jim Johnson

Manufacturing

The manufacturing division supplies products to industries ranging from electronics, medical equipment, aerospace & defense to oil & gas. The division is vertically integrated with the other businesses of Hunting, by supplying key components from the in-house production facilities. An example of this is the power switch for “Titan”. The Manufacturing division produces around 2.5 million switches for “Titan” annually, and has the capacity to increase this if demand grows. It’s great for Hunting to have a vertically integrated business model (in some areas), because this reduces costs and time spent in the transportation process.

Furthermore, Hunting’s Manufacturing division has long lasting relationships with clients, that will last for decades.

“Turbine engines along with helicopter rotors, periscopes and other defense contracts offer a high barrier to entry for our competitors. These programs last for several decades after initial development.”

— Hunting PLC Capital Markets Day 2023

This division is expected to grow by 29% p.a. till 2025, which will be driven by growth in the defense, medical devices and space industry. While the space market seems like a division that isn’t meaningful, it paints a clear picture of how Hunting uses its brand to expand into other areas. By having a well respected brand, Hunting has been able to supply companies such as SpaceX and BlueOrigin with products for their rockets. As the number of satellites shot into space keeps growing, Hunting profits by supplying critical parts required in the industry.

Subsea

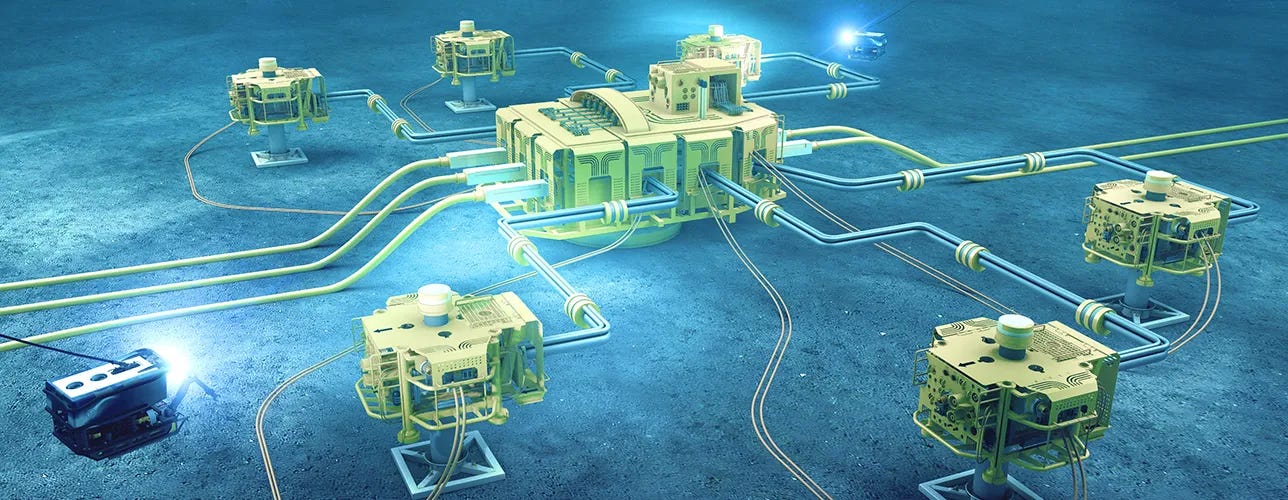

Last but not least, we have the Subsea business. The Subsea technology aims to produce oil from the sea surface. Subsea offers low production costs and is therefore in high demand.

The Subsea market is one of the tightest markets in regards to supply and demand in the energy sector. Subsea trees are structures that regulate the flow of oil and gas from the wells. The tree regulates the pressure and amount of hydrocarbons that are transported to the surface.

“Just a tree alone has around 250 connections on it. To bring it online is about another 250. So every well site a solid 500 connections. These simple connections, thats what we own! And we own that entire space. 1986 first installation offshore, 37 years of field history, well over 2 million installations globally [and] zero field failures to date.”

— Hunting PLC Capital markets Day 2023

What shouldn’t be underestimated, is that the Subsea business can generate value for long periods of time. Even after the initial sale of the products. This is driven by cross selling over the lifetime of the well. Over time, Hunting can generate tremendous value by engaging in more projects with the same customers.

Recently, the Subsea division announced a deal in the turkish part of the Black Sea3, which showcases the expansion of Hunting’s operations globally.

Hunting has 2420 employees, 16 distribution centers and 27 operating sites globally. The company is geographically focused on North America, the Middle East and East Asia.4

Recently, the company opened a production center in India, while at the same time focusing more on South America. Brazil and Argentina are especially interesting for the company, as both countries hold significant natural resources.

4| Culture

As any business that has survived 2 world wars, countless crises and political instability, culture is what makes the existence of any successful corporation possible. The average employee stays 9 years at Hunting, with many staying their entire career at the company.

“Our people are at the heart of our business, and we ensure that their health, safety and well-being are a priority. We mainly operate in a competitive and cyclical sector, which is high profile and well regulated. To be successful, we must deliver reliable products, which are quality-assured to the highest industry standards, offer improved cost efficiencies, and assist safer processes for our customers.”

