Vår Energi’s strategic acquisition and OKEA’s roller coaster

Undervalued oil & gas stocks from Norway 🇳🇴

A lot has happened the last few months, from shut downs in oil production to wars and political conflicts. In regards to oil, the bull thesis is still intact. Demand is very strong and growing fast, while supply has issues with OPEC cuts, Shale becoming gassier and a structural CAPEX deficit (as of now!).

1/ Vår Energi

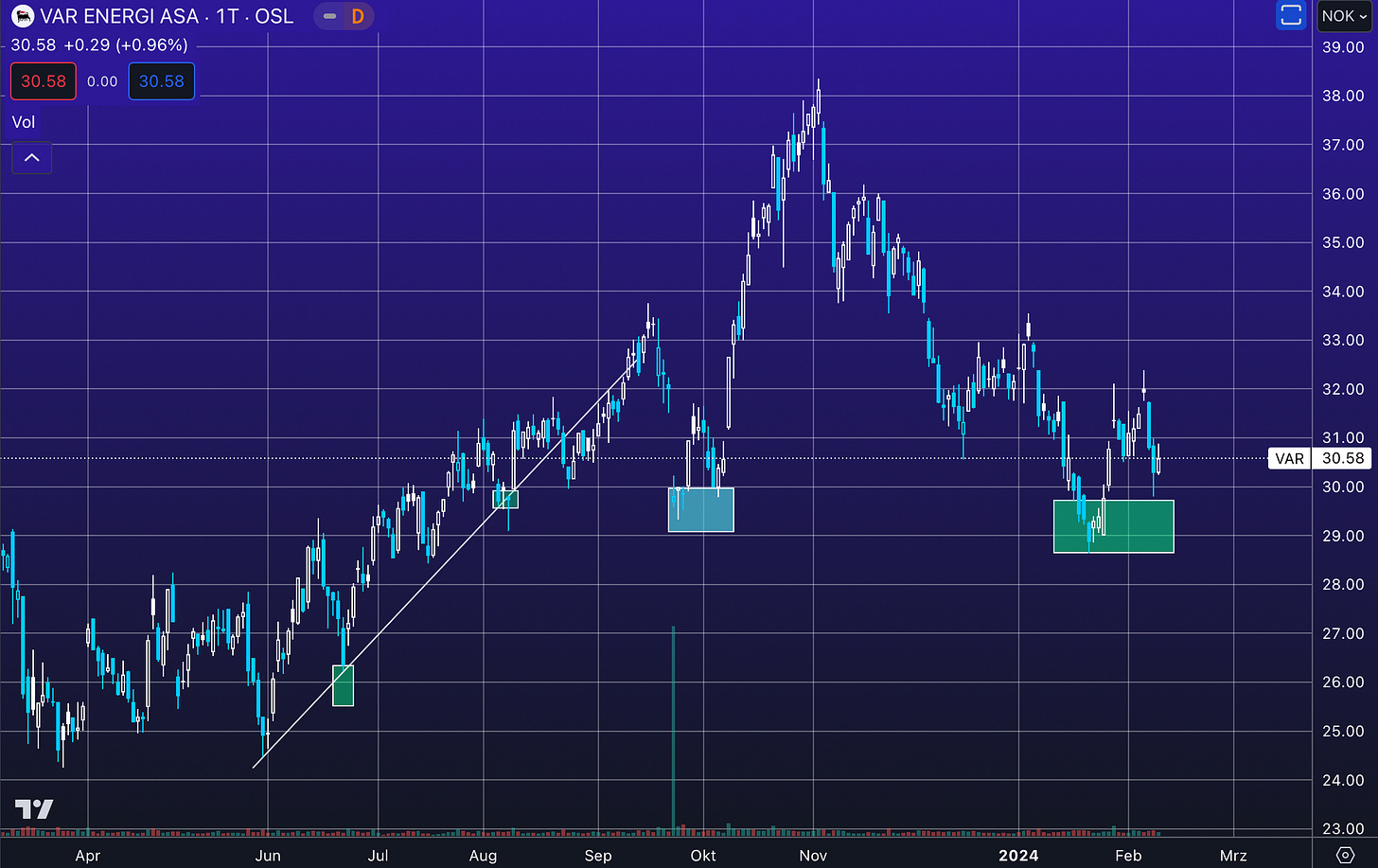

Vår Energi VAR 0.00%↑ , which is a stock I wrote about in detail last July, has closed the acquisition of Neptune Energy’s Norwegian assets, and has given an update regarding it’s reserves (while also paying dividends). The acquisition had an effective date of the 1st of January of 2023 and the agreed price was 2.275 Billion USD.