— Hunting PLC Annual Report 2023

5| Growth & Structural Tailwinds

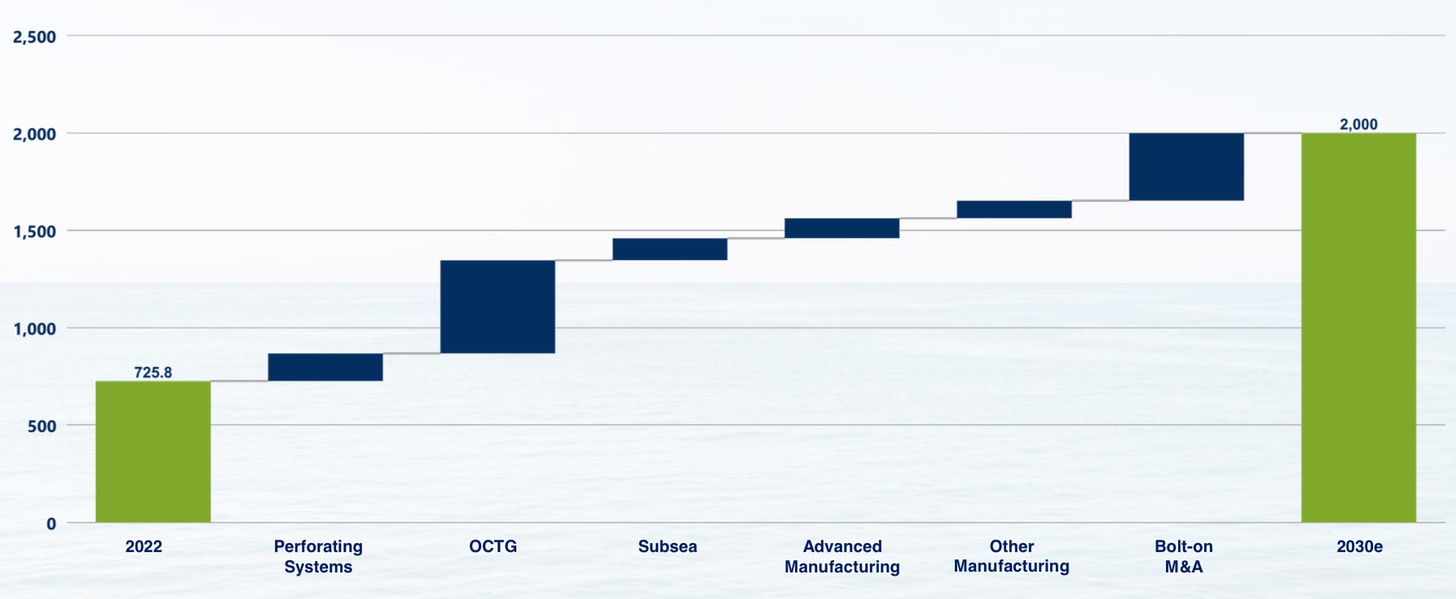

Hunting has several structural tailwinds, that will support the growth of the company over the coming years. Hunting guides for revenue of $1.3 Billion by 2025 and $2 Billion by 2030. I personally see the guidance for 2025 as realistic, in the context of very strong momentum, but think that the goal for 2030 is a bit conservative.

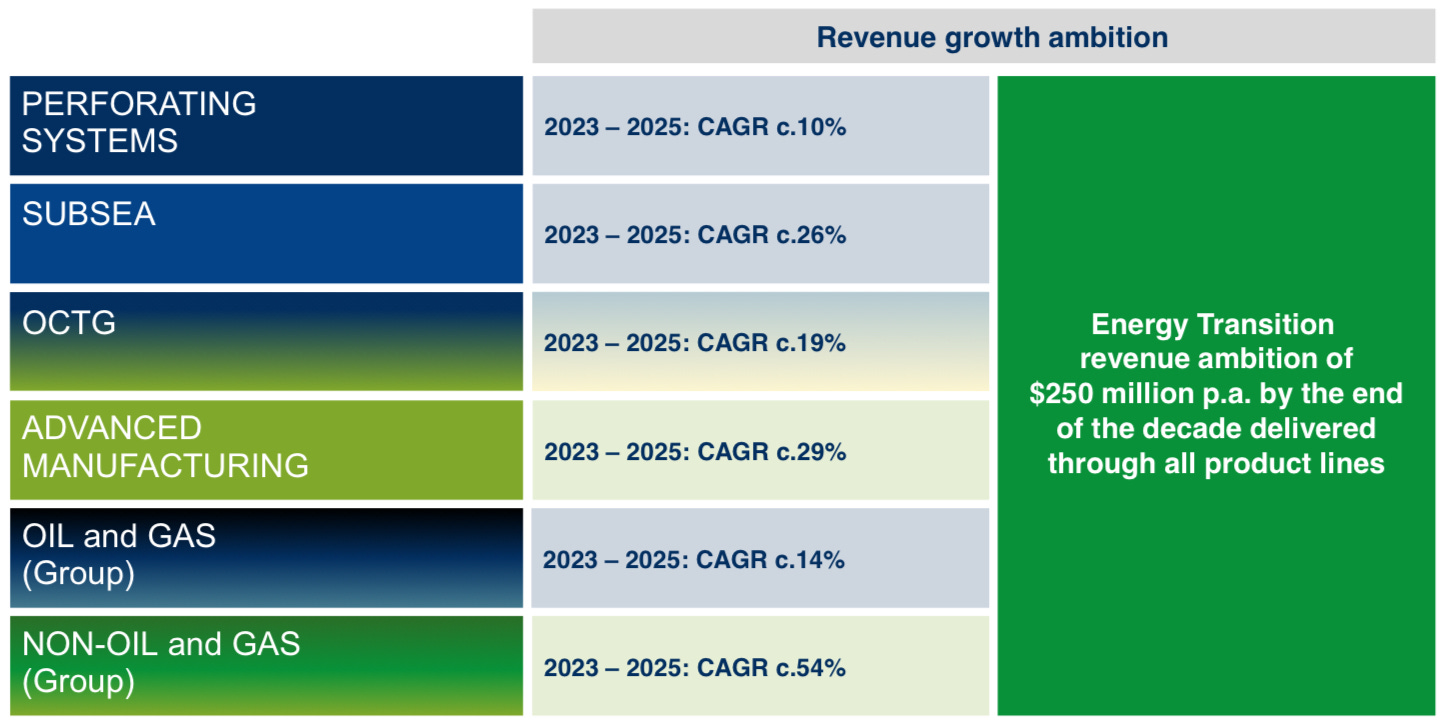

The key driver behind this growth will be the roll out of all business divisions. Remarkable progress is expected in OCTG, Subsea and Advanced Manufacturing.

OCTG should grow at a CAGR of 19%, while Advanced Manufacturing & Subsea are expected to grow in the mid to high 20s.

5.1 Oil & Gas Business

As 80% of Hunting’s profits derive from the business related to oil and gas, we have to look deeper at the drivers behind this expected growth.

“Deepwater is the fastest growing upstream oil and gas resource theme. From just 300,000 barrels of oil equivalent per day (boe/d) in 1990, production is expected to hit 10.4 million boe/d in 2022. By the end of the decade, that figure should pass 17 million boe/d. […]Deepwater basins tend to be hyper productive, recovering huge volumes of oil and gas from each well. This translates into high economic returns and low emissions.”

— Wood Mackenzie5

Growth drivers are a growing population and importantly human development. As emerging markets become wealthier, their demand for energy will grow. Today 80% of the world’s energy mix derive from fossil fuels, with no trend change in sight. While there remain narratives of renewables disrupting fossil fuels over the coming decades, this is just noise with no data to back up. Trillions have been spend over the last decades to accelerate the growth of renewables, and the share of fossil fuels has more or less stayed the same. Furthermore, wind parks are going bankrupt because they are not economical, and the today installed wind mills will have to be replaced by 2040. How is this economical/ecological? The Chinese Middle class will double till 20306, and India will see tremendous growth in the coming years/decades.

Managment is one of the most important parts of an investment thesis, as the people behind a company are responsible for decisions that impact the future of the company. It’s great to have someone at the head of Hunting, who has the same view as I on global energy demand and sources of energy going forward.

“I know everybody read the article yesterday, when this decade is going to be the peak in oil and natural gas. I just do not believe that! Today from 102 we’re already up to 103 million barrels a day of consumption. I think that is only going to accelerate, as people have demands for GDP to increase, to a global population that needs to leave poverty! Ten years ago 82% of the energy mix was oil and natural gas, trillions of dollars later, 10 years passed, it’s still 82% of the energy mix.”

— Jim Johnson

I went into much more detail on the energy transition, oil, gas & renewables in this article —> Link.

5.2 Non-Oil & Gas Business

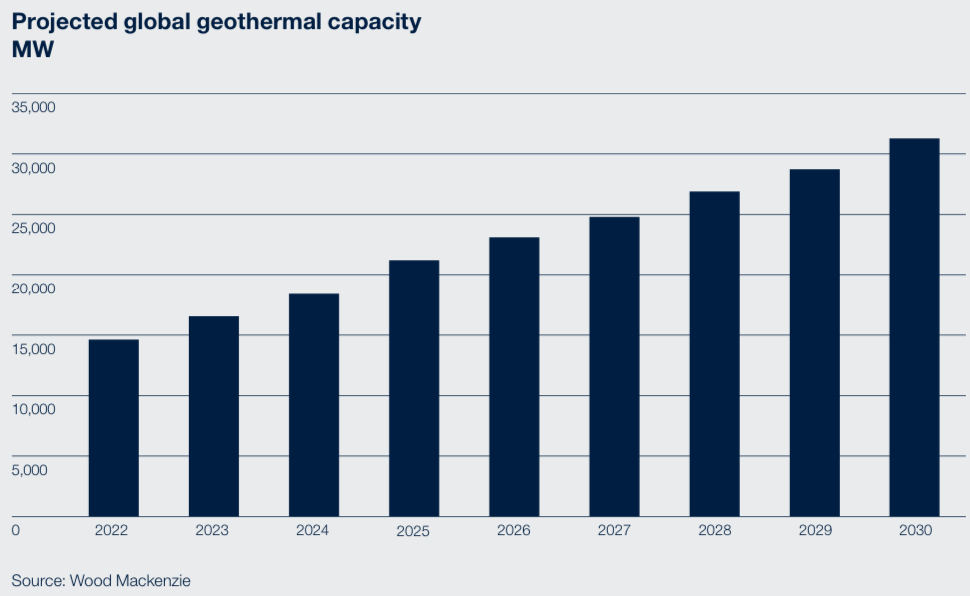

Geothermal is a huge opportunity for the company, as the global installations of geothermal are expected to increase, driven by investments in the U.S., Indonesia and the Philippines. The annual demand for OCTG by geothermal is expected to grow at a 30% CAGR till 2030! Geothermal requires components that can withstand enormous temperatures, therefore the demand for premium OCTG will probably grow quicker than the general demand for OCTG. Hunting is well positioned to profit from this trend, as they have decades off experience in this sector and have recently signed an 10 year agreement to cooperate with Jiuli (Chinese company) in the production of OCTG.7