The Transaction was financed through available liquidity and credit facilities, and the net cash consideration paid upon completion less cash available in Neptune Norway was approximately USD 1.2 billion.

— Vår Energi

So with that, the price VAR 0.00%↑ paid from their own pocket amounted to around 1 Billion USD. Neptune Energy Norway produces 66k boe/d and has 2P reserves of 265 million boe. The acquisition is critical to achieve the ambitious goal of doubling production till the end of 2025 to 400k boe/d.

Vår Energi has become cheaper the last few months, while performing well operationally. The company recently announced that its now has 2 Billion in 2P + 2C reserves. These are comprised of 1.241 Billion BOE in 2P and 745m boe in 2C reserves. You can find my original thesis on Vår Energi below. 👇

2/ OKEA ASA

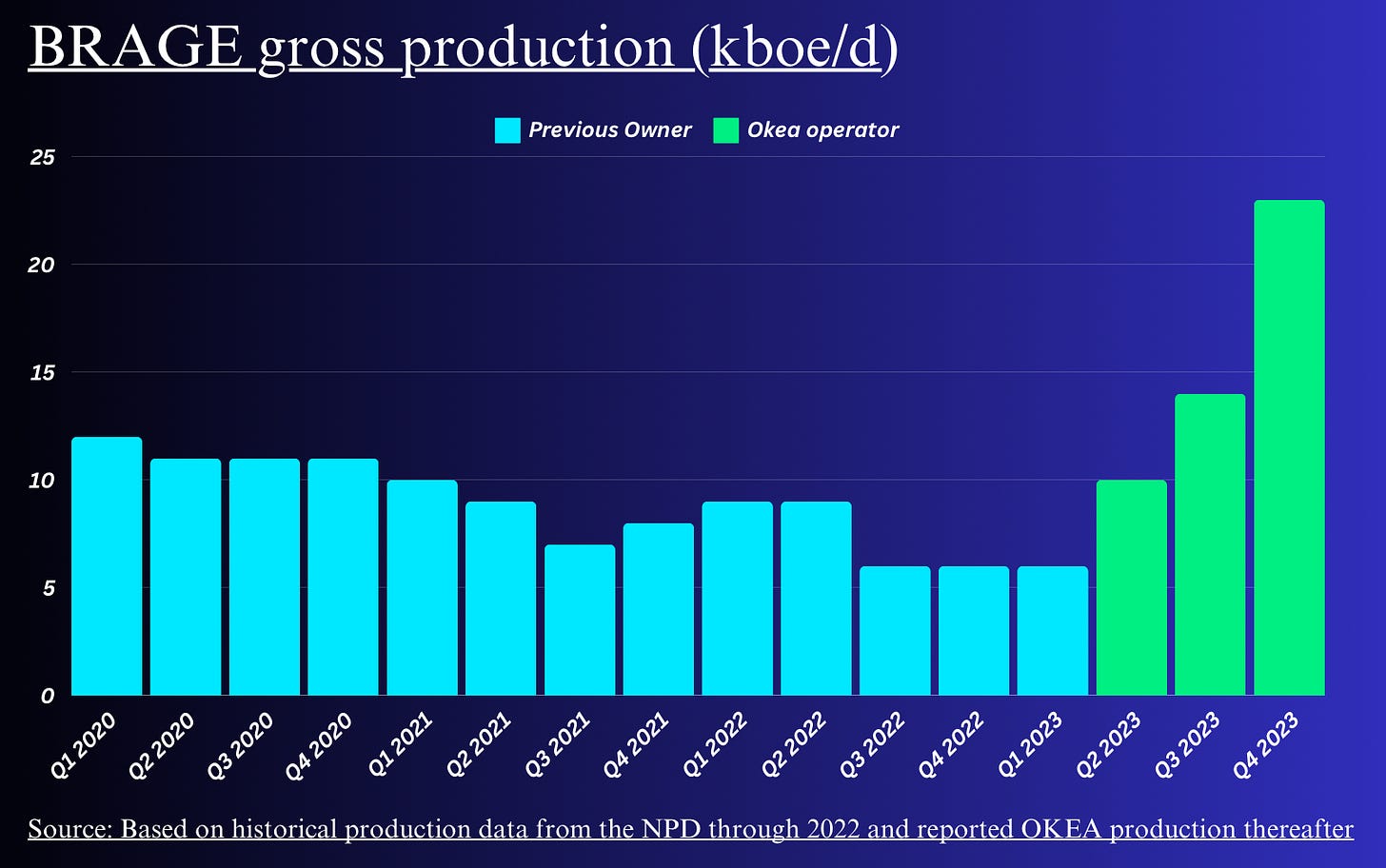

OKEA is a small-cap Norwegian oil & gas producer, that I have written about earlier. To quickly summarize it’s business strategy, OKEA is a company focused on mid to late life assets. These are assets that are often 30+ years old. While most companies are divesting from these projects, OKEA has specialized in exactly these kinds of operations. The company has grown via 14 deals, that resulted in the company growing to 41k boe/d in production, as of Q4. It’s important to highlight, that the company is entirely focused on M&A, to grow the business in Norway. The company has a market cap of around 2.4 Billion NOK (230m USD) and is listed on the Norwegian stock exchange in Oslo.

OKEA successfully turned around the Brage field and grew production by nearly 4x since taking control in Q2 2023. Furthermore, the company was able to increase the life expectancy of the Draugen asset from 2027 to 2040+ !

Below you can find the original thesis from December 👇

OKEAs strategy centers around buying stakes in old assets and improving their performance, by increasing efficiency. The risk with this strategy is of course, that you could buy an asset that turns out to be worth less then previously expected.

2.1/ The Statfjord Dilemma

This is exactly what happened with the Statfjord acquisition in December. The deal was postponed, as the reduction in 2P and 2C volumes amounted to 10-15% and the CAPEX would increase greatly.

“OKEA ASA announced that it had entered into an agreement with Equinor Energy AS to acquire 28% working interest in PL037 (Statfjord Area) with effective date 1 January 2023 for an initial fixed consideration of USD 220 million.