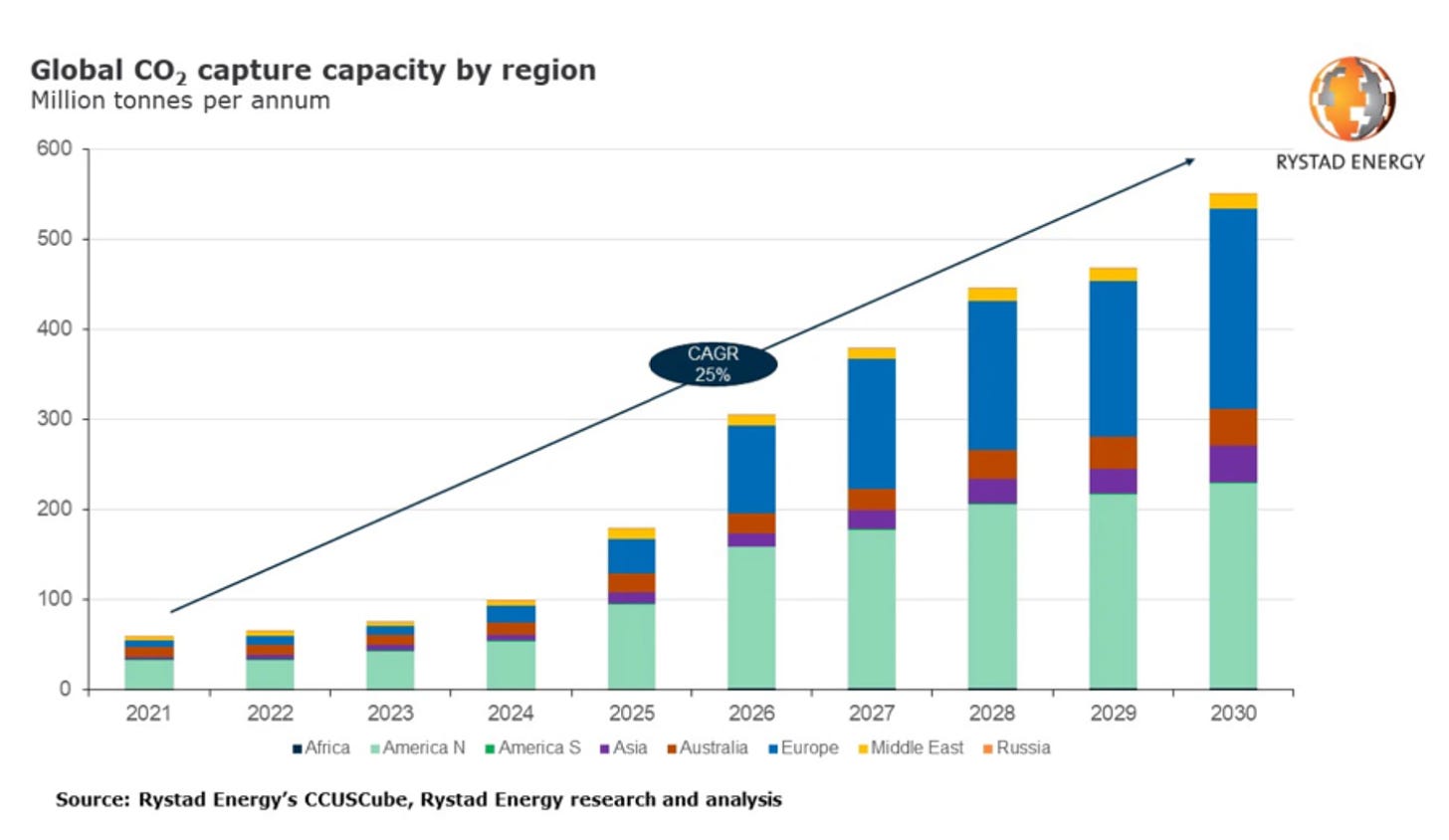

Furthermore, Hunting will also profit from the trend of Carbon Capture, as Carbon Capture Utilization and Storage (CCUS) requires tremendous amounts of premium OCTG. Rystad Energy estimates that the CCUS market could reach $55 Billion annually by 2030.8

During the Capital Markets Day 2023, the following was stated:

“We're looking to put this into context of OCTG. In 2026 we will have 136 million tons per annum of Co2. This equates to at least 1.2 Billion of OCTG, due to the high exotic materials that are required in the [process].

What we are seeing [...] is huge demand for 25 Chrome Super duplex and higher exotic materials. 25 grades and higher grades of metallurgy costs in the region of 15-20 times more of carbon steel. And there's only about 3-4 players in the world who can supply the types of materials, and testing, that's required in the industry. Hunting has the tech and connections and supply chain to manage this.”— Hunting PLC Capital Markets Day 2023

While both geothermal and CCUS are currently not meaningful contributors to Hunting’s top and bottom line, there is huge potential to grow in this sector. The main focus on the company still lies in the oil & gas sector, while the share of non-oil & gas businesses is expected to grow at a fast pace over the coming years/decades.

6| Competitive Advantage (e.g. Moat)

I noted the cooperation between Hunting and Jiuli earlier, but want to expand on that, as it has implications for the competitive advantage of Hunting. Jiuli is one of the only companies in the world, with the skills and technological capabilities to assist Hunting in its highly complex tasks. This is a competitive advantage, because it provides barriers to entry for possible competitors.

The cooperation between Jiuli and Hunting is a beautiful example, of what is possible, when companies from the west and east cooperate with each other. In this specific example, engineering know-how from west meets technical capabilities in the east.

“We have already started bringing Hunting’ western technology and our acceptance by the major operators globally, coupling that with fantastic mill state of the art products. And we are driving that, like we have done since 2008, into the Middle East [and] into the rest of Asia and even internationally.

Jiuli has the capacity to grow from 4-5 k metric tons today to 20k metric tones. That’s a 1/3rd of global supply today. It's a win- win- win for Hunting, Jiuli and the customers.”

— Hunting PLC Capital Markets Day 2023

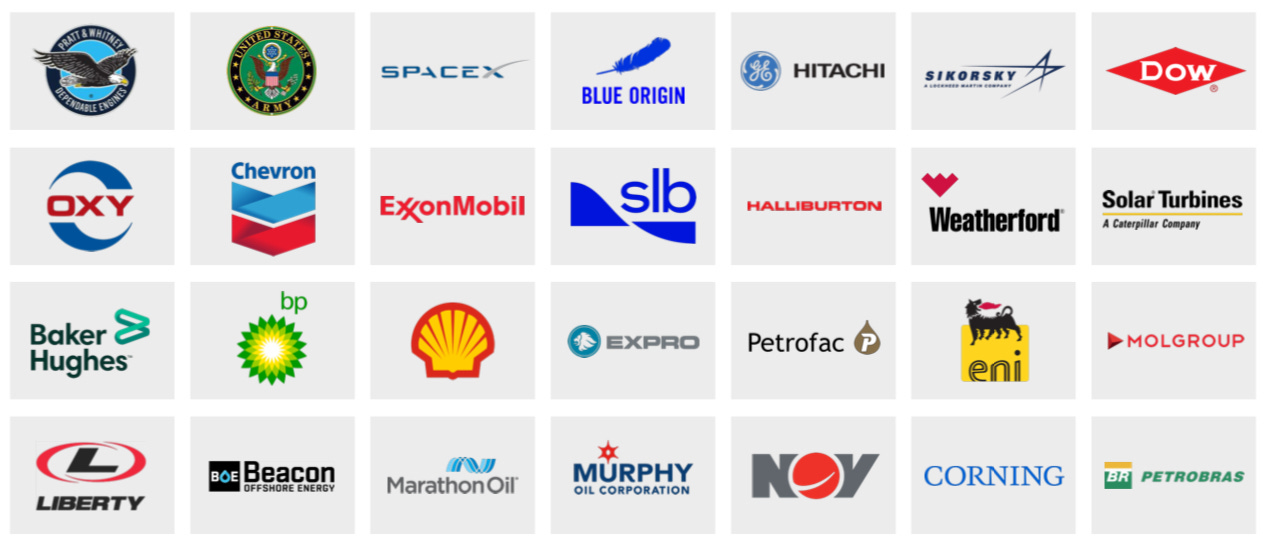

The relationship between Hunting’s customers and the company is noteworthy to mention, as the list of customers is of very high quality and industry leading companies. Just to name a few of their customers, we have SpaceX and BlueOrigin for the space industry. Exxon Mobile, Chevron, Petrobras, Shell, Saudi Aramco, etc. in the oil & gas industry. In the defense sector customers include the U.S. Military, Lockheed Martin and L3Harris.

A great example of Hunting’s technical capabilities and the fact that they are highly regarded amongst the industry is their relationship with Schlumberger. The company is a direct competitor in the oil & gas industry. Nonetheless, Schlumberger is a customer of Hunting.

“We are doing business with everybody, clients and competitors.”

— Hunting PLC Capital Markets Day 2023

While some people would point out, that cooperating with your competition will lead to a destructive cycle of competition amongst both companies, Hunting’s philosophy is this regard is vastly different. By setting its focus on manufacturing the best products for the industry, the company is doing business with everybody. The fact, that Schlumberger is choosing Hunting as a supplier instead of producing it by themselves, shows that the quality of Hunting’s products is very high.

Furthermore, Hunting produces products that are critical for several industries such as Energy, Aerospace & Defense, Medicine, etc. Just imagine a pipe that Hunting produces, having quality issues. The consequences can cost hundreds of thousands of dollars, while in other industries the consequences of a bad product would be the death of people. By having a track-record of supplying customers with highly critical parts, Hunting is well respected and doesn’t face much of competition in my fields.

In addition, Hunting has a total of 538 patents, that protect them from competitors entering there markets. It’s a difficult and time consuming process of building a strong relationship with clients, but once you’ve established yourself in the industry, competition can’t catch up to you.

“Most of our oil and gas clients have been with us for over four decades. Our clients also know we are a valuable partner, as there are only a handful of competitors in our industry. It takes months and sometimes a year to become a qualified supplier. But once approved they rely on the precious on of our expertise and it becomes a long lasting relationship.”