Completion of the Acquisition was contemplated to take place on 30 November 2023. OKEA has notified Equinor that completion will be postponed.

In connection with Equinor’s (as operator) obligation to provide RNB 2024 figures for the Statfjord Area, OKEA received updated information which indicates a reduction in 2P and 2C volumes of 10-15% over the lifetime of the acquired assets compared to RNB 2023, combined with increase in cost.“

— OKEA

The stock dropped like a stone from 36 NOK a share in late November, to 23 NOK today. OKEA closed the acquisition at the earlier agreed price of 220m $ in late December 2023. As a result of the acquisition, that OKEA now had to accept (formerly agreed to), the company isn’t allowed to pay a dividend in 2024. The reason behind this is, that the company issued a bond in September, which has conditions, that only allow dividend payments when the company generated a net profit on a yearly basis. While the company achieved operationally a record performance, the impairment following the acquisition, resulted in an accounting loss for the company.

By definition, an impairment is the permanent reduction in the fair value of an asset owned by the company. An impairment affects reported profits on the income statement, but it doesn’t necessarily mean that the business is losing money in a real operational sense. An impairment is a non-cash expense, meaning, it doesn’t directly effect the cash flows of the company.

Looking at the cash flow statement, the company generated FCF of 270m NOK in the 4th quarter of 2024. Net Cash Flow from operating activities amounted to 1.72 Billion NOK, while Net Cash Flow used in investment activities amounted to -1.45 Billion NOK. It’s important to note that the production from Statfjord isn’t yet considered in the earnings. In 2024 we can expect tailwinds from this.

The biggest item in Cash flow used in investment activities is *Business combinations, cash paid*. This is basically the Statfjord acquisition cost OKEA had to pay from there own pocket. If we exclude this expense, we get to FCF of 1.19 Billion NOK for the quarter ! For 2024 I expect conservatively 6 Billion NOK in cash flow from operating activities. This is slightly below the number we would get if we annualize the Q4 numbers. But the key difference is, that OKEA is expecting production of 35-40k boe/d for 2024, or an increase of 17-33%. If we include Statfjord in the recent quarter, we are already at 41k boe/d of production.