— Hunting PLC Capital Markets Day 2023

7| Financials

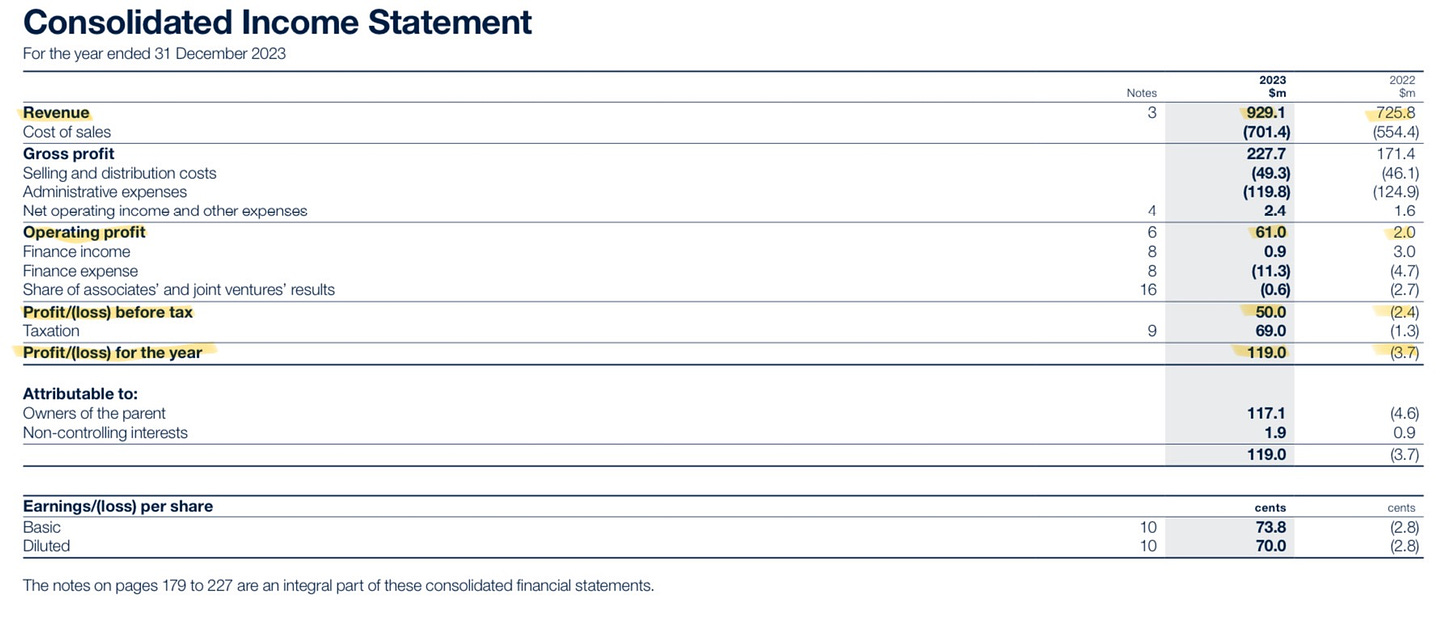

In 2023, Hunting generated revenues of $929m, which was up by 28% YoY. Operating profit (EBIT) amounted to $61m, which was up more than 30x compared to 2022. Net Income stood at $119m, compared to a loss in 2022. Net income was to a large extend driven by tax credits, that Hunting used, as they are now confident that the business will generate growing revenues and profits.

FCF stood at just $16.9m in 2023 which was largely driven by working capital. More on FCF and margins in the next section.

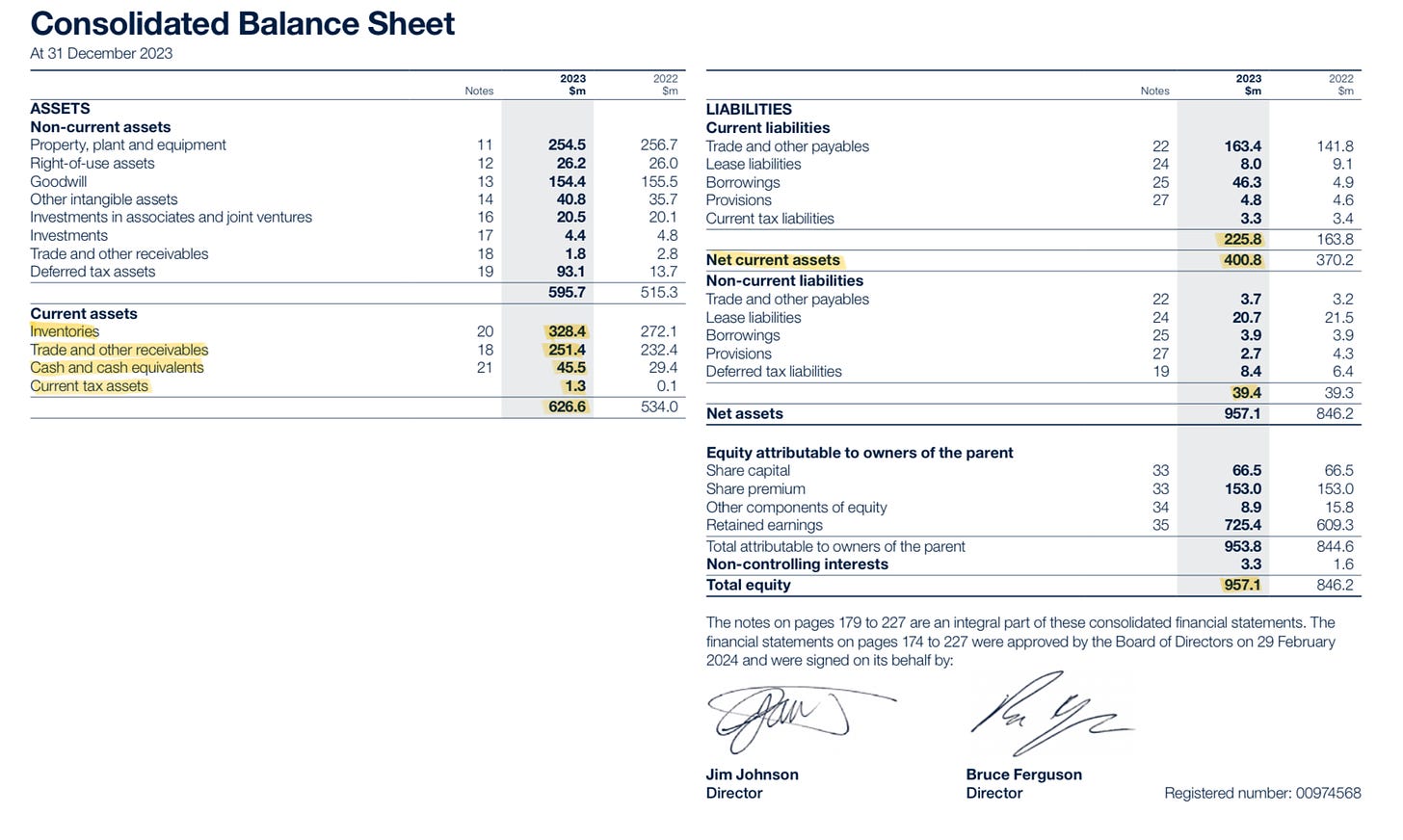

The balance sheet of Hunting is strong, with a current ratio (current assets/current liabilities) of 2.7. In fact, current assets exceed total liabilities by $360m! Since most of the current assets are inventories, the point can be made, that the real liquidity of Hunting is much lower. This is true, but considering the strong operating performance and the fact that working capital has peaked, I expect that Hunting can convert most of the inventory into cash.

Because of the good performance, Hunting has declared dividends of 11 cents per share, which is in line with the outlined strategy of growing the dividend by 10% p.a. till 2030. Hunting doesn’t buy back shares and the CEO has publicly stated that he doesn’t intend to do that, because the company is reinvesting cash into the business and returning cash to shareholders via dividends.

“My preference is to increase the dividend. I don't want to get into share buybacks since our goal is to grow the business”

— Jim Johnson CEO of Hunting PLC

8| Margins

Hunting operates in the manufacturing business, with key customers from the oil & gas industry. Therefore the company has quite low margins by design. Nonetheless, the company targets to achieve between 14 and 16% EBITDA margins by 2025, with a FCF conversion rate of >50%. Further improvement in profitability is expected till 2030. While Hunting suffered during COVID and because of supply chain constraints, the company has focused on efficiency, which has lifted EBITDA margins to 11% for the FY 2023. In the 2nd half of 2023, EBITDA margins stood at 12%. While FCF stood at just $16.9 million for the FY 2023, the 2nd half of the year saw FCF of $69.3 million!

This was predominantly driven by working capital. Because of a normalization in supply chain issues, inventory and receivables are not that high anymore. Working capital is still very high, but will decline gradually over the coming months. This will have magical effects on FCF conversion and generation.

On this topic, Hunting’s CFO said the following:

“We hit our high in working capital in May, and FCF conversion picked up in H2 2023, driven by supply chain issues softening.”