In my projection I also assume cash flow used in investment activities of 4 Billion NOK for the year 2024. The company is guiding for CAPEX of 2.8-3.3 Billion NOK. Assuming no other acquisition and higher expenses, I estimate roughly 4 Billion NOK in cash flow in cash flow used in investment activities.

Putting it all together we come to around 2 Billion NOK FCF from 2024. This is a FCF yield of 83% ! Even if the number would be just half of that, the stock would still be massively undervalued. As a cheery on top, the company has a Net cash position of 578m NOK. This gets us to an EV of 1.82 Billion NOK and an EV/FCF yield of of ~110% !

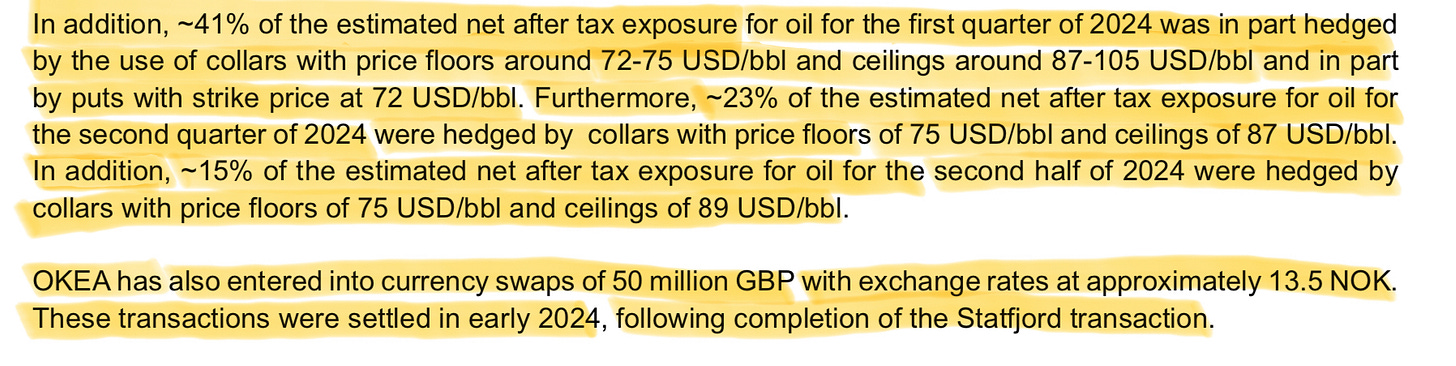

OKEA has hedged a large part of it’s production going into 2024 too. 👇

The main risk with the stock are further impairments related to the Stafjord deal. Yesterday Fearnley, an investment bank focused on oil, gas and shipping, lowered its price target for OKEA from 48 to 45 NOK a share. While this is lower then prior, this still represents upside of 95% !

3/ Conclusion

All in all, I remain bullish oil and especially on Norwegian E&Ps such as Vår or OKEA. Both are trading at a vast discount to fair value, while VAR 0.00%↑ has advantages due to scale. OKEA trades at prices so depressed, as if they would go bankrupt.

I hold positions in both stocks and therefore there could be a conflict of interest with this article. If you have any comments, feel free to share them with the community down below.

Yours sincerely,

MODERN INVESTING

They have 83m boe in 2P reserves. At a production of 35-40k boe/d this represents a reserve life of around 6 years. Keep in mind that they are constantly doing improvements on their fields and extended reserves life by 15 years at Draugen. Furthermore, they will continue to do M&A in the following years and grow production & reserves.

https://www.okea.no/wp-content/uploads/2024/02/okea-q4-2023-quarterly-report.pdf

Digging through OKEA, it may be cheap on an FCF basis because of low reserves. Looking at slides 11 (top left - production) and 9 (bottom right - 2P reserves). Most of their fields (Brage, Gjoa, Yme, Ima Asen) have only 1-3 years 2P reserves. Thats 2/3rds of their production! Only Draugen has 10 years. That would be why the market considers Stratjford so important.

I am coming around to agreeing with Var Energi. Though I wish they paid less dividends.