— Hunting PLC Annual Report 2023 Presentation

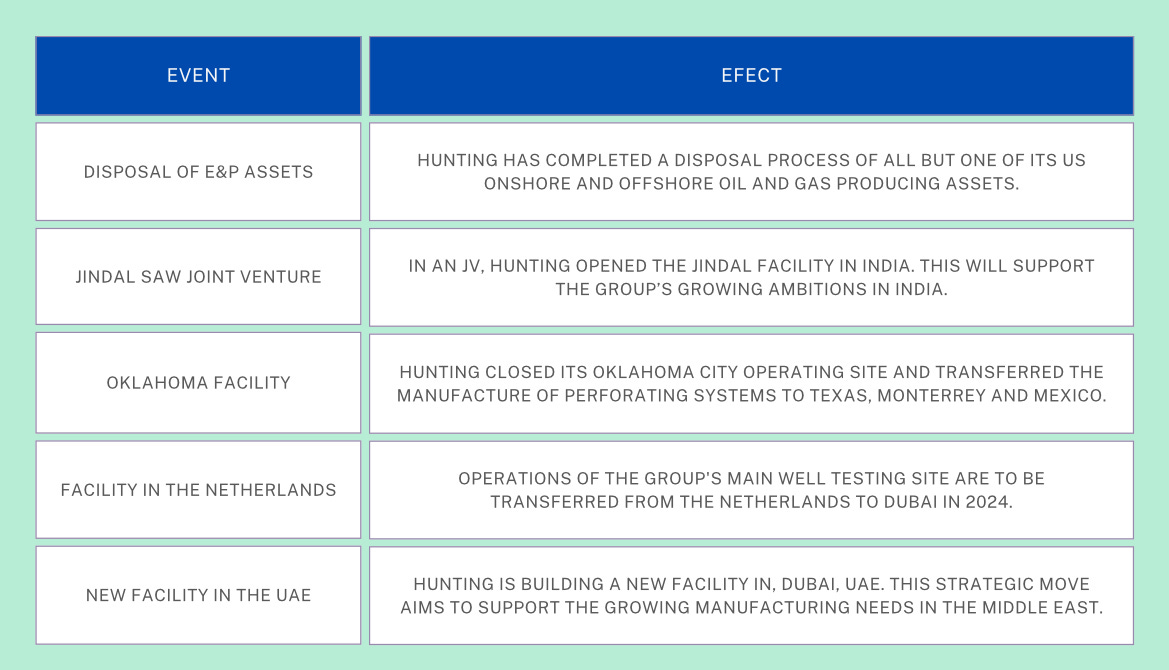

In an effort to increase margins, Hunting has embarked upon a strategy of reducing costs as much as possible, by shutting down production in some regions, while building new production facilities in other parts of the world. The new facilities are located in strategic locations near customers and long term growth markets.

Above, you can see the new production facility in Dubai, that will be opened in 2024. The Middle East is a growth market for oil & gas, which makes this region especially attractive for Hunting. To increase margins, Hunting shut down its production facility in the Netherlands, while only keeping a customer serving center there. Furthermore, the company closed its operations in Oklahoma and relocated the production facility to Texas, Mexico and Monterrey.

In September of last year, the company opened its first facility in India. In a joint venture between Hunting and Jindal SAW, Hunting expanded into the most populated country in the world.

Below you can find a summary of the most important steps by the company, in an effort to improve profitability.

Considering that working capital has likely peaked, supply chain issues have been softening and efficiency being increased (by relocating facilities), I expect margins to grow over the coming years. With growing revenues operating leverage should also positively contribute towards the bottom line.

9| Valuation

I will try to keep the valuation pretty simple and straight forward, so we will try to roughly forecast FCF and then apply a fair/conservative multiple on it.

For 2024, Hunting is guiding for EBITDA of $125-135m. Furthermore, the company is guiding for a conversion rate of around 50%, which would mean FCF of around $65m. This would result in a current valuation of around 11x FCF for a company with a rock solid balance sheet, 150 years of history and a growing business that is improving in all metrics.

I see the target of $1.3B in revenues till 2025 as realistic considering the measures taken by the company to grow margins and conversation rates. I expect margins of 14-15% by 2025. The company is guiding for 15% and conversation rates of around 60%. At $1.3B in revenues, an EBITDA margin of 15% and a conversion rate of 50%, we arrive at FCF of ~ $100m in 2025. At an EV/FCF of 10, the market cap would be $1B.

If we take a look at a longer time frame, the stock becomes very attractive. The $2B revenue target by 2030 would imply a growth rate of 9% p.a. Something that I think is conservative considering the tailwinds Hunting has. At $2B in revenues and an EBITDA margin of 15% (Hunting is guiding for >15%), the company would generate $300m in EBITDA by 2030. With a 60% conversion rate, Hunting would generate $180m in FCF. With a 10x EV/FCF (I estimate EV to be the same as market cap) multiple, we would arrive at $1.8B in value. Adding the around $200m in dividends over that period (at a growth rate of 10% p.a. as outlined in the 2030 plan), we arrive at around $2B, which is a 176% above the current market cap.

It’s important to point out that small changes to the estimates have huge impacts on the fair value estimates. With revenues of $2.2B, a 16% EBITDA margin and a 70% conversion rate, Hunting would generate $246m in FCF. At a 12x multiple and the same dividend payments as discussed above, the value by 2030 would be $3.15B, or 336% above the current market cap

In a bear case I assume $1.8B in revenues, a 14% margin, a FCF conversion of 50% and a multiple of 8x. Dividends would in this case not grow over the entire period and the multiple would decline. Even in such a case, the stock offers 53% upside, so we wouldn’t lose money in this case.

10| Conclusion

In summary, Hunting plc is a boring company that flies under the radar of most investors due to its size, geographic location and industry. This is contrary to the fact, that the business is performing very well and has existed for 150 years. Continued investment into the oil & gas sector, coupled with a growing non-oil & gas business support the long term growth of revenues and profits.

The train of energy demand is going full steam and won’t stop anytime soon. Supported by global prosperity and emerging markets, energy demand is growing at a rapid pace.

I expect Hunting to perform well, when the perception of oil & gas changes among investors (like here👇 9).

I build a first small position in the stock during February at a market cap of ~ $600m. Since this time the multiple has sadly been going up, which prevented me from building a full position. I see Hunting as a great hedge against growth in the Shale (U.S. oil production). Since I own many oil stocks like Geopark, Vår or Petrobras, lower production from the Shale would be very beneficial for oil prices and these stocks (supply & demand). But if the Shale would surge which I see unlikely but possible, Hunting would profit meaningfully due to higher drilling activity. So Hunting is a good addition to my energy portfolio to serve as a hedge, while still being a great business.

Yours sincerely,

MODERN INVESTING

If you have any feedback or thoughts, feel free to share them in the comments below and become a member of our community for free 👇

Excellent write up, thank you. High quality report. Cheers John.

Great write-up!